Australia Vitamin Water Market

Australia Vitamin Water Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Flavored Vitamin Water, Non-flavored Vitamin Water, Sugar-free Vitamin Water, Low-calorie Vitamin Water, Electrolyte-infused Vitamin Water, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Fitness and Health Clubs, and Others), and Australia Vitamin Water Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

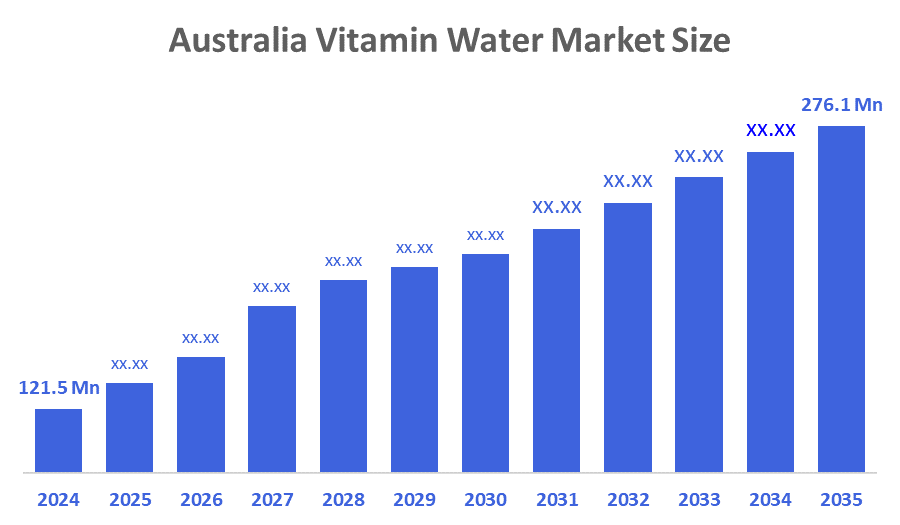

Australia Vitamin Water Market Size Insights Forecasts to 2035

- The Australia Vitamin Water Market Size Was Estimated at USD 121.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.75% from 2025 to 2035

- The Australia Vitamin Water Market Size is Expected to Reach USD 276.1 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Vitamin Water Market Size is anticipated to Reach USD 276.1 Million by 2035, Growing at a CAGR of 7.75% from 2025 to 2035. The vitamin water market in Australia is driven by rising demand for functional, nutrient-enriched beverages, supportive government health initiatives, strong regulatory standards, expanding specialty retail channels, and growing e-commerce penetration that boosts product accessibility and consumer adoption.

Market Overview

The vitamin water market of the beverage industry is concerned with the production and distribution of water supplemented with vitamins, minerals, electrolytes, and other useful additives. These drinks' main purpose is to keep you hydrated, but they may also offer a number of other health advantages, such as improved energy, immunity, or metabolism. The vitamin water sector in Australia is experiencing growth as consumers pursue functional, nutrient-enhanced beverages to support hydration, energy, and immunity. The market growth is associated with an increase in health consciousness among consumers, shifting consumer preferences to low sugar, fortified beverages, and to strong FSANZ regulatory oversight that protects product safety and builds consumer trust. Additionally, numerous government bodies advocate for a transition to cleaner fortified beverages, such as the Australian Healthy Food Partnership, which encourages manufacturers to reduce added sugars and improve the overall nutritional profile of foods and beverages. For example, the beverage reformulation for drinks tracks diminishes added sugar. Technology is enhancing the appeal of products in the vitamin water market with recent innovations, including nutrient-preserving caps and clean label ingredients. Opportunities in e-commerce, fitness hydration, and natural vitamin blends are also on the rise, supported by new product launches and expanded retail distribution.

Report Coverage

This research report categorizes the market for the Australia vitamin water market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia vitamin water market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia vitamin water market.

Driving Factors

The vitamin water market in Australia is driven by increasing consumer interest in functional beverages that provide enhanced hydration, energy, and support immunity. The growing emphasis on health and a shift away from traditional sugary soft drinks is helping to drive uptake. Government incentives aimed at improving nutrition, including the Healthy Food Partnership targets to reduce sugar, help cement product reformulation processes whilst sustainably supporting market growth. The emergence of e-commerce platforms, direct-to-consumer availability, and increasing penetration in gyms, health food stores, and online, coupled with clean label and nutrient-preservation innovations, further accelerates market growth.

Restraining Factors

The vitamin water market in Australia is mostly constrained by perceived hidden sugars, artificial ingredients, and unsubstantiated “health” claims. Regulatory scrutiny by FSANZ and the emergence of electrolyte drinks as substitutes also limit the market, along with higher pricing compared to bottled water.

Market Segmentation

The Australia vitamin water market share is classified into product type and distribution channel.

- The flavored vitamin water segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia vitamin water market is segmented by product type into flavored vitamin water, non-flavored vitamin water, sugar-free vitamin water, low-calorie vitamin water, electrolyte-infused vitamin water, and others. Among these, the flavored vitamin water segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Flavored vitamin water offers better taste, greater consumer appeal, and a wider range of products; hence, it dominates the Australian vitamin water market. Convenience stores, gyms, and retail establishments are seeing a rise in the popularity of flavored hydration due to Australian customers' growing preference for tasty drinks that mix vitamins with pleasing taste profiles.

- The supermarkets/hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia vitamin water market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, fitness and health clubs, and others. Among these, the supermarkets/hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Major retail chains like Woolworths, Coles, and Aldi are the main places to buy functional beverages since they provide the greatest product selection, good shelf visibility, and regular special prices. Their dominance is further reinforced by their wide-ranging national presence, high customer traffic, and capacity to swiftly launch new vitamin-water brands.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia vitamin water market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vitadrop

- Nutrition Industries / Macro Mike

- Savvy Beverage

- Refilled

- PlantWater

- IPA / Infinite Nutrition

- Herbs of Gold

- Made Group / Nutrient Water

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, Elixinol Wellness Ltd. (ASX: EXL) released its Healthy Chef Protein Water line in Australia, which includes 20 g of protein along with vitamin C and functional nutrients.

- In May 2025, Vitaminwater (Coca-Cola) introduced a new package design along with new flavors: “Elevate” (blue raspberry limeade with multivitamins) and “Re-Hydrate Zero Sugar” (pineapple passionfruit with electrolytes).

- In December 2024, FSANZ (Food Standards Australia New Zealand) is considering reforms to the Health Star Rating and Nutrition Information Panels on the front of packaging that may impact labeling for functional beverages, including vitamin waters.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia vitamin water market based on the below-mentioned segments:

Australia Vitamin Water Market, By Product Type

- Flavored Vitamin Water

- Non-flavored Vitamin Water

- Sugar-free Vitamin Water

- Low-calorie Vitamin Water

- Electrolyte-infused Vitamin Water

- Others

Australia Vitamin Water Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Fitness and Health Clubs

- Others

FAQ’s

Q: What is the Australia vitamin water market size?

A: Australia vitamin water market size is expected to grow from USD 121.5 million in 2024 to USD 276.1 million by 2035, growing at a CAGR of 7.75% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increasing consumer interest in functional beverages that provide enhanced hydration, energy, and support immunity. The growing emphasis on health and a shift away from traditional sugary soft drinks is helping to drive uptake. Government incentives aimed at improving nutrition, including the Healthy Food Partnership targets to reduce sugar, help cement product reformulation processes whilst sustainably supporting market growth.

Q: What factors restrain the Australia vitamin water market?

A: Constraints include the perceived hidden sugars, artificial ingredients, and unsubstantiated “health” claims. Regulatory scrutiny by FSANZ and the emergence of electrolyte drinks as substitutes also limit the market, along with higher pricing compared to bottled water.

Q: How is the market segmented by product type?

A: The market is segmented into flavored vitamin water, non-flavored vitamin water, sugar-free vitamin water, low-calorie vitamin water, electrolyte-infused vitamin water, and others.

Q: Who are the key players in the Australia vitamin water market?

A: Key companies include Vitadrop, Nutrition Industries / Macro Mike, Savvy Beverage, Refilled, PlantWater, IPA / Infinite Nutrition, Herbs of Gold, and Made Group / Nutrient Water.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 172 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |