Australia Security Market

Australia Security Market Size, Share, and COVID-19 Impact Analysis, By Component (System, and Service), By End Use (Commercial, Government, Industrial, Military & Defense, Transportation, and Others), and Australia Security Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Security Market Size Insights Forecasts to 2035

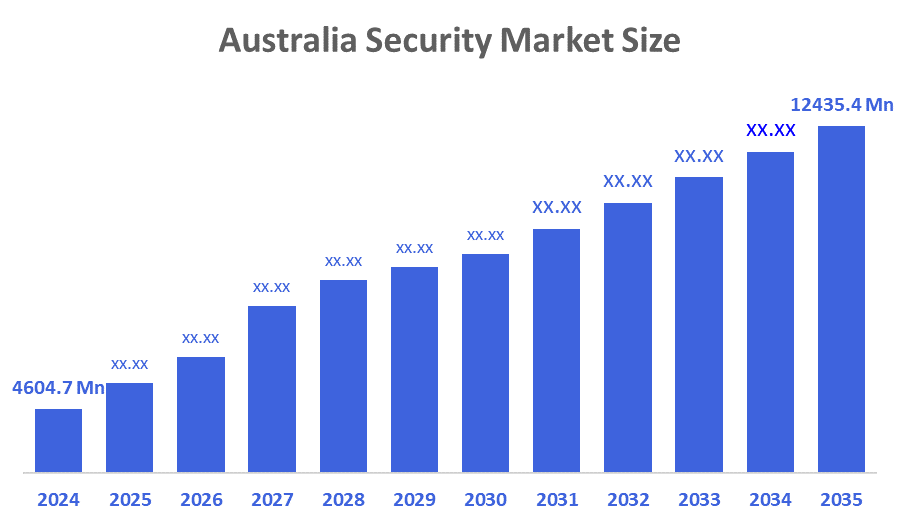

- The Australia Security Market Size Was Estimated at USD 4604.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.45% from 2025 to 2035

- The Australia Security Market Size is Expected to Reach USD 12435.4 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Security Market Size is anticipated to Reach USD 12435.4 Million by 2035, Growing at a CAGR of 9.45% from 2025 to 2035. The security market in Australia is driven by rising cybersecurity risks, rising crime rates, expanding smart surveillance system adoption, government investments in public safety infrastructure, and growing use of cutting-edge security solutions in both commercial and residential sectors.

Market Overview

Australia's security market is a combination of different technologies and services aimed at securing the lives of individuals, the most valuable resources, information, and even the entire infrastructure from both physical and digital attacks. Physical security devices like video surveillance systems, gates for unauthorized access control, alarm systems, and security services for watching over premises are included, whereas in the case of Information Technology protection, the solutions consist of network security, data protection, and identity management.

Through the various initiatives, the Australian government backs the security market, one of which is the 2023–2030 Cyber Security Strategy, with A$586.9 million for critical infrastructure, small business security, and personnel training. The Cyber Security Skills Partnership Innovation Fund (A$70.3 million) and similar programs foster collaboration, training, and adoption of cybersecurity and secure solution technologies throughout the country.

Among the latest happenings in the Australian security market, the most important ones are the move of DroneShield that opened up a new $13 million R&D facility in Adelaide aimed at the development of next-gen counter-drone technology, and the local application of AI-driven surveillance features with improved performance. The Australian companies have also been up to the point of developing AI-based cybersecurity and video analytics solutions, and at the same time, the future in the form of converged physical-cybersecurity systems, AI-powered threat detection, and cloud-native security platforms to deal with the changing threats is opening up ahead.

Report Coverage

This research report categorizes the market for the Australia security market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia security market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia security market.

Driving Factors

The security market in Australia is driven by the increasing cyber threats, data breach concerns, and the need for advanced surveillance and access controls. Moreover, the emerging markets in the form of smart cities and the government's increasing spending on critical infrastructure security are other contributors to the growth of the market. On the other hand, the ongoing restrictions imposed by the authorities, the market’s gradual shift towards IoT-based security solutions, and the growing awareness of safety, both personal and public, in the residential, commercial, and governmental sectors are also pushing the market towards the upward side.

Restraining Factors

The security market in Australia is mostly constrained by the high costs of implementation and maintenance, privacy and data protection issues, a lack of cyber-skilled professionals, and regulatory compliance complexity. Additionally, integration difficulties with the old security systems are a barrier too.

Market Segmentation

The Australia security market share is classified into component and end use.

- The system segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia security market is segmented by component into system, and service. Among these, the system segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because businesses are progressively investing in cutting-edge hardware and software solutions, including surveillance systems, access control, alarms, and cybersecurity platforms, the system sector dominates the Australian security industry. Spending on integrated security systems is larger than that of services due to growing security risks, smart city initiatives, and the requirement for real-time monitoring.

- The commercial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia security market is segmented by end use into commercial, government, industrial, military & defense, transportation, and others. Among these, the commercial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because enterprises, offices, retail stores, and commercial complexes are adopting more sophisticated security systems to safeguard assets, personnel, and sensitive data, the commercial segment dominates the Australian security industry. Significant market share is driven by the high need for cybersecurity, access control, and video surveillance in commercial settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia security market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CyberCX

- Qoria

- Senetas

- Prophecy International Holdings

- FirstWave Cloud Technology

- ArchTIS

- Future Fibre Technologies (FFT)

- DroneShield

- First Focus

- Sentient Vision Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, a series of cyberattacks aimed at Australian defence supply chains demonstrated the existence of cybersecurity weaknesses.

- In November 2025, the Australian Department of Health put out a call for applications for combined cybersecurity management with SIEM and SOAR features.

- In October 2025, Australia introduced CI Fortify, a wide-ranging cybersecurity framework dedicated to protecting critical infrastructures.

- In August 2025, the decision was made by Accenture to purchase CyberCX, an Australian cybersecurity company, thereby strengthening the security capabilities in the region.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia security market based on the below-mentioned segments:

Australia Security Market, By Component

- System

- Service

Australia Security Market, By End Use

- Commercial

- Government

- Industrial

- Military & Defense

- Transportation

- Others

FAQ’s

Q: What is the Australia security market size?

A: Australia security market size is expected to grow from USD 4604.7 million in 2024 to USD 12435.4 million by 2035, growing at a CAGR of 9.45% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increasing cyber threats, data breach concerns, and the need for advanced surveillance and access controls. Moreover, the emerging markets in the form of smart cities and the government's increasing spending on critical infrastructure security are other contributors to the growth of the market.

Q: What factors restrain the Australia security market?

A: Constraints include the high costs of implementation and maintenance, privacy and data protection issues, a lack of cyber-skilled professionals, and regulatory compliance complexity.

Q: How is the market segmented by type?

A: The market is segmented into commercial, government, industrial, military & defense, transportation, and others.

Q: Who are the key players in the Australia security market?

A: Key companies include CyberCX, Qoria, Senetas, Prophecy International Holdings, FirstWave Cloud Technology, ArchTIS, Future Fibre Technologies (FFT), DroneShield, First Focus, Sentient Vision Systems, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 146 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |