Australia Personal Protective Equipment Market

Australia Personal Protective Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Head, Eye & Face Protection, Hearing Protection, Protective Clothing, Protective Footwear, Hand & Arm Protection, and Others), By End Use Industry (Oil and Gas, Construction, Chemical, Healthcare, Manufacturing, and Others), and Australia Personal Protective Equipment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Personal Protective Equipment Market Size Insights Forecasts to 2035

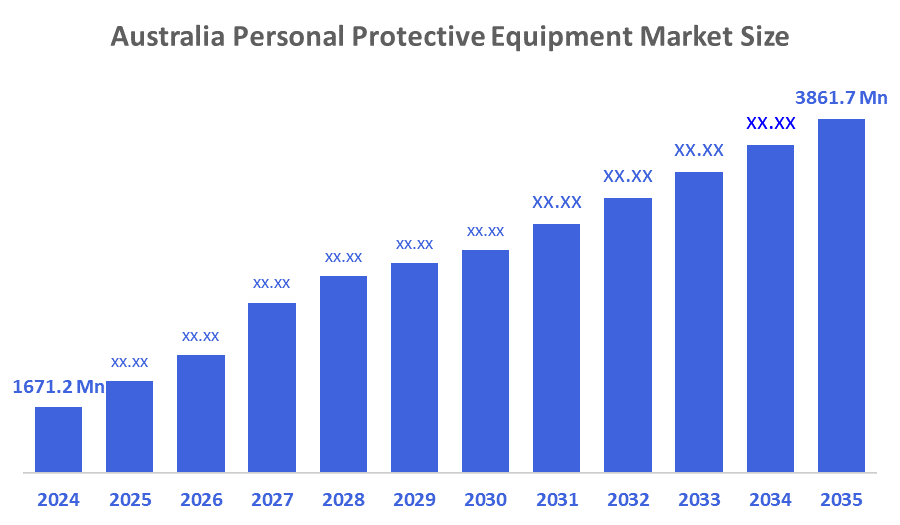

- The Australia Personal Protective Equipment Market Size Was Estimated at USD 1671.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.91% from 2025 to 2035

- The Australia Personal Protective Equipment Market Size is Expected to Reach USD 3861.7 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Personal Protective Equipment Market Size is anticipated to Reach USD 3861.7 Million by 2035, Growing at a CAGR of 7.91% from 2025 to 2035. The home decor market in Australia is driven by strict safety regulations, rapid industrial expansion, growing awareness of workplace safety, rapid technological advancements, COVID-19, strategic corporate acquisitions, the growing demand for specialized protective gear, and environmental sustainability initiatives.

Market Overview

The personal protective equipment (PPE) market is an industry that encompasses the manufacture, distribution, and sale of protective equipment used to protect workers and individuals from workplace injuries, health hazards, and environmental hazards. PPE includes products such as gloves, masks, face shields, respirators, safety helmets, protective and safety clothing, goggles, ear protection, safety footwear, and fall protection devices. The Australian personal protective equipment (PPE) industry is being stimulated by strict workplace-safety regulations from Safe Work Australia and other state regulators that require employers to provide appropriate PPE. The Australian government is furthering domestic manufacturing and supply-chain resilience through initiatives like the Supply Chain Resilience Initiative (which included PPE and provided matched funding). DSS initiatives are driving smart wearable devices, IoT PPE, and enhanced materials to drive product protection with a pathway to data analytics & safety. There are also opportunities for sustainable & locally manufactured PPE, especially with lessons learned through the pandemic and high-risk industries such as construction, mining & healthcare. The recent acquisition of Kimberly-Clark's global personal protective gear business by Australian-based Ansell Ltd for US$640 million demonstrates the growth of industry consolidation.

Report Coverage

This research report categorizes the market for the Australia personal protective equipment market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia personal protective equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia personal protective equipment market.

Driving Factors

The personal protective equipment market in Australia is driven by rigorous workplace health and safety requirements across sectors such as manufacturing, mining, construction, and health care. Safe Work Australia’s constant push for compliance and risk reduction has helped drive demand for quality PPE and fall protection systems. Increasing workplace hazards from chemical exposure and other respiratory-related issues and physical injuries also provide opportunities for product adoption. The increased recognition of personal protective clothing and personal protection equipment in the wake of COVID-19, especially in hospitals and aged care facilities, will create ongoing demand for medical PPE. Other advances, such as smart PPE, materials development, and sustainability, will also help drive future demand for PPE.

Restraining Factors

The personal protective equipment market in Australia is mostly constrained by the high cost of advanced and specialist PPE, the lack of consistent compliance among small businesses, and increasing competition from low-cost imports. Ongoing supply chain interruptions and dependence on overseas manufacturers impact product availability. Environmental issues related to the disposal of single-use PPE also impacted sustainable market development.

Market Segmentation

The Australia personal protective equipment market share is classified into product type and end use industry.

- The hand & arm protection segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia personal protective equipment market is segmented by product type into head, eye & face protection, hearing protection, protective clothing, protective footwear, hand & arm protection, and others. Among these, the hand & arm protection segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth due to its extensive use in the healthcare, construction, and industrial sectors, stringent safety standards, and frequent replacement of disposable and protective gloves, hand and arm protection is in great demand.

- The healthcare segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia personal protective equipment market is segmented by end use industry into oil and gas, construction, chemical, healthcare, manufacturing, and others. Among these, the healthcare segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to infection control regulations, continuous medical practice, and pandemic-driven readiness, healthcare facilities, including hospitals, clinics, and assisted living facilities, need a lot of personal protective equipment (PPE), such as gloves, masks, and gowns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia personal protective equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ansell Limited

- PPE Tech

- RSEA Safety

- VISIONSafe Pty Ltd

- Safety Zone Australia Pty Ltd

- Med?Con Pty Ltd

- At?Call Safety

- Badger Australia

- RWW Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2024, Ansell Limited confirmed the purchase of Kimberly-Clark's PPE business, which includes the brands Kimtech and KleenGuard, to enhance its industrial and healthcare PPE offerings.

- In March 2024, A review of Australian government procurement revealed that many PPE masks purchased during the pandemic were unusable, and the Australian Institute of Health and Welfare (AIHW) is requesting government agencies put more stringent measures in place to assess quality.

- In March 2024, PPE Tech and other local mask manufacturers requested a meeting with the Australian government to discuss support for local manufacturers in light of cheaper imported masks competing for domestic production capacity.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia personal protective equipment market based on the below-mentioned segments:

Australia Personal Protective Equipment Market, By Product Type

- Head

- Eye & Face Protection

- Hearing Protection

- Protective Clothing

- Protective Footwear

- Hand & Arm Protection

- Others

Australia Personal Protective Equipment Market, By End Use Industry

- Oil and Gas

- Construction

- Chemical

- Healthcare

- Manufacturing

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 298 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |