Australia Natural Gas Storage Market

Australia Natural Gas Storage Market Size, Share, and COVID-19 Impact Analysis, By Type (Underground, Depleted Gas Reservoir, Aquifer Reservoir, Salt Caverns, and Above Ground), By End-User (Natural Gas Producers, Utility Companies, Industrial Customers, Power Generation Companies, and Others), and Australia Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

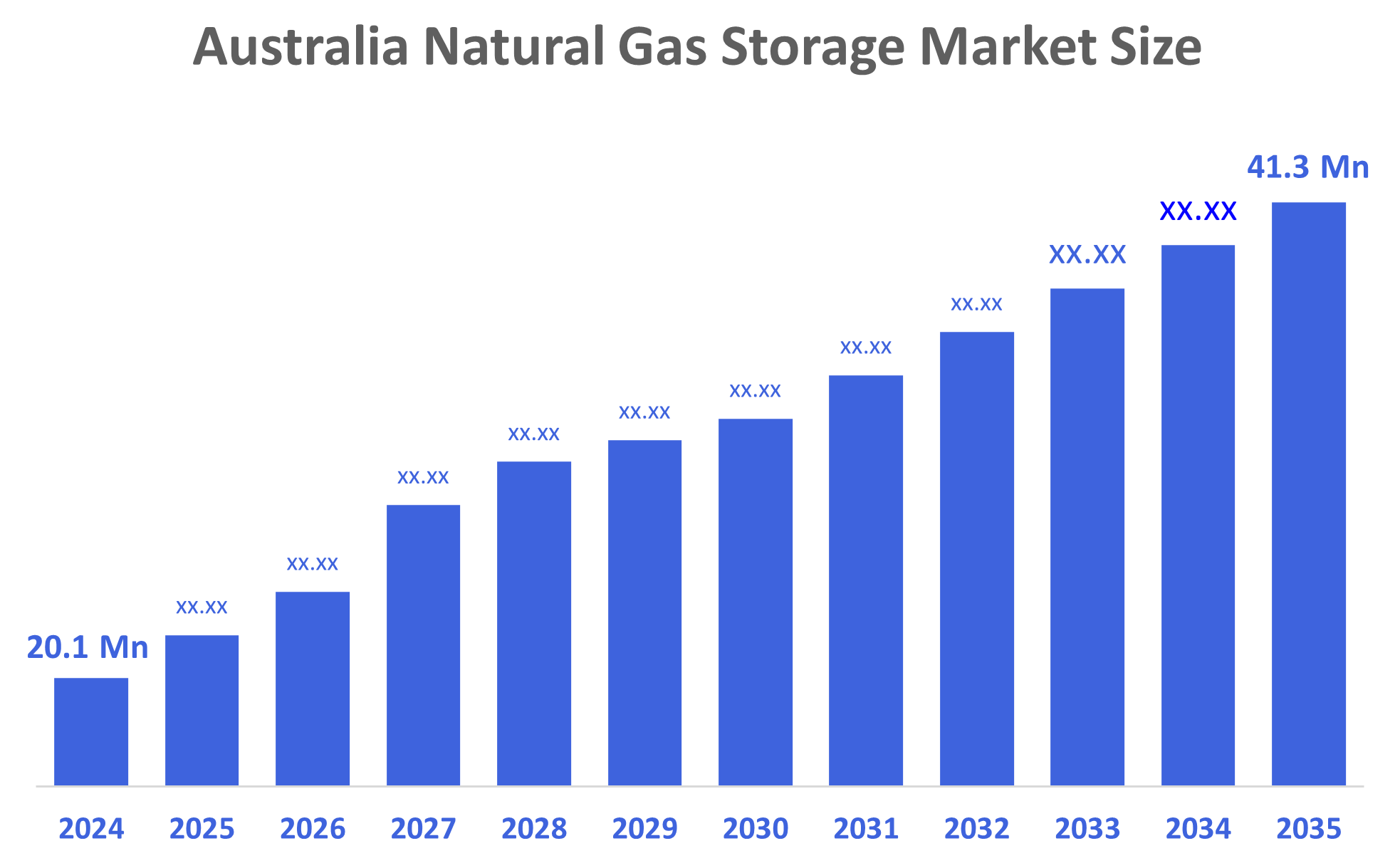

Australia Natural Gas Storage Market Size Insights Forecasts to 2035

- The Australia Natural Gas Storage Market Size Was Estimated at USD 20.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.77% from 2025 to 2035

- The Australia Natural Gas Storage Market Size is Expected to Reach USD 41.3 Million by 2035

According to a research report published by Decisions Advisors, The Australia Natural Gas Storage Market Size is Anticipated to Reach USD 41.3 Million by 2035, Growing at a CAGR of 6.77% from 2025 to 2035. The natural gas storage market in Australia is driven by rising energy consumption, expanding LNG exports, seasonal supply-demand balancing requirements, worries about energy security, and growing investment in gas infrastructure to serve power production and industrial applications.

Market Overview

The natural gas storage market in Australia consists of the facilities and services that are employed to store natural gas in both underground reservoirs and above-ground systems, thus guaranteeing reliability of supply, seasonal balancing, energy security, and the efficient distribution of gas for power generation, industrial, and residential consumption across the country. The Australian natural gas storage market plays a crucial role in energy security, seasonal demand balancing, and providing support for gas-fired power plants and LNG exports. Electricity demand, gas as a transition fuel, and variability from renewables create a favorable condition for the gas storage market in Australia.

The Australia natural gas storage market is supported by energy security initiatives, like the AUD 1.5 billion Gas-Fired Recovery Fund, which funds important gas infrastructure and storage-related projects. Furthermore, the National Gas Infrastructure Plan steers the investment of billions of dollars from private and public sectors in pipelines and storage, while the state gas reservation and supply programs ensure domestic availability and system reliability.

The market opens up for new investments in the areas of strategic gas reserves, managing the peak-demand, and hybrid energy systems. Australia has been making some ups and downs in its gas supply resilience, but the latest policy developments show a renewed commitment to strengthening it.

Report Coverage

This research report categorizes the market for the Australia natural gas storage market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia natural gas storage market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia natural gas storage market.

Driving Factors

The natural gas storage market in Australia is driven by rising electric power consumption, the increasing use of gas-fired power plants as a backup for renewables, and the necessity to manage the variations in gas use during different seasons and periods of peak demand. Moreover, the activities of the LNG exporters and the unpredictability of local producers add to the necessity of having gas storage plants. Besides, the Australian natural gas storage market is aided by not only the energy security issues but also the government policies, which are aimed at enhancing the availability of domestic gas and the resilience of the infrastructure, thus attracting investments in both underground and surface natural gas storage facilities.

Restraining Factors

The natural gas storage market in Australia is mostly constrained by the high capital and operating costs, long project approval timelines, environmental and land use regulations, limited suitable geological sites, and uncertainty around long-term gas demand amidst the transition toward renewable energy sources.

Market Segmentation

The Australia natural gas storage market share is classified into type and end user.

- The depleted gas reservoir segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia natural gas storage market is segmented by type into underground, depleted gas reservoir, aquifer reservoir, salt caverns, and above ground. Among these, the depleted gas reservoir segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The availability of pre-existing gas fields, reduced development costs, demonstrated geological compatibility, and high storage capacities, all of which make them perfect for seasonal balancing and energy security applications, are the reasons for their supremacy.

- The utility companies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia natural gas storage market is segmented by end user into natural gas producers, utility companies, industrial customers, power generation companies, and others. Among these, the utility companies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is caused by utilities' need to maintain grid stability in the face of growing integration of renewable energy sources, support gas-fired power generation, control seasonal demand swings, and guarantee a steady supply of gas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia natural gas storage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- APA Group

- AGL Energy Limited

- Santos Limited

- Woodside Energy Group Ltd

- Origin Energy Limited

- Beach Energy Limited

- Chevron Australia

- Shell Australia

- Jemena Limited

- Strike Energy Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In March 2025, the Australian government reiterated its support for gas as a transition fuel and highlighted the role of storage in energy security under the National Gas Infrastructure Plan.

- In January 2025, APA Group revealed plans to invest in projects that will enhance the capacity for storing and compressing gas, and this will be connected to important pipeline networks on the East Coast.

- In October 2024, Santos affirmed the increased application of exhausted gas reservoirs for storage in a move that would help ensure the reliability of domestic supply.

- In May 2024, the Federal government considered different strategic gas storage alternatives in its move to secure domestic gas supply and stabilize prices.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia natural gas storage market based on the below-mentioned segments:

Australia Natural Gas Storage Market, By Type

- Underground

- Depleted Gas Reservoir

- Aquifer Reservoir

- Salt Caverns

- Above Ground

Australia Natural Gas Storage Market, By End User

- Natural Gas Producers

- Utility Companies

- Industrial Customers

- Power Generation Companies

- Others

FAQ’s

Q: What is the Australia natural gas storage market size?

A: Australia natural gas storage market size is expected to grow from USD 20.1 million in 2024 to USD 41.3 million by 2035, growing at a CAGR of 6.77% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by rising electric power consumption, the increasing use of gas-fired power plants as a backup for renewables, and the necessity to manage the variations in gas use during different seasons and periods of peak demand. Moreover, the activities of the LNG exporters and the unpredictability of local producers add to the necessity of having gas storage plants. Besides, the Australian natural gas storage market is aided by not only the energy security issues but also the government policies, which are aimed at enhancing the availability of domestic gas and the resilience of the infrastructure, thus attracting investments in both underground and surface natural gas storage facilities.

Q: What factors restrain the Australia natural gas storage market?

A: Constraints include the high capital and operating costs, long project approval timelines, environmental and land use regulations, limited suitable geological sites, and uncertainty around long-term gas demand amidst the transition toward renewable energy sources.

Q: How is the market segmented by end user?

A: The market is segmented into natural gas producers, utility companies, industrial customers, power generation companies, and others.

Q: Who are the key players in the Australia natural gas storage market?

A: Key companies include APA Group, AGL Energy Limited, Santos Limited, Woodside Energy Group Ltd, Origin Energy Limited, Beach Energy Limited, Chevron Australia, Shell Australia, Jemena Limited, Strike Energy Limited, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |