Australia Secondhand Luxury Goods Market

Australia Secondhand Luxury Goods Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Handbags, Jewelry and Watches, Clothing, Small Leather Goods, Footwear, Accessories, and Others), By Distribution Channel (Offline, Online, Auction Houses, and Others), and Australia Secondhand Luxury Goods Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Secondhand Luxury Goods Market Size Insights Forecasts to 2035

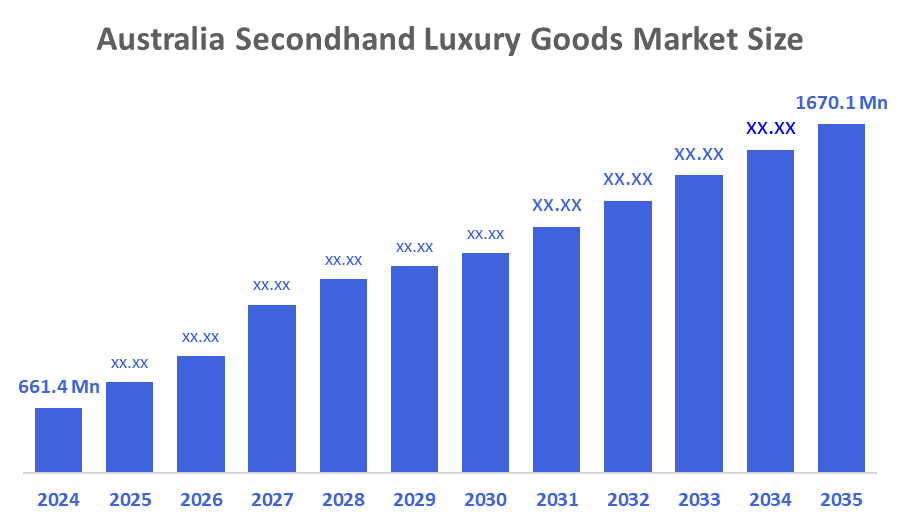

- The Australia Secondhand Luxury Goods Market Size Was Estimated at USD 661.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.79% from 2025 to 2035

- The Australia Secondhand Luxury Goods Market Size is Expected to Reach USD 1670.1 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Secondhand Luxury Goods Market Size is anticipated to Reach USD 1670.1 Million by 2035, Growing at a CAGR of 8.79% from 2025 to 2035. The secondhand luxury goods market in Australia is driven by growing demand for eco-friendly clothing, more reasonably priced used goods, and the development of online resale marketplaces.

Market Overview

The secondhand luxury goods industry encompasses the purchasing, selling, and trading of pre-owned high-end products such as luxury handbags, clothes, watches, jewelry, footwear, and accessories via online platforms, resale shops, consignment stores, and auction houses. Pre-owned luxury goods provide customers access to authenticated goods at a price point lower than a new item. The market for secondhand luxury in Australia is growing rapidly as consumer interest in affordable high-end fashion, sustainability, and circular economy behaviours is on the rise. The market has gained momentum from the increasing acceptance of secondhand designer handbags, watches, and clothing by shopping consumers, especially younger demographics. The rise of resale and online secondhand sites and authentication methods, such as AI-validated sites, RFID tags, and blockchain-proof tracking, helps to build consumer confidence when purchasing secondhand luxury. Additionally, the government promotes waste minimisation efforts and supports circular fashion and sustainability projects, which may have indirect impacts on consumers' willingness to purchase secondhand luxury. Growth in the number of authenticated products, demand for rare or discontinued collections, and the continuing omnichannel effort created opportunities for brands, consignment retailers, and digital marketplace growth nationwide. Consumers generally view secondhand luxury as a value-based investment.

Report Coverage

This research report categorizes the market for the Australia secondhand luxury goods market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia secondhand luxury goods market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia secondhand luxury goods market.

Driving Factors

The secondhand luxury goods market in Australia is driven by consumer demand for lower-priced access to luxury brands, an increasing emphasis on sustainability and circularity, and solid online resale platforms and payment methods. Platforms offering online resales have focused on building customer trust by offering platforms that support artificial intelligence-based authentication and secure payment options. The growth of product sponsorships and marketing through social media has also stimulated demand in the luxury market, particularly as many prefer buying rare, unique, or limited-edition items. Finally, economic uncertainty may encourage secondhand luxury purchases and sales to be financially practical, while brand support for resale can bolster legitimacy and market participation.

Restraining Factors

The secondhand luxury goods market in Australia is mostly constrained by concerns of counterfeit, inconsistent product condition, and limited availability reduces consumer confidence. In addition, warranty issues, hygiene concerns, and price transparency continue to impede consumers from engaging with resale marketplaces. Lastly, high authentication (noted with complexity) and logistics costs (with resale platform issues) continue to hinder marketplace success and slow scaling with new consumers in the resale market.

Market Segmentation

The Australia secondhand luxury goods market share is classified into product type and distribution channel.

- The handbags segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia secondhand luxury goods market is segmented by product type into handbags, jewelry and watches, clothing, small leather goods, footwear, accessories, and others. Among these, the handbags segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Handbags lead Australia's secondhand luxury goods sector due to their resale value, increased demand for renowned designer brands, broader selection on platforms selling used products, and a robust consumer preference for investment-quality fashion items.

- The offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia secondhand luxury goods market is segmented by distribution channel into offline, online, auction houses, and others. Among these, the offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the preference for physically inspecting items, the authentication of an expert, and the trust built when the transaction is completed in a high-quality retail setting like a boutique store or consignment shop.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia secondhand luxury goods market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Purse Affair

- Luxe.It. Fwd

- Luxury Consignment Store

- Blue Spinach

- Gazele Luxury Consignment

- Emier

- Royal Bags & P.A.

- Lost Designer

- LUXE LINK

- Cash Converters International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, Vinnies NSW launched “Vinnies Finds,” an online boutique featuring around 20,000 curated second-hand fashion items, including designer pieces, enhancing the digital shopping experience and resale accessibility in Australia.

- In November 2024, Reports revealed Australian charity shops exporting high-quality second-hand clothing overseas, raising concerns about fashion waste management and driving calls for stronger domestic resale and circular economy reforms.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia secondhand luxury goods market based on the below-mentioned segments:

Australia Secondhand Luxury Goods Market, By Product Type

- Handbags

- Jewelry and Watches

- Clothing

- Small Leather Goods

- Footwear

- Accessories

- Others

Australia Secondhand Luxury Goods Market, By Distribution Channel

- Offline

- Online

- Auction Houses

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 189 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |