Global Autonomous Hauler Market

Global Autonomous Hauler Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Autonomous Mining Trucks and Autonomous Road Freight Trucks), By Autonomy Level (Level 3, Level 4, and Level 5), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Autonomous Hauler Market Summary, Size & Emerging Trends

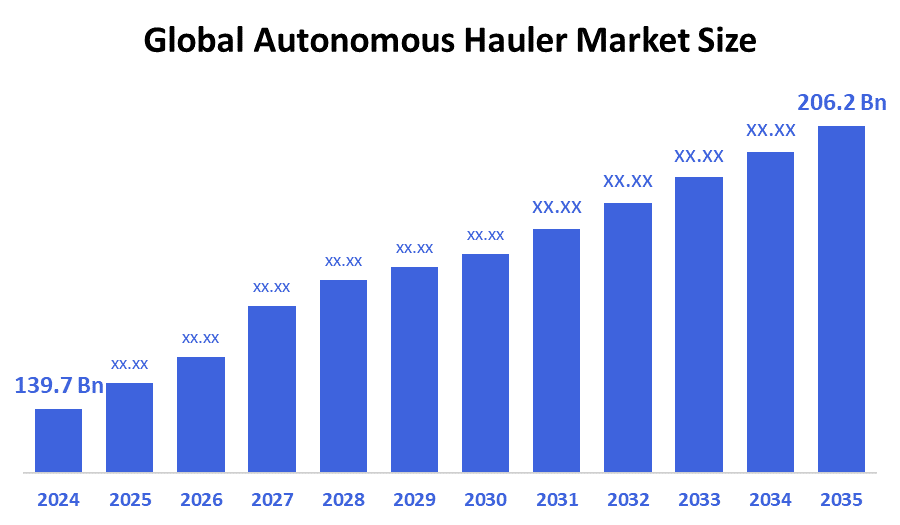

According to Decision Advisors, The Global Autonomous Hauler Market Size is Expected to Grow from USD 139.7 Billion in 2024 to USD 206.2 Billion by 2035, at a CAGR of 3.6% during the forecast period 2025-2035. The autonomous hauler market is propelled by the growing need for automation in sectors like mining and construction to enhance safety and cut labor expenses.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the autonomous hauler market during the forecast period.

- In terms of type, the autonomous mining trucks segment accounted for the largest revenue share of the global autonomous hauler market during the forecast period

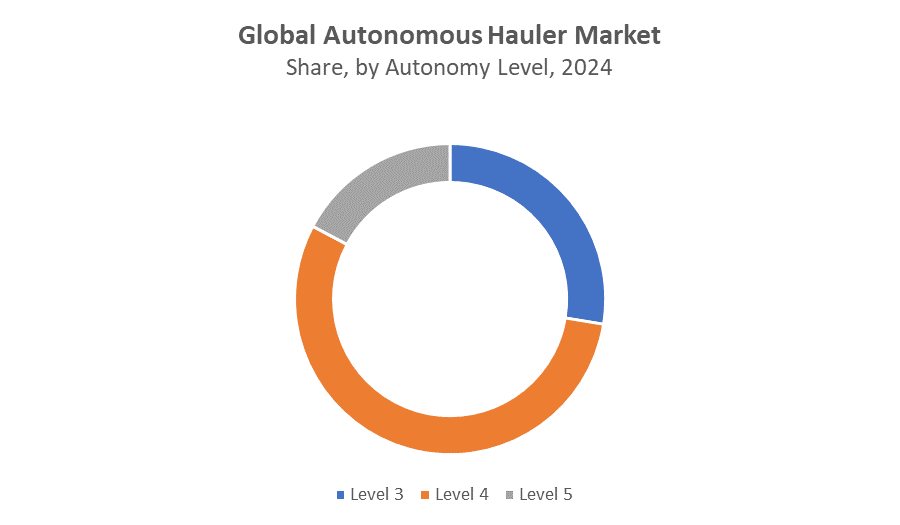

- In terms of autonomy level, the level 4 segment accounted for the highest market share of the global autonomous hauler market during the forecast period

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 139.7 Billion

- 2035 Projected Market Size: USD 206.2 Billion

- CAGR (2025-2035): 3.6%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Autonomous Hauler Market

The autonomous hauler market focuses on self-driving trucks used mainly in mining, construction, and logistics to transport materials efficiently without human drivers. These vehicles improve safety, reduce labor costs, and increase productivity. Governments worldwide support the development and deployment of autonomous haulers through various initiatives, such as funding research, setting safety regulations, and promoting technology adoption. For instance, programs by the U.S. Department of Transportation and the European Union aim to accelerate autonomous vehicle integration. The market is expanding rapidly due to advancements in artificial intelligence, sensor technology, and connectivity. Autonomous haulers are transforming industries by enabling continuous operations and optimizing resource management. With growing emphasis on automation and efficiency, these vehicles are becoming essential in modern industrial processes, shaping the future of material transport across multiple sectors.

Autonomous Hauler Market Trends

- Autonomous haulers are increasingly used in mining and construction for safer and more efficient material transport, enabling 24/7 operations without fatigue-related risks.

- Improved artificial intelligence, LiDAR, radar, and camera systems enhance navigation accuracy and obstacle detection, making autonomous haulers more reliable in complex environments.

- Growing government initiatives and clearer regulations are accelerating the deployment of autonomous haulers, providing funding, safety standards, and pilot program support.

- Autonomous haulers are being integrated with digital fleet management and IoT platforms to optimize routes, monitor vehicle health, and improve overall operational efficiency.

Autonomous Hauler Market Dynamics

Driving Factors: Growing need for automation in sectors like mining and construction

The autonomous hauler market is propelled by the growing need for automation in sectors like mining and construction to enhance safety and cut labor expenses. Breakthroughs in AI, advanced sensors, and connectivity technologies are making autonomous hauling more dependable and efficient. Government initiatives, including funding and regulatory support, are fostering wider adoption. Industries increasingly demand around-the-clock operations, which autonomous haulers enable by reducing downtime and boosting productivity. Moreover, the drive to lower operational costs and promote sustainable practices through optimized resource management is accelerating market growth, establishing autonomous haulers as essential assets in the evolution of industrial transportation.

Restrain Factors: Technical complexities related to integrating autonomous systems

The autonomous hauler market faces restraining factors such as high initial investment costs, which can be a barrier for many companies. Technical complexities related to integrating autonomous systems with existing infrastructure slow down widespread adoption. Concerns around cybersecurity and data privacy also pose challenges, as autonomous vehicles rely heavily on connected technologies. Additionally, the lack of universally accepted regulations and safety standards can delay implementation. Resistance from the workforce due to potential job displacement and the need for skilled personnel to manage and maintain these systems further limit growth. These factors collectively slow the pace of market expansion despite strong technological advancements.

Opportunity: Expanding government support through grants

The autonomous hauler market presents significant opportunities driven by increasing demand for automation in industries like mining, construction, and logistics. As companies seek to improve operational efficiency and reduce labor costs, there is a strong incentive to adopt autonomous hauling solutions. Technological advancements in AI, machine learning, and sensor systems offer opportunities to develop more sophisticated and reliable vehicles. Additionally, expanding government support through grants, pilot projects, and regulatory frameworks creates a favorable environment for innovation and deployment. The push for sustainable and eco-friendly operations also encourages the integration of electric and hybrid autonomous haulers. Moreover, emerging markets with growing industrial activities present untapped potential for market expansion, making this a promising sector for investment and development in the coming years.

Challenges: Regulatory uncertainty and the absence of standardized safety protocols slow deployment efforts

The autonomous hauler market faces challenges such as high upfront costs and complex integration with existing infrastructure, which can hinder adoption. Regulatory uncertainty and the absence of standardized safety protocols slow deployment efforts. Cybersecurity risks pose threats to vehicle control and data integrity. Additionally, the need for skilled operators and maintenance personnel limits scalability. Workforce resistance due to potential job losses and concerns about reliability in harsh environments also present obstacles. These challenges must be addressed to unlock the full potential of autonomous hauling technology.

Global Autonomous Hauler Market Ecosystem Analysis

The global autonomous hauler market ecosystem includes key players like OEMs (Volvo, Caterpillar), technology providers (Aurora, Plus), fleet operators, regulatory bodies, and infrastructure developers. Advanced sensors, AI, and connectivity form the technological backbone. Collaborations and pilot programs, such as Volvo and DHL’s driverless trucks, accelerate adoption. However, fragmented regulations pose challenges. This interconnected ecosystem drives innovation, enhances efficiency, and supports the growing demand for autonomous hauling solutions in mining, construction, and logistics industries worldwide.

Global Autonomous Hauler Market, By Type

The autonomous mining trucks segment holds the largest revenue share in the global autonomous hauler market, capturing approximately 50% of the total market during the forecast period. This dominance is driven by the mining industry's strong demand for automation to enhance safety, reduce labor costs, and boost operational efficiency in challenging environments. Autonomous mining trucks enable continuous, 24/7 operations, minimizing downtime and improving productivity. Their ability to operate in harsh terrains without human intervention makes them a preferred choice, leading to significant revenue contribution compared to other autonomous hauler types like construction or logistics trucks.

The autonomous road freight trucks segment accounted for a significant revenue share of the global autonomous hauler market during the forecast period, capturing approximately 30% of the market. This growth is driven by the rising demand for automation in logistics and long-haul transportation to improve efficiency, reduce driver shortages, and cut operational costs. Advances in AI and connectivity have enabled these trucks to navigate highways and optimize delivery routes, making them an increasingly vital component of the autonomous hauler ecosystem alongside mining trucks.

Global Autonomous Hauler Market, By Autonomy Level

The level 4 segment held the highest market share in the global autonomous hauler market during the forecast period, accounting for approximately 55% of the market. Level 4 autonomy allows vehicles to operate without human intervention within specific conditions or environments, making it ideal for industries like mining and logistics where controlled settings prevail. The advanced capabilities of Level 4 autonomous haulers such as enhanced safety features, reliable navigation, and operational efficiency drive their widespread adoption over lower autonomy levels.

The level 3 segment accounted for a substantial revenue share of the global autonomous hauler market during the forecast period. Level 3 autonomy enables vehicles to perform most driving tasks independently but still requires human intervention in certain situations. This segment gained traction due to its balance between automation and safety, allowing industries to gradually adopt autonomous technologies while maintaining control, contributing significantly to overall market growth alongside higher autonomy levels.

Asia Pacific is anticipated to hold the largest market share of the autonomous hauler market during the forecast period, accounting for approximately 40% of the global market, driven by rapid industrialization, expanding mining and construction activities, and significant investments in automation technologies across countries like China, Australia, and India. The region’s focus on improving operational efficiency and safety, coupled with supportive government initiatives, is fueling strong demand for autonomous haulers, making Asia Pacific a key growth hub in the global market.

China is anticipated to register the highest CAGR in the autonomous hauler market during the forecast period, with a market share expected to reach approximately 39.7% by 2025, driven by China’s vast mining and construction industries, strong government support through favorable policies and investments, and advancements in autonomous vehicle technologies by local tech companies. These factors position China as the dominant growth hub in the region, significantly contributing to the expansion of the autonomous hauler market in Asia Pacific.

North America is expected to grow at the fastest CAGR in the autonomous hauler market during the forecast period, with an estimated market share of around 30% by 2025, driven by advanced technological development, strong presence of key industry players, and substantial investments in autonomous vehicle research and infrastructure. Additionally, increasing adoption of autonomous haulers in mining and logistics sectors, along with supportive government initiatives and regulatory frameworks, contribute to North America’s rapid market expansion.

The United States is experiencing steady and significant growth in the autonomous hauler market, driven by factors such as substantial investments in autonomous driving technology, favorable regulatory frameworks, and advanced infrastructure. The U.S. Department of Transportation launched a $120 million initiative in 2024 to advance smart freight corridors for autonomous vehicles. Additionally, companies like Kodiak Robotics and Aurora are deploying autonomous freight technology to enhance safety and economic efficiency in regions like the Permian Basin.

WORLDWIDE TOP KEY PLAYERS IN THE AUTONOMOUS HAULER MARKET INCLUDE

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Volvo Group

- Daimler AG

- Inceptio Technology

- Waymo Via

- Aurora Innovation

- Torc Robotics

- Kodiak Robotics

- Others

Product Launches in Autonomous Hauler Market

- In April 2025, Cartken launched the "Cartken Hauler," an autonomous robot designed for seamless material handling across mixed indoor and outdoor environments. The Hauler features all-terrain mobility, high payload capacity, and rapid deployment, making it suitable for manufacturing facilities, warehouses, and distribution centers.

- In July 2024, Fortescue and Liebherr Mining announced a partnership to develop a fully integrated Autonomous Haulage Solution (AHS) aimed at operating zero-emission vehicles globally. The solution is being tested and validated at Fortescue's iron ore operations in Western Australia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the autonomous hauler market based on the below-mentioned segments:

Global Autonomous Hauler Market, By Type

- Autonomous Mining Trucks

- Autonomous Road Freight Trucks

Global Autonomous Hauler Market, By Autonomy Level

- Level 3

- Level 4

- Level 5

Global Autonomous Hauler Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What are the main drivers fueling growth in the Autonomous Hauler Market?

A: Growth is driven by the increasing need for automation in mining and construction, advancements in AI and sensor technologies, government initiatives supporting autonomous vehicle deployment, and demand for improved safety and operational efficiency.

Q: What challenges are limiting the adoption of autonomous haulers?

A: Challenges include high initial investment costs, technical complexities integrating autonomous systems, cybersecurity concerns, regulatory uncertainties, and workforce resistance.

Q: What are the emerging trends in the Autonomous Hauler Market?

A: Key trends include increased use of AI and sensor fusion for improved navigation, integration with digital fleet management and IoT platforms, government funding and pilot projects, and development of zero-emission autonomous haulage solutions.

Q: What opportunities exist for the Autonomous Hauler Market?

A: Opportunities arise from expanding government grants and regulatory support, demand for sustainable and electric autonomous haulers, and growing industrialization in emerging markets such as China and India.

Q: How is the Autonomous Hauler Market segmented by type?

A: The market is segmented into Autonomous Mining Trucks and Autonomous Road Freight Trucks.

Q: How is the market segmented by autonomy levels?

A: It is segmented into Level 3, Level 4, and Level 5 autonomy.

Q: Which country in Asia Pacific is expected to have the highest growth in the Autonomous Hauler Market?

A: China is expected to register the highest CAGR and dominate the Asia Pacific market due to its extensive mining industry and government support.

Q: Can you provide examples of recent product launches in the Autonomous Hauler Market?

A: In April 2025, Cartken launched the "Cartken Hauler," an autonomous robot for material handling. In July 2024, Fortescue and Liebherr Mining announced a partnership to develop a zero-emission Autonomous Haulage Solution.

Q: What government initiatives are supporting the Autonomous Hauler Market?

A: Programs like the U.S. Department of Transportation’s $120 million initiative for smart freight corridors and EU autonomous vehicle regulations support market growth.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |