Australia Whey Protein Market

Australia Whey Protein Market Size, Share, and COVID-19 Impact Analysis, By Type (Whey Protein Isolates, Whey Protein Concentrates, and Whey Protein Hydrolysates), By Application (Sports Nutrition, Dietary Supplements, Infant Formula, Food Additives, Beverages, and Feed), and Australia Whey Protein Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Whey Protein Market Size Insights Forecasts to 2035

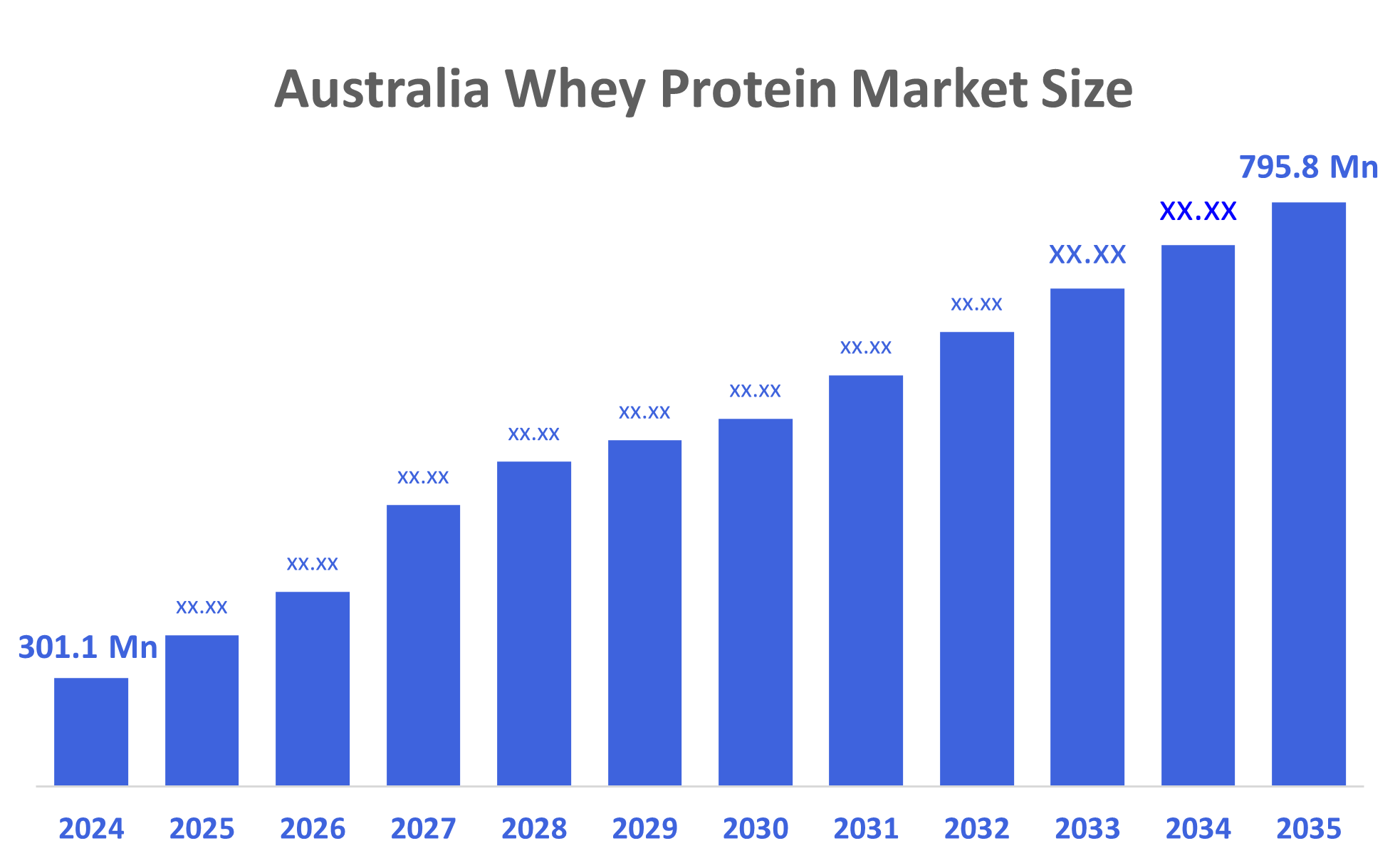

- The Australia Whey Protein Market Size Was Estimated at USD 301.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.24% from 2025 to 2035

- The Australia Whey Protein Market Size is Expected to Reach USD 795.8 Million by 2035

According to a research report published by Decisions Advisors, The Australia Whey Protein Market Size is Anticipated to Reach USD 795.8 Million by 2035, Growing at a CAGR of 9.24% from 2025 to 2035. The whey protein market in Australia is driven by growing health consciousness, increased involvement in sports and fitness, and athletes' growing need for premium protein supplements. Nationwide market adoption is also accelerated by growing gym memberships, lifestyle-related dietary requirements, and product improvements.

Market Overview

The whey protein market, which is a milk-derived protein powder, has become a flourishing industry and is used for muscle building, weight management, and clinical nutrition purposes. This power is mainly driven by health consciousness, fitness trends, and the need for protein-rich foods. The growth of this market globally will be substantial. The Australian dairy producers are taking advantage of research and development programs co-financed by the government and industries, which the Dairy Services Levy annually contributes around AU$33 million, and federal funding of about AU$19 million for research, development, and extension activities that support value-added dairy products, such as whey protein, etc., is granted as a match. Moreover, innovation grants ranging from AU$250,000 to AU$1.5 million have been available for agrotech projects.

Technological advances in the dairy industry, including fractionation techniques (i.e., improved yield), instantization techniques (i.e., improved yield & functionality), and precision fermentation techniques (i.e., new opportunities to develop alternative proteins), have improved dairies' ability to produce value-added proteins. There are significant opportunities for the development of value-added proteins within sports nutrition, the functional food sector, infant formula ingredients, and exports to Asian markets.

Report Coverage

This research report categorizes the market for the Australia whey protein market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia whey protein market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia whey protein market.

Driving Factors

The whey protein market in Australia is driven by rising fitness participation, including the opening of new gyms, participation in sports events, and active lives. The use of whey protein in functional foods and beverages is expanding, and so is the demand for clean-label and premium quality products, which adds to the market's growth. The strong dairy sector, product innovation, and consumers' inclination towards easy, high-protein snacks are other factors that support the uninterrupted growth of the protein market across the country.

Restraining Factors

The whey protein market in Australia is mostly constrained by growing competition from plant-based proteins, unpredictable dairy supply, and rising raw milk and processing prices. Concerns about allergies or lactose intolerance, as well as reliance on imports for specific whey varieties, also restrict market growth.

Market Segmentation

The Australia whey protein market share is classified into type and application.

- The whey protein concentrates segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia whey protein market is segmented by type into whey protein isolates, whey protein concentrates, and whey protein hydrolysates. Among these, the whey protein concentrates segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its balanced protein content, nice amino acid profile, and wide availability are all factors that contribute to its being the favorite choice of both consumers and manufacturers, thus helping it to remain the largest in the market.

- The sports nutrition segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia whey protein market is segmented by application into sports nutrition, dietary supplements, infant formula, food additives, beverages, and feed. Among these, the sports nutrition segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing number of fitness centers, active lifestyles, and specially designed protein-rich formulations have all contributed to sports nutrition being the largest and fastest-growing application category in the country.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia whey protein market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Noumi Limited

- Bioflex Nutrition Pty Ltd

- Stillone Investment Group

- Bulk Nutrients

- Activ Nutrition

- Musashi

- True Protein

- Vital Strength

- Herbs of Gold

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, Dairy Farmers High Protein Milk was introduced, featuring 18?g of protein per serve, reflecting growing protein-rich dairy product trends.

- In June 2025, Day1Performance ISOLATE NiHPRO protein product launched nationwide in Australia, introducing an advanced non?dairy isolate with improved digestibility and flavour, expanding clean?label protein options.

- In March 2025, University of Adelaide research highlighted opportunities to convert whey by?products into valuable food products, boosting industry value?addition potential.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia whey protein market based on the below-mentioned segments:

Australia Whey Protein Market, By Type

- Whey Protein Isolates

- Whey Protein Concentrates

- Whey Protein Hydrolysates

Australia Whey Protein Market, By Application

- Sports Nutrition

- Dietary Supplements

- Infant Formula

- Food Additives

- Beverages

- Feed

FAQ’s

Q: What is the Australia whey protein market size?

A: Australia whey protein market size is expected to grow from USD 301.1 million in 2024 to USD 795.8 million by 2035, growing at a CAGR of 9.24% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by rising fitness participation, including the opening of new gyms, participation in sports events, and active lives. The use of whey protein in functional foods and beverages is expanding, and so is the demand for clean-label and premium quality products, which adds to the market's growth. The strong dairy sector, product innovation, and consumers' inclination towards easy, high-protein snacks are other factors that support the uninterrupted growth of the protein market across the country.

Q: What factors restrain the Australia whey protein market?

A: Constraints include the growing competition from plant-based proteins, unpredictable dairy supply, and rising raw milk and processing prices.

Q: How is the market segmented by application?

A: The market is segmented into sports nutrition, dietary supplements, infant formula, food additives, beverages, and feed.

Q: Who are the key players in the Australia whey protein market?

A: Key companies include Noumi Limited, Bioflex Nutrition Pty Ltd, Stillone Investment Group, Bulk Nutrients, Activ Nutrition, Musashi, True Protein, Vital Strength, Herbs of Gold, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |