Australia Satellite Data Services Market

Australia Satellite Data Services Market Size, Share, and COVID-19 Impact Analysis, By Service (Image Data Service, and Data Analytics Service), By Application (Defense & Security, Energy & Utilities, Agriculture & Forestry, Environmental & Climate Monitoring, Engineering & Infrastructure Development, Marine, and Others), and Australia Satellite Data Services Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Satellite Data Services Market Insights Forecasts to 2035

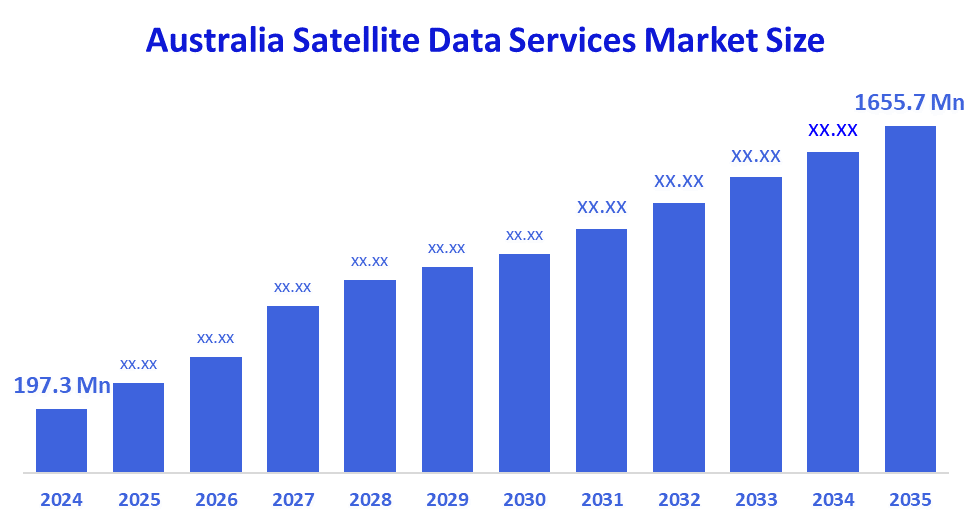

- The Australia Satellite Data Services Market Size Was Estimated at USD 197.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 21.34% from 2025 to 2035

- The Australia Satellite Data Services Market Size is Expected to Reach USD 1655.7 Million by 2035

According To A Research Report Published By Decision Advisors, The Australia Satellite Data Services Market Size Is Anticipated To Reach USD 1655.7 Million By 2035, Growing At A CAGR Of 21.34% From 2025 To 2035. The Satellite Data Services Market In Australia Is Driven By The Growing Need For Earth Observation, Government Defense And Space Programs, Agricultural And Mining Analytics, The Need For Disaster Monitoring, The Development Of Smart Infrastructure, And The Growing Use Of Geospatial Intelligence Solutions.

Market Overview

The term Australia satellite data services market denotes the supply of satellite-derived data and analytics for monitoring, mapping, and decision-making. This market segment incorporates earth observation, geospatial intelligence, and remote sensing services. The primary applications are agriculture monitoring, mining and resource management, urban planning, environmental monitoring, and disaster management, which are the core areas of application in the defense and security sector, as well as in infrastructure development and climate analysis, both in public and private sectors.

The market for satellite data services in Australia is backed by excellent government initiatives of around AU$13 million every year for Digital Earth Australia, AU$18 million for global satellite projects, AU$6.5 million for establishing optical ground stations, and free Earth-observation data programs that make agriculture, mining, defense, disaster management, and climate monitoring possible.

Recent events and technologies in the satellite data services market of Australia are marked by the winning of a $1 million innovation prize by the Sydney-based start-up Arlula for their real-time processing of satellite images technology (Sep 2025), thus improving the surveillance abilities. LiveEO from Germany made a breakthrough role in the Australian market with the provision of satellite imagery analytics (2025) to help monitor the infrastructure. There would be room for more opportunities if there were a LEO broadband expansion, which is estimated to be worth A$664m by 2026, enhancing earth observation services, AI analytics, and data-driven solutions for the mining and agriculture sectors.

Report Coverage

This research report categorizes the market for the Australia satellite data services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia satellite data services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia satellite data services market.

Driving Factors

The satellite data services market in Australia is driven by the need for earth observation and geospatial intelligence in the agriculture, mining, defense, and infrastructure sectors. The government support for space and digital earth programs needs climate and disaster monitoring with increasing urgency, very advanced AI-driven analytics, the expansion of low-earth-orbit satellites, and rising acceptance of the data-driven decision-making approach in both public and private sectors are major factors, which, along with the above mentioned, contribute to the growth of the market.

Restraining Factors

The satellite data services market in Australia is mostly constrained by the high costs associated with satellite deployment and data processing, a shortage of domestic capability for satellite manufacturing, complexities related to regulatory and licensing issues, data security worries, and the need to rely on foreign satellite constellations for access to continuous and high-resolution data.

Market Segmentation

The Australia satellite data services market share is classified into service and application.

- The image data service segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia satellite data services market is segmented by service into image data service, and data analytics service. Among these, the image data service segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to frequent data capture and widespread commercial usage, as well as the significant demand for raw satellite images across agricultural, mining, defense, urban planning, and catastrophe monitoring, the image data service category accounted for the biggest revenue share.

- The defense & security segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia satellite data services market is segmented by application into defense & security, energy & utilities, agriculture & forestry, environmental & climate monitoring, engineering & infrastructure development, marine, and others. Among these, the defense & security segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to significant government expenditure in intelligence capabilities, border security, surveillance, and maritime monitoring, the defense and security sector leads the Australian satellite data services industry. Sustained revenue growth is further supported by the significant demand for geospatial intelligence and real-time, high-resolution satellite imagery.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia satellite data services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Geoimage Pty Ltd

- Nearmap Pty Ltd

- Geospatial Intelligence Pty Ltd

- SpecTerra Geospatial Imagery

- Outline Global Pty Ltd

- Orbivis

- Geoverse Australia

- Activ8me

- NGIS Australia

- LatConnect60 Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, six space startups were initiated by the UniSA launchpad, and they worked on satellite communications and data analytics services.

- In November 2025, Australia makes universal mobile coverage through satellite D2D technology, thus hastening the expansion of satellite-based connectivity.

- In August 2025, Akula Tech revealed the AI-powered Nexus-01 smart satellite, which allows for real-time satellite data processing for military, agriculture, and environmental purposes.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia satellite data services market based on the below-mentioned segments:

Australia Satellite Data Services Market, By Service

- Image Data Service

- Data Analytics Service

Australia Satellite Data Services Market, By Application

- Defense & Security

- Energy & Utilities

- Agriculture & Forestry

- Environmental & Climate Monitoring

- Engineering & Infrastructure Development

- Marine

- Others

FAQ’s

Q: What is the Australia satellite data services market size?

A: Australia satellite data services market size is expected to grow from USD 197.3 million in 2024 to USD 1655.7 million by 2035, growing at a CAGR of 21.34% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the need for earth observation and geospatial intelligence in the agriculture, mining, defense, and infrastructure sectors. The government support for space and digital earth programs needs climate and disaster monitoring with increasing urgency, very advanced AI-driven analytics, the expansion of low-earth-orbit satellites, and rising acceptance of the data-driven decision-making approach in both public and private sectors are major factors, which, along with the above mentioned, contribute to the growth of the market.

Q: What factors restrain the Australia satellite data services market?

A: Constraints include the high costs associated with satellite deployment and data processing, a shortage of domestic capability for satellite manufacturing, complexities related to regulatory and licensing issues, data security worries, and the need to rely on foreign satellite constellations for access to continuous and high-resolution data.

Q: How is the market segmented by service?

A: The market is segmented into image data service, and data analytics service.

Q: Who are the key players in the Australia satellite data services market?

A: Key companies include Geoimage Pty Ltd, Nearmap Pty Ltd, Geospatial Intelligence Pty Ltd, SpecTerra Geospatial Imagery, Outline Global Pty Ltd, Orbivis, Geoverse Australia, Activ8me, NGIS Australia, LatConnect60 Pty Ltd, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |