Australia Kaolin Market

Australia Kaolin Market Size, Share, and COVID-19 Impact Analysis, By Type (Calcined, Hydrous, Air Floated, and Others), By Application (Paper, Ceramics, Paint & Coatings, Fiber glass, Plastic, Rubber, Pharmaceuticals & medical, Cosmetics, and Others), and Australia Kaolin Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Kaolin Market Insights Forecasts to 2035

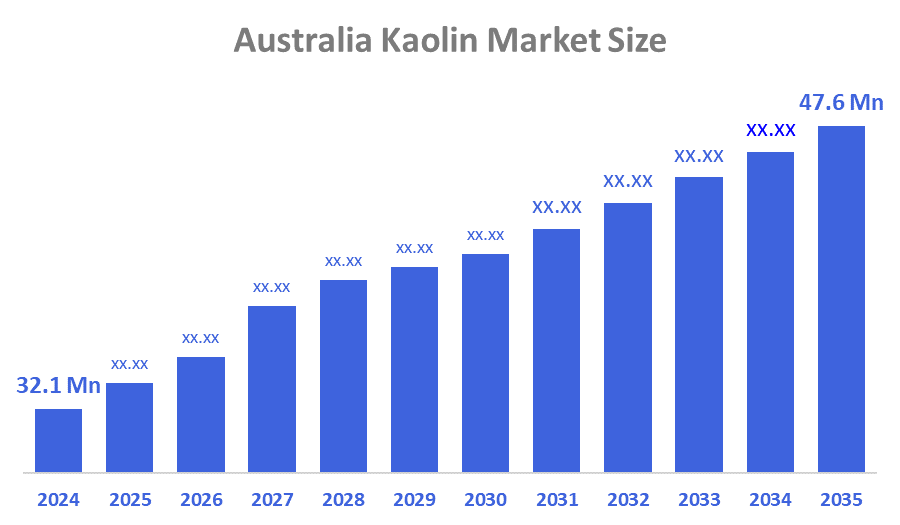

- The Australia Kaolin Market Size Was Estimated at USD 32.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.65% from 2025 to 2035

- The Australia Kaolin Market Size is Expected to Reach USD 47.6 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Australia Kaolin Market Size is Anticipated to reach USD 47.6 Million by 2035, Growing at a CAGR of 3.65% from 2025 to 2035. The kaolin market in Australia is driven by growing demand from the ceramics, paper, paints and coatings, and construction industries. This demand is bolstered by infrastructure development, an increase in manufacturing activity, the growing use of kaolin as a functional filler, and an expansion of industrial applications throughout the nation.

Market Overview

The kaolin market of Australia includes the processing and consumption of kaolin clay, which is a very fine white aluminosilicate mineral, and is known for its brightness, smoothness, and chemical stability. The main uses are ceramics, paper coating and filling, paints and coatings, rubber, plastics, fiberglass, construction materials, pharmaceuticals, and cosmetics that not only cater to industrial manufacturing but also the value-added end-use sectors.

Australia's kaolin market is bolstered by government support and financial aid programs. As an example, Zeotech was granted AUD 145,000 through Queensland's METS Collaborative Project Fund for its Toondoon Kaolin Project; at the same time, ASX-listed firms like Andromeda Metals were able to collect AUD 3.4 million for their kaolin projects, which is a clear indication of government-backed support and opportunities for growth through exports.

The kaolin market in Australia has seen some recent developments, like Zeotech's feasibility study, production of AusPozz metakaolin, an export deal worth USD 200 million, and large-scale test pit production. Besides, future opportunities consist of high-purity kaolin scaling, export expansion, low-carbon concrete support, and the incorporation of kaolin into advanced materials and industrial applications.

Report Coverage

This research report categorizes the market for the Australia Kaolin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia Kaolin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia Kaolin market.

Driving Factors

The kaolin market in Australia is driven by the rising demand from the main users like ceramics, paper, paints and coatings, rubber, and construction. The market enlargement mainly results from the infrastructural projects that are being built, the increasing usage of functional fillers, and the development of high-purity and low-impurity kaolin production through new technologies. Moreover, strong export potential, government-backed initiatives, and the rising adoption of kaolin in eco-friendly materials like low-carbon concrete are some of the factors that further contribute to the market growth and position kaolin as an essential raw material for both domestic and international industrial applications.

Restraining Factors

The kaolin market in Australia is mostly constrained by the lack of high-quality reserves, hefty extraction and processing costs, strict environmental regulations, unstable global kaolin prices, and the rivalry with alternative fillers and synthetic materials, which, to some extent, hinder large-scale production and market expansion.

Market Segmentation

The Australia kaolin market share is classified into type and application.

- The hydrous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia kaolin market is segmented by type into calcined, hydrous, air floated, and others. Among these, the hydrous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its numerous industrial uses, such as ceramics, paper coating, paints, and rubber, the hydrous kaolin segment will dominate the Australian kaolin market. It generates the greatest revenue share and has strong development potential because of its high purity, ease of processing, and constant quality.

- The paper segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia kaolin market is segmented by application into paper, ceramics, paint & coatings, fiber glass, plastic, rubber, pharmaceuticals & medical, cosmetics, and others. Among these, the paper segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Kaolin increases brightness, smoothness, printability, and opacity, thus improving the quality of paper. The publishing, packaging, and specialty paper industries have the highest demand, which not only shares the largest revenue but also has a very strong market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia kaolin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- WA Kaolin Limited

- Andromeda Metals Limited

- Australian Kaolin Ltd

- Zeotech Limited

- LB Minerals Australia

- Imerys Minerals Australia Pty Ltd

- Green360

- Suvo Strategic Minerals Limited

- Cape York Kaolin

- Minerals Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Zeotech's large-scale test pit at Toondoon was completed with a production of more than 2,300 tons of kaolin, and consequently, influenced the ship-loading trials.

- In October 2025, WA Kaolin announces the highest quarterly sales ever and the introduction of new kaolin grades, which leads to an increase in production capacity.

- In August 2025, Zeotech entered into a binding term sheet with MSI for the offtake of kaolin for a multi-year supply of direct shipping ore kaolin.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Australia kaolin market based on the below-mentioned segments:

Australia Kaolin Market, By Type

- Calcined

- Hydrous

- Air Floated

- Others

Australia Kaolin Market, By Application

- Paper

- Ceramics

- Paint & Coatings

- Fiber glass

- Plastic

- Rubber

- Pharmaceuticals & medical

- Cosmetics

- Others

FAQ’s

Q: What is the Australia kaolin market size?

A: Australia kaolin market size is expected to grow from USD 32.1 million in 2024 to USD 47.6 million by 2035, growing at a CAGR of 3.65% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rising demand from the main users like ceramics, paper, paints and coatings, rubber, and construction. The market enlargement mainly results from the infrastructural projects that are being built, the increasing usage of functional fillers, and the development of high-purity and low-impurity kaolin production through new technologies.

Q: What factors restrain the Australia kaolin market?

A: Constraints include the lack of high-quality reserves, hefty extraction and processing costs, strict environmental regulations, unstable global kaolin prices, and the rivalry with alternative fillers and synthetic materials, which, to some extent, hinder large-scale production and market expansion.

Q: How is the market segmented by type?

A: The market is segmented into calcined, hydrous, air floated, and others.

Q: Who are the key players in the Australia kaolin market?

A: Key companies include WA Kaolin Limited, Andromeda Metals Limited, Australian Kaolin Ltd, Zeotech Limited, LB Minerals Australia, Imerys Minerals Australia Pty Ltd, Green360, Suvo Strategic Minerals Limited, Cape York Kaolin, Minerals Corporation, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |