Australia Steel Tubes Market

Australia Steel Tubes Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Seamless Steel Tubes, Welded Steel Tubes), By End Use Industry (Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, and Others), and Australia Steel Tubes Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Steel Tubes Market Size Insights Forecasts to 2035

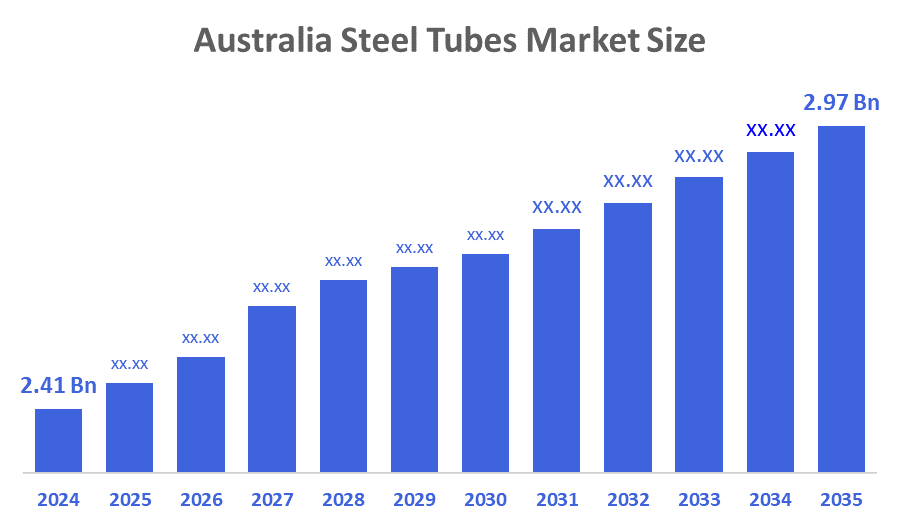

- The Australia Steel Tubes Market Size Was Estimated at USD 2.41 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.92% from 2025 to 2035

- The Australia Steel Tubes Market Size is Expected to Reach USD 2.97 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Steel Tubes Market Size is anticipated to Reach USD 2.97 Billion by 2035, Growing at a CAGR of 1.92% from 2025 to 2035. The steel tubes market in Australia is driven by the creation of stronger, lighter product variations that are more sustainable and energy-efficient than their conventional counterparts.

Market Overview

The steel tubes sector pertains to the manufacturing, selling, and distribution of hollow, cylindrical steel items that serve the purpose of transporting fluids or gases and to used for structural applications. Steel tubes can take many forms (such as seamless and welded), be made with various metals (including carbon steel, alloy steel, and stainless steel), and have performance characteristics and grades tailored to those functions and applications. The market for steel tubes in Australia benefits from a sustained level of demand across the construction, mining, energy, and municipal water infrastructure industries. The market is also impacted by large public infrastructure spend, expansion of pipeline projects, and a renewed focus on security of supply through locally produced steel. Government funding for green steel and hydrogen development, as well as an emphasis on anti-dumping duties, are also strengthening local production capabilities and delivering lower emissions. Advancements in welding automation, corrosion-resistant coatings, and energy-efficient manufacturing processes are likewise helping to improve product performance and competitiveness. New opportunities for the steel tube market will be generated by renewable energy projects, certified low-carbon tubes, and value-added fabrication services. Long-standing challenges in the steel tube market have also brought recent announcements for investment focusing on green-steel pathways, improving Australian steelworks, and new contracts for steel tubes for national infrastructure projects.

Report Coverage

This research report categorizes the market for the Australia steel tubes market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia steel tubes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia steel tubes market.

Driving Factors

The steel tubes market in Australia is driven by high levels of demand from construction, mining, and infrastructure work, including significant upgrades to pipelines and water supply systems. Renewed investment in energy transition projects, such as hydrogen distribution and renewable energy system construction, also supports the demand for new tubular products. The promotion of domestic manufacturing supports supply security and is accompanied by anti-dumping rules. Advancements in technology related to welding, coatings, and corrosion resistance contribute positively to performance characteristics, increasing the range of industrial, automotive, and fabrication applications.

Restraining Factors

The steel tubes market in Australia is mostly constrained by fluctuations in the global price for steel, which has an impact on production costs and project budgets. Reliance on imported raw materials and certain tube categories can create instability in the market and costly exposure to trade issues. Competition from imports increases the pressure on margins for domestic manufacturers, even with anti-dumping measures. Changes in mining activity and long-term delays in infrastructure projects may also decrease demand at times.

Market Segmentation

The Australia steel tubes market share is classified into product type and end use industry.

- The welded steel tubes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia steel tubes market is segmented by product type into seamless steel tubes and welded steel tubes. Among these, the welded steel tubes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth due to its affordability, widespread application in infrastructure and construction, robust local production capability, and growing demand for pipeline and renewable energy projects, the welded steel tubes market dominates.

- The infrastructure and construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia steel tubes market is segmented by end use industry into oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others. Among these, the infrastructure and construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is fueled by ongoing expenditures in public infrastructure, the growth of water and transportation pipelines, and the high demand for mechanical and structural tubing in commercial, residential, and industrial applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia steel tubes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Austube Mills

- Atlas Steels

- BlueScope Distribution

- Industrial Tube Australia

- Orrcon Steel

- Steel Mains Pty Ltd

- Steelpipes

- Australian Pipe & Tube

- United Steel

- Van Leeuwen Pipe and Tube Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, InfraBuild (part of the GFG group) announced plans to significantly expand business in Melbourne & Sydney, with the installation of new electric-arc furnace bowls at its Laverton plant in Melbourne, to help lift annual output to around 1 million tonnes by 2026.

- In April 2025, Greensteel Australia announced a deal to build a new low-carbon steel mill at Whyalla worth around A$1.6 billion: two electric arc furnaces and structural steel rolling mills aimed at commissioning in 2026-27.

- In February 2025, the Australian government initiated a A$1 billion (approximately US$636 million) green iron fund that first funded a A$500 million rescue of GFG Alliance-owned steelworks in Whyalla to underwrite supply chains for low-emissions steel production.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia steel tubes market based on the below-mentioned segments:

Australia Steel Tubes Market, By Product Type

- Seamless Steel Tubes

- Welded Steel Tubes

Australia Steel Tubes Market, By End Use Industry

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 175 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |