Australia Whiskey Market

Australia Whiskey Market Size, Share, and COVID-19 Impact Analysis, By Product Type (American Whiskey, Irish Whiskey, Scotch Whiskey, Canadian Whiskey, and Others), By Quality (Premium, High-End Premium, and Super Premium), and Australia Whiskey Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Whiskey Market Insights Forecasts to 2035

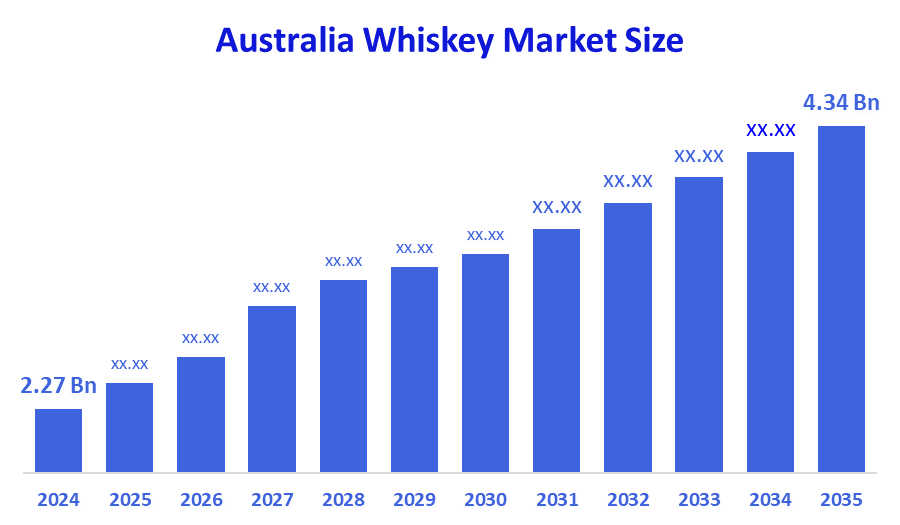

- The Australia Whiskey Market Size Was Estimated at USD 2.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.07% from 2025 to 2035

- The Australia Whiskey Market Size is Expected to Reach USD 4.34 Billion By 2035

According to a research report published by Decision Advisors, The Australia Whiskey Market Size Is Anticipated To Reach USD 4.34 Billion By 2035, Growing At A CAGR Of 6.07% From 2025 To 2035. The Whiskey Market In Australia Is Driven By Increasing Demand For Premium And Craft Whiskey, Higher Disposable Incomes, New Distilleries Coming Up In The Country, And A Strong On-Trade Presence; Besides, The Changing Consumer Taste Preferences And The Growing Demand For Aged, Flavored, And Limited-Edition Whiskey Products Have Also Contributed To The Market's Growth.

The Australian whiskey market comprises the creation, shipment, and selling of locally brewed and imported whiskeys that are classified according to their prices. Its application is widespread throughout the retail, hospitality, and tourism industries, while the consumption is divided into personal use, gifting, premium dining, bars, and whiskey-based cocktails.

The Australian government backs the whiskey industry with various measures like the annual excise tax relief cap (A$400,000), export support through Austrade, and regional development grants for infrastructure and tourism. Besides, the state-aided projects such as WA Distilling Industry Strategy 2025?2030 provide support for local spirits, increase exports, and create more jobs, while the agricultural programs help maintain the quality of grains required for producing premium whiskeys.

Innovators among Australian whiskey makers have been using the extraordinary wood barrels and the wine cask aging method as their production techniques to come up with a different range of regional flavors and premium expressions. To make the market visibility higher, there are limited edition releases with 10-year single casks and craft launches. The future has in it the export growth, digital selling of whiskey, ice-cream tasting, and whiskey tourism, which will all be consumer engagement and a great global marketing strategy driving forces.

Report Coverage

This research report categorizes the market for the Australia whiskey market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia whiskey market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia whiskey market.

Driving Factors

The whiskey market in Australia is driven by the consumer's gradual shift towards high-end and craft spirits, along with the higher income and the unique, aged, and flavored whiskeys attracting more buyers. The demand is stimulated even more by the opening of new distilleries, the introduction of tourism-linked whiskey experiences, and the strong presence of whiskey in bars and restaurants. Moreover, opening up to export markets, experiments in the production area, and rising whiskey education among millennials and urban folks are all contributing to the market's acceleration, thus not only making whiskey a favorite option in the home market but also in the international market.

Restraining Factors

The whiskey market in Australia is mostly constrained by the government's tight regulations, the very high excise taxes, and the fierce competition from imported spirits, along with the fluctuating costs of raw materials and consumer preferences, which can severely limit the scalability of production and hence growth in the market.

Market Segmentation

The Australia whiskey market share is classified into product type and quality.

- The scotch whiskey segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia whiskey market is segmented by product type into American whiskey, Irish whiskey, Scotch whiskey, Canadian whiskey, and others. Among these, the scotch whiskey segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its well-established worldwide reputation, premium positioning, and significant customer demand for premium, aged Scotch. The biggest revenue share is driven by its well-known name, widespread availability in pubs and stores, and appeal to both collectors and casual drinkers.

- The premium segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia whiskey market is segmented by quality into premium, high-end premium, and super premium. Among these, the premium segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The reason for this is that it attracts a large customer base by offering good quality at moderate prices. Retail and on-trade outlets are the main sources of supply for premium whiskeys and, hence, they remain the most popular category amongst consumers even when compared to high-end and super-premium alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia whiskey market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sullivans Cove Distillery

- Hellyers Road Distillery

- Lark Distilling Co.

- Starward Whisky

- Archie Rose Distilling Co.

- Bakery Hill Distillery

- Whipper Snapper Distillery

- Old Kempton Distillery

- Black Gate Distillery

- Timboon Distillery

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Sullivans Cove made a watershed moment for the local craft whisky by releasing Australia's oldest single malt whiskey, which comes in a 25-year-old flavor and is available globally only through ballot and private invitation.

- In October 2025, the South Australian government-initiated an A$250,000 Spirits Expansion Program to geographically broaden the state distilleries' market and to help them expand their presence in the international market.

- In August 2025, the craft distillers evidenced the catching-up of demand for Australian and small-batch whiskeys, the main reason being the growing domestic interest in premium, artisanal spirits, which signifies that the interest in the latter is rising.

- In May 2025, the Sydney Whisky Month 2025 came back alive with the king of spirits and the ones in control entertaining love and loyalty via tastings, rare releases, and whisky-centered events throughout Sydney.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision advisors has segmented the Australia whiskey market based on the below-mentioned segments:

Australia Whiskey Market, By Product Type

- American Whiskey

- Irish Whiskey

- Scotch Whiskey

- Canadian Whiskey

- Others

Australia Whiskey Market, By Quality

- Premium

- High-End Premium

- Super Premium

FAQ’s

Q: What is the Australia whiskey market size?

A: Australia whiskey market size is expected to grow from USD 2.27 billion in 2024 to USD 4.34 billion by 2035, growing at a CAGR of 6.07% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by consumers' gradual shift towards high-end and craft spirits, along with the higher income and the unique, aged, and flavored whiskeys attracting more buyers. The demand is stimulated even more by the opening of new distilleries, the introduction of tourism-linked whiskey experiences, and the strong presence of whiskey in bars and restaurants.

Q: What factors restrain the Australia whiskey market?

A: Constraints include the government's tight regulations, the very high excise taxes, and the fierce competition from imported spirits, along with the fluctuating costs of raw materials and consumer preferences, which can severely limit the scalability of production and hence growth in the market.

Q: Who are the key players in the Australia whiskey market?

A: Key companies include Sullivans Cove Distillery, Hellyers Road Distillery, Lark Distilling Co., Starward Whisky, Archie Rose Distilling Co., Bakery Hill Distillery, Whipper Snapper Distillery, Old Kempton Distillery, Black Gate Distillery, Timboon Distillery, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |