Australia Liquid Packaging Cartons Market

Australia Liquid Packaging Cartons Market Size, Share, and COVID-19 Impact Analysis, By Carton Type (Brick Liquid Cartons, Shaped Liquid Cartons, and Gable Top Cartons), By End Use (Liquid Dairy Products, Non-Carbonated Soft Drinks, Liquid Foods, and Alcoholic Drinks), and Australia Liquid Packaging Cartons Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Liquid Packaging Cartons Market Insights Forecasts to 2035

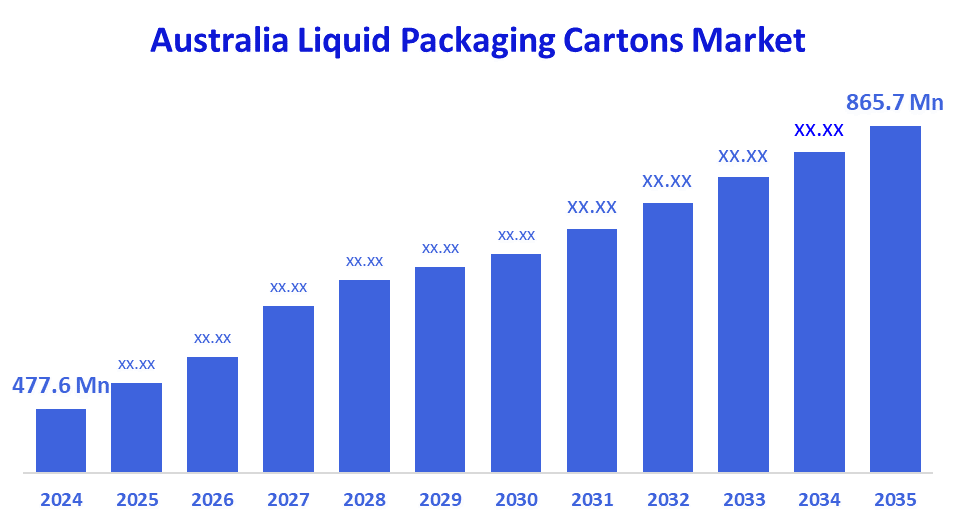

- The Australia Liquid Packaging Cartons Market Size Was Estimated at USD 477.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.56% from 2025 to 2035

- The Australia Liquid Packaging Cartons Market Size is Expected to Reach USD 865.7 Million by 2035

According To A Research Report Published By Decision Advisors, The Australia Liquid Packaging Cartons Market Size Is Anticipated To Reach USD 865.7 Million By 2035, Growing At A CAGR Of 5.56% From 2025 To 2035. The Liquid Packaging Cartons Market In Australia Is Driven By Increased Consumer Demand For Environmentally Friendly Packaging, Expanding Dairy And Beverage Consumption, Robust Recycling Programs, The Advantages Of Lightweight Packaging, Longer Shelf Life, And A Growing Inclination Towards Eco-Friendly Carton Options.

Market Overview

The Australia liquid packaging cartons market encompasses paperboard-based multi-layered cartons that are specifically manufactured for packaging liquid products such as milk, juices, dairy alternatives, soups, drinks, and the like. With these cartons coming as an assurance of protection, no light, no oxygen, and no moisture will enter the product, thus guaranteeing its safety and determining the length of its shelf life. The areas of application are food and beverage, dairy processing, retail, and foodservice, and they are all driven by the demand for packaging solutions that are not only lightweight and recyclable but also eco-friendly and sustainable in Australia.

The Australian government is putting money into recycling infrastructure and sustainable packaging through the Recycling Modernisation Fund (over A$200 million toward new processing capacity) and National Packaging Targets that go for 100% recyclable packaging and 50% recycled content by 2025. Grants of A$1.74 million are given to support facilities that convert beverage cartons into building materials, which are in accordance with circular economy aims and thus lead to an increase in the market for carton recycling.

Australian companies that deal with packaging are applying new ideas to liquid cartons, which are made of recyclable, plant-based materials in combination with improved barrier coatings, thus using less plastic and giving the cartons a longer lifetime. Partnerships among Australian packaging recyclers are strengthening the infrastructure for collecting and processing these materials. Among the options for the future are the use of biodegradable coatings, the installation of smart packaging sensors, and investment in the circular economy that will contribute to sustainability and resource recovery.

Report Coverage

This research report categorizes the market for the Australia liquid packaging cartons market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia liquid packaging cartons market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia liquid packaging cartons market.

Driving Factors

The liquid packaging cartons market in Australia is driven by the increasing consumer preference for sustainable and recyclable packaging, the growing use of dairy, juices, and plant-based drinks, and the imposition of more environmental laws on plastic production. These cartons provide advantages like longer shelf life, lighter transport, and lower manufacturing costs, which are the reasons why they are favored by manufacturers. Besides, the strong recycling infrastructure, the branding on the companies' part to reduce carbon footprint, and the developments in the aseptic packaging technologies all contribute to the overall market growth in the food and beverage sectors.

Restraining Factors

The liquid packaging cartons market in Australia is mostly constrained by the expensive initial setup and equipment costs, insufficient recycling knowledge for composite materials, the competition from plastic packaging, the unstable raw material prices, and the problems in the effective collection and processing of used cartons.

Market Segmentation

The Australia liquid packaging cartons market share is classified into carton type and end use.

- The brick liquid cartons segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia liquid packaging cartons market is segmented by carton type into brick liquid cartons, shaped liquid cartons, and gable top cartons. Among these, the brick liquid cartons segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its greater space efficiency, reduced transportation costs, longer beverage shelf life, and extensive use in dairy, juice, and aseptic packaging applications, the brick liquid cartons segment leads the Australian liquid packaging cartons market.

- The liquid dairy products segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia liquid packaging cartons market is segmented by end use into liquid dairy products, non-carbonated soft drinks, liquid foods, and alcoholic drinks. Among these, the liquid dairy products segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to the significant consumption of milk and dairy-based beverages, the extensive use of carton packaging for freshness and longer shelf life, and the strong customer preference for practical, environmentally friendly packaging, the liquid dairy goods segment leads the Australian market for liquid packaging cartons.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia liquid packaging cartons market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor Limited

- Visy Industries

- Orora Limited

- Opal Packaging

- Liquid Pack Pty Ltd

- Carewell Group

- Massel

- Detmold Group

- Scholle IPN / Local facility partners

- Nippon Paper Liquid Package Australia Pty. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, the first aseptic beverage co-packing facility in Western Australia was opened by C4C Packaging, which allowed the local carton packaging of both wine and RTD (ready-to-drink) beverages using cutting-edge Tetra Pak technology.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia liquid packaging cartons market based on the below-mentioned segments:

Australia Liquid Packaging Cartons Market, By Carton Type

- Brick Liquid Cartons

- Shaped Liquid Cartons

- Gable Top Cartons

Australia Liquid Packaging Cartons Market, By End Use

- Liquid Dairy Products

- Non-Carbonated Soft Drinks

- Liquid Foods

- Alcoholic Drinks

FAQ’s

Q: What is the Australia liquid packaging cartons market size?

A: Australia liquid packaging cartons market size is expected to grow from USD 477.6 million in 2024 to USD 865.7 million by 2035, growing at a CAGR of 5.56% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increasing consumer preference for sustainable and recyclable packaging, the growing use of dairy, juices, and plant-based drinks, and the imposition of more environmental laws on plastic production. These cartons provide advantages like longer shelf life, lighter transport, and lower manufacturing costs, which are the reasons why they are favored by manufacturers.

Q: What factors restrain the Australia liquid packaging cartons market?

A: Constraints include the expensive initial setup and equipment costs, insufficient recycling knowledge for composite materials, the competition from plastic packaging, the unstable raw material prices, and the problems in the effective collection and processing of used cartons.

Q: How is the market segmented by carton type?

A: The market is segmented into brick liquid cartons, shaped liquid cartons, and gable top cartons.

Q: Who are the key players in the Australia liquid packaging cartons market?

A: Key companies include Amcor Limited, Visy Industries, Orora Limited, Opal Packaging, Liquid Pack Pty Ltd, Carewell Group, Massel, Detmold Group, Scholle IPN / Local facility partners, Nippon Paper Liquid Package Australia Pty. Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |