Australia Leak Detection and Repair Market

Australia Leak Detection and Repair Market Size, Share, and COVID-19 Impact Analysis, By Component (Equipment, and Services), By Technology (Volatile Organic Compounds (VOC) Analyzer, Optical Gas Imaging (OGI), Laser Absorption Spectroscopy, Ambient/Mobile Leak Monitoring, Acoustic Leak Detector, and Audio-Visual-Olfactory Inspection), and Australia Leak Detection and Repair Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Leak Detection and Repair Market Insights Forecasts to 2035

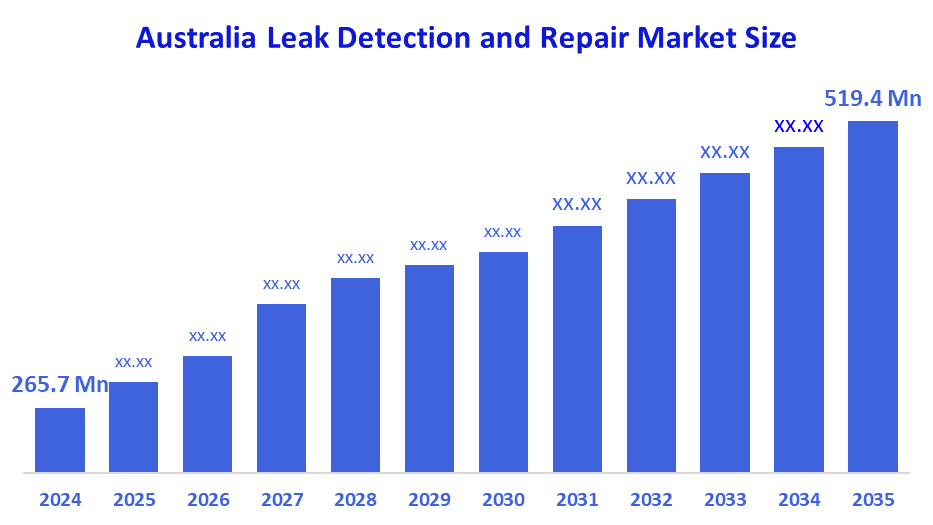

- The Australia Leak Detection and Repair Market Size Was Estimated at USD 265.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.28% from 2025 to 2035

- The Australia Leak Detection and Repair Market Size is Expected to Reach USD 519.4 Million by 2035

According To A Research Report Published By Decision Advisors, The Australia Leak Detection And Repair Market Size Is Anticipated To Reach USD 519.4 Million By 2035, Growing At A CAGR Of 6.28% From 2025 To 2035. The Leak Detection And Repair Market In Australia Is Driven By Strict Environmental Regulations, Aging Oil And Gas Infrastructure, Growing Emphasis On Reducing Methane Emissions, Industrial Safety Requirements, Technological Developments In Monitoring Systems, And Rising Investments In Pipeline Maintenance And Utilities.

Market Overview

The market in Australia for leak detection and repair encompasses the different technologies and services utilized to identify, measure, and fix leaks, including pipelines, storage tanks, and industrial systems. It comprises the use of various tools such as sensors, infrared cameras, ultrasonic devices, and monitoring software. The applications cover a wide range, including oil and gas, water and wastewater utilities, chemical and manufacturing industries, and energy infrastructure, all of which are benefits of emission reduction, operational efficiency, regulatory compliance, safety enhancement, and asset integrity management.

The leak detection and repair market in Australia is positively affected by government actions such as the A$35.3 million water efficiency program in NSW, A$3 million for active leak detection projects, and grants for regional leakage reduction, among others. Moreover, the federal methane-reduction regulations for the oil and gas sector also promote LDAR implementation as a means of cutting down on emissions, enhancing the infrastructural efficiency, and meeting the regulatory standards.

Australian companies are using the latest in-pipe CCTV/robotic inspection systems (Detection Services with Synthotech) and AI-enabled acoustic sensors (Leakster), while the usage of fibre-optic sensing for leak detection via telecom networks is still in the trial phase. The technologies associated with smart sensor analytics, robotics, and IoT platforms are not yet used to their full potential, but they could provide the future market of predictive maintenance, real-time monitoring, and cloud management of leak issues.

Report Coverage

This research report categorizes the market for the Australia leak detection and repair market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia leak detection and repair market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia leak detection and repair market.

Driving Factors

The leak detection and repair market in Australia is driven by the deteriorating condition of the water, oil, and gas infrastructure, environmental regulations and restrictions on methane emissions that are quite stringent, and the growing concern over water waste. On the other hand, the adoption of leak detection and repair technologies is being quickened through the rising industrial safety standards, the high costs of water and energy losses, and the development of IoT, AI-based monitoring, and sensor technologies.

Restraining Factors

The leak detection and repair market in Australia is mostly constrained by the high installation and maintenance costs of advanced detection technologies. Even so, the limited number of skilled workers available and the complex nature of regulatory compliance have not been the only reasons for the market to be deterred. A small or medium-sized utility can easily be discouraged by the need for huge upfront investments.

Market Segmentation

The Australia leak detection and repair market share is classified into component and technology.

- The services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia leak detection and repair market is segmented by component into equipment, and services. Among these, the services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because the majority of utilities and businesses outsource specialized inspection, monitoring, and repair operations, the services segment dominates the Australian leak detection and repair market. Service providers guarantee effective leak management without requiring a large upfront financial investment for equipment by providing knowledge, cutting-edge equipment, maintenance, and compliance assistance.

- The optical gas imaging (OGI) segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia leak detection and repair market is segmented by technology into volatile organic compounds (VOC) analyzer, optical gas imaging (OGI), laser absorption spectroscopy, ambient/mobile leak monitoring, acoustic leak detector, and audio-visual-olfactory inspection. Among these, the optical gas imaging (OGI) segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to its high accuracy, real-time gas leak visualization, regulatory acceptance for methane monitoring, and widespread use in oil, gas, and industrial facilities for effective, non-intrusive inspections, the optical gas imaging (OGI) segment leads the Australian leak detection and repair market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia leak detection and repair market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Leakster Pty Ltd

- Liqualogic Australia Pty Ltd

- Aquatek Australia

- Hydrosmart Solutions

- International Leak Detection (ILD) Australia

- Highpoint Solutions Pty Ltd

- KLINGER Atmeco

- Detection Services

- Dill-Tech Pty Ltd

- 1300 FINDLEAK

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2025, South Australia introduce the digital water leak detection strategy that utilizes smart meters and cloud systems for compliance and funding objectives.

- In November 2024, Iplex Australia appointed Phyn as its technological partner, providing the Phyn Plus intelligent leak detectors with automatic shut-off to the homeowners in WA.

- In December 2023, Melbourne commenced the optical-fiber leak detection experiment, employing the telecom lines as detectors for the immediacy of the water network leaks underground.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia leak detection and repair market based on the below-mentioned segments:

Australia Leak Detection and Repair Market, By Component

- Equipment

- Services

Australia Leak Detection and Repair Market, By Technology

- Volatile Organic Compounds (VOC) Analyzer

- Optical Gas Imaging (OGI)

- Laser Absorption Spectroscopy

- Ambient/Mobile Leak Monitoring

- Acoustic Leak Detector

- Audio-Visual-Olfactory Inspection

FAQ’s

Q: What is the Australia leak detection and repair market size?

A: Australia leak detection and repair market size is expected to grow from USD 265.7 million in 2024 to USD 519.4 million by 2035, growing at a CAGR of 6.28% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the deteriorating condition of the water, oil, and gas infrastructure, environmental regulations and restrictions on methane emissions that are quite stringent, and the growing concern over water waste.

Q: What factors restrain the Australia leak detection and repair market?

A: Constraints include the high installation and maintenance costs of advanced detection technologies. Even so, the limited number of skilled workers available and the complex nature of regulatory compliance have not been the only reasons for the market to be deterred.

Q: How is the market segmented by technology?

A: The market is segmented into volatile organic compounds (VOC) analyzer, optical gas imaging (OGI), laser absorption spectroscopy, ambient/mobile leak monitoring, acoustic leak detector, and audio-visual-olfactory inspection.

Q: Who are the key players in the Australia leak detection and repair market?

A: Key companies include Leakster Pty Ltd, Liqualogic Australia Pty Ltd, Aquatek Australia, Hydrosmart Solutions, International Leak Detection (ILD) Australia, Highpoint Solutions Pty Ltd, KLINGER Atmeco, Detection Services, Dill-Tech Pty Ltd, 1300 FINDLEAK, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |