Australia Vehicle Leasing Market

Australia Vehicle Leasing Market Size, Share, and COVID-19 Impact Analysis, By Type (Passenger Cars, and Commercial Vehicles), By Mode of Booking (Online, and Offline), and Australia Vehicle Leasing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Vehicle Leasing Market Insights Forecasts to 2035

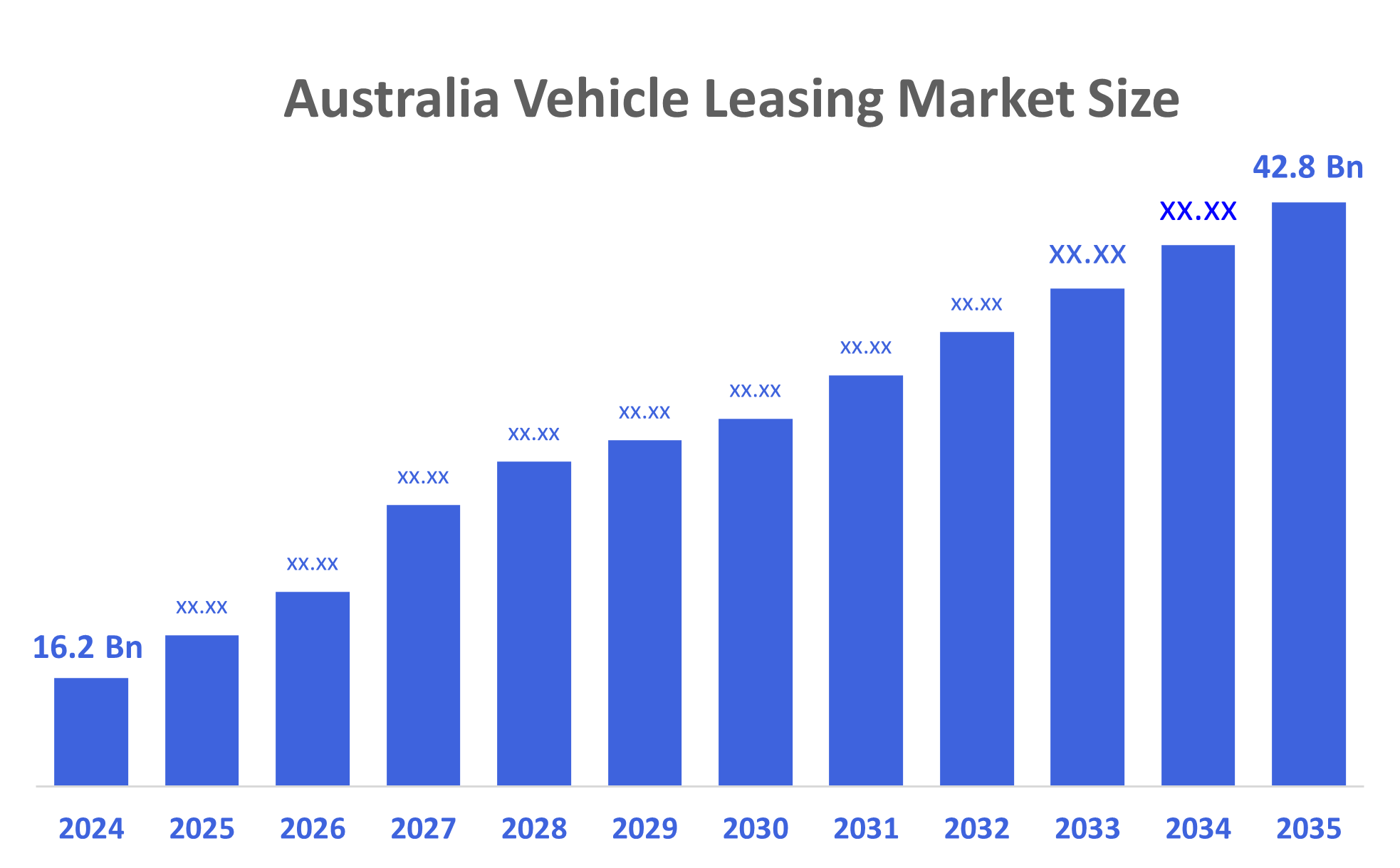

- The Australia Vehicle Leasing Market Size Was Estimated at USD 16.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.23% from 2025 to 2035

- The Australia Vehicle Leasing Market Size is Expected to Reach USD 42.8 Billion by 2035

According to a research report published by Decisions Advisors, The Australia Vehicle Leasing Market Size is Anticipated to Reach USD 42.8 Billion by 2035, Growing at a CAGR of 9.23% from 2025 to 2035. The vehicle leasing market in Australia is driven by rising corporate fleet leasing adoption, shifting attitudes away from ownership, urban mobility needs, and growing availability of electric and hybrid vehicles that enhance flexible, cost-efficient mobility options.

Market Overview

Vehicle leasing is a marketplace that provides cars to consumers or businesses using a contract agreement. Under these contracts, individuals or businesses can use a car, van, or a fleet for a specified time for a predetermined amount, and do not own the vehicle outright. The market for vehicle leasing in Australia is growing as a result of growing corporate fleet leasing adoption, changing consumer perceptions toward traditional automobile ownership, and rapid expansion in the availability of electric and hybrid vehicles. Government support is boosting leased EV demand in Australia, with incentives such as reduced stamp duty, registration discounts, and the Electric Car Discount scheme. EV uptake continues to rise, with more than 114,000 EVs sold in 2024 and over 14,000 vehicles financed under salary packaging and fleet programs. These policies significantly enhance affordability and accelerate fleet electrification nationwide. Technological improvements, including telemetry, AI-enabled fleet optimisation, and improved charging infrastructure, are boosting operational efficiency and reducing the total cost of ownership. There are multiple opportunities in the market, e.g., fleet electrification, novated leasing, and used electric vehicle remarketing. Current trends in the market are the growing sales momentum of EVs, continuing state-level subsidy programs, and higher spending by primary leasing companies on fleet technologies and consolidation activities.

Report Coverage

This research report categorizes the market for the Australia vehicle leasing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia vehicle leasing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia vehicle leasing market.

Driving Factors

The vehicle leasing market in Australia is driven by the increasing prevalence of fleet leasing to minimize business budgets is encouraging corporations to utilize fleet leasing options. Additionally, shifting consumer attitudes towards individual vehicle ownership and the need for increased urban mobility contribute to this growing vehicle lease market. Electric and hybrid vehicles will experience an increase in leasing demand, partially due to government incentives and lower operating expenses, as well as the development of telematics, digital fleet management, and AI-based analysis for improved operational efficiency. Furthermore, novated lease options as well as flexible subscription plans are attracting both corporate customers and the public.

Restraining Factors

The vehicle leasing market in Australia is mostly constrained by high initial lease costs, inadequate infrastructure for charging electric vehicles (EVs), and high interest fluctuation rates. In addition, Australia suffers from supply chain disruptions, instability in the residual values of EVs, and consumer preferences for ownership, all of which contribute to reduced growth of vehicle leasing solutions in Australia.

Market Segmentation

The Australia vehicle leasing market share is classified into type and mode of booking.

- The passenger cars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia vehicle leasing market is segmented by type into passenger cars, and commercial vehicles. Among these, the passenger cars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the high demand for novated leases, the growing urban preference for flexible mobility, and the increased availability of electric and hybrid car models, which are more affordable and appealing to both individual and corporate users, the passenger car segment dominates the Australian vehicle leasing market.

- The offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia vehicle leasing market is segmented by mode of booking into online, and offline. Among these, the offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because consumers and business clients prefer in-person consultations, thorough vehicle appraisals, and individualized financial advice, the offline segment dominates the Australian car leasing market. Offline channels are more reliable and popular than online booking options because of high-value lease agreements and well-established dealership networks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia vehicle leasing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SG Fleet

- Toyota Fleet Management

- McMillan Shakespeare

- Eclipx Group

- Custom Fleet

- Smartgroup

- Summit Fleet Leasing

- ORIX Australia

- Fleetcare

- Fleet Partners

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September of 2025, Mitsubishi Motors Corporation (MMC) raised its ownership stake in Fleet Partners by 19.93%, thereby increasing MMC's influence in Australia as it pertains to the fleet leasing market.

- In April 2025, as a result of rising novated leasing volumes and operating lease disposals that increased revenue, the SG Fleet business unit reported its first-half of FY 2025 results with strong growth despite a decline in net profit.

- In March 2025, Industry insiders have reported that consolidation has begun in the fleet leasing sector. This includes the repositioning of some of the largest fleet leasing companies within the market and strategic changes being considered by smaller fleet leasing firms to exit the industry or position themselves accordingly.

- In September 2024, Manheim Australia indicated that there had been a dramatic increase in auction volumes for vehicles no longer in a fleet. The number of wholesale sales conducted for leased vehicles has nearly doubled over the 2022 totals, providing insight into a large volume of turnover and remarketing activity.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia vehicle leasing market based on the below-mentioned segments:

Australia Vehicle Leasing Market, By Type

- Passenger Cars

- Commercial Vehicles

Australia Vehicle Leasing Market, By Mode of Booking

- Online

- Offline

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |