Australia Urology Surgery Market

Australia Urology Surgery Market Size, Share, and COVID-19 Impact Analysis, By Technology (Laparoscopic Systems for Kidney Surgeries, MRI/Ultrasound Fusion Technology for Prostate Biopsies, Robotic-Assisted Surgical Systems, Ablation Technologies, Others), By End User (Hospitals, Urology Specialty Clinics, Others), and Australia Urology Surgery Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Urology Surgery Market Size Insights Forecasts to 2035

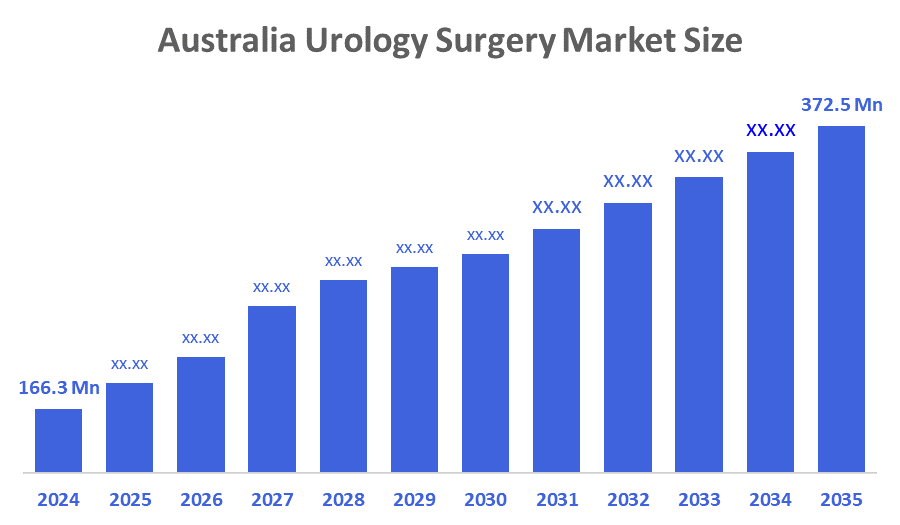

- The Australia Urology Surgery Market Size Was Estimated at USD 166.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.61% from 2025 to 2035

- The Australia Urology Surgery Market Size is Expected to Reach USD 372.5 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Urology Surgery Market Size is anticipated to Reach USD 372.5 Million by 2035, Growing at a CAGR of 7.61% from 2025 to 2035. The urology surgery market in Australia is driven by increasing incidence of urological conditions, an aging population, new technologically advanced minimally invasive surgical devices, better medicare rebates, and greater hospital infrastructure throughout Australia.

Market Overview

The market for urology surgery is the area of the healthcare sector that deals with technology, medical equipment, and surgical procedures used to identify, treat, and manage conditions affecting the male reproductive system and urinary tract. This covers ailments such as kidney stones, prostate disorders, bladder cancer, and birth defects. Endoscopes, implants, robotic and minimally invasive systems, surgical equipment, consumables, and associated services provided in hospitals, specialty clinics, and ambulatory centers are all included in the market. The continuous increases in ailments such as kidney stones, prostate cancer, and urine incontinence, especially in older male patients, are supporting the steady growth of the urology surgery market in Australia. As a result of continuous technology improvements such as robotic-assisted procedures, laser lithotripsy, and minimally invasive endoscopic surgery, hospitals and other facilities are increasingly adopting procedures that offer improved accuracy and shorter recovery periods. Access to improved care is further buoyed by ways the government has approved the use of new and innovative urology procedures by including them on the Medicare Benefits Schedule MBS and public cancer initiatives like their Australian Cancer Plan 2023-2033. Continued investment in tele-urology, the digital health space, and improved urology specialty centers also adds opportunity for increased growth in the Australian market.

Report Coverage

This research report categorizes the market for the Australia urology surgery market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia urology surgery market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia urology surgery market.

Driving Factors

The urology surgery market in Australia is driven by an aging population and a rise in kidney stones, urine incontinence, and prostate cancer diagnoses. Better patient outcomes and a higher volume of medical device procedures are a result of the growing availability of contemporary, minimally invasive techniques like robotic-assisted operations and laser lithotripsy. Wider acceptance of treatment programs will be supported by a combination of government support through Medicare reimbursement and cancer care initiatives. Increased awareness of early-stage urological disease diagnosis, technological improvement in scopes and surgical robotic devices, and urology units increasingly being installed at hospitals will all drive significant growth.

Restraining Factors

The urology surgery market in Australia is mostly constrained by the high price of advanced robotic and laser surgical systems, which limits their uptake in smaller hospitals. Workforce shortages, including limited urologists in regional areas, restrict patients' access to services. The regulatory approval process, where new technologies have to undergo regulatory approvals and slow processes to acquire new technology, presents further barriers to innovation. There are unexpected gaps in reimbursement for newer procedures, and the increased costs of health care are also putting pressure on budgets, decreasing available funds for advanced surgical equipment.

Market Segmentation

The Australia urology surgery market share is classified into technology and end user.

- The robotic-assisted surgical systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia urology surgery market is segmented by technology into laparoscopic systems for kidney surgeries, MRI/ultrasound fusion technology for prostate biopsies, robotic-assisted surgical systems, ablation technologies, and others. Among these, the robotic-assisted surgical systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This field of leadership demonstrates a strong trajectory from the number of prostate and kidney surgeries that require more precision, lower complication rates, and quicker recovery times.

- The hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia urology surgery market is segmented by end user into hospitals, urology specialty clinics, and others. Among these, the hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is a result of the advanced surgical infrastructure that hospitals possess, including robotic systems, endoscopic instruments, and imaging technologies necessary for complex urological procedures. They also see the greatest volume of prostate cancer, kidney disease, and other emergent urological diseases, with the added advantage of good reimbursement rates from Medicare.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia urology surgery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Paragon Care Group Australia Pty Ltd

- m|devices Pty Ltd

- CR Kennedy Medical Solutions

- Akeeko Medical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, at Launceston General Hospital, Tasmania, a $4.7 million da Vinci XI robot was launched to assist with urology, colorectal, and women's health surgical specialties.

- In May 2025, the Australian Government pledged approximately USD 3.05 million to install a surgical robot at Launceston General Hospital to support advanced urology surgical capacity.

- In December 2024, Mater Private Hospital Townsville saw a first in the state with a pediatric renal surgery conducted with a da Vinci XI surgical system, enabling a 24-hour discharge in Queensland.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia urology surgery market based on the below-mentioned segments:

Australia Urology Surgery Market, By Technology

- Laparoscopic Systems for Kidney Surgeries

- MRI/Ultrasound Fusion Technology for Prostate Biopsies

- Robotic-Assisted Surgical Systems

- Ablation Technologies

- Others

Australia Urology Surgery Market, By End User

- Hospitals

- Urology Specialty Clinics

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 289 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |