Australia Infectious Respiratory Disease Diagnostics Market

Australia Infectious Respiratory Disease Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Sample Type (Saliva, Nasopharyngeal Swabs (NPS), Anterior Nasal Region, Blood, and Others), By Application (COVID-19, Influenza, Respiratory Syncytial Virus (RSV), Tuberculosis, Streptococcus Testing, and Other Respiratory Disease Testing), and Australia Infectious Respiratory Disease Diagnostics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Infectious Respiratory Disease Diagnostics Market Insights Forecasts to 2035

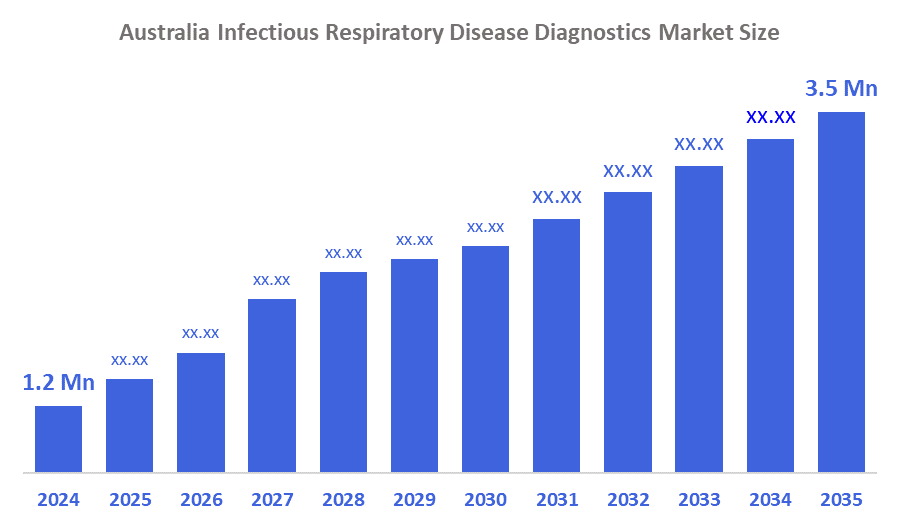

- The Australia Infectious Respiratory Disease Diagnostics Market Size Was Estimated at USD 827.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.14% from 2025 to 2035

- The Australia Infectious Respiratory Disease Diagnostics Market Size is Expected to Reach USD 1593.7 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Australia Infectious Respiratory Disease Diagnostics Market Size is anticipated to reach USD 1593.7 million by 2035, growing at a CAGR of 6.14% from 2025 to 2035. The infectious respiratory disease diagnostics market in Australia is driven by the country's aging population, rising incidence of respiratory infections, increased awareness of early diagnosis, advances in molecular diagnostics technology, and robust government support for disease surveillance and testing initiatives.

Market Overview

The Australia infectious respiratory disease diagnostics market includes diagnostic testing and technology that is able to diagnose respiratory diseases, including influenza, COVID-19, RSV, tuberculosis, and pneumonia, and therefore provides an overview of the diagnostics available along with their application.

Australia has improved the diagnosis of infectious diseases of the respiratory system by establishing a structured surveillance system and implementing funding programs. The National Respiratory Infections Surveillance Committee is responsible for monitoring flu, COVID-19, and RSV across the capitals, which is very supportive of their work. The federal investment is making it possible for the Point-of-care testing programs to conduct rapid diagnostics in remote areas, while the grant funding under the CRC-P program, such as AU$3 million, is pushing AI-driven respiratory diagnostic innovation forward fast.

The Australian diagnostics industry is making strides in respiratory disease testing through the use of next-gen, rapid point-of-care platforms and multi-pathogen assays that are capable of detecting influenza, RSV, and SARS-CoV-2 at the same time. The innovators in the area are using AI-assisted imaging and molecular diagnostics to produce quicker and more accurate results. Such innovations bring with them a new range of possibilities like mobile multiplex testing, telehealth merging, and greater application in rural and aged-care facilities to sustain early detection and to control outbreaks more effectively.

Report Coverage

This research report categorizes the market for the Australia infectious respiratory disease diagnostics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia infectious respiratory disease diagnostics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia infectious respiratory disease diagnostics market.

Driving Factors

The infectious respiratory disease diagnostics market in Australia is driven by the rising incidence of respiratory infections like COVID-19, RSV, and influenza, coupled with an increasing number of older Australians. Other factors that will drive growth include greater recognition of the importance of obtaining a precise diagnosis earlier, an increase in the number of hospitals, and an increase in the number of patients. In addition, there is an increasing trend towards increasing the use of molecular diagnostics, point-of-care testing, and other related technologies. Finally, the increasing number of government initiatives that focus on disease surveillance, public health preparedness, and supporting diagnostic testing programs will further fuel the demand for diagnostic testing in hospitals, laboratories, and clinics.

Restraining Factors

The infectious respiratory disease diagnostics market in Australia is mostly constrained by the high cost of diagnostics, the extensive area of rural regions where access to advanced testing is restricted, the unavailability of skilled laboratory practitioners, the complex regulatory approvals of applications, and limitations posed by reimbursements for advanced molecular diagnostic tests.

Market Segmentation

The Australia infectious respiratory disease diagnostics market share is classified into sample type and application.

- The nasopharyngeal swabs (NPS) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia infectious respiratory disease diagnostics market is segmented by sample type into saliva, nasopharyngeal swabs (NPS), anterior nasal region, blood, and others. Among these, the nasopharyngeal swabs (NPS) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because NPS samples are the best option in clinics, hospitals, and diagnostic labs since they offer the highest accuracy for identifying respiratory infections, such as influenza, COVID-19, and RSV.

- The COVID-19 segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia infectious respiratory disease diagnostics market is segmented by application into COVID-19, influenza, respiratory syncytial virus (RSV), tuberculosis, streptococcus testing, and other respiratory disease testing. Among these, the COVID-19 segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The greatest acceptance and revenue share among respiratory diagnostics is caused by the continuous need for extensive testing, government-led surveillance programs, and the requirement for precise detection to control outbreaks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia infectious respiratory disease diagnostics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AusDiagnostics Pty Ltd

- Sonic Healthcare Ltd

- 4DMedical Ltd.

- ZiP Diagnostics

- Lumos Diagnostics

- Genetic Signatures Ltd.

- Proteomics International Laboratories

- Atomo Diagnostics (ASX: AT1)

- Niche Medical

- Abacus Dx

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2025, the first Annual Australian Respiratory Surveillance Report was published, giving thorough information about respiratory virus activity (COVID-19, influenza, RSV) over the whole country, which can be used for diagnostics and healthcare planning purposes.

- In April 2024, the Australian National Respiratory Surveillance Plan and Report were made public, thus laying down the foundation for the national surveillance of COVID-19, influenza, and RSV that would continue for a long time and would also improve the collection of diagnostic data and the response of the public health sector.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia infectious respiratory disease diagnostics market based on the below-mentioned segments:

Australia Infectious Respiratory Disease Diagnostics Market, By Sample Type

- Saliva

- Nasopharyngeal Swabs (NPS)

- Anterior Nasal Region

- Blood

- Others

Australia Infectious Respiratory Disease Diagnostics Market, By Application

- COVID-19, Influenza

- Respiratory Syncytial Virus (RSV)

- Tuberculosis, Streptococcus Testing

- Other Respiratory Disease Testing

FAQ’s

Q: What is the Australia infectious respiratory disease diagnostics market size?

A: Australia infectious respiratory disease diagnostics market size is expected to grow from USD 827.4 million in 2024 to USD 1593.7 million by 2035, growing at a CAGR of 6.14% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rising incidence of respiratory infections like COVID-19, RSV, and influenza, coupled with an increasing number of older Australians. Other factors that will drive growth include greater recognition of the importance of obtaining a precise diagnosis earlier, an increase in the number of hospitals, and an increase in the number of patients.

Q: What factors restrain the Australia infectious respiratory disease diagnostics market?

A: Constraints include the high cost of diagnostics, the extensive area of rural regions where access to advanced testing is restricted, the unavailability of skilled laboratory practitioners, the complex regulatory approvals of applications, and limitations posed by reimbursements for advanced molecular diagnostic tests.

Q: How is the market segmented by sample type?

A: The market is segmented into saliva, nasopharyngeal swabs (NPS), anterior nasal region, blood, and others.

Q: Who are the key players in the Australia infectious respiratory disease diagnostics market?

A: Key companies include AusDiagnostics Pty Ltd, Sonic Healthcare Ltd, 4DMedical Ltd., ZiP Diagnostics, Lumos Diagnostics, Genetic Signatures Ltd., Proteomics International Laboratories, Atomo Diagnostics (ASX: AT1), Niche Medical, Abacus Dx, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |