Australia Photovoltaic Cell Market

Australia Photovoltaic Cell Market

Report Overview

Table of Contents

Australia Photovoltaic Cell Market Australia Market Insights Forecasts to 2035

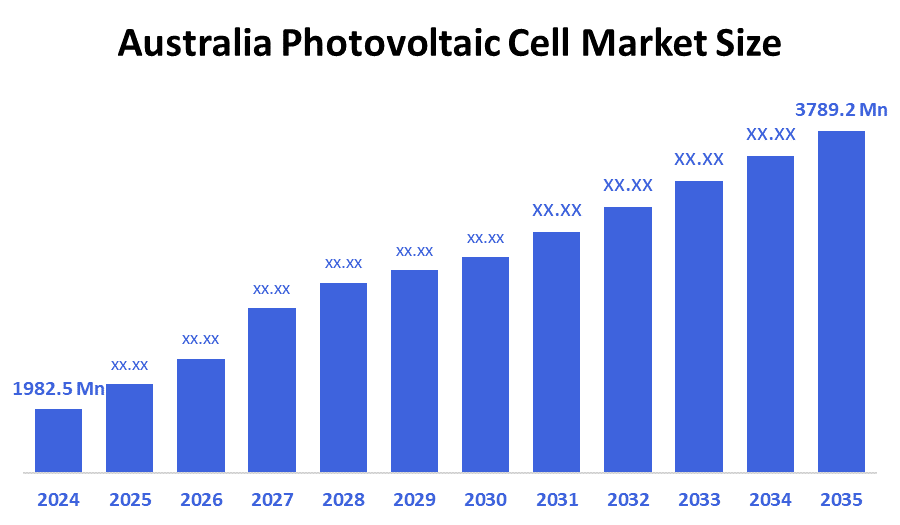

- The Australia Photovoltaic Cell Market Size Was Estimated at USD 1982.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.07% from 2025 to 2035

- The Australia Photovoltaic Cell Market Size is Expected to Reach USD 3789.2 Million by 2035

According to a research report published by decision advisor & Consulting, the Australia photovoltaic cell market size is anticipated to reach USD 3789.2 million by 2035, growing at a CAGR of 6.07% from 2025 to 2035. The photovoltaic cell market in Australia is driven by major government investment in domestic solar manufacturing, rapid residential adoption, advancements in perovskite and bifacial technologies, and growing integration of battery energy storage systems.

Market Overview

The Photovoltaic Cell Market relates to the worldwide and local engagement in research and development, manufacturing, distribution, and utilization of photovoltaic (PV) cells that convert sunlight directly to electricity based on the photovoltaic effect. The PV Cell Market includes manufacturers, half manufacturers of crystalline silicon, thin film, perovskite, bifacial, or other emerging solar cells, besides related products and technologies to improve efficiency and performance. The market for photovoltaic cells is expanding rapidly in Australia as a result of rising demand for clean electricity, the quick uptake of rooftop solar in homes, and continued government support for domestic solar PV production. At both the federal and state levels, support for local manufacturing capacity and reductions in deployed costs continue through subsidies, rebates, and the Solar Sunshot program. Additionally, technology advancements, including high-efficiency bifacial modules, perovskite tandem cells, and solar-plus-battery systems, which improve the performance of solar systems, are helping to increase uptake. New markets are developing across residential, commercial, and utility-scale solar PV, especially where photovoltaic projects are co-deployed with battery energy storage to support grid resilience. Recent announcements of new solar manufacturing facilities and funding for next-generation PV research are all signs that the momentum in the market in Australia is sustainable.

Report Coverage

This research report categorizes the market for the Australia home decor market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia photovoltaic cell market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia photovoltaic cell market.

Driving Factors

The photovoltaic cell market in Australia is driven by the government's strong commitment to renewable energy through initiatives including solar deployment objectives, manufacturing incentives, and rebates. additionally, Australia's position as the world leader in installed solar per capita and the quick adoption of residential rooftop solar contribute to the continued high demand for photovoltaic cells. Further encouraging adoption are novel technologies like bifacial cells and perovskite tandem, which provide lower lifespan costs and more efficiency. Furthermore, such integration of battery energy storage systems with a PV installation can provide enhanced reliability and independence, further supporting market growth.

Restraining Factors

The photovoltaic cell market in Australia is mostly constrained by high total upfront installation and manufacturing costs, difficulties integrating into the grid, reliance on supply chains in foreign countries, land restrictions for large projects, and uncertainty in policy affecting long-term investment and industry growth.

Market Segmentation

The Australia home decor market share is classified into grid type and application.

- The on-grid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia photovoltaic cell market is segmented by grid type into on-grid, off-grid, and hybrid. Among these, the on-grid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because the majority of residential, commercial, and utility solar systems are grid-connected and supported by government incentives, lower installation costs, feed-in tariffs, and a quicker return on investment than off-grid and hybrid systems, the on-grid segment dominates the Australian photovoltaic cell market.

- The solar farms segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia photovoltaic cell market is segmented by application into solar farms, healthcare facilities, public infrastructure, aerospace, construction, military and defence, transportation, and others. Among these, the solar farms segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because big utility-scale projects demand high installation capacity, draw significant government and private investment, provide the lowest cost of solar energy, and encourage bulk photovoltaic cell procurement, the solar farms segment dominates the Australian photovoltaic cell market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia photovoltaic cell market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tindo Solar

- GreatCell Solar

- SunDrive Solar

- Australian Solar Manufacturing Pty Ltd

- NSEG (National Solar Energy Group)

- Smart Energy Group

- Infinite Energy

- SolarHub

- Redback Technologies

- GEM Energy Australia Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Australia is investigating the use of indium (and other critical minerals) from domestic sources and waste streams for solar panels, intending to strengthen local supply chains.

- In November 2025, the Solar Sunshot programme is supporting Australia's move into upstream solar manufacturing ingots, wafers, and cells, and will be less reliant on imports. A new funding round (~AU$150 million) is also mentioned.

- In October 2025, Australia's average grid-scale solar generation was 1,699 MW in Q3 2025, and there has been a growth of ~2,936 MW in battery storage capacity since Q3 2024.

- In August 2025, Stellar PV received AUD 4.7 million for a feasibility study for a 2 GW silicon ingot and wafer facility near Townsville, Queensland, a major upstream move into solar manufacturing.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. decision advisor has segmented the Australia photovoltaic cell market based on the below-mentioned segments:

Australia Photovoltaic Cell Market, By Grid Type

- On-Grid

- Off-Grid

- Hybrid

Australia Photovoltaic Cell Market, By Application

- Solar Farms

- Healthcare Facilities

- Public Infrastructure

- Aerospace

- Construction

- Military and Defence

- Transportation

- Others

FAQ’s

Q: What is the Australia photovoltaic cell market size?

A: Australia photovoltaic cell market size is expected to grow from USD 1982.5 million in 2024 to USD 3789.2 million by 2035, growing at a CAGR of 6.07% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the government's strong commitment to renewable energy through initiatives including solar deployment objectives, manufacturing incentives, and rebates. additionally, Australia's position as the world leader in installed solar per capita and the quick adoption of residential rooftop solar contribute to the continued high demand for photovoltaic cells. Further encouraging adoption are novel technologies like bifacial cells and perovskite tandem, which provide lower lifespan costs and more efficiency.

Q: What factors restrain the Australia photovoltaic cell market?

A: Constraints include the high total upfront installation and manufacturing costs, difficulties integrating into the grid, reliance on supply chains in foreign countries, land restrictions for large projects, and uncertainty in policy affecting long-term investment and industry growth.

Q: How is the market segmented by grid type?

A: The market is segmented into on-grid, off-grid, and hybrid.

Q: Who are the key players in the Australia photovoltaic cell market?

A: Key companies include Tindo Solar, GreatCell Solar, SunDrive Solar, Australian Solar Manufacturing Pty Ltd, NSEG (National Solar Energy Group), Smart Energy Group, Infinite Energy, SolarHub, Redback Technologies, and GEM Energy Australia Pty Ltd.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |