Australia Real Estate Investment Market

Australia Real Estate Investment Market Size, Share, and COVID-19 Impact Analysis, By Property Type (Residential Investment, Commercial Investment, Industrial Investment, and Land Investment), By Distribution Channel (Public REIT, Private REIT, and Private Real Estate Investment), Australia Real Estate Investment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Real Estate Investment Market Insights Forecasts to 2035

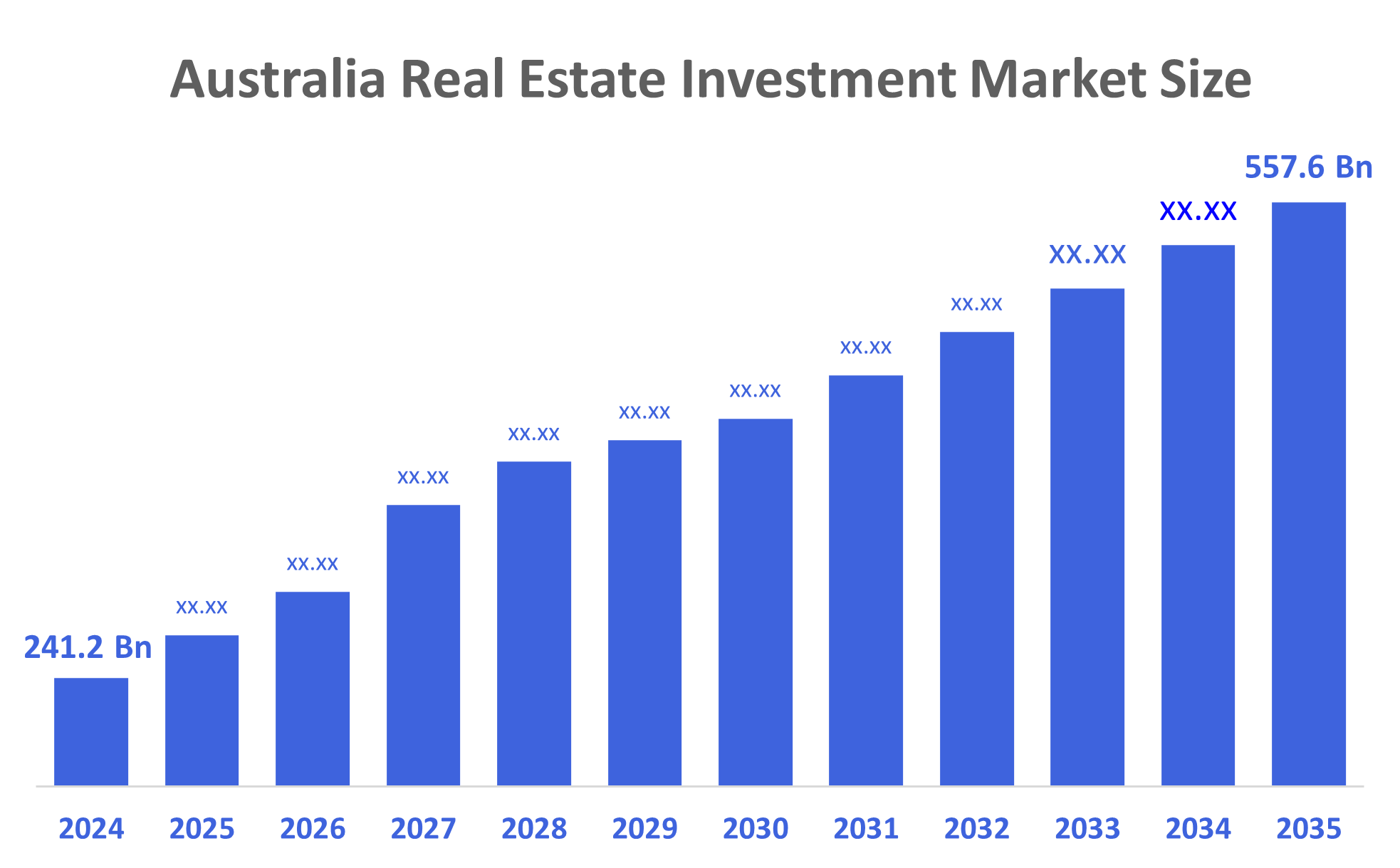

- The Australia Real Estate Investment Market Size Was Estimated at USD 241.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.92% from 2025 to 2035

- The Australia Real Estate Investment Market Size is Expected to Reach USD 557.6 Billion by 2035

According to a research report published by Decisions Advisors, The Australia Real Estate Investment Market Size is Anticipated to Reach USD 557.6 Billion by 2035, Growing at a CAGR of 7.92% from 2025 to 2035. The real estate investment market in Australia is driven by strong migration-led population growth, stable low interest rates, rising demand for commercial and residential assets, ongoing infrastructure expansion, government incentives, and increasing investment in tech-oriented sectors like logistics and data centers.

Market Overview

The real estate investment market involves the purchase, sale, financing, and administration of residential, commercial, and industrial properties with the goal of creating income, capital appreciation, or both. It encompasses investments in direct property ownership, real estate funds, REITs, and institutional portfolios, which are motivated by economic growth, infrastructural development, and demand for space across industries. The cash rate (interest rates) changes that will happen through the RBA's monetary policy will have a direct impact (positive and/or negative) on the cost of borrowing for all investors as well as homebuyers. It is (thought) likely that the RBA's monetary policy will create an incentive to invest in real estate and help to stabilise house prices. Furthermore, the government's immigration policies affect how much demand there will be for the rental and/or purchase of properties in Australia. Australia's population has significantly increased due to a high rate of net international migration.

The population of the country was around 27,122,411 as of March 2024, up 615,300 from the previous year and representing a 2.3% growth rate. The Australian government has also been encouraging investment in this sector through policies designed to support investor confidence and growth, such as infrastructure projects, approval processes, and urban development initiatives.

Report Coverage

This research report categorizes the market for the Australia real estate investment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia real estate investment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia real estate investment market.

Driving Factors

The real estate investment market in Australia is driven by strong growth in Australia's population, notably due to migration, and low interest rates also provide greater motivation for financing properties. There are more potential investors as a result of the rise in demand from the commercial, industrial, and technology-driven (such as data centers and logistics hubs) sectors. Government incentives, urban sprawl, and ongoing infrastructure upgrades all contribute to increased connectedness and livability, which boosts investor confidence. Additionally, investor trends (smart buildings, green construction) have created greater interest among many modern investors seeking to achieve long-term returns.

Restraining Factors

The real estate investment market in Australia is mostly constrained by high property prices, a lack of affordable housing, and a number of regulatory limitations. Market instability resulting from increased construction costs, uncertainty in the economy, and oversupply within some areas can lower rental yields and/or returns.

Market Segmentation

The Australia real estate investment market share is classified into property type and distribution channel.

- The residential investment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia real estate investment market is segmented by property type into residential investment, commercial investment, industrial investment, and land investment. Among these, the residential investment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Strong population increase, high rates of urbanization, and rising demand for homeownership and rental properties are the causes of this. Compared to commercial, industrial, or land investments, residential buildings offer comparatively predictable rental income, less vacancy risk, and consistent demand, making them the favored option for both individual and institutional investors.

- The private real estate investment segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia real estate investment market is segmented by distribution channel into public REIT, private REIT, and private real estate investment. Among these, the private real estate investment segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that it gives investors more authority over the choice, administration, and personalization of investment plans. High-net-worth individuals and institutional investors looking for customized portfolios in residential, commercial, and industrial real estate are drawn to private investments because they frequently provide greater potential returns and flexibility than public or private REITs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia real estate investment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dexus

- Stockland

- Mirvac Group

- Scentre Group

- Goodman Group

- Charter Hall Group

- GPT Group

- Vicinity Centres

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, there is an increase in both investor and buyer demand for residential properties located in outer cities/suburbs. Reports indicate this trend is primarily propelled by new post-pandemic developments related to hybrid working arrangements as well as established migration patterns.

- In June 2025, building approvals across Australia remain elevated, demonstrating both a continued supply growth of residential properties and investor confidence in new building development across Australia.

- In February 2025, Link REIT (based in Hong Kong) appointed a new Australian Head of Investment. This appointment represents Link REIT's continuing strategy of expanding into the Australian property market. In particular, Link REIT has an increased interest from international investors in the Australian commercial property market and is focusing on major markets in New South Wales and Victoria. Additionally, Link REIT is working to develop its portfolio through diversification nationally and internationally.

- In December 2024, Goodman Group (formerly known as Goodman Group Australia) established itself as a leader within the Australian property sector by exploiting the increased demand for data centers caused by developments related to artificial intelligence (AI). Goodman Group's focus on digital infrastructure generates strong investor confidence and establishes Goodman Group in a leading position in the market. This shift indicates a change in the trend of real estate investment from traditional asset classes towards a focus on technology-based assets.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia real estate investment market based on the below-mentioned segments:

Australia Real Estate Investment Market, By Property Type

- Residential Investment

- Commercial Investment

- Industrial Investment

- Land Investment

Australia Real Estate Investment Market, By Distribution Channel

- Public REIT

- Private REIT

- Private Real Estate Investment

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |