Global Autonomous Mining Equipment Market

Global Autonomous Mining Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Autonomous Mining/Hauling Trucks, Autonomous Drilling Rigs, Underground LHD Loaders, Tunneling Equipment, Others), By Mining (Surface Mining, Underground Mining), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Autonomous Mining Equipment Market Summary

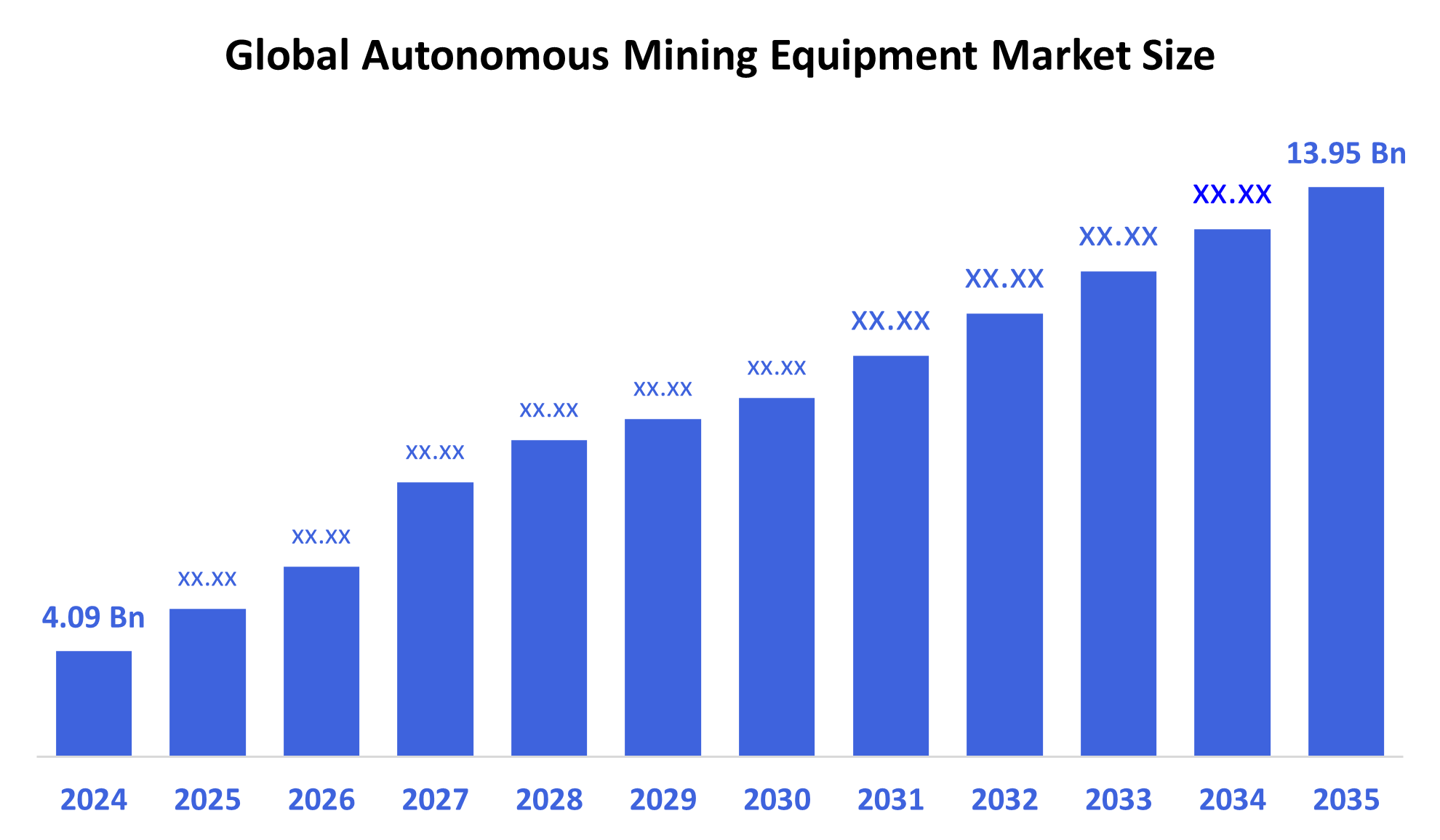

The Global Autonomous Mining Equipment Market Size Was Estimated at USD 4.09 Billion in 2024, and is Projected to Reach USD 13.95 Billion by 2035, Growing at a CAGR of 11.8% from 2025 to 2035. The market for autonomous mining equipment is expanding due to growing demands for increased safety, lower labor costs, enhanced operational efficiency, advances in robotics and artificial intelligence, and a greater adoption of automation in mining operations.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific market for autonomous mining equipment had the largest share, accounting for 38.4%.

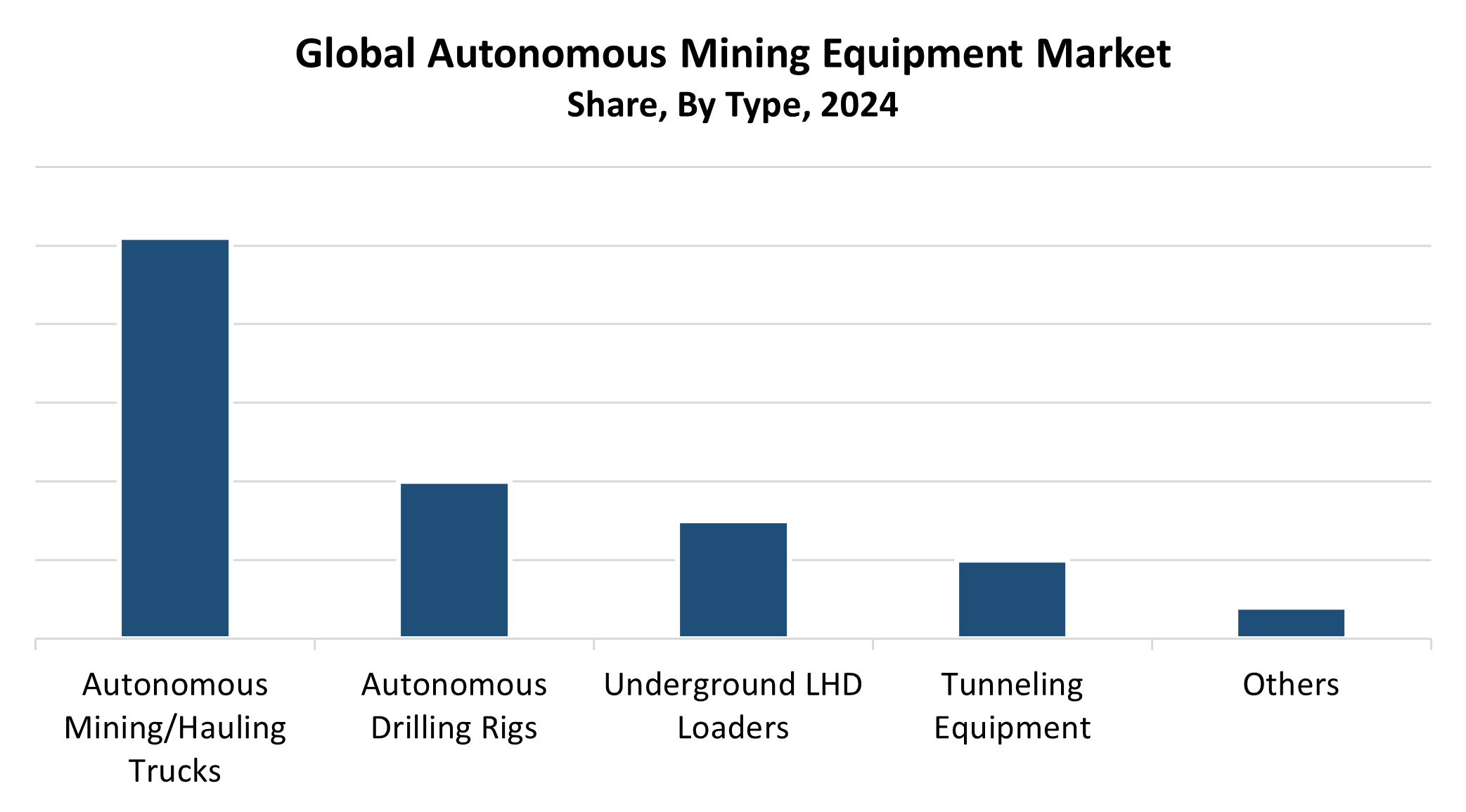

- In 2024, the autonomous mining hauling truck segment had the biggest share by type, accounting for 51.7%.

- Based on mining, the surface mining segment held the biggest market share in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.09 Billion

- 2035 Projected Market Size: USD 13.95 Billion

- CAGR (2025-2035): 11.8%

- Asia Pacific: Largest market in 2024

The autonomous mining equipment market represents an industry that develops mining machinery and vehicles that need minimal human engagement because of AI technology, along with robotic systems and GPS controls. These devices are intended to save labor expenses, increase safety, and improve operational efficiency in mining settings. The mining sector experiences a rapid growth in market size because organizations need to automate their operations as the world demands cost-cutting measures alongside enhanced productivity and improved working conditions. The depletion of easily accessible mineral deposits drives mining operations toward high-risk remote sites where automated machinery proves safer and more efficient than human labor.

The Autonomous Mining Equipment Market evolves significantly because of recent technological progress. Artificial intelligence, together with machine learning, Internet of Things, and real-time data analytics, enables predictive maintenance as well as route optimization and autonomous decision-making to improve mining operational efficiency. The adoption of autonomous mining equipment receives encouragement through government programs that focus on automation and safety in mining operations, especially in Australian, Canadian, and South African territories. Companies are investing in environmentally friendly autonomous machinery because of sustainability targets and environmental regulations. The market development happens through these technological advancements that affect both underground operations and surface mining activities.

Type Insights

The autonomous mining/hauling truck segment led the autonomous mining equipment market, accounting for the largest revenue share of 51.7% in 2024. Autonomous trucks dominate mining operations because of their widespread application in large-scale mining projects, especially in remote and high-risk environments. These trucks eliminate human error while improving operational efficiency as well as lowering labor needs, and enhancing safety measures. Major mining companies invest heavily in autonomous haulage fleets because these systems reduce fuel costs and maintenance fees, and unexpected downtime. Modern vehicles achieve precise navigation capabilities through their integration of advanced technology systems that include GPS, along with AI, LiDAR, and real-time monitoring. Their proven capability to boost productivity and minimize operating expenses has established them as a dominant force in the marketplace.

During the forecast period, the autonomous drilling rigs segment of the autonomous mining equipment market is expected to grow at the fastest CAGR. Mining operations, which require precise control, enhanced security, and improved productivity in dangerous environments, drive this market expansion. Autonomous drilling rigs decrease human participation in operations, which leads to higher production output and reduced operational dangers. The rigs operate through advanced technologies which include artificial intelligence (AI), machine learning, along real-time data analytics to enable automatic positioning and depth control alongside optimal drilling patterns. Autonomous drilling systems will experience explosive growth because mining companies focus on reducing costs and maximizing ore recovery, thus making this market segment the leading factor for future expansion.

Mining Insights

The surface mining segment held the largest revenue share and led the autonomous mining equipment market during 2024. The main factor behind this dominance stems from large-scale open-pit mining operations where autonomous haul trucks, along with bulldozers and drilling rigs, deliver superior operational efficiency across vast territories. The implementation of automation in surface mining operations results in better productivity rates and lower operating expenses, and enhances worker protection through decreased exposure to dangerous environments. The segment shows increased growth potential because autonomous devices are easier to deploy and manage in open areas compared to underground locations. Large mining corporations dedicate substantial funding to surface automation because they aim to enhance resource extraction, which establishes this market segment as a primary growth driver.

The underground mining segment of the autonomous mining equipment market is anticipated to grow at the fastest CAGR during the forecast period. The rising need for deep mineral extraction, combined with operational efficiency requirements in constrained and dangerous spaces, and increasing safety issues, drives this market expansion. Drilling rigs together with load-haul-dump (LHD) machines and robotic support systems operate autonomously to reduce the number of human operators working in dangerous underground settings. These devices utilize advanced technologies such as LiDAR systems alongside AI and real-time monitoring to operate effectively within tight spaces. Autonomous solutions will continue to gain popularity among mining businesses because they focus on reducing worker risks and enhancing production efficiency in underground mines, which will lead to market expansion.

Regional Insights

North America held a 25.4% revenue share in the global autonomous mining equipment market during 2024 because of its vast mining activities and early adoption of modern technology. The United States, along with Canada, serves as a top contributor because major mining companies have invested heavily in automation technology to boost worker safety while reducing operating expenses and increasing production capabilities. The area achieves benefits through skilled human resources and strong technological systems, as well as favorable laws that promote mining automation development. Mineral extraction companies now need to implement autonomous machines because copper, lithium, and iron ore demand grows to meet electric vehicle and renewable energy market requirements. The different components combine to establish North America's strong presence in the global market.

Europe Autonomous Mining Equipment Market Trends

Europe held a significant revenue share of the autonomous mining equipment market because of its rising mining automation costs, strict environmental standards, and its increased focus on protecting workers. Germany, Sweden, and Finland rank as top leaders in mining technology implementation because they possess established industrial systems combined with innovative economic structures. European mining businesses are deploying autonomous equipment to boost performance levels while minimizing environmental impact and protecting personnel from hazardous work locations. The region advances sustainable mining practices by encouraging the use of AI-powered autonomous machinery, which operates with energy efficiency. The global market position of Europe in autonomous mining equipment stems from mining company-technology supplier partnerships and governmental support for digital mining industry transformation.

Asia Pacific Autonomous Mining Equipment Market Trends

The Asia Pacific region held the leading position in the autonomous mining equipment market worldwide by holding the largest revenue share of 38.4% in 2024. The main factors driving this market leadership include large-scale mining operations in China, Australia, India, and increasing automation investments in digital mining technology. The region is witnessing a substantial surge in robotic mining systems along with autonomous haul trucks and drilling rigs because these technologies enhance productivity and safety while reducing operational costs. Australia stands as a worldwide mining automation leader because major companies now operate autonomous fleets across their coal and iron ore mining operations. The Asia Pacific autonomous mining equipment sector expands steadily as government mining technology support combines with rising mineral and metal requirements in the region.

Key Autonomous Mining Equipment Companies:

The following are the leading companies in the autonomous mining equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- XCMG Group

- Sandvik AB

- Komatsu Ltd.

- AB Volvo

- Epiroc AB

- BELAZ-HOLDING

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Sany Group

- Others

Recent Developments

- In April 2025, in Western Australia, Epiroc earned its biggest-ever contract to supply Pit Viper 271 E and SmartROC D65 BE, two completely battery-electric and autonomous surface drill rigs, to Fortescue Metals Group. By operating these rigs remotely from Perth, an estimated 35 million gallons of diesel will be saved yearly. The deal has a five-year duration and is worth about AUD 350 million.

- In November 2023, with SSAB, Sandvik signed a Letter of Intent (LoI) to purchase steel that is free of fossil fuels for its line of autonomous mining equipment, which includes trucks and loaders. This program is in line with Sandvik's objective to create sustainable and emission-free mining solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the autonomous mining equipment market based on the below-mentioned segments:

Global Autonomous Mining Equipment Market, By Type

- Autonomous Mining/Hauling Trucks

- Autonomous Drilling Rigs

- Underground LHD Loaders

- Tunneling Equipment

- Others

Global Autonomous Mining Equipment Market, By Mining

- Surface Mining

- Underground Mining

Global Autonomous Mining Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |