Australia Recombinant Cell Culture Supplements Market

Australia Recombinant Cell Culture Supplements Market Size, Share, By Product Type (Recombinant Albumin, Recombinant Insulin, Recombinant Transferrin, Recombinant Cytokines, and Others), By Application (Biopharmaceutical Production, Regenerative Medicine, and Others), Australia Recombinant Cell Culture Supplements Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Recombinant Cell Culture Supplements Market Insights Forecasts to 2035

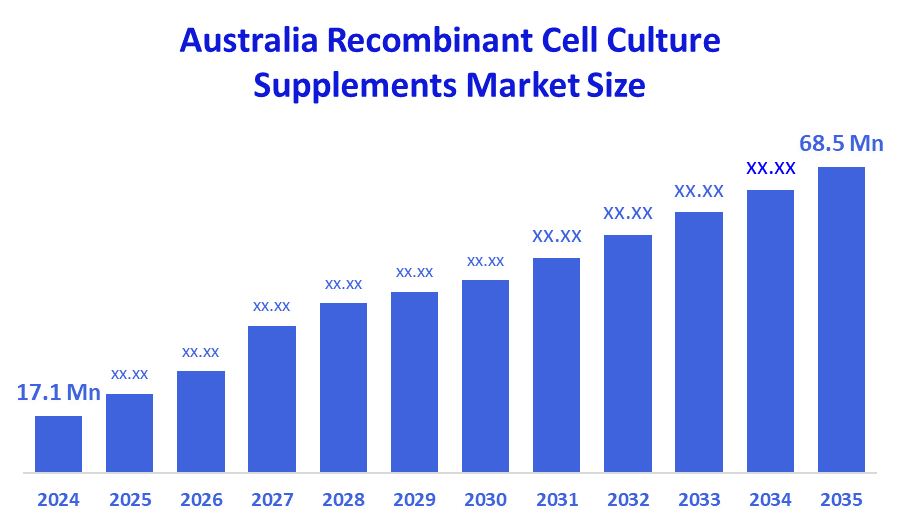

- Australia Recombinant Cell Culture Supplements Market Size 2024: USD 17.1 Mn

- Australia Recombinant Cell Culture Supplements Market Size 2035: USD 68.5 Mn

- Australia Recombinant Cell Culture Supplements Market CAGR 2024: 13.45%

- Australia Recombinant Cell Culture Supplements Market Segments: Product Type and Application

The Australian recombinant cell culture supplements market comprises the manufacturing and application of recombinant proteins, growth factors, hormones, and enzymes that boost the development and efficiency of cultured cells used in the production of biopharmaceuticals and research. Growth factors, hormones, and other substances from the cell culture supplement marketplace are receiving increased attention as the market for biologic therapies expands, along with the growing trend toward using serum-free and animal-free mediums in cell culture. This growth will be further facilitated by increased government backing of biotechnological research and development, along with increased expenditures by pharmaceutical and biotech companies throughout Australia.

The market of recombinant cell culture supplements in Australia is backed by solid governmental support and incentives. The Medical Research Future Fund (AUD 20 billion), NHMRC grants, and state life-science investments are the major programs that provide strong support for research in biologics and cell cultures. On top of that, the R&D Tax Incentive makes development costs lower, which, in turn, makes the biotech sector more innovative and commercialized.

In the land down under, recombinant cell culture supplements are getting breakthroughs through innovations brought forth by companies like CSL Limited and new biotech firms. The development of these products is accompanied by better recombinant growth factors, supplements that are free from serum and animal components, and bioprocessing technologies that can be easily scaled. Such improvements are being made in the production of biologics, vaccines, and cell and gene therapy, and at the same time, the quality of the cells, their uniformity, and the compliance with regulations have been enhanced.

Market Dynamics of the Australia Recombinant Cell Culture Supplements Market:

The Australia recombinant cell culture supplements market is driven by the rapid growth of biologics, biosimilars, and vaccine manufacturing, along with the increasing use of cell and gene therapies. On top of that, the strong support from the government for life sciences and the opening of more biomanufacturing facilities have also contributed to the growth of the market. Furthermore, the demand for serum-free and animal component-free media remains high as companies strive to meet regulatory requirements, which also gives a boost to market growth. Moreover, the rising number of research and development activities in both academic and biotech companies is gradually leading to the widespread use of high-yielding and scalable cell culture processes.

The Australia recombinant cell culture supplements market is restrained by the high developmental and manufacturing costs, the complicated process of getting regulatory approvals, and the supply chain that relies on importing raw materials. This situation drives up prices and prolongs the time before a smaller biotech company can sell its product.

The Australia recombinant cell culture supplements market has started to recognize the future to be in the development of cost-efficient, serum-free formulations, the combination with continuous bioprocessing, and AI optimization. Synthetic biology innovations, local manufacturing expansion, and collaboration between biotech companies and research institutions are anticipated to further increase product availability and facilitate advanced therapeutics manufacturing.

Market Segmentation

The Australia recombinant cell culture supplements market share is classified into product type and application.

By Product Type:

The Australia recombinant cell culture supplements market is divided by product type into recombinant albumin, recombinant insulin, recombinant transferrin, recombinant cytokines, and others. Among these, the recombinant albumin segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Its extensive use as a crucial supplement in serum-free and animal-component-free cell culture medium, its capacity to improve cell growth and stability, and its high demand from the production of biologics, vaccines, and cell therapies are the main factors driving this dominance.

By Application:

The Australia recombinant cell culture supplements market is divided by application into biopharmaceutical production, regenerative medicine, and others. Among these, the biopharmaceutical production segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. The manufacturing of biologics and biosimilars, the huge demand for recombinant proteins, and the widespread use of sophisticated cell culture supplements to enhance yield, consistency, and regulatory compliance throughout large-scale production processes are the reasons for this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Australia recombinant cell culture supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Australia Recombinant Cell Culture Supplements Market:

- CSL Limited

- CSL Behring

- AusGeneX

- Selborne Biological Services

- Levprot Bioscience

- Bioprocessing Network Australia

- Genome and proteome core facilities

- Australian Biotech Startups (e.g., All G)

- State-supported biotech incubators & CDMOs

- Microscopy Australia & Bioinformatics Australia collaborations

- Others

Recent Developments in Australia Recombinant Cell Culture Supplements Market:

In December 2025, the Australian biotech company All G was able to raise an amount of 10 million Australian dollars by the method of precision fermentation of recombinant proteins such as bio-identical lactoferrin for the purpose of nutrition and cell culture applications.

In October2025, AusBiotech shared news on the development of the national cell and gene initiatives, which are supporting the broader biotech infrastructure and, in this way, indirectly benefiting the use of recombinant supplements.

In February 2025, AusBiotech expressed its approval of the government’s decision to reform R&D, thereby making Australia’s life sciences ecosystem stronger.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia recombinant cell culture supplements market based on the below-mentioned segments:

Australia Recombinant Cell Culture Supplements Market, By Product Type

- Recombinant Albumin

- Recombinant Insulin

- Recombinant Transferrin

- Recombinant Cytokines

- Others

Australia Recombinant Cell Culture Supplements Market, By Application

- Biopharmaceutical Production

- Regenerative Medicine

- Others

FAQ

Q: What is the Australia recombinant cell culture supplements market size?

A: Australia recombinant cell culture supplements market is expected to grow from USD 17.1 million in 2024 to USD 68.5 million by 2035, growing at a CAGR of 13.45% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rapid growth of biologics, biosimilars, and vaccine manufacturing, along with the increasing use of cell and gene therapies.

Q: What factors restrain the Australia recombinant cell culture supplements market?

A: Constraints include the high developmental and manufacturing costs, the complicated process of getting regulatory approvals, and the supply chain that relies on importing raw materials.

Q: How is the market segmented by product type?

A: The market is segmented into recombinant albumin, recombinant insulin, recombinant transferrin, recombinant cytokines, and others.

Q: Who are the key players in the Australia recombinant cell culture supplements market?

A: Key companies include CSL Limited, CSL Behring, AusGeneX, Selborne Biological Services, Levprot Bioscience, Bioprocessing Network Australia, Genome and proteome core facilities, Australian Biotech Startups (e.g., All G), State-supported biotech incubators & CDMOs, Microscopy Australia & Bioinformatics Australia collaborations, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |