Australia Synthetic Biology Market

Australia Synthetic Biology Market Size, Share, and COVID-19 Impact Analysis, By Technology (PCR Technology, Genome Editing Technology, NGS Technology, Bioprocessing Technology, and Others), By End Use (Biotechnology and Pharmaceutical companies, Academic and Government Research Institutes, and Others), and Australia Synthetic Biology Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Synthetic Biology Market Insights Forecasts to 2035

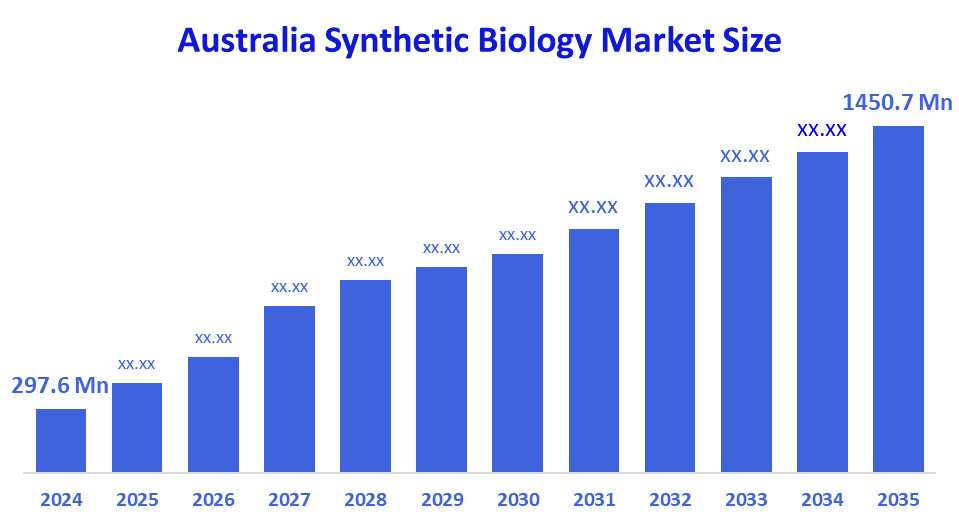

- The Australia Synthetic Biology Market Size Was Estimated at USD 297.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.49% from 2025 to 2035

- The Australia Synthetic Biology Market Size is Expected to Reach USD 1450.7 Million by 2035

According to a research report published by Decision Advisors, The Australia Synthetic Biology Market Size Is Anticipated To Reach USD 1450.7 Million By 2035, Growing At A CAGR Of 15.49% From 2025 To 2035. The synthetic biology market in Australia is driven by financial support from the government for research, the increasing demand for biotechnological and healthcare services, the progress in gene editing and DNA synthesis, the enhanced application of industrial biotechnology, and the ongoing attention towards eco-friendly solutions.

Market Overview

The Australia synthetic biology market encompasses the creation and manipulation of biological systems through various technologies such as genetic engineering, DNA synthesis, gene editing, and bioinformatics. This market facilitates the development of new solutions in different sectors like healthcare (vaccines, therapeutics), agriculture (crop improvement, biofertilisers), industrial biotechnology (enzymes, biofuels), and environmental solutions. Synthetic biology is providing a means for quicker innovation, environmentally friendly manufacturing, and highly specialized biological products across research institutions and commercial sectors in Australia.

The Australian government supports synthetic biology with the National Collaborative Research Infrastructure Strategy (NCRIS) and commits A$55 million to Bioplatforms Australia for the development of synthetic biology facilities and capacities. Under this program, the NCRIS Synthetic Biology Voucher Scheme allows matched funding of up to A$50,000 per project. Furthermore, the ARC Centre of Excellence in Synthetic Biology has been granted A$35 million from the federal government, which has boosted the process of research translation and commercialization.

Companies in Australia's synthetic biology field are making progress in bio-manufacturing and engineering precision. Provivi enhanced its pest control through pheromones, and Zymergen's site in Melbourne works on bio-materials that are eco-friendly. Microbiological platforms for the production of green chemicals and enzymes are created by local startups. The future will be filled with bio-based medicines, agricultural biosolutions, carbon-negative materials, and industrial bio-manufacturing opportunities, all of which are to be made possible through the support of increasing investments and collaborative research activities.

Report Coverage

This research report categorizes the market for the Australia synthetic biology market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia synthetic biology market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia synthetic biology market.

Driving Factors

The synthetic biology market in Australia is driven by the government policies that are very supportive of the life sciences sector, biotechnology, and genomics investments that are continuously increasing, and the provision of advanced healthcare and personalized medicine that is steadily growing. Adoption, in part, is also driven by industrial biotechnology, agriculture, and sustainable bio-based solutions. Innovations in gene editing, DNA synthesis, and computational biology, along with the partnerships between universities, startups, and global biotech companies, are rapidly bringing about innovation and commercialization in the country.

Restraining Factors

The synthetic biology market in Australia is mostly constrained by the very high costs of research and development, the very complex processes of regulatory approvals, the ethical and biosafety issues, the lack of large-scale manufacturing facilities, and the shortage of highly-skilled professionals with specialized training in advanced genetic engineering.

Market Segmentation

The Australia Synthetic Biology market share is classified into technology and end use.

- The genome editing technology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia synthetic biology market is segmented by technology into PCR technology, genome editing technology, NGS technology, bioprocessing technology, and others. Among these, the genome editing technology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because CRISPR-based techniques are widely used in industrial biotechnology, healthcare, and agriculture. Because genome editing makes it possible to modify organisms precisely, quickly, and affordably, it is in high demand from pharmaceutical businesses, biotech startups, and research institutes.

- The biotechnology and pharmaceutical companies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia synthetic biology market is segmented by end use into biotechnology and pharmaceutical companies, academic and government research institutes, and others. Among these, the biotechnology and pharmaceutical companies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to significant R&D expenditure, drug discovery applications, and the commercialization of synthetic biology solutions, the biotechnology and pharmaceutical firms segment led the share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia synthetic biology market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CSL Limited

- Bondi Bio

- Uluu

- Levur

- Cauldron Ferments

- Eden Brew

- Nourish Ingredients

- Provectus Algae

- MicroBioGen

- Plant SynBio Australia (PSBA)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, NCRIS Synthetic Biology Voucher Scheme enlarged its support, which led to the initiation of several new projects and brought together diverse sectors like agriculture, biomedical, and industrial ones for collaboration.

- In June 2025, Plant SynBio Australia (PSBA) was officially i.e. A$20 million investment was made to create a synthetic biology infrastructure network at different universities across the country, thus fueling plant engineering for agriculture and green bio-manufacturing.

- In February 2024, CSIRO published the Synthetic Biology National Progress Report, indicating that the sector might contribute A$30 billion annually and create 50,000 jobs by 2040, thus raising the confidence of investors.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia synthetic biology market based on the below-mentioned segments:

Australia Synthetic Biology Market, By Technology

- PCR Technology

- Genome Editing Technology

- NGS Technology

- Bioprocessing Technology

- Others

Australia Synthetic Biology Market, By End Use

- Biotechnology and Pharmaceutical companies

- Academic and Government Research Institutes

- Others

FAQ’s

Q: What is the Australia synthetic biology market size?

A: Australia synthetic biology market size is expected to grow from USD 297.6 million in 2024 to USD 1450.7 million by 2035, growing at a CAGR of 15.49% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by government policies that are very supportive of the life sciences sector, biotechnology, and genomics investments that are continuously increasing, and the provision of advanced healthcare and personalized medicine that is steadily growing.

Q: What factors restrain the Australia synthetic biology market?

A: Constraints include the very high costs of research and development, the very complex processes of regulatory approvals, the ethical and biosafety issues, the lack of large-scale manufacturing facilities, and the shortage of highly-skilled professionals with specialized training in advanced genetic engineering.

Q: How is the market segmented by technology?

A: The market is segmented into PCR technology, genome editing technology, NGS technology, bioprocessing technology, and others.

Q: Who are the key players in the Australia synthetic biology market?

A: Key companies include CSL Limited, Bondi Bio, Uluu, Levur, Cauldron Ferments, Eden Brew, Nourish Ingredients, Provectus Algae, MicroBioGen, Plant SynBio Australia (PSBA), and Others

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |