Australia Pallet Market

Australia Pallet Market Size, Share, and COVID-19 Impact Analysis, By Type (Wood, Plastic, Metal, and Corrugated Paper), By Application (Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, and Others), and Australia Pallet Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Market Insights Forecasts to 2035

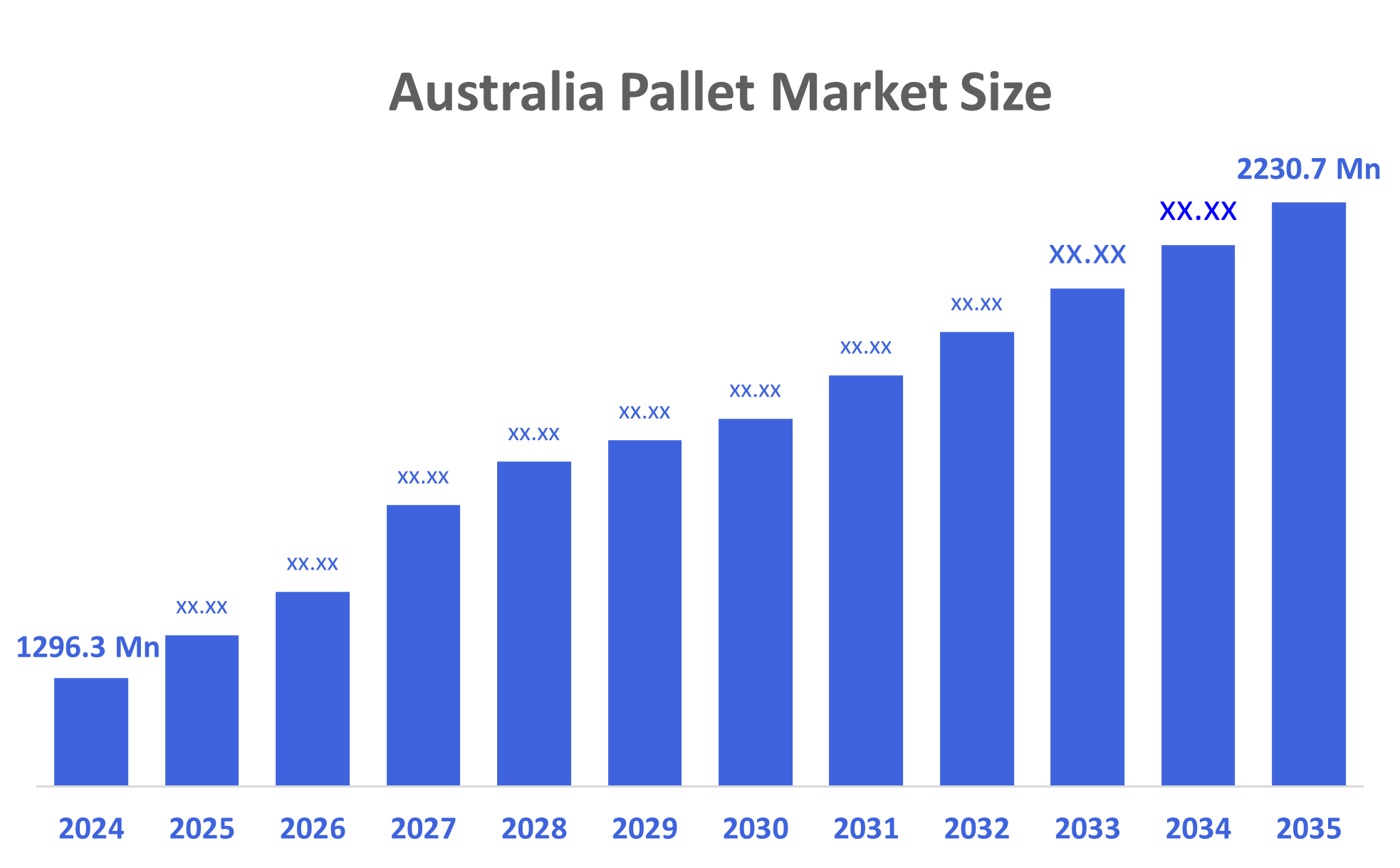

- The Australia Pallet Market Size Was Estimated at USD 1296.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.06% from 2025 to 2035

- The Australia Pallet Market Size is Expected to Reach USD 2230.7 Million by 2035

According to a research report published by Decisions Advisors, The Australia Pallet Market Size is Anticipated to Reach USD 2230.7 Million by 2035, Growing at a CAGR of 5.06% from 2025 to 2035. The pallet market in Australia is driven by expanding e-commerce and logistics, rising infrastructure development, growth in exports, sustainability initiatives, ongoing pallet tracking technology improvements, and increased demand for durable, cost-efficient, and reusable pallet solutions across diverse industries.

Market Overview

The pallet market is for the manufacturing, marketing, and distribution of pallets, which are flat, moveable platforms used to support goods during storage, handling, and transportation. These marketplaces are influenced by factors like economic situations, industry demand, sustainability trends, and technical breakthroughs. The market for pallets in Australia is experiencing growth and expansion as a result of many factors, including the rise of e-commerce, increasing logistics and warehousing requirements, higher levels of exported products, and increased consumer demand for strong, durable, reusable pallet solutions. In Australia, government-supported initiatives are improving pallet sustainability. For example, the Victorian government funded SMART Recycling's upgraded production process, which allows for 700,000 recycled pallets each year, greatly reducing trash. Furthermore, a $14 million sawmill improvement funded by regional development initiatives increased local hardwood pallet manufacture, improving circular-economy outcomes and encouraging long-term pallet reuse across supply chains. Innovations in technology, including RFID and IoT-enabled smart pallets, pallets that can be used in automated environments, as well as improved recycled material manufacturing processes, will create incentives for the continued development of supply chain efficiency. The number of businesses utilizing automation technologies is growing within many sectors, such as food, pharmaceuticals, retail, and automated warehousing.

Report Coverage

This research report categorizes the market for the Australia pallet market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia pallet market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia pallet market.

Driving Factors

The pallet market in Australia is driven by the rapid growth of e-commerce, the expansion of logistics and warehousing services, and the increase in exports that require a reliable method to handle loads. Infrastructure expansion and industrial production are also increasing the demand for pallets. Many industries are shifting towards reusable, recyclable, and renewable pallet materials due to the impact of sustainability. In addition, pallet pooling, RFID-enabled/IoT tracking capabilities, and pallet designs that support automation are helping to improve the efficiency of the supply chain and therefore encourage the use of pallets by manufacturers, retailers, the food sector, and pharmaceutical companies.

Restraining Factors

The pallet market in Australia is mostly constrained by fluctuating prices of raw materials, particularly wood, as well as increasing manufacturing costs and transportation expenses. The limited availability of recycling infrastructure, current disruptions in supply chains, and the slower-than-average acceptance of advanced pallets by smaller companies are all barriers to the growth of the market as a whole.

Market Segmentation

The Australia pallet market share is classified into type and application.

- The wood segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia pallet market is segmented by type into wood, plastic, metal, and corrugated paper. Among these, the wood segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The wood pallet segment dominates Australia’s pallet market due to its low cost, durability, wide availability, repairability, and robust recycling network, coupled with broad acceptance across logistics, manufacturing, retail, and export sectors.

- The food and beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia pallet market is segmented by application into food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others. Among these, the food and beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the industry's need for regular, high-volume pallet utilization for distribution, transportation, and storage. Strict hygiene rules, continuous production cycles, and extensive retail supply chains further drive pallet demand, making food and beverages the largest and most consistent end-user of pallets countrywide.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia pallet market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CHEP

- Loscam Australia

- Palleco

- Aussie Pallet Control

- Eco Pallets

- Top Pallets Perth

- JP Pallets (WA)

- Aussie Crates

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, Hyne Group's acquisition of Seapal Pallets & Crates (Kilcoy) allows Hyne Group to increase its pallet manufacturing network nationally.

- In May 2025, Hyne Group's acquisition of Pallet & Bin Pty Ltd (Shepparton) increases its reach into the pallet manufacturing market and provides a stable supply for major food companies and export customers.

- In October 2024, CMTP's acquisition of Palletmasters was a logical step that increased CMTP's presence and product offerings in the market; this acquisition helps CMTP improve its competitiveness in the pallet industry in Australia.

- In August 2024, FedEx's introduction of Dynamic Drive Thru Pallet Dimensioning Systems throughout Australia is designed to improve productivity and accuracy; these improvements will facilitate the increase in e-commerce sales that will drive growth in the marketplace.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia pallet market based on the below-mentioned segments:

Australia Pallet Market, By Type

- Wood

- Plastic

- Metal

- Corrugated Paper

Australia Pallet Market, By Application

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |