Australia Oats Market

Australia Oats Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Steel-Cut Oats, Whole Oats, Instant Oats, Rolled Oats, and Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online Retail, and Others), and Australia Oats Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Oats Market Insights Forecasts to 2035

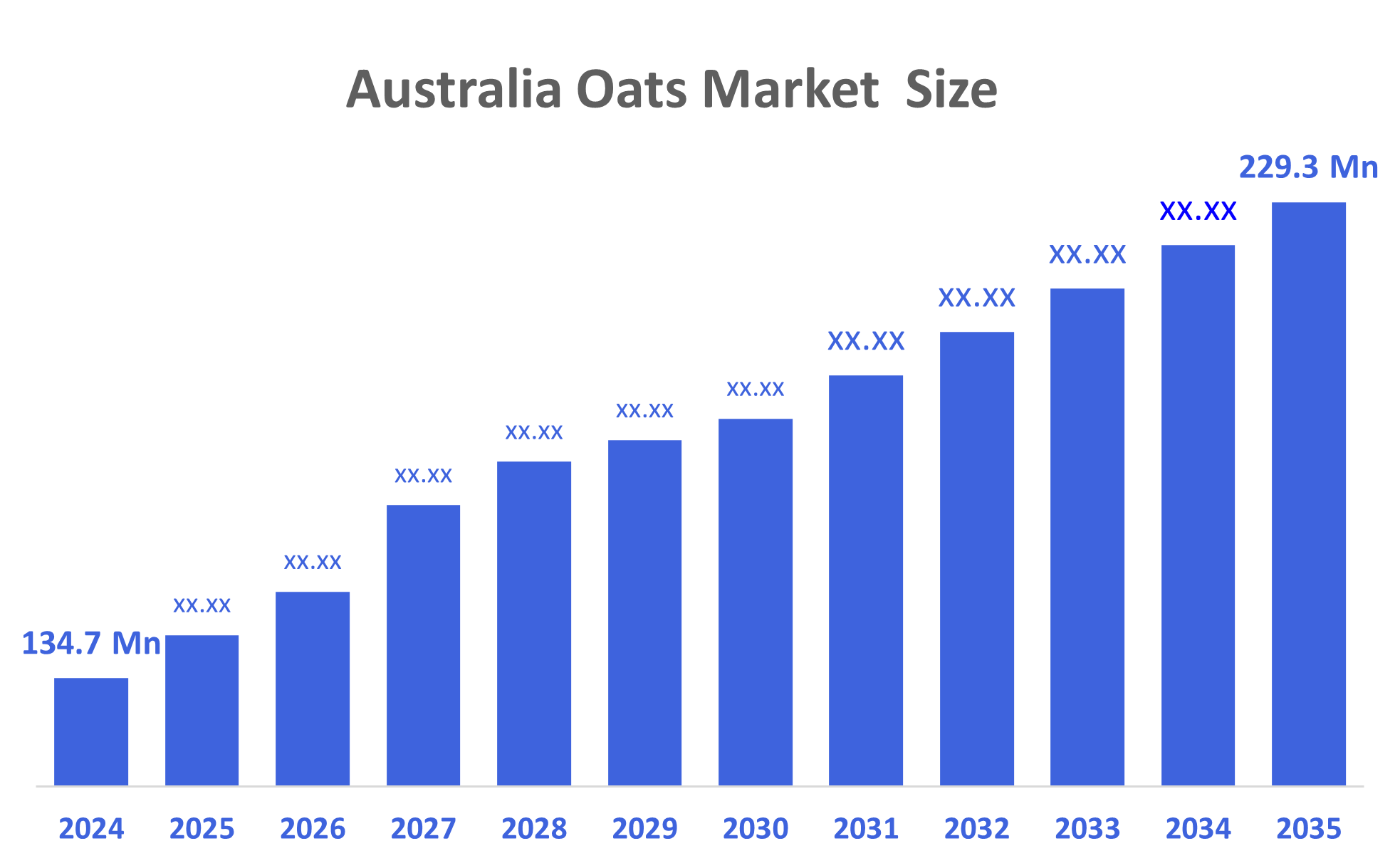

- The Australia Oats Market Size Was Estimated at USD 134.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.96% from 2025 to 2035

- The Australia Oats Market Size is Expected to Reach USD 229.3 Million by 2035

According to a research report published by Decisions Advisors, The Australia Oats Market Size is Anticipated to Reach USD 229.3 Million by 2035, Growing at a CAGR of 4.96% from 2025 to 2035. The oats market in Australia is driven by consumers increased emphasis on changing their eating and lifestyle choices, as well as the rising demand for nutritious snacks.

Market Overview

The oats market deals with the production, processing, distribution, and consumption of oats and products made from oats. It encompasses whole oats, rolled oats, steel-cut oats, oats flour, and food and beverage products containing oats. The demand is fueled by existing consumer awareness of the healthy benefits of oats, particularly high fiber foods, beta-glucan, and heart health, interest in ready-to-eat cereals, and interest in plant-based food products. The oats market serves applications across food & beverage, animal feed, personal care, and industry. The Australian oats market benefits from healthy domestic breakfast food consumption and growing export demand, especially from Asian countries desperate for high-quality grain. Australia is one of the best milling oat producers in the world due to favorable growing conditions and total supply chains in Western Australia. The government and industry are involved in a variety of activities, such as research funding and breeding programs to improve yield, nutrition, and processing potential. Advances in farming technology (precision farming), digital agronomy, and new varieties will improve product quality and competitiveness. Some recent activities include investing in local oat processing capacity and developing existing industry programs to enhance international market access. Opportunities for value-added products, like oat milk and gluten-free oats, and functional foods will increase.

Report Coverage

This research report categorizes the market for the Australia oats market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia oats market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia oats market.

Driving Factors

The oats market in Australia is driven by consumer interest in healthy, high-fiber foods, as well as an ever-growing popularity for plant-based diets, which are the principal drivers for the oats market across Australia. Domestically, the process of expanding processing capacity in Australia can be linked to strong domestic and international demand for high-quality value-added oat products such as oat milk, cereals, and functional foods. The operational environment, including Australia's climate and the established export market, particularly in Asia, also supports expansion of the industry's output. Recent excitement about government-supported oat breeding and research, along with agronomic production practices, and capital investment in the milling and processing sectors, support higher quality and increased productivity across the industry's supply chain.

Restraining Factors

The oats market in Australia is mostly constrained by increased uncertainty regarding export demand, production impacted by climate variability, limited domestic processing capacity compared to international competitors, rising production costs, and competition from alternative grains and plant-based products, which may limit growth potential in the long run.

Market Segmentation

The Australia oats market share is classified into product type and distribution channel.

- The rolled oats segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia oats market is segmented by product type into steel-cut oats, whole oats, instant oats, rolled oats, and others. Among these, the rolled oats segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The most popular consumer format is rolled oats, which are used extensively in baking goods, muesli, morning cereals, and ready-to-eat meals. Strong domestic and commercial demand is fueled by their great nutritional content, ease of preparation, and variety.

- The hypermarkets and supermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia oats market is segmented by distribution channel into hypermarkets and supermarkets, convenience stores, online retail, and others. Among these, the hypermarkets and supermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because major supermarket chains have a large product selection, a strong retail presence, competitive prices, and consumer trust. By providing a variety of oat types, private-label options, and promotional programs that increase sales volumes nationwide, these establishments also contribute to the growing demand for quick and healthful food products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia oats market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Blue Lake Milling

- Kangaroo Island Oats

- Dad’s Oats

- Societa Cofica

- The Oat Company

- Australian Oats Millers

- Elders Limited

- Kialla Pure Foods

- NZAC Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Grains Australia opened applications for new members on its Oat Council to provide strategic advice and strengthen the industry's leadership and market strategy.

- In July 2025, UniSA researchers announced an oat oil biosynthesis breakthrough to enhance breeding of higher-yield, mill-efficient oat varieties.

- In May 2025, the University of Queensland and Real Oats (My PlantCo) launched a $5.6 million project to develop oat-based rice, noodles, and pasta for value-added diversification.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia oats market based on the below-mentioned segments:

Australia Oats Market, By Product Type

- Steel-Cut Oats

- Whole Oats

- Instant Oats

- Rolled Oats

- Others

Australia Oats Market, By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Retail

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |