Global Automotive OEM Coatings Market

Global Automotive OEM Coatings Market Size, Share, and COVID-19 Impact Analysis, By Product (Clear Coat, Base Coat, Primer, E-coat, Others), By Resin (Polyurethane, Acrylic, Epoxy, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Automotive OEM Coatings Market Summary

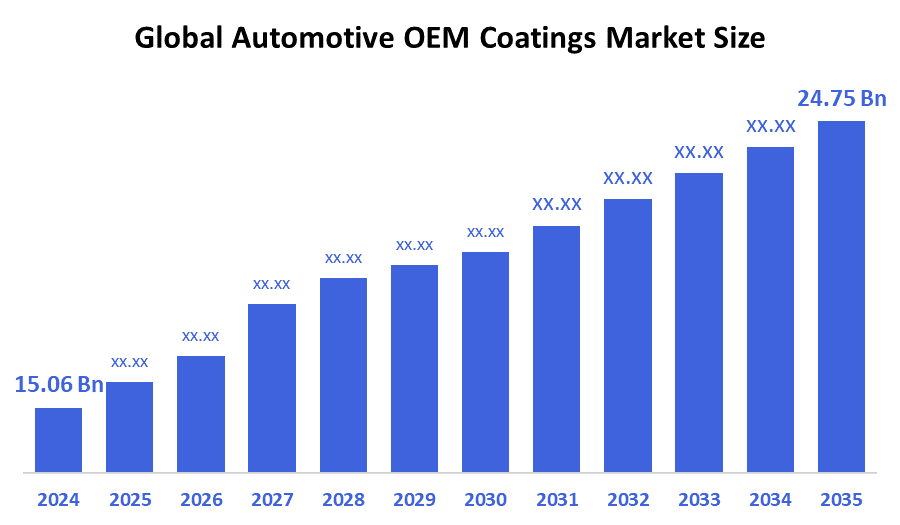

The Global Automotive OEM Coatings Market Size Was Valued at USD 15.06 Billion in 2024 and is Projected to Reach USD 24.75 Billion by 2035, Growing at a CAGR of 4.62% from 2025 to 2035. Increased worldwide vehicle production, especially in emerging economies, the need for sophisticated protection and aesthetic features, and a notable trend towards electric and driverless vehicles are the main factors propelling the growth of the automotive OEM coatings market.

Key Regional and Segment-Wise Insights

- In 2024, the North American automotive OEM coatings market held a 39.2% market share, dominating the industry.

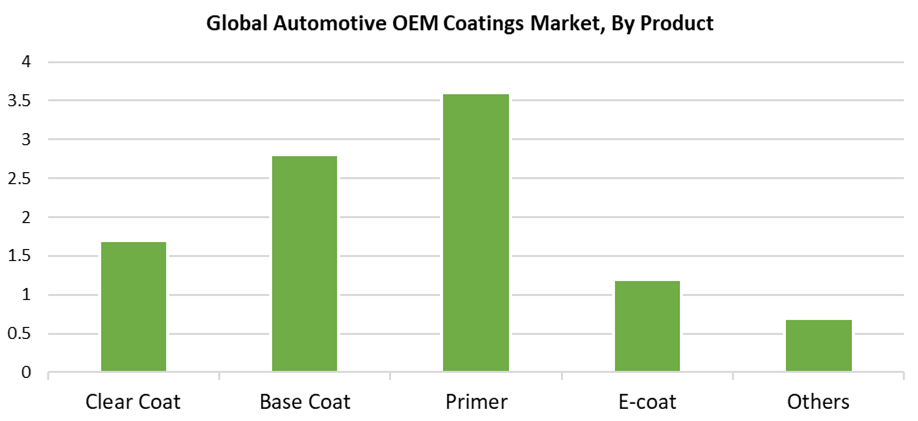

- In 2024, the primer segment held a 36.5% market share, dominating the market by product.

- In terms of resin, the epoxy segment generated the highest revenue in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 15.06 Billion

- 2035 Projected Market Size: USD 24.75 Billion

- CAGR (2025-2035): 4.62%

- North America: Largest market in 2024

The automotive OEM coatings market primarily targets original equipment manufacturers (OEMs) through manufacturing and applying protective and ornamental coatings. These coatings deliver enduring protection from environmental factors such as UV rays, moisture, and chemicals, and they enhance both vehicle endurance and visual appeal and corrosion protection. The automotive coatings market experiences growth due to rising customer interest in durable, attractive finishes combined with expanding vehicle production and growing vehicle maintenance awareness. The rising electric and premium vehicle production drives market demand for advanced protective coatings, which deliver enhanced protection and customization options. Regulatory standards about vehicle safety, together with emission control and fuel efficiency requirements, motivate manufacturers to use high-performance coatings.

The automobile OEM coatings market experiences a significant impact from technological advancements, which serve as a key market driver. The development of eco-friendly powder and aqueous coatings, which minimize VOC emissions while meeting international environmental standards, represents a key innovation in the field. Nanotechnology and smart coatings deliver self-healing, anti-scratch, and anti-corrosion features to the market. Worldwide governments implement stringent regulations that force manufacturers to minimize dangerous emissions while motivating sustainable production techniques. Market growth accelerates and innovation advances because industry players adopt green coating technologies through incentive programs and regulatory requirements, which aim to reduce environmental impact.

Product Insights

The primer segment held the largest revenue share of 36.5% in 2024 and dominated the automotive OEM coatings industry. The production of automobiles depends on primers because these coatings establish a firm foundation that enhances the bonding strength of successive layers while protecting metal surfaces against corrosion and environmental damage. The growing requirement to enhance vehicle endurance alongside automotive component life extension drives the expanding market for primers. The industry has better accepted primers because manufacturers introduced environmentally friendly alternatives together with low-VOC versions. The primer category represents a significant portion of the automotive OEM coatings market revenue because it plays an essential part in achieving superior final coatings and protecting vehicles from deterioration.

During the projection period, the base coat segment is anticipated to grow at a significant CAGR. The growing need for colorful top-quality finishes that enhance vehicle appearance represents the main factor behind this growth. A vehicle's appearance gets its color through base coats, which also provide its style, while the clear coat offers protection and durability. The rising demand for high-end customized vehicles, along with luxury and electric cars popularity drives market growth. Base coat formulas become more resilient and colorfast through technological advancements, which reduce volatile organic compounds (VOCs) while making them environmentally friendly. The base coat market will experience accelerated growth because automakers focus on sustainability and aesthetics, and will serve as a fundamental element for the evolving automotive OEM coatings industry.

Resin Insights

The epoxy resin segment held the largest revenue share in the automobile OEM coatings industry during 2024. The combination of durability, chemical resistance, and adhesion properties makes epoxy resins ideal for protective coatings and automobile primers. Their strong corrosion resistance enables them to extend the lifespan of automotive components, especially metal parts exposed to harsh weather conditions. The automotive industry extensively uses epoxy-based coatings because these products enhance vehicle performance and extend vehicle operational life. The market continues to lead because of ongoing research, which produces improved epoxy resin formulations, including low-VOC and environmentally friendly versions. The market leadership indicates that epoxy resins play a fundamental role in protecting automotive coatings through their durability and quality.

The automotive OEM coatings market's polyurethane resin segment is anticipated to grow at a significant CAGR during the forecast period. Polyurethane coatings work perfectly for topcoats and clear automotive coatings since they deliver excellent flexibility together with resistance to solvents and UV light, and durable abrasion protection. Vehicles benefit from polyurethane coatings that offer both protective features and enhanced gloss and color retention capabilities. Polyurethane-based formulations experience rising popularity because the automotive industry demands advanced coatings and lightweight vehicle solutions, particularly for luxury and electrified vehicles. Technological progress enhances sustainability and decreases volatile organic compounds (VOCs), which results in improved environmental characteristics of polyurethane coatings. The polyurethane resin market will experience substantial growth during the next years because automotive manufacturers focus more on performance and environmental sustainability.

Regional Insights

The North American automotive OEM coatings market led globally with the largest revenue share of 39.2% during 2024. The industry's leadership position stems from the strong automotive manufacturing base in the region and the increasing market need for modern vehicle coatings and consumer preferences for durable and decorative finishes. The automotive industry of North America maintains a well-developed network of OEMs and suppliers that allocate substantial funds towards advanced coating technologies such as waterborne and powder coatings, which meet environmental regulations. The increasing number of luxurious automobiles, together with electric vehicles in this region, drives the requirement for superior coatings that deliver enhanced performance characteristics. The North American automotive OEM coatings market maintains its position as a leading global force because of government regulations that promote sustainable practices alongside emission reduction standards.

Europe Automotive OEM Coatings Market Trends

The European automotive OEM coatings industry is anticipated to experience notable expansion during the forecasted timeframe. The rising use of environmentally friendly coatings, combined with regulations targeting VOC reduction, serves as the primary market growth driver. The automotive sector's expanding need for durable and visually attractive coatings, along with premium quality coatings, drives market growth. The advanced coatings market grows because manufacturers produce more luxury vehicles and electric cars in this area. The development of powder and aqueous coatings technology drives market expansion. The future growth of the European automotive OEM coatings market will be driven by government programs that back eco-friendly production methods and increased research and development investments.

Asia Pacific Automotive OEM Coatings Market Trends

During the forecast period, the Asia Pacific automotive OEM coatings market will demonstrate significant expansion. The automotive manufacturing sector of China, India, and Japan serves as the primary growth driver for the rapid expansion of this market in the region. The market advances because of rising car manufacturing volumes, together with increasing consumer preference for durable, attractive finishes, and the emergence of luxury and electric vehicle usage. Government initiatives promoting environmental sustainability encourage the adoption of powder and aqueous coatings, which function as eco-friendly coatings. Technological advancements, together with rising research & development investments, enable the creation of advanced automobile coatings that minimize volatile organic compound emissions. The Asia Pacific automotive OEM coatings market experiences rapid expansion because of the region's cost benefits, together with rising urbanization and infrastructure growth.

Key Automotive OEM Coatings Companies:

The following are the leading companies in the automotive OEM coatings market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- KCC Corporation

- The Sherwin-Williams Company

- PPG Industries Inc.

- Kansai Paint Co. Ltd

- Akzo Nobel N.V.

- Berger Paints India Ltd

- Axalta Coating Systems Ltd

- Nippon Paints Holdings Co. Ltd

- Covestro AG

- Others

Recent Developments

- In March 2025, to establish a strategic alliance centered on car exterior coatings for NIO's EVs, NIO and BASF Coatings signed a letter of intent. The goal of the partnership is to improve long-term collaboration between the two businesses by using NIO's market position in smart electric vehicles and BASF's cutting-edge coating technology to improve product sustainability and performance.

- In March 2025, Nippon Paint and Uchihamakasei Corp. announced collaborating to develop a next-generation in-mold coating (IMC) technology that will enable vehicle coating processes to become carbon neutral. For extensive thermoplastic automotive exterior applications, this creative solution is Japan's first IMC.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the automotive OEM coatings market based on the below-mentioned segments:

Global Automotive OEM Coatings Market, By Product

- Clear Coat

- Base Coat

- Primer

- E-coat

- Others

Global Automotive OEM Coatings Market, By Resin

- Polyurethane

- Acrylic

- Epoxy

- Others

Global Automotive OEM Coatings Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |