Australia Recycled Plastics Market

Australia Recycled Plastics Market Size, Share, and COVID-19 Impact Analysis, By Plastic Type (Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Polypropylene (PP), Low-Density Polyethylene (LDPE), and Others), By Application (Non-Food Contact Packaging, Food Contact Packaging, Construction, Automotive, and Others), and Australia Recycled Plastics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Recycled Plastics Market Insights Forecasts to 2035

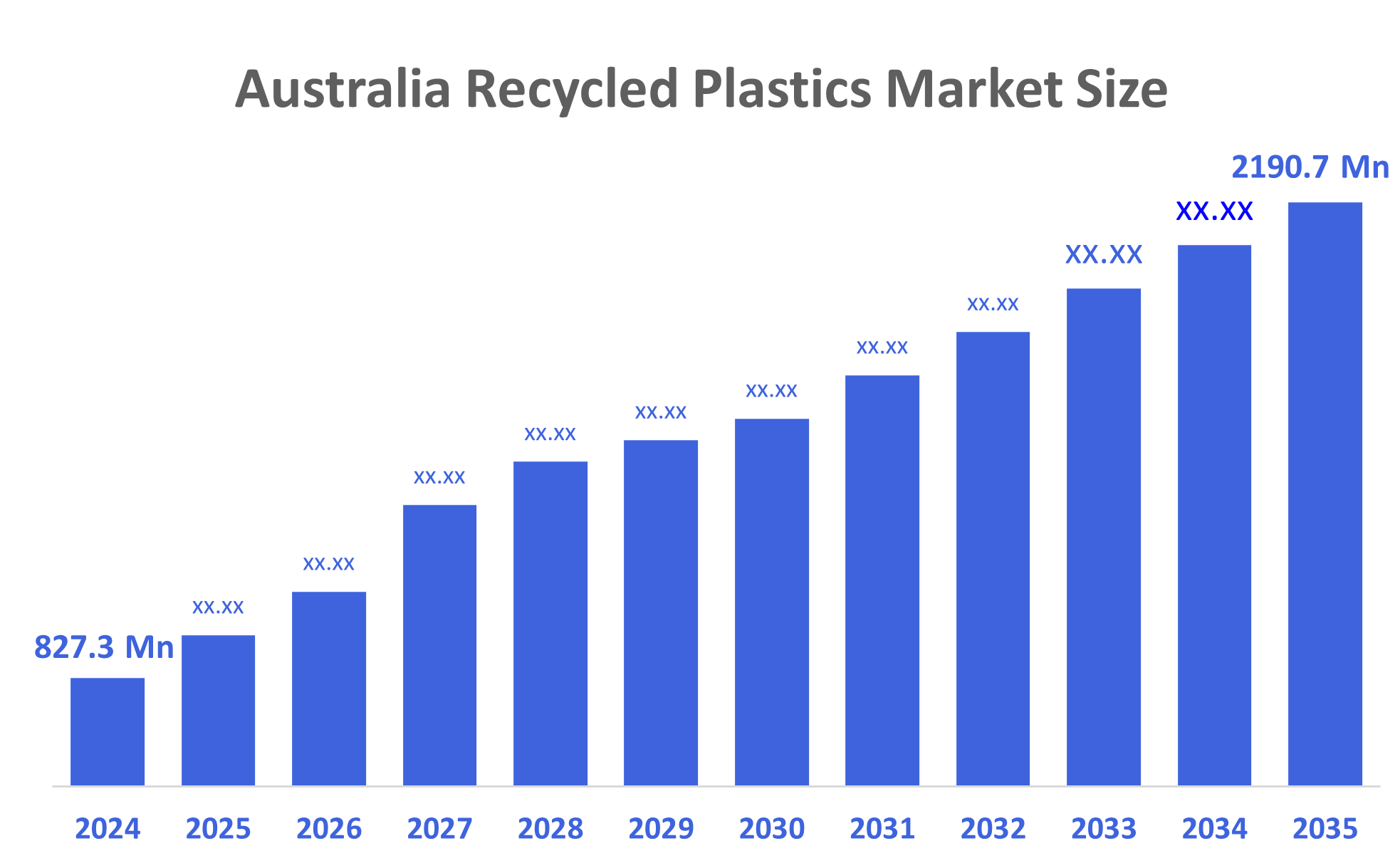

- The Australia Recycled Plastics Market Size Was Estimated at USD 827.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.26% from 2025 to 2035

- The Australia Recycled Plastics Market Size is Expected to Reach USD 2190.7 Million by 2035

According to a research report published by Decisions Advisors, The Australia Recycled Plastics Market Size is Anticipated to Reach USD 2190.7 Million by 2035, Growing at a CAGR of 9.26% from 2025 to 2035. The recycled plastics market in Australia is driven by a push to phase out problematic plastics, strengthen recycling infrastructure, enforce packaging targets, rising environmental awareness, demand for sustainable products, and the adoption of advanced recycling technologies.

Market Overview

The recycled plastics market involves the gathering, processing, and transforming of post-consumer and post-industrial plastic waste into usable plastic materials. This market includes the gathering, classification, sanitization, and repurposing of plastic waste to create recycled plastics suitable for producing new items in diverse sectors like packaging, automotive, construction, consumer goods, and electronics. It also encompasses the trade, distribution, and sale of recycled plastic products. Growth is fueled by government initiatives like the Recycling Modernisation Fund and National Waste Policy, legislative measures phasing out harmful plastics, increased environmental awareness, and corporate sustainability pledges. The Australian government is supporting a circular economy through rules, enhanced producer responsibility, and single-use plastic restrictions. By 2025, 70% of waste must be recycled or composted, according to the 2020 National Waste Policy.

Plastic collection and recycling have expanded as a result of state measures, such as NSW's Plastics Action Plan and rebate schemes in South Australia and Queensland, which have improved sustainable practices across the country. Technological developments in mechanical and chemical recycling, as well as sorting and upcycling, are extending chances to process hard-to-recycle and soft plastics. New soft plastic recycling facilities in Victoria and South Australia (2024–2025) and industry-led initiatives supporting packaging with recycled material are examples of recent advancements. These developments encourage a circular economy and a rise in the use of sustainable goods.

Report Coverage

This research report categorizes the market for the Australia recycled plastics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia recycled plastics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia recycled plastics market.

Driving Factors

The recycled plastics market in Australia is driven by growing government regulations and initiatives promoting circular economy practices, such as bans on single-use plastics and extended producer responsibility policies. The heightened degree of environmental awareness amongst Australian consumers is also leading to increased sales and use of recycled plastics within product groups such as packaging, building materials, and the automotive sector, with manufacturers now selecting recycled raw materials for maximum cost efficiency. The rise in the use of these products is encouraged by the development and improvement of advanced mechanical and chemical recycling processes, as well as state programs to support recycling collection, sorting, and processing systems, which lead to an increase in recycled plastic supplies and less reliance on virgin plastics.

Restraining Factors

The recycled plastics market in Australia is mostly constrained by high processing costs, varying quality of recycled products, uneven availability in terms of recycling facilities, and price competition from cheaper virgin plastics. Furthermore, regulatory loopholes and contamination of collected wastes limit overall growth.

Market Segmentation

The Australia recycled plastics market share is classified into plastic type and application.

- The polyethylene terephthalate (PET) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia recycled plastics market is segmented by plastic type into polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), low-density polyethylene (LDPE), and others. Among these, the polyethylene terephthalate (PET) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. PET is widely used in beverage bottles, food packaging, and containers, making it the most collected and recycled plastic. Its dominating revenue share is a result of its outstanding mechanical qualities, high recyclability, and well-established recycling infrastructure.

- The non-food contact packaging segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia recycled plastics market is segmented by application into non-food contact packaging, food contact packaging, construction, automotive, and others. Among these, the non-food contact packaging segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the widespread usage of recycled plastics in packaging products that do not come into direct contact with food, such as trays, containers, and packaging films. Its dominant revenue share is driven by cost-effectiveness and sustainability criteria, as well as strong demand from the retail, e-commerce, and consumer goods industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia recycled plastics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Circular Plastics Australia

- Kangaroo Plastics Technology Pty Ltd

- Replas

- Goldrec Australia

- Plastic Recycling Hub

- Ace Recycling Group Pty Ltd.

- Australian Recycled Plastics Pty Ltd

- Corex Recycling

- HF Plastics Recycling Pty. Ltd.

- Kito Plastics Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, the ACCC approved a new voluntary industry-run soft plastics recycling scheme under SPSA with a consortium of retail companies and plastic manufacturers.

- In August 2025, a new major facility on the New South Wales Mid North Coast came online, which can recycle approximately 14000t of soft plastics into flakes and then pellets. This new facility is designed to recover some of the lost capacity after the failure of the previous national soft plastics collection program.

- In June 2025, more than fifty new and upgraded recycling facilities throughout Australia became operational under the Recycling Modernisation Fund. This increase in recycling facilities greatly improved the ability to sort and process all types of plastics, including hard-to-recycle plastics and soft plastics, removing approximately 500000t of waste from the landfills each year.

- In April 2025, Cleanaway and Viva Energy completed a pre-feasibility study for the development of Australia's first large-scale soft plastics recycling facility, which, if advanced, would allow the conversion of soft plastics into food-grade recyclables, thereby progressing towards the complete circularity of soft plastics.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia recycled plastics market based on the below-mentioned segments:

Australia Recycled Plastics Market, By Plastic Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low-Density Polyethylene (LDPE)

- Others

Australia Recycled Plastics Market, By Application

- Non-Food Contact Packaging

- Food Contact Packaging

- Construction

- Automotive

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |