Australia Popcorn Market

Australia Popcorn Market Size, Share, and COVID-19 Impact Analysis, By Type (Microwave Popcorn, and Ready-To-Eat Popcorn), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Channels, and Others), and Australia Popcorn Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Popcorn Market Insights Forecasts to 2035

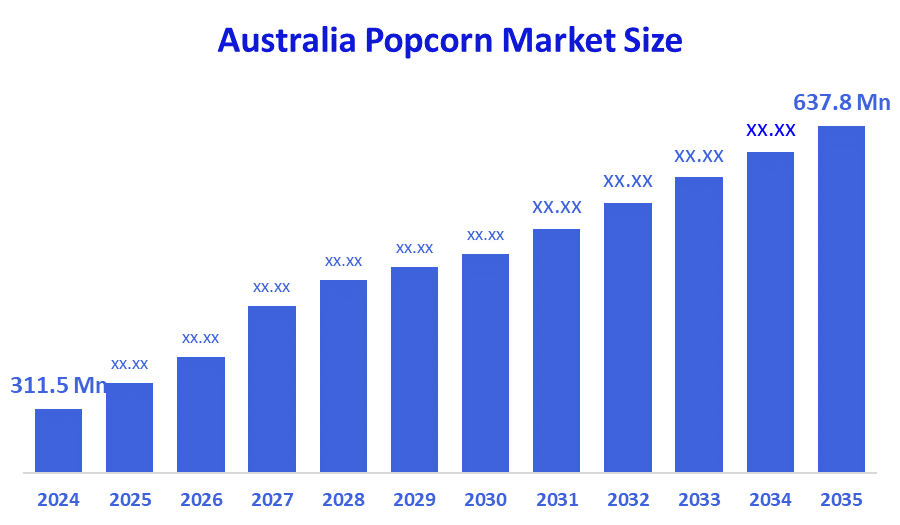

- The Australia Popcorn Market Size Was Estimated at USD 311.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.73% from 2025 to 2035

- The Australia Popcorn Market Size is Expected to Reach USD 637.8 Million by 2035

According To A Research Report Published By Decision Advisors, The Australia Popcorn Market Size Is Anticipated To Reach USD 637.8 Million By 2035, Growing At A CAGR Of 6.73% From 2025 To 2035. The Popcorn Market In Australia Is Driven By Growing Consumer Desire For Quick, Healthful Snacks, The Appeal Of Flavored And Gourmet Variants, The Expansion Of Home Entertainment Culture, And The Expansion Of Distribution Through Supermarkets And Internet Retail Channels.

Market Overview

The Australia popcorn market encompasses the entire process of making and selling popcorn, from the kernels to the ready-to-eat products. It includes microwave popcorn, packaged snack popcorn, and flavored popcorn. Main uses go from home consumption to cinemas, foodservice outlets, and retail snack segments. This is because people look for convenient, affordable, and healthier snacking options, among which are low-fat, organic, and gourmet popcorn products that are available throughout Australia.

The government of Australia acknowledges the importance of agriculture and food processing, and thus supports the sectors through programs like the Agriculture Industries Innovation and Growth Program, a program that provides funding to capitalize on projects that will enhance productivity in processing and supply chains. The innovation grants with amounts between A$250,000 and A$1.5 million are used for the application of sustainable methods and increasing the efficiencies in the production of crops such as maize, which is mainly used for popcorn. Certain national export support schemes are also in place to help the growers who are targeting foreign markets.

The Australian popcorn manufacturers are coming up with new flavors and healthier kinds of popcorn, such as air-popped, organic, and protein-fortified, which are attracting consumers who normally do not eat snacks. Besides, they are also using modern packaging techniques to keep the quality and eco-friendliness of their products. Clean-label flavors, functional snacking, e-commerce growth, and export to Asia Pacific markets are some of the potential future opportunities.

Report Coverage

This research report categorizes the market for the Australia popcorn market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia popcorn market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia popcorn market.

Driving Factors

The popcorn market in Australia is driven by the increasing demand for convenient and ready-to-eat snacks, the health-conscious population, and the expansion of both cinema and home-entertainment culture, among others. These factors include, but are not limited to, the penetration of supermarkets and online retail, the introduction of new and innovative packaging, and the high spending of urban populations on premium and organic snack products.

Restraining Factors

The popcorn market in Australia is mostly constrained by the uncertain prices of raw corn, competition from other snacks, increasing production and packaging costs, and health concerns over added salt and flavorings. Additionally, limited consumer awareness of healthier popcorn variants in some regions also contributes to this constraint.

Market Segmentation

The Australia popcorn market share is classified into type and distribution channel.

- The ready-to-eat popcorn segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia popcorn market is segmented by type into microwave popcorn, and ready-to-eat popcorn. Among these, the ready-to-eat popcorn segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because, in comparison to microwave popcorn, it offers convenience, a variety of flavors, and instant consumption appeal, satisfying busy lifestyles and the growing demand for gourmet and snack-on-the-go options. This results in higher revenue and market share.

- The supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia popcorn market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, online channels, and others. Among these, the supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because these stores are the main source of home popcorn consumption due to their extensive product availability, possibilities for bulk purchases, and brand visibility. When compared to convenience stores and internet outlets, their robust distribution networks, marketing initiatives, and reliable retail presence boost sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia popcorn market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Burst Foods Pty Ltd

- The Popping Nut Pty Ltd

- Popkin’s Artisan Popcorn Pty Ltd

- Popsy Popcorn Company

- Popcorn Man Pty Ltd

- 180 Popcorn Limited

- Bean Growers Australia Limited

- Jonny’s Popcorn Delights

- Popcorn People

- Popcorn Australia / Superpop Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Just Kernelz not only grew but also spread out throughout the whole country, and has thus earned the status of a high-end gourmet popcorn brand with over 20 different flavors and a variety of retailers in Western Australia and other states.

- In September?2025, Cobs Popcorn did a national TV campaign, “Live a Little Lighter” launch, which increased brand visibility.

- In August?2025, Poppin Popcorn's collaboration with Mars led to the introduction of chocolate-flavored popcorn (e.g., SNICKERS, TWIX, M&M’S) at Woolworths, with the plan to later extend it to Coles.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia popcorn market based on the below-mentioned segments:

Australia Popcorn Market, By Type

- Microwave Popcorn

- Ready-To-Eat Popcorn

Australia Popcorn Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Channels

- Others

FAQ’s

Q: What is the Australia popcorn market size?

A: Australia popcorn Market size is expected to grow from USD 311.5 million in 2024 to USD 637.8 million by 2035, growing at a CAGR of 6.73% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increasing demand for convenient and ready-to-eat snacks, the health-conscious population, and the expansion of both cinema and home-entertainment culture, among others.

Q: What factors restrain the Australia popcorn market?

A: Constraints include the uncertain prices of raw corn, competition from other snacks, increasing production and packaging costs, and health concerns over added salt and flavorings.

Q: How is the market segmented by type?

A: The market is segmented into microwave popcorn, and ready-to-eat popcorn.

Q: Who are the key players in the Australia popcorn market?

A: Key companies include Burst Foods Pty Ltd, The Popping Nut Pty Ltd, Popkin’s Artisan Popcorn Pty Ltd, Popsy Popcorn Company, Popcorn Man Pty Ltd, 180 Popcorn Limited, Bean Growers Australia Limited, Jonny’s Popcorn Delights, Popcorn People, Popcorn Australia / Superpop Pty Ltd, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |