Australia Textile Chemicals Market

Australia Textile Chemicals Market Size, Share, By Product Type (Coating and Sizing Chemicals, Finishing Agents, Colorants and Auxiliaries, Surfactants, Desizing Agents, and Others), By Application (Home Furnishing, Apparels, Industrial Textile, Automotive Textile, and Others), Australia Textile Chemicals Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Textile Chemicals Market Insights Forecasts to 2035

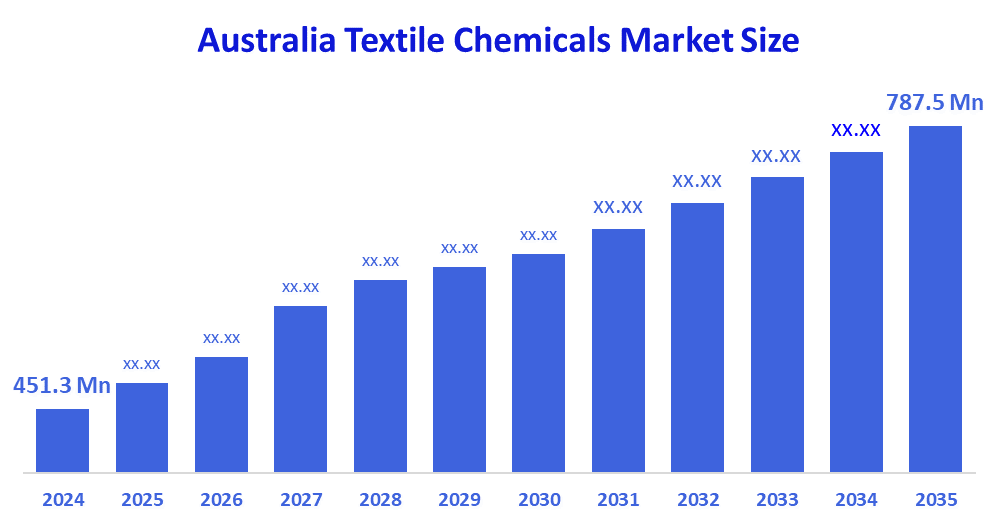

- Australia Textile Chemicals Market Size 2024: USD 451.3 Mn

- Australia Textile Chemicals Market Size 2035: USD 787.5 Mn

- Australia Textile Chemicals Market CAGR 2024: 5.19%

- Australia Textile Chemicals Market Segments: Product Type and Application

The Australia textile chemicals market consists of chemical materials (for example Dyes, pigments, finishing agents, softeners, flame retardants, etc.) that are consumed in textile processing. That improves the performance, look, and longevity of fabrics. In addition, it is anticipated that this market will continue its strong growth as a result of rising demand from both the clothing and home fashion businesses, continued strong interest and requests for environmentally friendly and sustainable chemical solutions, and increasing returns from the development of domestic textile manufacturing as a result of new technologies for functional textile finishes.

The government sustainability and innovation initiatives are the backbone of Australia’s textile chemicals market. The Circular Clothing Textiles Fund (which provides grants of up to AUD 150,000 per project), the National Product Stewardship Investment Fund, and the CEFC (Clean Energy Finance Corporation) support clean textile technologies, which are among the programs that promote the use of eco-friendly chemicals. All these schemes are advancing the use of recycling, cleaner production, and low-impact textile chemicals in domestic textile manufacturing.

The Australian textile chemicals market has witnessed local innovation like waterless and low-impact dyeing technologies (e.g., Xefco's energy-efficient dyeing systems), sustainable finishing solutions that minimize chemical and water use, and biodegradable performance treatments created by textile tech startups. Environmental performance is enhanced by innovations, and domestic textile manufacturing and processing are made greener and supported.

Market Dynamics of the Australia Textile Chemicals Market:

The Australia textile chemicals market is driven by actors are comprised of apparel, home textiles, and technical textiles, plus consumers or viewers who are always in favor of high-performance and sustainable fabrics. The use of eco-friendly dyes, finishing agents, and chemicals with an environmentally friendly impact is the other factor that is making the market grow. The government policies aimed at circular fabrics, recycling, and less polluting manufacturing, together with the functional textiles innovation, such as those of antimicrobial, flame retardant, and water repellent treatments, are all driving the demand up in the local textile production and processing industries.

The Australia textile chemicals market is restrained by the tough environmental rules, high expenses for compliance and production, unable to meet the local demand because of the limited textile manufacturing capacity, and fluctuations in the prices of raw materials. In addition, competition from imports with lower prices and the long and complicated process of getting the new chemicals approved are also factors that slow down the growth of the market.

The future of the Australia textile chemicals market is very positive for companies that can come up with eco-friendly, biodegradable formulations, waterless dyeing, cleaner finishing technologies, and bio-based performance chemicals. And on top of that, the very promising innovations in smart textiles, as well as antimicrobial and UV-protective treatments, plus digital process monitoring, can excellently contribute to both sustainability and efficiency. Besides, partnerships between manufacturers, research institutions, and government initiatives supporting circular textiles are also going to be the major contributors to market growth.

Market Segmentation

The Australia textile chemicals market share is classified into product type and application.

By Product Type:

The Australia textile chemicals market is divided by product type into coating and sizing chemicals, finishing agents, colorants and auxiliaries, surfactants, desizing agents, and others. Among these, the finishing agents segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Strong demand for value-added textiles with improved qualities like softness, wrinkle resistance, antimicrobial protection, flame retardancy, and water repellency is what propels this supremacy. The extensive use of finishing chemicals in textile processing is further supported by the growing emphasis on functional, technological, and sustainable fabrics in clothing, home furnishings, and industrial applications.

By Application:

The Australia textile chemicals market is divided by application into home furnishing, apparels, industrial textile, automotive textile, and others. Among these, the apparels segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. The steady demand for apparel, the growing inclination for completed and colored textiles, and the growing application of functional textile chemicals for performance, comfort, and durability are the main factors driving this dominance. Chemical use in the apparel sector is further increased by the growth of technical clothing and sustainable fashion.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Australia textile chemicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Australia Textile Chemicals Market:

- Orica Limited

- Nufarm Limited

- DuluxGroup (PPG Australia)

- Redox Pty Ltd

- Ixom Operations Pty Ltd

- Chemical House (Australia) Pty Ltd

- Australian Textile Chemical Corporation (ATCC)

- Callington Haven Pty Ltd

- Xefco Pty Ltd

- Coogee Chemicals Pty Ltd

- Others

Recent Developments in Australia Textile Chemicals Market:

In March 2025, the gradual elimination of PFAS chemicals in textiles became widely known, which led the industry to be challenged to switch to safer and more environmentally friendly alternative chemistries.

In April 2024, Xefco increased its workforce by two times after getting an AUD 10.5 million capital boost and worked on plasma-based dyeing and finishing technologies that are less harmful to the environment and more appropriate for textile processing.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia textile chemicals market based on the below-mentioned segments:

Australia Textile Chemicals Market, By Product Type

- Coating and Sizing Chemicals

- Finishing Agents

- Colorants and Auxiliaries

- Surfactants

- Desizing Agents

- Others

Australia Textile Chemicals Market, By Application

- Home Furnishing

- Apparels

- Industrial Textile

- Automotive Textile

- Others

FAQ

Q: What is the Australia textile chemicals market size?

A: Australia textile chemicals market is expected to grow from USD 451.3 million in 2024 to USD 787.5 million by 2035, growing at a CAGR of 5.19% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by actors are comprised of apparel, home textiles, and technical textiles, plus consumers or viewers who are always in favor of high-performance and sustainable fabrics.

Q: What factors restrain the Australia textile chemicals market?

A: Constraints include the tough environmental rules, high expenses for compliance and production, inability to meet the local demand because of the limited textile manufacturing capacity, and fluctuations in the prices of raw materials.

Q: How is the market segmented by product type?

A: The market is segmented into coating and sizing chemicals, finishing agents, colorants and auxiliaries, surfactants, desizing agents, and others.

Q: Who are the key players in the Australia textile chemicals market?

A: Key companies include Orica Limited, Nufarm Limited, DuluxGroup (PPG Australia), Redox Pty Ltd, Ixom Operations Pty Ltd, Chemical House (Australia) Pty Ltd, Australian Textile Chemical Corporation (ATCC), Callington Haven Pty Ltd, Xefco Pty Ltd, Coogee Chemicals Pty Ltd, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 207 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |