Australia Organic Beverages Market

Australia Organic Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Organic Coffee and Tea, Organic Non-Dairy Beverages, Organic Alcoholic Beverages, Organic Soft Drinks, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Grocery Stores, Pharmacies, Online, and Others), and Australia Organic Beverages Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

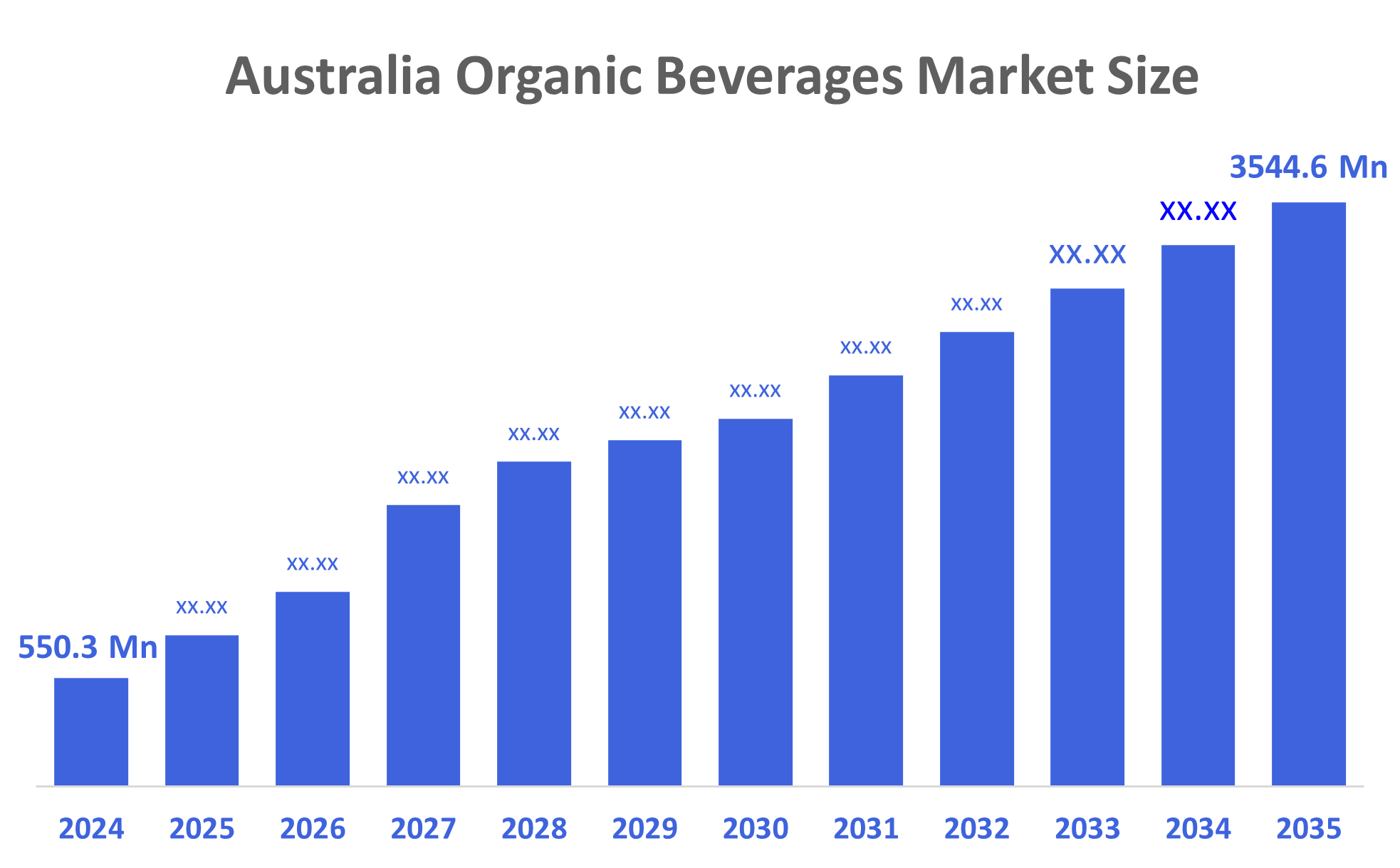

Australia Organic Beverages Market Size Insights Forecasts to 2035

- The Australia Organic Beverages Market Size Was Estimated at USD 550.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 18.45% from 2025 to 2035

- The Australia Organic Beverages Market Size is Expected to Reach USD 3544.6 Million by 2035

According to a research report published by Decisions Advisors, The Australia Organic Beverages Market Size is Anticipated to Reach USD 3544.6 Million by 2035, Growing at a CAGR of 18.45% from 2025 to 2035. The organic beverages market in Australia is driven by growing demand for natural and functional drinks, the popularity of organic teas and kombucha, native botanical ingredients, and a growing need for convenient, sustainable beverage options.

Market Overview

The organic beverages market includes the production and distribution of drink products made with ingredients sourced from an organic cultivation process that excludes synthetic fertilizers, synthetic pesticides, genetically modified organisms (GMOs), and artificially introduced chemicals or substances like sugar or flavor enhancers. The organic beverages market in Australia is one of the sectors that is growing most rapidly, benefiting the most from the consumers’ increasing demand for clean-label, natural, and sustainable drinks. Besides the health-consciousness trend, the rise in demand for functional beverages that support immunity and gut health, and the popularity of organic teas, kombucha, and cold-pressed juices made of native plants contribute to the market development. The Australian government assists the organic drinks industry on the verge of taking off, with sustainable agriculture, grants of millions of AUD, organic certification that allows more than the export of AUD 2 billion, over AUD 100 million a year, as well as R&D funding and Export Market Development Grants taking care of 50% of qualifying export promotion costs. Premium exports, plant-based and functional drinks, and innovative flavors are the areas where the potential is the highest. Among the recent activities, the organic product launches, the opening of new retail outlets, and investments in sustainable sourcing and packaging are some of the measures taken across Australia.

Report Coverage

This research report categorizes the market for the Australia organic beverages market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia organic beverages market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia organic beverages market.

Driving Factors

The organic beverages market in Australia is driven by public awareness of health issues, a strong trend toward clean-label and chemical-free products, and a surge in the market for functional drinks that help digestion, the immune system, and general well-being. Additionally, consumers' worries about environmental sustainability and their choice for organic, ethically sourced ingredients contribute to further growth in demand. Besides, the trend of organic teas, kombucha, cold-pressed juices, and plant-based drinks, coupled with the innovation of using native botanicals and retail and online channels expanding availability, is contributing to the continuous growth of the market throughout the country.

Restraining Factors

The organic beverages market in Australia is mostly constrained by the high costs of production and certification, premium pricing that restricts mass adoption, inadequacy of organic raw materials, short shelf life of natural products, and stiff competition from both conventional and functional beverages.

Market Segmentation

The Australia organic beverages market share is classified into product type and distribution channel.

- The organic coffee and tea segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia organic beverages market is segmented by product type into organic coffee and tea, organic non-dairy beverages, organic alcoholic beverages, organic soft drinks, and others. Among these, the organic coffee and tea segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. High daily consumption patterns, extensive availability in supermarkets, cafés, and online retail channels, and expanding consumer preference for functional herbal teas are all contributing factors to this.

- The supermarkets and hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia organic beverages market is segmented by distribution channel into supermarkets and hypermarkets, grocery stores, pharmacies, online, and others. Among these, the supermarkets and hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Wide product availability, robust private label offers, competitive prices, high customer trust, and the ease of one-stop shopping all contribute to increased sales volumes when compared to other channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia organic beverages market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Remedy Drinks

- MOJO Kombucha

- Nexba

- Raw C

- Kreol Sparkling

- Buderim Ginger

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Functional teas and specialty blends with native botanicals are gaining traction in the tea market of Australia, which is a manifestation of the general demand for organic beverages and their innovations.

- In November 2025, the Gipps Nature biological A2 brand that was developed by an Australian company, ViPlus Dairy, is mainly directed to export to the Southeast Asian market, thereby increasing the export of organic dairy-based beverages.

- In October 2025, the Australian government broadened the organics equivalence agreements with Japan and India, thus making it easier for exporters of organic wines and related beverages.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia organic beverages market based on the below-mentioned segments:

Australia Organic Beverages Market, By Product Type

- Organic Coffee and Tea

- Organic Non-Dairy Beverages

- Organic Alcoholic Beverages

- Organic Soft Drinks

- Others

Australia Organic Beverages Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Grocery Stores

- Pharmacies

- Online

- Others

FAQ’s

Q: What is the Australia organic beverages market size?

A: Australia organic beverages market size is expected to grow from USD 550.3 million in 2024 to USD 3544.6 million by 2035, growing at a CAGR of 18.45% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by public awareness of health issues, a strong trend toward clean-label and chemical-free products, and a surge in the market for functional drinks that help digestion, the immune system, and general well-being. Additionally, consumers' worries about environmental sustainability and their choice for organic, ethically sourced ingredients contribute to further growth in demand. Besides, the trend of organic teas, kombucha, cold-pressed juices, and plant-based drinks, coupled with the innovation of using native botanicals and retail and online channels expanding availability, is contributing to the continuous growth of the market throughout the country.

Q: What factors restrain the Australia organic beverages market?

A: Constraints include the high costs of production and certification, premium pricing that restricts mass adoption, inadequacy of organic raw materials, short shelf life of natural products, and stiff competition from both conventional and functional beverages.

Q: How is the market segmented by product type?

A: The market is segmented into organic coffee and tea, organic non-dairy beverages, organic alcoholic beverages, organic soft drinks, and others.

Q: Who are the key players in the Australia organic beverages market?

A: Key companies include Remedy Drinks, MOJO Kombucha, Nexba, Raw C, Kreol Sparkling, Buderim Ginger, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |