Australia Poultry Feed Market

Australia Poultry Feed Market Size, Share, By Animal Type (Layers, Broilers, Turkey, and Others), By Additives (Antibiotics, Vitamins, Antioxidants, Amino Acid, Feed Enzymes, Feed Acidifiers, and Others), Australia Poultry Feed Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Poultry Feed Market Insights Forecasts to 2035

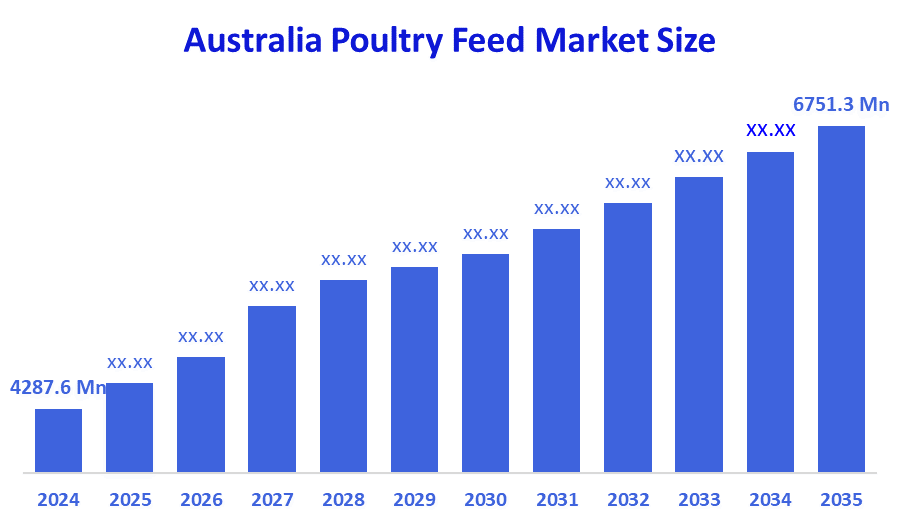

- Australia Poultry Feed Market Size 2024: USD 4287.6 Mn

- Australia Poultry Feed Market Size 2035: USD 6751.3 Mn

- Australia Poultry Feed Market CAGR 2024: 4.21%

- Australia Poultry Feed Market Segments: Animal Type and Additives

The term Australia poultry feed market designates the complete production and distribution of feed formulations that provide the necessary nutrients for broilers, layers, and breeders, which consist of grains, proteins, additives, and supplements. The market is being fueled by the increase in the consumption of poultry meat and eggs, the rise of commercial poultry farming, the continuous demand for high-performance feed, and the growing interest in animal health, feed efficiency, and sustainable nutrition practices throughout Australia, thus experiencing a steady increase in size.

The poultry feed market in Australia receives the backing of the government through AgriFutures Australia's Chicken Meat Program, where the government will inject AUD 6.6 million (2022-2027) into research on productivity and feed efficiency. Moreover, the government supports the poultry sector through a variety of policies, including agricultural competitiveness programs, biosecurity funding, and provision of low-interest RIC loans, all of which together amount to AUD 4 billion, and the poultry producers getting the benefit of these activities are thus able to better manage their feed costs and fortify the resilience of their supply chains.

The poultry feed market in Australia is moving forward with the introduction of precision nutrition blends, digital feed management platforms, and automated feed mills. For instance, the companies Ridley and CBH not only apply real-time data, IoT, and analytics but also depend on innovations in probiotics, enzymes, and prebiotics to improve bird health, feed efficiency, and ecological sustainability of the poultry industry.

Market Dynamics of the Australia Poultry Feed Market:

The Australia poultry feed market is driven by the increasing demand for poultry meat and eggs, combined with the increase in the number of commercial poultry farms, and the increased focus on nutritionally balanced and high-performance poultry feed. Additionally, population growth, urbanisation, and the increasing consumer preference for protein-rich diets have increased feed consumption. Advances in technology have also contributed to the development of the poultry feed industry by providing precision nutrition, feed additives, probiotics, and automated feed mills that have improved bird health, growth rate, and feed conversion efficiency, as well as supporting the sustainable development of poultry production through the promotion of government initiatives.

The Australia poultry feed market is restrained by the changing prices of raw materials, strict regulations, and increasing production costs. Besides, the outbreak of diseases and environmental issues restricts the production size and thus affects the market growth and profitability of this sector, little by little.

Australia poultry feed market has future opportunities opened up in the form of eco-friendly, high-nutrient feed formulations, precision nutrition technologies, and enzyme/probiotic innovations. The main factor behind the growth is the demand for products and solutions that are eco-friendly and cost-effective, digital feed management systems, and collaborations for the betterment of animal health, productivity, and reduced environmental impact, which eventually leads to industry resilience and profitability in the long run.

Market Segmentation

The Australia poultry feed market share is classified into animal type and additives.

By Animal Type:

The Australia poultry feed market is divided by animal type into layers, broilers, turkey, and others. Among these, the broilers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because broiler production concentrates on meat, which is always more in demand both domestically and internationally than eggs (layers) or turkey. Large-scale feed consumption is also fueled by intensive broiler farming, which supports a significant market share and is anticipated to experience strong growth.

By Additives:

The Australia poultry feed market is divided by additives into antibiotics, vitamins, antioxidants, amino acid, feed enzymes, feed acidifiers, and others. Among these, the amino acid segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. They are a crucial component of commercial poultry feed formulations because of their vital role in boosting poultry growth, increasing feed efficiency, and promoting general health.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Australia poultry feed market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Australia Poultry Feed Market:

- Inghams Group Limited

- Baiada Poultry Pty Limited

- Cargill Australia

- Riverina (Australia) Pty Limited

- Laucke Mills

- SunRice / CopRice

- FeedWorks

- Premier Stockfeeds

- BEC Feed Solutions

- Others

Recent Developments in Australia Poultry Feed Market:

In June?2025, Ridley Corporation introduced its innovative Precision Nutrition feed blends that employed data analytics and real-time performance monitoring to perfect the poultry diet and elevate feed conversion ratios.

In December?2024, the advancements in nutritional additives were not limited to the previous year since the Australian feed industry had started using more probiotics, prebiotics, and enzyme complexes in their poultry feed formulations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia poultry feed market based on the below-mentioned segments:

Australia Poultry Feed Market, By Animal Type

- Layers

- Broilers

- Turkey

- Others

Australia Poultry Feed Market, By Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

FAQ

Q: What is the Australia poultry feed market size?

A: Australia poultry feed market is expected to grow from USD 4287.6 million in 2024 to USD 6751.3 million by 2035, growing at a CAGR of 4.21% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increasing demand for poultry meat and eggs, combined with the increase in the number of commercial poultry farms, and the increased focus on nutritionally balanced and high-performance poultry feed. Additionally, population growth, urbanisation, and the increasing consumer preference for protein-rich diets have increased feed consumption. Advances in technology have also contributed to the development of the poultry feed industry by providing precision nutrition, feed additives, probiotics, and automated feed mills that have improved bird health, growth rate, and feed conversion efficiency, as well as supporting the sustainable development of poultry production through the promotion of government initiatives.

Q: What factors restrain the Australia poultry feed market?

A: Constraints include the changing prices of raw materials, strict regulations, and increasing production costs. Besides, the outbreak of diseases and environmental issues restricts the production size and thus affects the market growth and profitability of this sector, little by little.

Q: How is the market segmented by animal type?

A: The market is segmented into layers, broilers, turkey, and others.

Q: Who are the key players in the Australia poultry feed market?

A: Key companies include Inghams Group Limited, Baiada Poultry Pty Limited, Cargill Australia, Riverina (Australia) Pty Limited, Laucke Mills, SunRice / CopRice, FeedWorks, Premier Stockfeeds, BEC Feed Solutions, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 207 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |