Global Automotive Drivetrain Market

Global Automotive Drivetrain Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (ICE, Electric Motor), By Drive Type (FWD, RWD, AWD), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Automotive Drivetrain Market Summary

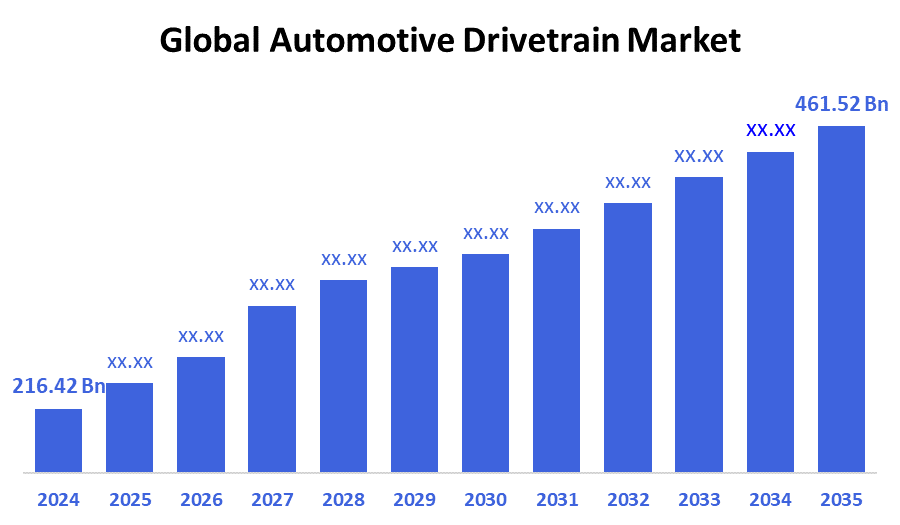

The Global Automotive Drivetrain Market Size Was Estimated at USD 216.42 Billion in 2024 and is Projected to Reach USD 461.52 Billion by 2035, Growing at a CAGR of 7.13% from 2025 to 2035. The increased production of cars, the growing need for performance and fuel economy, the growing popularity of electric and hybrid vehicles, and developments in drivetrain technologies across all vehicle segments are the main factors propelling the automotive drivetrain market.

Key Regional and Segment-Wise Insights

- With 43.2% revenue share in 2024, the Asia Pacific automotive drivetrain market led the world market.

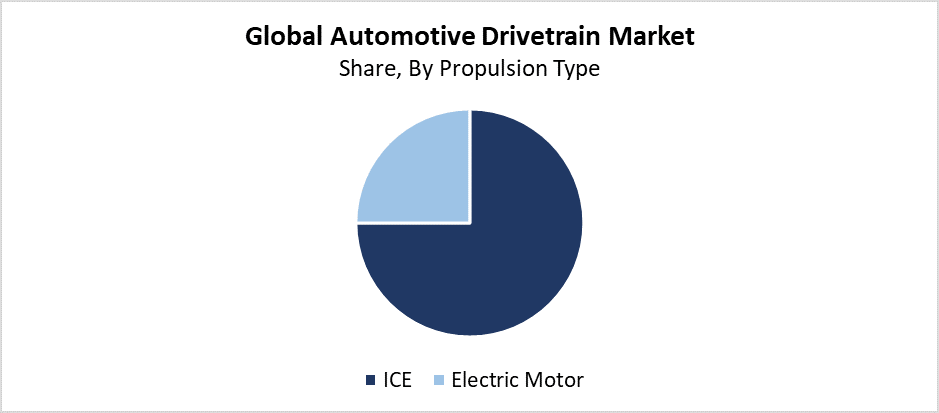

- In 2024, the ICE segment represented the biggest revenue share of 75.4% and dominated the market based on propulsion type.

- In 2024, the FWD segment held a 49.3% revenue share, dominating the automobile drivetrain market based on drive type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 216.42 Billion

- 2035 Projected Market Size: USD 461.52 Billion

- CAGR (2025-2035): 7.13%

- Asia Pacific: Largest market in 2024

The automotive drivetrain market consists of a power transfer system connecting the engine or motor to wheels through driveshafts, axles, differentials, and transmissions. The automotive market plays a vital role in determining vehicle performance and efficiency, as well as handling characteristics. This market shows continuous growth because customers want better driving experiences and fuel efficiency, and because global vehicle production is expanding. The automotive drivetrain industry experiences rising demand because four-wheel drive (4WD) and all-wheel drive (AWD) systems are gaining popularity, especially among SUVs and off-road vehicles. The automotive industry experiences transformation through the rapid adoption of hybrid and electric vehicles because these vehicles require unique drivetrain configurations that include e-axles and single-speed gearboxes.

Vehicle drivetrain technology experiences transformational effects from recent technological progress. The combination of enhanced torque vectoring systems with integrated electric drivetrains and lightweight materials decreases energy losses and improves performance. The advancement of modular electric axles and e-drives in electric vehicles (EVs) enables manufacturers to create efficient systems while reducing manufacturing complexity. The combination of government initiatives for cleaner transportation, together with EV adoption subsidies, forces automobile manufacturers to create drivetrain systems made for electrified vehicles. Experts expect these developments to drive the continuous expansion and transformation of the worldwide automotive drivetrain market.

Propulsion Type Insights

What Factors Enabled the Internal Combustion Engine (ICE) Segment to Capture a 75.4% Revenue Share in the Automotive Drivetrain Market in 2024?

The internal combustion engine (ICE) segment held the largest revenue share of 75.4% to lead the automotive drivetrain market in 2024. ICE-powered vehicles maintain their market dominance because they have extensive market penetration and established fuel distribution systems, and affordable initial costs when compared to electric vehicles, which are gaining momentum. Emerging markets show strong dominance of ICE vehicles because they provide affordable access to fuel and abundant availability to consumers. The significance of ICE systems continues to rise because of ongoing developments in pollution control technology, engine efficiency improvements, and hybrid drivetrain integration. The market strength of this segment derives from its dominant use in passenger cars, light commercial vehicles, and heavy-duty trucks. Regulatory pressures, along with the worldwide shift toward electrification, will begin transforming this environment throughout the coming years.

During the forecast period, the automotive drivetrain market's electric motor segment will experience substantial growth. The electric motor segment of the automotive drivetrain market will experience substantial growth during the forecast period. The main reason behind this growth exists in worldwide vehicle electrification trends that receive support from increasing environmental consciousness, government subsidies, and stricter pollution regulations. Electric motors serve as the fundamental power source for EV drivetrains because they generate zero emissions and deliver rapid torque along with high efficiency and decreased maintenance needs. Big automakers' investments in specialized EV platforms, their acceleration of electric mobility adoption, drive the growing requirement for advanced electric motor systems. The technological advancements in motor design through permanent magnet and induction motors boost performance metrics and energy efficiency, which drives the segment's growth potential.

Drive Type Insights

Why Did the FWD Segment Capture the Largest Revenue Share of 49.3% in the Automotive Drivetrain Market in 2024?

The FWD segment held the largest revenue share of 49.3% during 2024 and dominated the automotive drivetrain market. The compact dimensions of FWD systems, along with their affordable production expenses and better fuel efficiency, make them popular choices for passenger vehicles. The layout of FWD suits small to mid-sized cars by placing the engine and transmission at the front, which decreases weight and creates more interior space. The front-wheel-drive configuration delivers superior traction during slippery conditions, which enhances vehicle control and safety features for drivers. The worldwide drivetrain market remains led by this segment because it serves both advanced and developing markets and satisfies the increasing need for economical vehicles with good fuel efficiency.

During the forecast period, the automotive drivetrain market's AWD segment is anticipated to grow at the fastest CAGR. Consumer preferences toward vehicles with superior off-road capability and traction, and safety features, lead to the primary increase in demand for AWD systems. All-wheel-drive systems enhance vehicle control and stability by directing power to each wheel during adverse weather conditions such as rain, snow, or rough terrain. The rising trend of SUVs and crossovers, which feature AWD functionality, drives segment expansion. Intelligent AWD technology improvements have attracted more diverse consumer groups since these systems maximize power distribution efficiency, which leads to better fuel economy. The growing adoption of AWD systems in hybrid and electric vehicles also supports this upward trend.

Regional Insights

The Asia Pacific automotive drivetrain market dominated the global market by generating 42.7% of revenue in 2024. The region surpasses others due to its massive vehicle manufacturing numbers, combined with quick city development and strong automotive needs for passenger and commercial vehicles. The automotive production centers of China, India, Japan, and South Korea lead the market because they have established supply networks and are increasing the adoption of advanced drivetrain technologies. Market growth expanded due to increasing vehicle ownership, which stems from the growing middle class and increasing disposable income levels. The advancement of drivetrain technology receives support through infrastructure development and supportive government rules, together with increasing interest in electric vehicles. The region continues to boost demand for advanced drivetrain technology because it focuses on cost-effectiveness and performance, and fuel efficiency.

Europe Automotive Drivetrain Market Trends

The European automotive drivetrain market experiences substantial expansion as the region continues to enforce emission standards while promoting electric vehicle adoption. The rising demand for electric and hybrid vehicles drives the market toward advanced drivetrain components including e-axles and multi-speed gearboxes which improve performance and efficiency. European governments, through their emission-reduction policies and incentive programs, are accelerating the shift to electric powertrains and advancing green mobility initiatives. The market gains momentum because of advanced torque vectoring technology alongside lightweight materials that enhance vehicle performance. The European automotive drivetrain market shows significant growth potential because major automakers operate in the region, and research and development investments keep increasing.

North America Automotive Drivetrain Market Trends

The North American automotive drivetrain market is growing significantly because of rising consumer interest in advanced vehicle performance alongside fuel economy. The market grows because the region prioritizes modern technologies, including electric and hybrid drivetrains. The market experiences additional growth because consumers prefer SUVs and pickup trucks, which typically have sophisticated drivetrain systems including all-wheel drive (AWD). The implementation of novel drivetrain solutions by automakers becomes more prevalent because government regulations require reduced pollution output and better fuel efficiency. The continuous development of technology benefits from leading automotive manufacturers and suppliers operating throughout the United States and Canada.

Key Automotive Drivetrain Companies:

The following are the leading companies in the automotive drivetrain market. These companies collectively hold the largest market share and dictate industry trends.

- TOYOTA MOTOR CORPORATION

- ZF Friedrichshafen AG

- Aisin Seki Co., Ltd.

- Volkswagen Group

- American Axle & Manufacturing, Inc.

- BorgWarner Inc.

- General Motors

- Schaeffler AG

- Stellantis NV

- Hyundai Motor Company

- Others

Recent Developments

- In February 2025, Toyota Motor Corporation made a significant advancement in hydrogen technology with the introduction of its third-generation fuel cell (FC) system. With a lifespan twice as long as its predecessor, the new system delivers improved durability, fuel efficiency that results in a 20% longer driving range, and a notable decrease in production costs. The third-generation FC system was created to satisfy the exacting demands of the commercial sector and may be used in a variety of applications, including large trucks, buses, rail transportation, passenger cars, and stationary power generators.

- In January 2025, in an arrangement for roughly USD 1.4 billion, American Axle & Manufacturing (AAM) completed the acquisition of Dowlais Group plc, the parent company of GKN Automotive. With this calculated action, American Axle & Manufacturing (AAM) hopes to establish itself as a top supplier of driveline systems and metal-forming technology worldwide, serving internal combustion, hybrid, and electric vehicles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the automotive drivetrain market based on the below-mentioned segments:

Global Automotive Drivetrain Market, By Propulsion Type

- ICE

- Electric Motor

Global Automotive Drivetrain Market, By Drive Type

- FWD

- RWD

- AWD

Global Automotive Drivetrain Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |