Australia Pharmacovigilance and Drug Safety Software Market

Australia Pharmacovigilance and Drug Safety Software Market Size, Share, and COVID-19 Impact Analysis, By Functionality (Adverse Event Reporting Software, Signal Detection, and Others), By End User (Contract Research Organizations (CROs), Pharma and Biotech Companies, Business Process Outsourcing Firms, and Others), and Australia Pharmacovigilance and Drug Safety Software Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Pharmacovigilance and Drug Safety Software Market Insights Forecasts to 2035

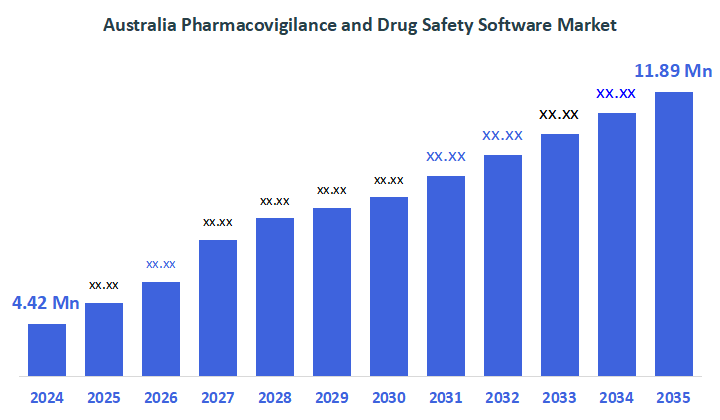

- The Australia Pharmacovigilance and Drug Safety Software Market Size Was Estimated at USD 4.42 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.41% from 2025 to 2035

- The Australia Pharmacovigilance and Drug Safety Software Market Size is Expected to Reach USD 11.89 Million by 2035

According to a research report published by Decisions Advisors & Consulting, the Australia Pharmacovigilance and Drug Safety Software Market Size is anticipated to reach USD 11.89 Million by 2035, growing at a CAGR of 9.41% from 2025 to 2035. The pharmacovigilance and drug safety software market in Australia is driven by strict regulatory compliance requirements, an increase in adverse event reporting, an increase in clinical trials, the digital revolution of healthcare, and the increasing use of automated, cloud-based safety monitoring solutions.

Market Overview

The Australia Pharmacovigilance and Drug Safety Software Market Size is described as the market for electronic tools and systems that are capable of spotting, evaluating, tracking, and documenting negative drug reactions and safety data, thereby making it possible for the pharmaceutical industry, CROs, and authorities in Australia to guarantee drug safety, follow the regulations, and protect patients. The use of AI, machine learning, and cloud solutions not only facilitates drug safety monitoring but also speeds up data analysis and detection of signals, thereby increasing overall efficiency.

The Australian government, by its TGA (Therapeutic Goods Administration) requirement for adverse event reporting, supports the market for pharmacovigilance and drug safety software through the electronic submission of reports within strict time limits. Digital health innovators are directed by partnerships between AND Health and TGA, while integration of electronic reporting into clinical and pharmacy systems increases efficiency. Hospitals and clinics, active monitoring, and researchers all get easier access to the good drug safety solutions.

The extra cash that goes towards the digitization of health, plus the safe use of AI initiatives, encourages the acceptance of new technologies. The most recent innovations in AI usage within pharmacovigilance, guidelines for regulatory readiness, and altering compliance frameworks by the year 2025 are all vibrant developments.

Report Coverage

This research report categorizes the market for the Australia Pharmacovigilance and Drug Safety Software Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia Pharmacovigilance and Drug Safety Software Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia pharmacovigilance and drug safety software market.

Driving Factors

The Pharmacovigilance and Drug Safety Software Market in Australia is driven by the increasing regulatory requirements, the rise in the number of reported adverse drug reactions, and the expansion of clinical trials in Australia. Digital health technologies are being used more widely, along with the adoption of digital health technologies, cloud-based platforms, and AI-powered analytics, which support drug safety monitoring, signal detection, and compliance. The need for reducing manual reporting errors, increasing operational efficiency, and ensuring patient safety across pharma and biotech companies further propels the market, and thus, there is a strong demand for automated and integrated pharmacovigilance and drug safety software solutions.

Restraining Factors

The Pharmacovigilance and Drug Safety Software Market in Australia is mostly constrained by the high cost of implementation, the complicated process of regulatory compliance, the shortage of skilled labor, the difficulty in integrating with the existing healthcare IT systems, and the worries related to data privacy.

Market Segmentation

The Australia pharmacovigilance and drug safety software market share is classified into functionality and end user.

- The adverse event reporting software segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia pharmacovigilance and drug safety software market is segmented by functionality into adverse event reporting software, signal detection, and others. Among these, the adverse event reporting software segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Strict TGA regulations requiring prompt reporting of adverse drug reactions, widespread adoption by pharmaceutical companies for compliance, and the requirement for effective, automated reporting systems to lower errors, enhance patient safety, and simplify pharmacovigilance operations are the main drivers of this dominance.

- The pharma and biotech companies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia pharmacovigilance and drug safety software market is segmented by end user into contract research organizations (CROs), pharma and biotech companies, business process outsourcing firms, and others. Among these, the pharma and biotech companies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Pharmacovigilance software is crucial for guaranteeing drug safety and upholding regulatory compliance because of its massive clinical trials, high drug development activity, stringent regulatory compliance standards, and demand for ongoing adverse event monitoring.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia pharmacovigilance and drug safety software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GxPVigilance

- Datapharm Australia

- Beamtree

- Opyl Limited

- My Health Record

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Guidance from the industry concerning the utilization of AI in pharmacovigilance processes became more widely accepted and acknowledged, and the focus of the regulators on the AI-supported drug safety operations' efficiency and readiness came along.

- In October 2025, the TGA's scrutiny of the regulations broadened concerning the software and AI-based tools, and thus, the medical software impacting drug safety monitoring was subjected to compliance and ARTG inclusion requirements.

- In March 2025, the TGA started its Pharmacovigilance Inspection Program, which was a measure that created an expectation of inspection readiness and compliance not only among the sponsors but also among the PV (pharmacovigilance) teams.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia pharmacovigilance and drug safety software market based on the below-mentioned segments:

Australia Pharmacovigilance and Drug Safety Software Market, By Functionality

- Adverse Event Reporting Software

- Signal Detection

- Others

Australia Pharmacovigilance and Drug Safety Software Market, By End User

- Contract Research Organizations (CROs)

- Pharma and Biotech Companies

- Business Process Outsourcing Firms

- Others

FAQ’s

Q: What is the Australia pharmacovigilance and drug safety software market size?

A: Australia pharmacovigilance and drug safety software market size is expected to grow from USD 4.42 million in 2024 to USD 11.89 million by 2035, growing at a CAGR of 9.41% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increasing regulatory requirements, the rise in the number of reported adverse drug reactions, and the expansion of clinical trials in Australia. Digital health technologies are being used more widely, along with the adoption of digital health technologies, cloud-based platforms, and AI-powered analytics, which support drug safety monitoring, signal detection, and compliance.

Q: What factors restrain the Australia pharmacovigilance and drug safety software market?

A: Constraints include the high cost of implementation, the complicated process of regulatory compliance, the shortage of skilled labor, the difficulty in integrating with the existing healthcare IT systems, and the worries related to data privacy.

Q: How is the market segmented by end user?

A: The market is segmented into contract research organizations (CROs), pharma and biotech companies, business process outsourcing firms, and others.

Q: Who are the key players in the Australia pharmacovigilance and drug safety software market?

A: Key companies include GxPVigilance, Datapharm Australia, Beamtree, Opyl Limited, My Health Record, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |