Australia Payment Processing Solutions Market

Australia Payment Processing Solutions Market Size, Share, and COVID-19 Impact Analysis, By Payment Method (Credit Card, Debit Card, and E-wallet), By End Use (Hospitality, Retail, Utilities and Telecommunication, and Others), and Australia Payment Processing Solutions Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Payment Processing Solutions Market Insights Forecasts to 2035

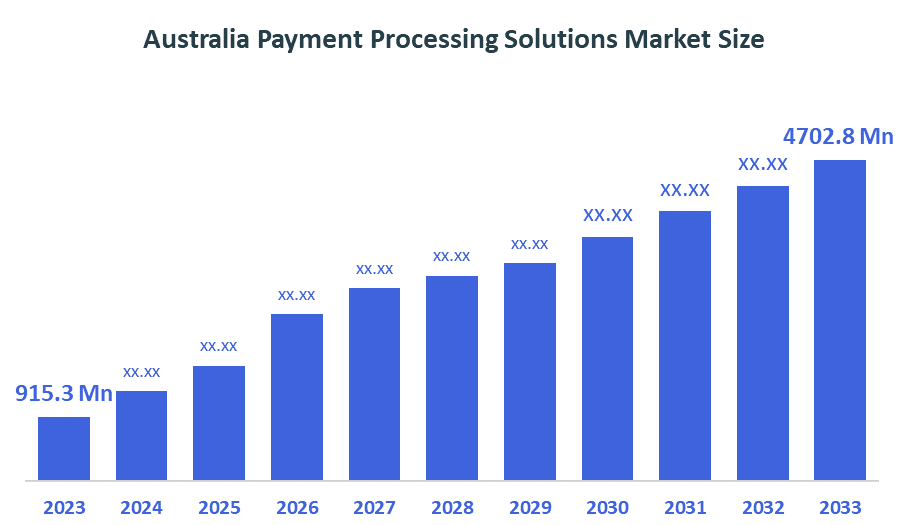

- The Australia Payment Processing Solutions Market Size Was Estimated at USD 915.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16.04% from 2025 to 2035

- The Australia Payment Processing Solutions Market Size is Expected to Reach USD 4702.8 Million by 2035

According to a Research Report Published by Decision Advisior & Consulting, the Australia payment processing solutions market size is anticipated to reach USD 4702.8 million by 2035, growing at a CAGR of 16.04% from 2025 to 2035. The payment processing solutions market in Australia is driven by rapid digitalization, an increase in cashless transactions, expanding e-commerce, rising smartphone usage, fintech innovation, government backing for digital payments, and a robust demand for safe, real-time payment systems.

Market Overview

The Australia Payment Processing Solutions Market Size is the market encompassing the hardware, software, and services that allow for electronic transactions in Australia, such as card payments, digital wallets, mobile payments, online banking, and real-time payment systems, thus making secure, efficient, and cashless financial transactions possible across all sectors. The market for payment processing solutions in Australia is on a fast track of growth, which is driven by factors like the increase in cashless transactions, the widespread use of contactless and mobile payments, and the robust growth of e-commerce.

Australia's government is backing up the payment processing technology with the New Payments Platform (NPP), settling real-time transactions of billions every year, and the upgrades of the RBA-backed settlement system, which manages more than A$300 billion daily. The reforms in the payments system, the extension of PayID and PayTo, and the regulations favorable to fintech have made it possible to have safe and efficient digital payments throughout the country.

There are openings in the areas of embedded finance, bank payment services, and digital payment solutions for SMEs. Fintech product launches, enhancement of real-time settlement infrastructure, and regulatory reviews for payment efficiency, transparency, and consumer protection have been some of the recent developments that have taken place in the payment processing solutions market.

Report Coverage

This research report categorizes the market for the Australia payment processing solutions market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia payment processing solutions market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia payment processing solutions market.

Driving Factors

The payment processing solutions market in Australia is driven by rapid digitalization and the strong consumer preference for contactless/no cash payments. Increased use of smartphones, along with growth in E-Commerce (B2B and B2C), the subscription service industry (SaaS), and the on-demand marketplace, means that more customers will require a secure way to complete their transactions via any of these channels. Government support for payment processing solutions through the development of the New Payments Platform (NPP), the Open Banking Initiative, and Mark Atkinson's work in regulatory compliance has encouraged competition and innovation in this area. The increasing use of real-time payments, AI-based fraud detection tools, digital wallets, and cloud-based payment systems will continue to provide increased efficiency, security, and scalability, and allow for greater adoption by both merchants and financial institutions.

Restraining Factors

The payment processing solutions market in Australia is mostly constrained by the high costs of compliance and regulation, fears of data breaches along with concerns about the privacy of data, the fierce rivalry among the providers, the difficulties in integrating the new systems with the traditional ones, as well as the transaction fees that could be a barrier for small merchants considering the adoption of advanced payment solutions.

Market Segmentation

The Australia payment processing solutions market share is classified into payment method and end use.

- The credit card segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia payment processing solutions market is segmented by payment method into credit card, debit card, and e-wallet. Among these, the credit card segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its broad acceptability, strong consumer demand for rewards and credit facilities, significant e-commerce usage, safe transaction systems, and broad merchant and banking network support throughout Australia, the credit card category leads the Australian market for payment processing solutions.

- The retail segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia payment processing solutions market is segmented by end use into hospitality, retail, utilities, telecommunication, and others. Among these, the retail segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. High transaction volumes, extensive POS and contactless payment usage, robust e-commerce integration, and growing customer desire for cashless and digital payments across retail locations are the main factors driving this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia payment processing solutions market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airwallex

- Tyro Payments

- BPAY Group

- Live Group Pty Ltd

- Monoova

- Novatti Group

- Eway

- Merchant Warrior

- eftpos Australia

- Sniip

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Tyro Payments acquired AI fintech Thriday. Tyro concluded a deal to buy Thriday, the Melbourne-based fintech, thus extending its payment and financial management ecosystem for small and medium enterprises (SMEs).

- In November 2025, with the Live Payments partnership, Pipe goes to Australia. The pioneer of embedded finance, Pipe, has arrived in the Australian market, which means that working capital will be available through Live Payments’ system.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Australia payment processing solutions market based on the below-mentioned segments:

Australia Payment Processing Solutions Market, By Payment Method

- Credit Card

- Debit Card

- E-wallet

Australia Payment Processing Solutions Market, By End Use

- Hospitality

- Retail

- Utilities and Telecommunication

- Others

FAQ’s

Q: What is the Australia payment processing solutions market size?

A: Australia home decor market size is expected to grow from USD 16.2 million in 2024 to USD 24.7 million by 2035, growing at a CAGR of 3.91% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by rapid digitalization and the strong consumer preference for contactless/no cash payments. Increased use of smartphones, along with growth in E-Commerce (B2B and B2C), the subscription service industry (SaaS), and the on-demand marketplace, means that more customers will require a secure way to complete their transactions via any of these channels. Government support for payment processing solutions through the development of the New Payments Platform (NPP), the Open Banking Initiative, and Mark Atkinson's work in regulatory compliance has encouraged competition and innovation in this area.

Q: What factors restrain the Australia payment processing solutions market?

A: Constraints include the high costs of compliance and regulation, fears of data breaches concern about the privacy of data, the fierce rivalry among the providers, the difficulties in integrating the new systems with the traditional ones, as well as the transaction fees that could be a barrier for small merchants considering the adoption of advanced payment solutions.

Q: How is the market segmented by payment method?

A: The market is segmented into credit card, debit card, and e-wallet.

Q: Who are the key players in the Australia payment processing solutions market?

A: Key companies include Airwallex, Tyro Payments, BPAY Group, Live Group Pty Ltd, Monoova, Novatti Group, Eway, Merchant Warrior, eftpos Australia, Sniip, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 168 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |