Global Automotive Connectors Market

Global Automotive Connectors Market Size, Share, and COVID-19 Impact Analysis, By Product Type (IC, PCB, Fiber Optic, RF, and Others), By Accessories (Connector Caps & Covers, EMC Shielding, Locks And Position Accessories, and Other Connector Accessories), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

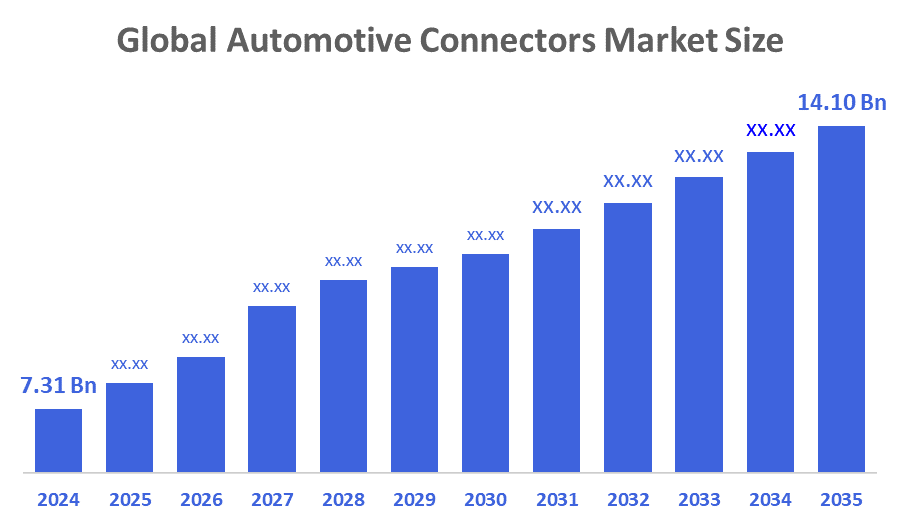

Global Automotive Connectors Market Size Insights Forecasts to 2035

- The Global Automotive Connectors Market Size was valued at USD 7.31 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.15% from 2025 to 2035

- The Worldwide Automotive Connectors Market Size is Expected to Reach USD 14.10 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Automotive Connectors Market Size was worth around USD 7.31 Billion in 2024 and is predicted to Grow to around USD 14.10 Billion by 2035 with a compound annual growth rate (CAGR) of 6.15% from 2025 to 2035. The growth is primarily driven by increasing demand for advanced connectivity, comfort, and safety features across passenger and commercial vehicles.

Market Overview

The Global Automotive Connectors Market is the term that describes the global market of companies designing and manufacturing electrical as well as electronic connectors and supplying them for the transmission of power, signals, and data between vehicles through the conventional, electric, and autonomous platforms. Additionally, the automotive connector market is being greatly influenced by the stricter automobile safety regulations around the world. With governments and organizations such as the European New Car Assessment Programme (Euro NCAP) demanding more advanced safety measures, the need for very reliable connectors is increasing to an enormous extent. For example, Euro NCAP's 2025 requirement for all new cars in the EU to have assisted driving technologies is a major factor behind this. These developments in legislation are speeding up the adoption of complex ADAS (Advanced Driver Assistance Systems), which necessitate a great number of sensors, cameras and control units. The corresponding data transfer between these components must be instantaneous, and that is why each of them is equipped with a high speed, perfect-quality connection. The very high standards of safety and performance that connectors must meet are causing their manufacturers to get more inventive and produce the more robust, durable, and fail-safe solutions.

Report Coverage

This research report categorizes the automotive connectors market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive connectors market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive connectors market.

Driving Factors

The increasing acceptance of electric vehicles (EVs) is a major factor in the need of specialized connectors for battery systems and power management. The role of connectors, which allow the power to flow without any interruption, becomes very important as EVs depend so much on the efficient storage and distribution of power. According to a report by IBEF, the Electric Vehicle (EV) market in India is expected to grow enormously from $3.21 billion in 2022 to $113.99 billion by 2029, having a Compound Annual Growth Rate (CAGR) of 66.52%. The market for EV batteries is also estimated to increase from $16.77 billion in 2023 to $27.70 billion by 2028, the demand being mainly supported by the strong government support and investments that continue to boost this sector's growth. The growing number of EVs coupled with the advances in battery technology are making the need for high-performance connectors for charging systems and battery management even stronger. The automotive connectors sector is predicted to see an increasing demand for the connectors as a result of the continuing growth of the electric vehicles market.

Restraining Factors

The global automotive connectors market suffers from restraints like volatile raw material prices, integrating connectors with advanced vehicle electronics is complex, very high development costs, and supply chain disruptions that have a negative impact on production efficiency and market growth.

Market Segmentation

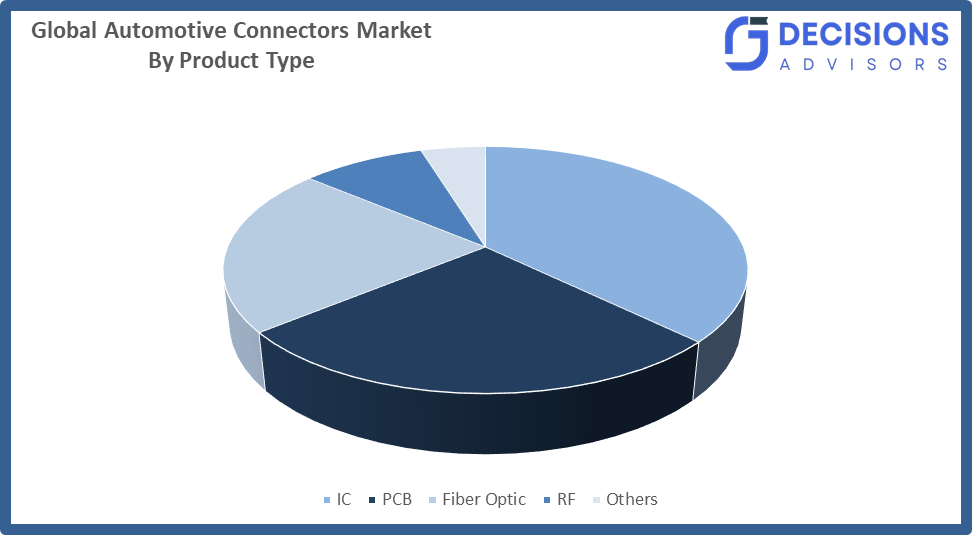

The automotive connectors market share is classified into product type and accessories.

- The IC segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the automotive connectors market is divided into IC, PCB, fiber optic, RF, and others. Among these, the IC segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The major factor behind the growth is the rising demand for integrated circuits in modern vehicles for signal processing, power management, and communication functions. IC connectors ensure stable and secure electrical connections that are essential for the proper functioning of cutting-edge vehicle systems such as engine management, infotainment, and safety modules.

- The connector caps & covers segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the accessories, the automotive connectors market is divided into connector caps & covers, EMC shielding, locks and position accessories, and other connector accessories. Among these, the connector caps & covers segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The demand for protective solutions that provide durability, reliability, and safety of automotive connectors is the main driving factor of the growth. The automotive connectors are the components that protect the electrical circuit and vehicle safety from contamination caused by dust, moisture, and debris.

Regional Segment Analysis of the Automotive Connectors Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive connectors market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the automotive connectors market over the predicted timeframe. This is partly because of the leading position of the continent in car production, particularly in countries like China, Japan, and South Korea. The quick development of the automotive industry, which is driven by the growing need for electric vehicles (EVs) and high-tech automotive products, makes high-quality and reliable connectors even more needed. In addition, the Asian-Pacific connectors market is gaining ground backed by the region's focus on improving manufacturing efficiency, investing in new technologies, and incorporating intelligent and connected vehicles into its systems.

North America is expected to grow at a rapid CAGR in the automotive connectors market during the forecast period. The remarkable evolution that is the automotive industry has been, among other reasons, driven by the increasing demand for advanced vehicle technologies and the rise of electric vehicles (EVs). So far the EVs have been the main reason for the push to integrate sophisticated connector solutions by vehicle manufacturers, but the areas of electrification and connectivity have also become even more important as they are considered the future technological trends. The manufacturers in the region, with the strong automotive production capability, are making a lot of investments to modernise their assembly lines in order to accommodate the latest connector technologies. On top of that, the demand for high-performance connectors is growing because of the regulatory pressures on vehicle safety and emissions, which require more complicated electrical systems in cars. The transition to smart, connected, and energy-efficient cars is another factor that motivates the requirement for connectors that are both reliable and adaptable and is, therefore, a powerful trend for the connectors market to follow. The rise in demand for EVs and advanced vehicle features will result in the North America automotive connectors market being the main beneficiary of technological achievements, increased vehicle production, and the need for strong electrical connectivity solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive connectors market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TE Connectivity

- Aptiv PLC

- Amphenol Corporation

- Yazaki Corporation

- Molex Incorporated

- Sumitomo Electric Industries, Ltd.

- Hirose Electric Co., Ltd.

- JST Manufacturing Co., Ltd.

- Kyocera Corporation

- Rosenberger Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Molex expanded its automotive connectors portfolio with the new MX?DaSH modular connector system, enhanced wiring harness efficiency by combining power, signal, and data connectivity, reduced complexity, weight, and cost, and supported advanced zonal vehicle architectures.

- In January 2024, Amphenol Corporation, a leader in sensor, interconnect, and antenna solutions, announced the acquisition of PCTEL. The acquisition was expected to accelerate growth opportunities through the combination of these two organizations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the automotive connectors market based on the below-mentioned segments:

Global Automotive Connectors Market, By Product Type

- IC

- PCB

- Fiber Optic

- RF

- Others

Global Automotive Connectors Market, By Accessories

- Connector Caps & Covers

- EMC Shielding

- Locks And Position Accessories

- Other Connector Accessories

Global Automotive Connectors Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the automotive connectors market over the forecast period?

A: The global automotive connectors market is projected to expand at a CAGR of 6.15% during the forecast period.

- What is the market size of the automotive connectors market?

A: The global automotive connectors market size is estimated to grow from USD 7.31 billion in 2024 to USD 14.10 billion by 2035, at a CAGR of 6.15% during the forecast period 2025-2035.

- Which region holds the largest share of the automotive connectors market?

A: Asia Pacific is anticipated to hold the largest share of the automotive connectors market over the predicted timeframe.

- Who are the top 10 companies operating in the global automotive connectors market?

A: TE Connectivity, Aptiv PLC, Amphenol Corporation, Yazaki Corporation, Molex Incorporated, Sumitomo Electric Industries, Ltd., Hirose Electric Co., Ltd., JST Manufacturing Co., Ltd., Kyocera Corporation, Rosenberger Group, and Others.

- What are the market trends in the automotive connectors market?

A: The main trends in the market consist of the demand for high-speed data connectors growing, and increased usage in electric and self-driving vehicles, along with the trends of miniaturization, lightweight materials, durability enhanced, and the integration of advanced driver-assistance and infotainment systems growing.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 148 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |