Global Automotive Chromium Market

Global Automotive Chromium Market Size, Share, and COVID-19 Impact Analysis, By Application (Decorative Plating and Functional Plating), By End Use (Two-wheelers, Passenger Vehicles, and Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Automotive Chromium Market Insights Forecasts to 2035

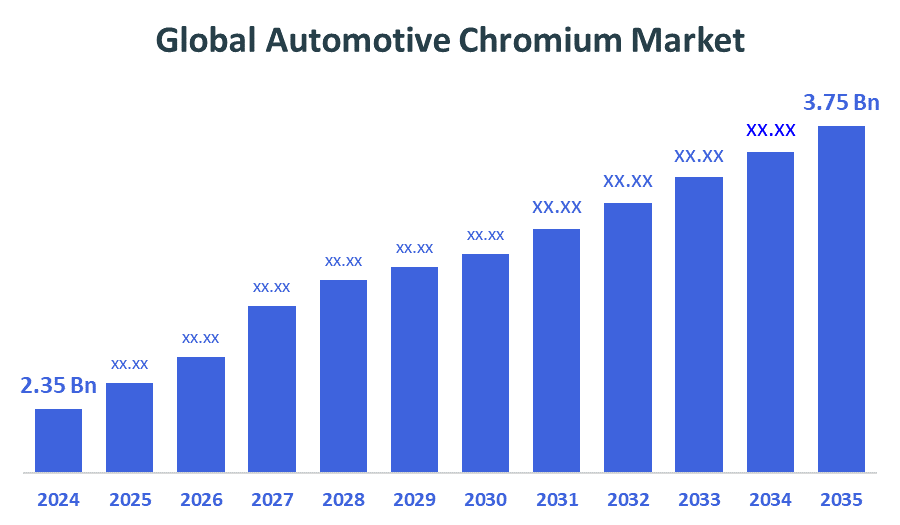

- The Global Automotive Chromium Market Size Was Estimated at USD 2.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.34% from 2025 to 2035

- The Worldwide Automotive Chromium Market Size is Expected to Reach USD 3.75 Billion by 2035

- Europe is Expected to Grow the fastest during the forecast period.

Automotive Chromium Market

The Global Automotive Chromium Market Size refers to the industry involved in the production and application of chromium, primarily in the form of chrome plating, in automotive components such as trims, wheels, grilles, and interior parts. Chromium enhances aesthetic appeal, corrosion resistance, and surface durability. Market growth is driven by rising vehicle production, increasing consumer preference for premium finishes, and demand for durable automotive parts. Governments worldwide are implementing regulations encouraging environmentally sustainable practices in chromium usage, particularly shifting from hexavalent to trivalent chromium to reduce toxicity. Initiatives in the EU, U.S., and Asia-Pacific aim to limit harmful emissions and promote green manufacturing technologies. Key market players are focusing on R&D and adopting advanced plating techniques to meet stringent environmental standards while maintaining product quality. The market is expanding in emerging economies due to growing automotive manufacturing and consumer demand for visually appealing and long-lasting vehicles.

Attractive Opportunities in the Automotive Chromium Market

- The growing market for electric and luxury vehicles, which emphasize premium aesthetics and durable finishes, creates a strong need for high-quality chrome-plated components. This trend drives demand for advanced chromium plating technologies that offer both visual appeal and long-lasting protection.

- The transition from toxic hexavalent chromium to safer trivalent chromium opens opportunities for manufacturers to innovate with environmentally friendly plating methods. Developing and adopting sustainable, regulatory-compliant chromium technologies aligns with government initiatives and consumer preferences for greener automotive products.

- Emerging economies in Asia-Pacific, Latin America, and Africa present significant growth potential due to increasing vehicle ownership and industrial expansion. Additionally, advancements in surface treatment and coating technologies enable cost-effective, efficient production, allowing companies to offer customized and eco-conscious solutions tailored to diverse regional demands.

Global Automotive Chromium Market Dynamics

DRIVER: Consumer preference for premium and durable finishes in vehicles further fuels demand

Increasing demand for aesthetic and corrosion-resistant vehicle components boosts the use of chrome plating in trims, grilles, and wheels. Rising automotive production, especially in emerging economies, supports market expansion. Consumer preference for premium and durable finishes in vehicles further fuels demand. Additionally, technological advancements in eco-friendly and cost-effective plating methods, such as trivalent chromium, align with stringent environmental regulations. Government initiatives promoting sustainable manufacturing practices also contribute to market growth. Overall, the push for enhanced vehicle appearance and performance drives steady demand for automotive chromium applications.

RESTRAINT: Environmental and health concerns related to hexavalent chromium

Environmental and health concerns related to hexavalent chromium, a commonly used form, have led to strict government regulations and increased compliance costs. Transitioning to safer alternatives like trivalent chromium involves significant investment in new technologies and processes. Additionally, the high cost of chrome plating and availability of alternative materials, such as plastic and aluminum with similar finishes, reduce chromium demand. Fluctuating raw material prices and increasing pressure for sustainable, lightweight vehicle components also challenge market growth. These factors collectively hinder widespread chromium use, especially among cost-sensitive manufacturers in developing regions.

OPPORTUNITY: Advancements in surface treatment and coating technologies

The rising demand for electric and luxury vehicles, which emphasize premium aesthetics and durable finishes, creates a growing need for high-quality chrome-plated components. The shift toward trivalent chromium offers manufacturers a chance to innovate with eco-friendly, regulatory-compliant solutions, opening doors for sustainable growth. Emerging markets in Asia-Pacific, Latin America, and Africa offer untapped potential due to increasing vehicle ownership and industrial expansion. Moreover, advancements in surface treatment and coating technologies can lead to cost-effective and efficient production methods. Collaborations between automotive OEMs and plating technology providers also foster innovation, enabling customized and environmentally conscious solutions that can cater to evolving consumer and regulatory demands across global markets.

CHALLENGES: Stringent environmental regulations

Stringent environmental regulations, especially against toxic hexavalent chromium, require costly transitions to safer alternatives. Adopting trivalent chromium involves technical complexities and significant investment. Additionally, rising raw material costs and the availability of alternative decorative finishes like powder coatings or lightweight materials reduce demand. Growing pressure for sustainability and electric vehicle production also pushes manufacturers toward greener, less resource-intensive solutions, further challenging the traditional use of chromium in automotive applications.

Global Automotive Chromium Market Ecosystem Analysis

The global automotive chromium market ecosystem involves multiple stakeholders. Raw material suppliers provide chromium compounds, while plating technology providers like Atotech and MacDermid offer decorative and functional chrome solutions. Tier 1 and Tier 2 manufacturers such as Magna and Motherson apply these finishes to automotive components. Distributors and retailers connect technologies to OEMs and the aftermarket. End users include major automotive OEMs and custom shops. Environmental regulations and demand for eco-friendly alternatives like trivalent chromium are reshaping the value chain and driving innovation.

Based on the application, the decorative plating segment led the market with a revenue share over the forecast period

The decorative plating segment led the global automotive chromium market, accounting for the largest revenue share over the forecast period. This dominance is attributed to the growing consumer demand for visually appealing vehicle components such as grilles, trims, emblems, and wheels. Decorative chrome plating enhances surface aesthetics, offers corrosion resistance, and adds premium value to vehicles. Increasing production of luxury and mid-range vehicles, especially in emerging economies, further boosts demand. Additionally, advancements in eco-friendly decorative plating technologies support sustained market growth amid environmental regulations.

Based on the end use, the passenger vehicles accounted for the largest market revenue share over the forecast period

Passenger vehicles accounted for the largest market revenue share in the global automotive chromium market over the forecast period. This is driven by the high production volume of passenger cars worldwide and the strong consumer preference for chrome-enhanced aesthetic features and durable components. The demand for stylish, corrosion-resistant trims, grilles, and wheels in passenger vehicles supports the extensive use of chromium plating. Additionally, growth in emerging markets and increasing disposable incomes are fueling passenger vehicle sales, further boosting chromium demand in this segment.

Asia Pacific is anticipated to hold the largest market share of the automotive chromium market during the forecast period

Asia Pacific is anticipated to hold the largest market share in the automotive chromium market during the forecast period. This growth is driven by the region’s rapid automotive production, expanding middle-class population, and rising consumer demand for aesthetically appealing and durable vehicle components. Countries like China, India, Japan, and South Korea are key contributors, supported by strong industrial infrastructure and government initiatives promoting vehicle manufacturing. Additionally, increasing investments in electric and luxury vehicles in the region further boost the demand for chromium plating in automotive applications.

Europe is expected to grow at the fastest CAGR in the automotive chromium market during the forecast period

Europe is expected to grow at the fastest CAGR in the automotive chromium market during the forecast period. This rapid growth is driven by stringent environmental regulations pushing manufacturers to adopt eco-friendly chromium plating technologies, such as trivalent chromium. Additionally, the region’s focus on premium and electric vehicles, which demand high-quality and durable finishes, fuels market expansion. Strong investments in automotive innovation, sustainability initiatives, and increasing consumer preference for luxury aesthetics further accelerate Europe’s chromium market growth.

Recent Development

- In June 2025, Sarrel launched a chromium-free finishing solution specifically designed for electric vehicle components. This innovation marks a significant milestone in sustainable plating technology, addressing environmental concerns associated with traditional chromium plating. By eliminating toxic chromium compounds, Sarrel’s solution offers eco-friendly durability and corrosion resistance, aligning with the automotive industry's push toward greener manufacturing practices especially critical in the rapidly growing electric vehicle market. This development positions Sarrel as a leader in sustainable automotive surface treatments.

Key Market Players

KEY PLAYERS IN THE AUTOMOTIVE CHROMIUM MARKET INCLUDE

- Atotech Group

- Coventya

- MacDermid Enthone

- Sarrel

- Elementis plc

- MVC Holdings

- SRG Global

- Plastic Omnium

- Magna International

- Motherson Sumi Systems

- Toyoda Gosei

- Yanfeng Automotive Interiors

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive chromium market based on the below-mentioned segments:

Global Automotive Chromium Market, By Application

- Decorative Plating

- Functional Plating

Global Automotive Chromium Market, By End Use

- Two-wheelers

- Passenger Vehicles

- Commercial Vehicles

Global Automotive Chromium Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 215 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |