Australia Smart Speaker Market

Australia Smart Speaker Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Hardware, and Software), By End User (Personal, and Commercial), and Australia Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

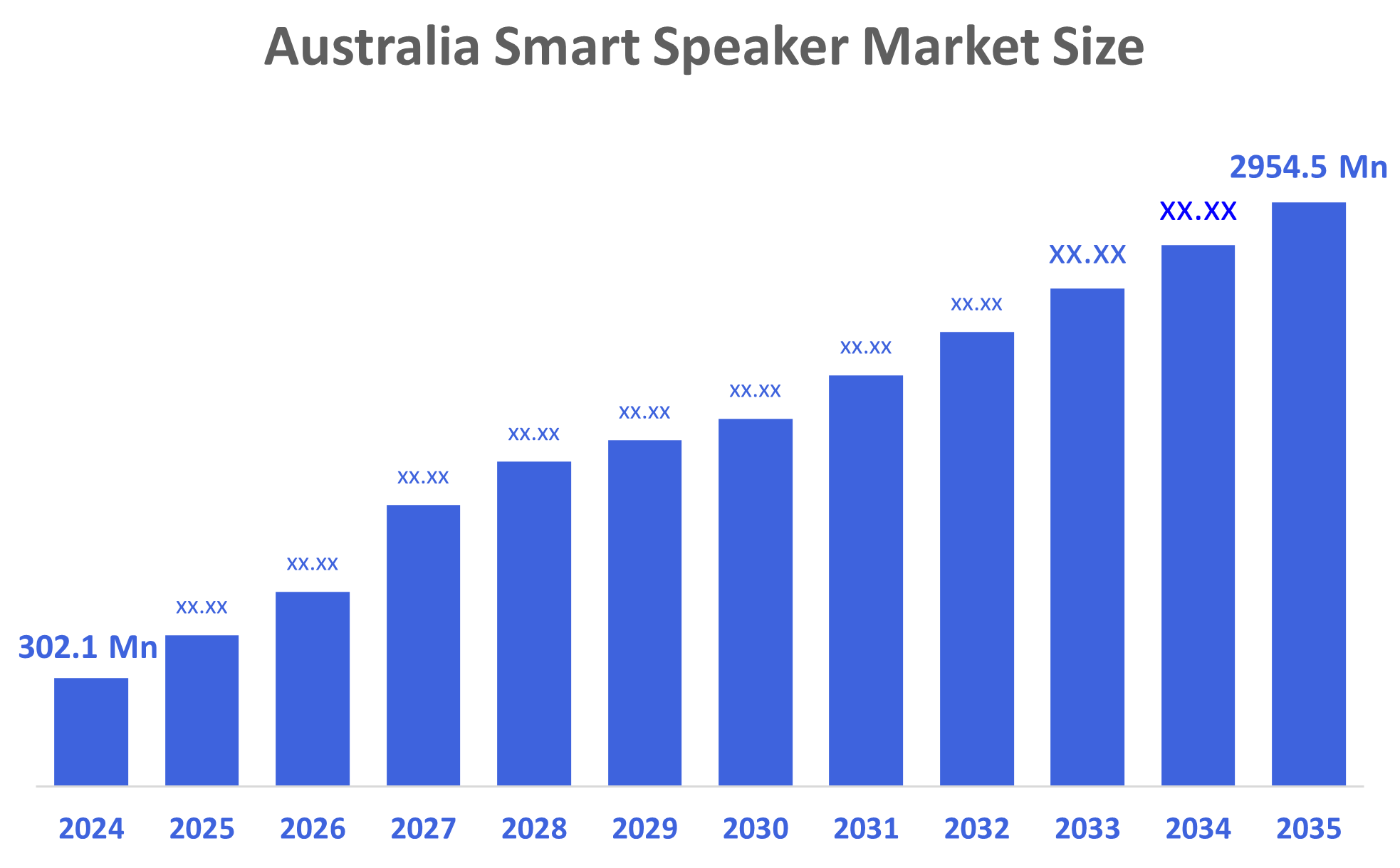

Australia Smart Speaker Market Size Insights Forecasts to 2035

- The Australia Smart Speaker Market Size Was Estimated at USD 302.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 23.04% from 2025 to 2035

- The Australia Smart Speaker Market Size is Expected to Reach USD 2954.5 Million by 2035

According to a research report published by Decisions Advisors, The Australia Smart Speaker Market Size is Anticipated to Reach USD 2954.5 Million by 2035, Growing at a CAGR of 23.04% from 2025 to 2035. The smart speaker market in Australia is driven by voice assistant use, smart home penetration, consumer need for connected living, enhanced AI capabilities, and growing integration with home automation and digital entertainment ecosystems.

Market Overview

The Australia smart speaker market is all about the sales and acceptance of the voice-activated wireless speakers fused with virtual assistants. The smart speaker sector in Australia is experiencing a very brisk and vigorous growth due to factors like the increased use of voice-enabled technologies, the push for smart homes, and the consumer's inclination towards connected lifestyles. The demand is encouraged by the betterment of AI skills and technologies, integration with home automation and entertainment systems, and IoT devices, making it easier and faster for people across different age groups to use them.

The Australian smart speaker market is underpinned by government digital initiatives rather than direct subsidies. The National Broadband Network (NBN) is a key example, with over AUD 57 billion invested to improve connectivity, and the Digital Economy Strategy 2030, which is committing AUD 1.2 billion to enhancing the digital adoption, smart homes, and IoT-enabled consumer technologies throughout Australia.

The improvements of natural language processing, machine learning, and multilingual voice recognition make the user experience more pleasant and increase the opportunities for smart homes, elder housing, energy use management, and enterprise applications that are backed by the new product launches and ecosystem partnerships in Australia.

Report Coverage

This research report categorizes the market for the Australia smart speaker market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia smart speaker market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia smart speaker market.

Driving Factors

The smart speaker market in Australia is driven by the increase in people using voice-activated technology. The ability to use these devices is appealing to consumers who prefer a hands-free lifestyle with overall connectivity. Also helping consumers discover smart technology for their homes are advances in artificial intelligence, natural language programming, and voice recognition; consumers are finding new, increased function and enjoyment when using smart speakers. The increased integration of smart speakers, streaming services, home automation, and other IoT products has only served to increase the market potential for smart speakers in this region. Finally, the expanded availability of broadband internet connectivity via the National Broadband Network (NBN) and the increase in digital literacy among Australians are helping to accelerate the adoption of smart speakers in homes and businesses across Australia.

Restraining Factors

The smart speaker market in Australia is mostly constrained by customers' worries about data privacy and security, the lack of support for local accents in multiple languages, interoperability issues among different platforms, and over-reliance on stable internet connectivity, plus hesitation from consumers towards always listening devices, along with their privacy concerns.

Market Segmentation

The Australia smart speaker market share is classified into component type and end user.

- The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia smart speaker market is segmented by component type into hardware, and software. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Strong customer demand for tangible products, regular product improvements, declining device costs, and more smart speaker adoption in homes all contribute to increased unit sales and income generation.

- The personal segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia smart speaker market is segmented by end user into personal, and commercial. Among these, the personal segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is fueled by the widespread usage of smart home control, voice assistance, entertainment, and daily convenience in homes, which is bolstered by growing consumer awareness and smart home penetration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia smart speaker market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Google Australia Pty Ltd

- Amazon Australia Services Pty Ltd

- Apple Pty Ltd Australia

- Samsung Electronics Australia

- Sonos Australia Pty Ltd

- LG Electronics Australia

- Bose Australia Pty Ltd

- Sony Australia Limited

- Lenovo Australia

- Xiaomi Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Amazon reveals the most sophisticated Echo series, alongside the new Echo Dot Max, Echo Studio, and Echo Show devices with improved sound and design, and broadening smart speaker choices in Australia.

- In October 2025, Google introduced the new Google Home Speaker, which is specifically designed for Gemini AI and which also greatly enhances voice interaction and blending with audio.

- In August 2024, in Australia, the Amazon Echo Show 8 (3rd Gen) was released. The device is enriched with features such as support for spatial audio, a 13MP camera with auto-framing, and adaptive content, thus offering a smarter display experience. The device is equipped with an 8-inch HD display screen with streaming quality and better sound.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia smart speaker market based on the below-mentioned segments:

Australia Smart Speaker Market, By Component Type

- Hardware

- Software

Australia Smart Speaker Market, By End User

- Personal

- Commercial

FAQ’s

Q: What is the Australia smart speaker market size?

A: Australia smart speaker market size is expected to grow from USD 302.1 million in 2024 to USD 2954.5 million by 2035, growing at a CAGR of 23.04% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increase in people using voice-activated technology. The ability to use these devices is appealing to consumers who prefer a hands-free lifestyle with overall connectivity. Also helping consumers discover smart technology for their homes are advances in artificial intelligence, natural language programming, and voice recognition; consumers are finding new, increased function and enjoyment when using smart speakers. The increased integration of smart speakers, streaming services, home automation, and other IoT products has only served to increase the market potential for smart speakers in this region.

Q: What factors restrain the Australia smart speaker market?

A: Constraints include the customers' worries about data privacy and security, the lack of support for local accents in multiple languages, interoperability issues among different platforms, and over-reliance on stable internet connectivity, plus hesitation from consumers towards always listening devices, along with their privacy concerns.

Q: How is the market segmented by component type?

A: The market is segmented into hardware, and software.

Q: Who are the key players in the Australia smart speaker market?

A: Key companies include Google Australia Pty Ltd, Amazon Australia Services Pty Ltd, Apple Pty Ltd Australia, Samsung Electronics Australia, Sonos Australia Pty Ltd, LG Electronics Australia, Bose Australia Pty Ltd, Sony Australia Limited, Lenovo Australia, Xiaomi Australia, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |