Australia Radiology Services Market

Australia Radiology Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Services, Product), By Distribution Channel (Hospitals, Ambulatory Centers, Diagnostic Centers, Clinics), and Australia Radiology Services Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Radiology Services Market Size Insights Forecasts to 2035

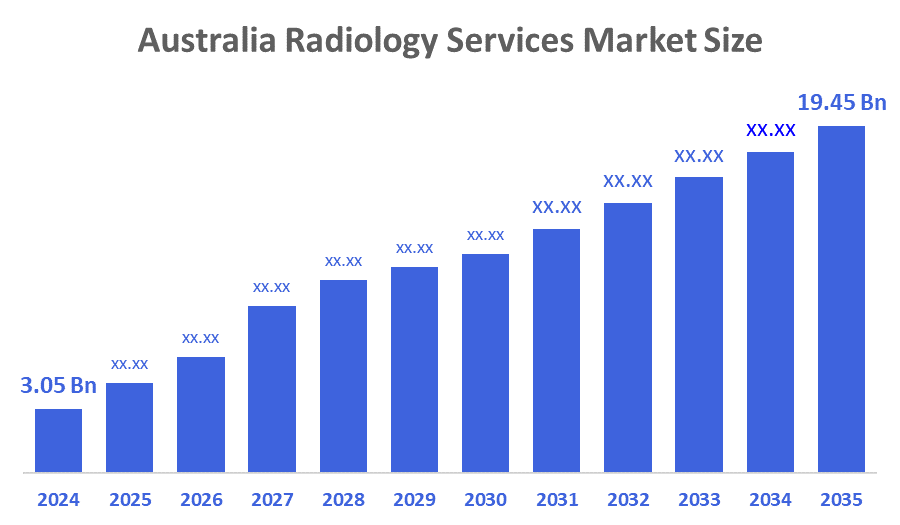

- The Australia Radiology Services Market Size Was Estimated at USD 3.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 18.34% from 2025 to 2035

- The Australia Radiology Services Market Size is Expected to Reach USD 19.45 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Radiology Services Market Size is anticipated to Reach USD 19.45 Billion by 2035, Growing at a CAGR of 18.34% from 2025 to 2035. The radiology services market in Australia is driven by the rising chronic disease rates, increasing imaging use through Artificial Intelligence, government investment in diagnostics, an older population, and the ability to order imaging at more sites.

Market Overview

The Radiology Services Market pertains to the field that offers medical imaging services that allow the detection, diagnosis, monitoring, or treatment of various diseases. Radiology services utilize imaging modalities, including X-ray, ultrasound, CT scan, MRI, nuclear imaging, and fluoroscopy, to provide visualizations of internal organs, tissues, and abnormalities without performing invasive procedures. The market for radiology services in Australia is being driven by an increasing prevalence of chronic and age-related diseases, which is creating demand for imaging diagnostics such as CT, MRI, and ultrasound. Beyond imaging, government initiatives, such as funding through Medicare, accreditation programs for radiology services like the Diagnostic Imaging Accreditation Scheme, and investments in digital health infrastructure, are increasing access to and upgrading the quality of radiology services. Technological advancements, such as AI-assisted analysis of radiology images, mobile and tele-radiology technologies, and digital imaging platforms, are improving the efficiency and accessibility of radiology services, particularly for rural Australia. There are substantial opportunities in low-access areas, including rural and remote areas, through tele-radiology, and in the use of leading-edge imaging technologies and software to assist with early diagnosis and support more individualized care.

Report Coverage

This research report categorizes the market for the Australia radiology services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia radiology services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia radiology services market.

Driving Factors

The radiology services market in Australia is driven by a notable rise in chronic diseases such as cancer, cardiovascular diseases, and musculoskeletal conditions, which increasingly rely on advanced imaging as part of the diagnosis and monitoring process. This trend is also propelled by a rapidly aging population that is increasing demand for CT, MRI, and ultrasound services. Government support, through Medicare reimbursement of services and hospitals' funding for diagnostic imaging for patients, promotes greater patient access to imaging services, in addition to supporting the growth of services themselves. Finally, continued investment into private diagnostic centers and improved access to these diagnostic services in regional areas, along with rising awareness of preventive health, will also boost the radiology services market in Australia.

Restraining Factors

The radiology services market in Australia is mostly constrained by high imaging equipment costs, a lack of workforce in rural areas, and changing Medicare reimbursement pressures, along with strict regulation. Long wait times and disparity access to radiology services in urban versus rural areas also hinder market growth.

Market Segmentation

The Australia radiology services market share is classified into type and distribution channel.

- The services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia radiology services market is segmented by type into services and products. Among these, the services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Imaging services, including CT, MRI, ultrasound, and teleradiology, are expected to generate excellent demand from the ongoing rise in diagnostic intensity, an aging population, and wide usage in hospitals and diagnostic centers. Continuous patient volumes and reimbursement support generate more robust revenue than imaging products in these areas.

- The hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia radiology services market is segmented by distribution channel into hospitals, ambulatory centers, diagnostic centers, and clinics. Among these, the hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. They flourish because of the advanced imaging equipment available, the inflow of patients for emergency and specialty care, and the reimbursement provided by the government for procedures that diagnose illness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia radiology services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- I?MED Radiology Network

- Sonic Healthcare Limited

- Integral Diagnostics

- Lumus Imaging

- Capital Radiology

- Quantum Radiology

- Jones Radiology

- Apex Radiology

- Healius Limited

- Synergy Radiology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, the Government of Queensland committed AUD 276 million to increase advanced MRI and CT imaging across 11 public hospitals, increasing diagnostic capacity, reducing wait times, and improving access to the latest modern and advanced radiology for patients in rural and regional communities.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia radiology services market based on the below-mentioned segments:

Australia Radiology Services Market, By Type

- Services

- Product

Australia Radiology Services Market, By Distribution Channel

- Hospitals

- Ambulatory Centers

- Diagnostic Centers

- Clinics

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 279 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |