Australia Overhead Cranes Market

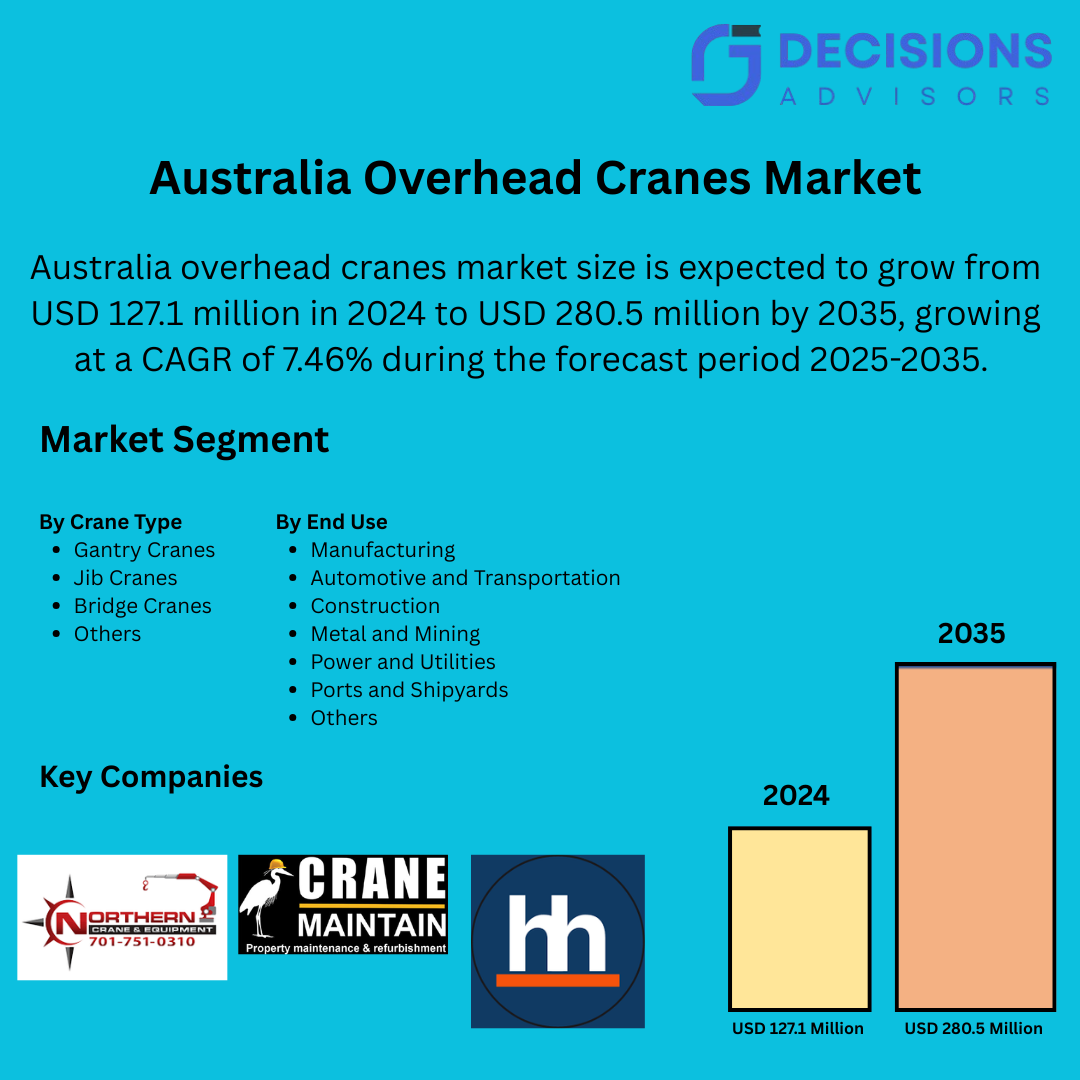

Australia Overhead Cranes Market Size, Share, and COVID-19 Impact Analysis, By Crane Type (Gantry Cranes, Jib Cranes, Bridge Cranes, and Others), By End Use (Manufacturing, Automotive and Transportation, Construction, Metal and Mining, Power and Utilities, Ports and Shipyards, and Others), and Australia Overhead Cranes Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Overhead Cranes Market Insights Forecasts to 2035

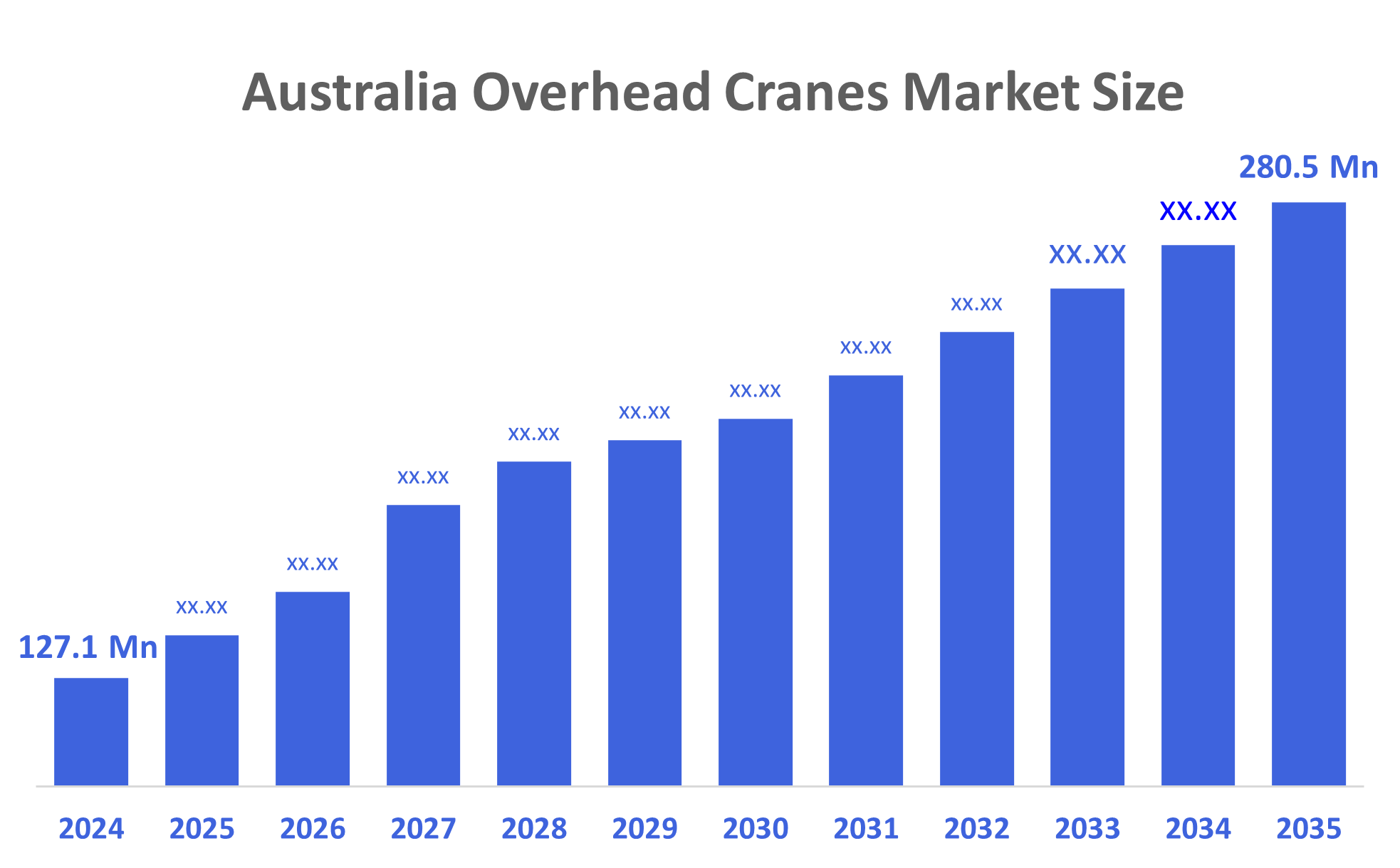

- The Australia Overhead Cranes Market Size Was Estimated at USD 127.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.46% from 2025 to 2035

- The Australia Overhead Cranes Market Size is Expected to Reach USD 280.5 Million by 2035

According to a research report published by Decisions Advisors, The Australia Overhead Cranes Market Size is Anticipated to Reach USD 280.5 Million by 2035, Growing at a CAGR of 7.46% from 2025 to 2035. The overhead cranes market in Australia is driven by businesses looking for safer, more effective material handling solutions and cutting-edge lifting technologies. These factors include growing construction, mining, and manufacturing activities, increased infrastructure spending, warehouse automation, and renewable energy projects.

Market Overview

An overhead crane is a piece of equipment made to precisely and safely lift and transport very heavy objects inside the overhead space of a building. These cranes provide effective, accurate, and secure material handling in industries including construction, manufacturing, mining, and logistics by operating on raised runways or tracks. Government-backed infrastructure initiatives are a major driver of the Australian overhead crane business. Many projects need heavy lifting and material handling solutions, with a national public infrastructure pipeline estimated to be worth US$242 billion for 2024–2029, including US$129 billion for transportation, US$77 billion for buildings, and US$36 billion for utilities. In order to ensure effective, safe, and dependable handling of structural steel, mechanical units, and other heavy items, these expenditures increase the demand for overhead cranes in industrial plants, warehouses, construction sites, and energy facilities. There are possibilities in upgrading older cranes, incorporating smart systems, and supporting distant industrial projects. Recent advancements feature the use of cranes for significant infrastructure projects in December 2024 and the setup of FEM standard cranes in production facilities in January 2025, underscoring the market’s emphasis on sophisticated, standardized, and secure lifting solutions.

Report Coverage

This research report categorizes the market for the Australia overhead cranes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia overhead cranes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia overhead cranes market.

Driving Factors

The overhead cranes market in Australia is driven by massive developments within the construction, mining, and manufacturing industries. Additionally, increasing levels of investment in both infrastructure and warehouse automation help to drive the market even further. Further base loads of heavy lift equipment are being created by additional renewable energy developments, including wind and solar farm activities. The use of the latest technology in cranes, including Internet of Things (IoT) enabled cranes, smart automated cranes, and predictive maintenance systems, is also paving the way for efficient materials handling while also adding reliability to crane operations in the industry and construction sectors.

Restraining Factors

The overhead cranes market in Australia is mostly constrained by high initial investment costs, complex installation issues, and the ongoing costs associated with maintaining them. The lack of skilled crane operators and difficulties associated with complying with the many safety regulations associated with these crane technologies are additional reasons that may slow down adoption rates for some verticals, specifically small and medium-sized enterprises.

Market Segmentation

The Australia overhead cranes market share is classified into crane type and end use.

- The bridge cranes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia overhead cranes market is segmented by crane type into gantry cranes, jib cranes, bridge cranes, and others. Among these, the bridge cranes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Bridge cranes are popular for construction, manufacturing, mining, and warehouse applications due to their high load capacities, long spans, and precision material handling capabilities. Their capacity to transfer large loads effectively along a facility's length and width shortens operating times and improves safety.

- The manufacturing segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia overhead cranes market is segmented by end use into manufacturing, automotive and transportation, construction, metal and mining, power and utilities, ports and shipyards, and others. Among these, the manufacturing segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. For the effective and safe lifting, moving, and placement of large materials, equipment, and components, manufacturing facilities mostly rely on overhead cranes. The manufacturing industry has the highest revenue share compared to the construction, mining, automotive, or other end-use sectors due to the expansion of automated production lines, warehouse integration, and stringent safety regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia overhead cranes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Northern Cranes

- Cranemaintain

- Hydromech Hoist and Crane Pty Ltd

- NQCranes

- Crane Systems

- West Crane Services

- Levitate Lifting

- Total Hoists and Cranes

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2024, West Crane Services installed a 3.2-tonne single-girder overhead crane that spanned 28 metres, demonstrating Australian-made precision lifting systems for industrial applications.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia overhead cranes market based on the below-mentioned segments:

Australia Overhead Cranes Market, By Crane Type

- Gantry Cranes

- Jib Cranes

- Bridge Cranes

- Others

Australia Overhead Cranes Market, By End Use

- Manufacturing

- Automotive and Transportation

- Construction

- Metal and Mining

- Power and Utilities

- Ports and Shipyards

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |