Australia Used Cooking Oil Market

Australia Used Cooking Oil Market Size, Share, and COVID-19 Impact Analysis, By Source (Food Processing Industry, HoReCa, Household, and Others), By Application (Biodiesel, Oleochemicals, Animal Feed, and Others), and Australia Used Cooking Oil Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Used Cooking Oil Market Insights Forecasts to 2035

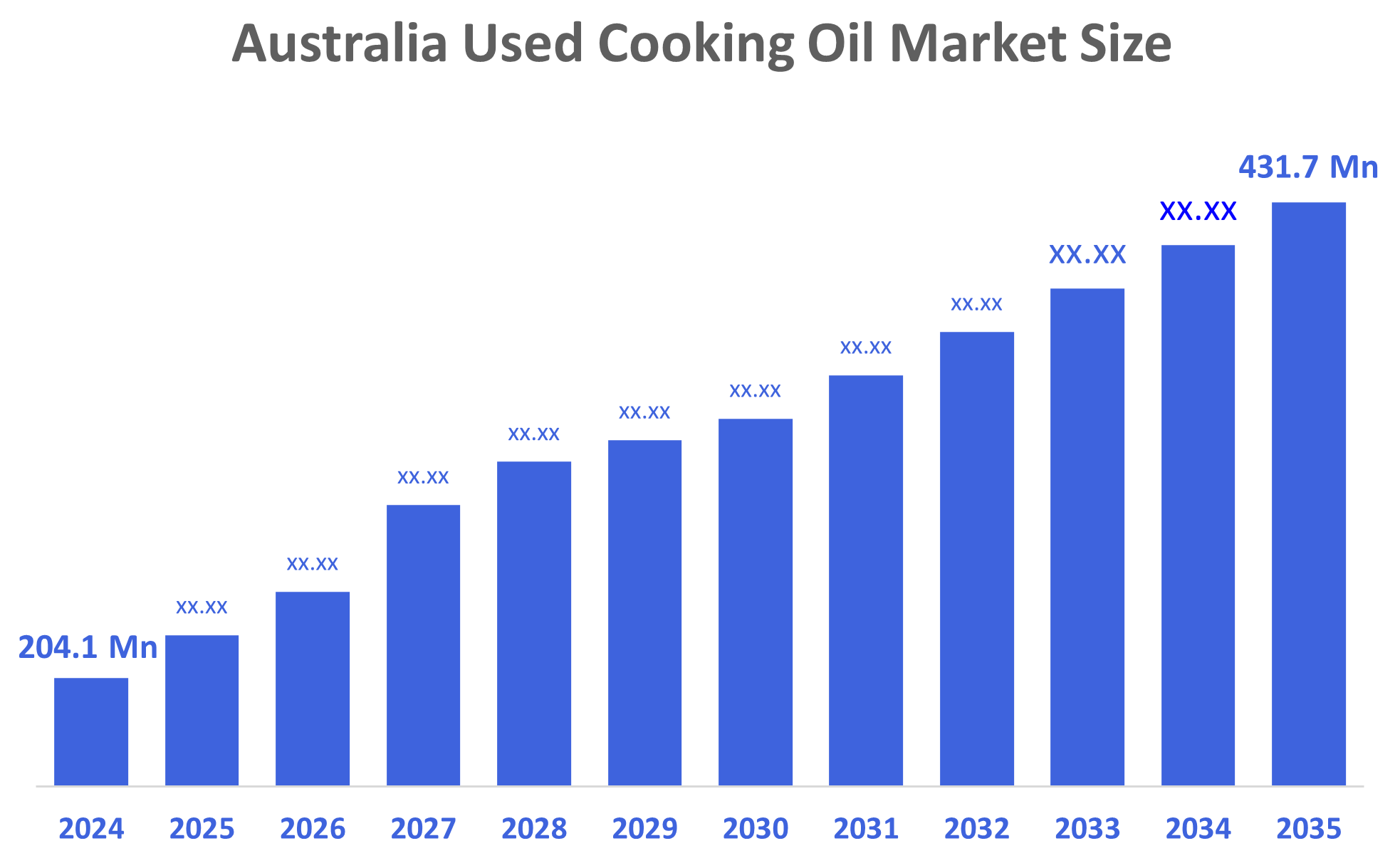

- The Australia Used Cooking Oil Market Size Was Estimated at USD 204.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.05% from 2025 to 2035

- The Australia Used Cooking Oil Market Size is Expected to Reach USD 431.7 Million by 2035

According to a research report published by Decisions Advisors, The Australia Used Cooking Oil Market Size is Anticipated to Reach USD 431.7 Million by 2035, Growing at a CAGR of 7.05% from 2025 to 2035. The used cooking oil market in Australia is driven by strong government renewable energy policies, growing biodiesel production requirements, carbon reduction goals, and increased food service activity in popular tourist areas.

Market Overview

The used cooking oil (UCO) market encompasses everything from collecting and processing the waste vegetable oil and animal fat that has been used for cooking in homes, restaurants, and food processing to being reused in several different ways. The Australia used cooking oil (UCO) market is being positively impacted by the increasing demand for biodiesel and renewable diesel driven by government environmental policy commitments, carbon reduction programs, and the establishment of a national framework for low-carbon liquid fuels.

The Government of Australia has committed to providing the sum of AUD?1.1?billion as a measure to support low-carbon liquid fuels such as renewable diesel and SAF, in addition to the adoption of alternative production methods that turn waste products like used cooking oil into sustainable fuels. Moreover, the amount of AUD?18.5?million has been earmarked for the creation of a certification scheme under the Future Made in Australia scheme to facilitate the growth of this sector.

New technology relating to UCO collection, processing, and refining has increased the fuel yield and quality of UCO. Increased food consumption resulting from increased tourism has made UCO more available for use in biodiesel production and resulted in additional opportunities in the production of renewable diesel, sustainable aviation fuel, and export partnerships. Recent developments include ongoing industry consultation, increased investment interest in biofuel facilities, and changes in supply chain and sustainability regulations.

Report Coverage

This research report categorizes the market for the Australia used cooking oil market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia used cooking oil market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia used cooking oil market.

Driving Factors

The used cooking oil market in Australia is driven by increasing demand for biodiesel and sustainable aviation fuel, which has been supported by national carbon reduction targets and renewable fuel policies. Increasing foodservice activity, tourism, and commercial kitchens have all driven UCO recycling generation across cities and coastal regions. Significant government investment in circular economy initiatives and low-carbon liquid fuels has helped expand the collection and processing of UCO. Lastly, continued improvements in UCO filtration and conversion technologies have improved efficiency and encouraged both energy companies and producers to move from the waste-to-fuel generation process.

Restraining Factors

The used cooking oil market in Australia is mostly constrained by the threat of an inconsistent collection infrastructure, contamination of UCO due to poor handling, and high processing costs. Moreover, the lack of awareness among small food businesses, coupled with the competition from illegal or unregulated UCO trading, tends to restrict the reliable supply and market expansion.

Market Segmentation

The Australia used cooking oil market share is classified into source and application.

- The HoReCa segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia used cooking oil market is segmented by source into the food processing industry, HoReCa, household, and others. Among these, the HoReCa segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its extensive frying and meal preparation, the HoReCa segment produces substantial and steady amounts of spent cooking oil, which accounts for the greatest revenue share. Strict food waste rules, collaborations with biodiesel manufacturers, and organized waste-oil collection systems all contribute to a steady supply of UCO and robust market expansion.

- The biodiesel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia used cooking oil market is segmented by application into biodiesel, oleochemicals, animal feed, and others. Among these, the biodiesel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because UCO is a cheap, sustainable feedstock that is frequently utilized by makers of renewable fuels, the biodiesel category has the highest share. Biodiesel is the main driver of market demand due to Australia's national emission reduction targets, rising demand for low-carbon fuels, and incentives for mixing biofuels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia used cooking oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Auscol

- BioWorks

- Environmental Oils Pty Ltd

- Greenlife Oil Holdings Pty Ltd

- OZ Oils Pty Ltd

- Revive Oils Pty Ltd

- Cleanaway

- Viva Energy

- Greenlife Oil Holdings

- Just Biodiesel

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Viva Energy & Cleanaway entered into a memorandum of understanding (MoU) to supply used cooking oils (UCO) for renewable diesel and biocircular products at Viva Energy's Geelong Refinery, which will facilitate the production of low-carbon fuels in Victoria.

- In February 2025, Viva Energy manufactured its first bio-based polymer (ISCC+) using used cooking oils. This has shown the versatility of UCO for applications other than biodiesel, like as a Sustainable Packaging Material.

- In February 2024, Cleanaway trialled low-emission trucks running on recycled vegetable oil biodiesel as part of Cleanaway's circular economy strategy.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia used cooking oil market based on the below-mentioned segments:

Australia Used Cooking Oil Market, By Source

- Food Processing Industry

- HoReCa

- Household

- Others

Australia Used Cooking Oil Market, By Application

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

FAQ’s

Q: What is the Australia used cooking oil market size?

A: Australia used cooking oil market size is expected to grow from USD 204.1 million in 2024 to USD 431.7 million by 2035, growing at a CAGR of 7.05% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increasing demand for biodiesel and sustainable aviation fuel, which has been supported by national carbon reduction targets and renewable fuel policies. Increasing foodservice activity, tourism, and commercial kitchens have all driven UCO recycling generation across cities and coastal regions. Significant government investment in circular economy initiatives and low-carbon liquid fuels has helped expand the collection and processing of UCO. Lastly, continued improvements in UCO filtration and conversion technologies have improved efficiency and encouraged both energy companies and producers to move from the waste-to-fuel generation process.

Q: What factors restrain the Australia used cooking oil market?

A: Constraints include the threat of an inconsistent collection infrastructure, contamination of UCO due to poor handling, and high processing costs.

Q: How is the market segmented by source type?

A: The market is segmented into the food processing industry, HoReCa, household, and others.

Q: Who are the key players in the Australia used cooking oil market?

A: Key companies include Auscol, BioWorks, Environmental Oils Pty Ltd, Greenlife Oil Holdings Pty Ltd, OZ Oils Pty Ltd, Revive Oils Pty Ltd, Cleanaway, Viva Energy, Greenlife Oil Holdings, Just Biodiesel, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |