Global B-Cell Non-Hodgkin Lymphoma Market

Global B-Cell Non-Hodgkin Lymphoma Market Size, Share, and COVID-19 Impact Analysis, By Treatment Type (Chemotherapy, Immunotherapy, Targeted Therapy, Radiation Therapy, and Stem Cell Transplantation), By Drug Class (Monoclonal Antibodies, Chemotherapeutic Agents, and Tyrosine Kinase Inhibitors), By Administration Route (Intravenous (IV), Subcutaneous, and Oral), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

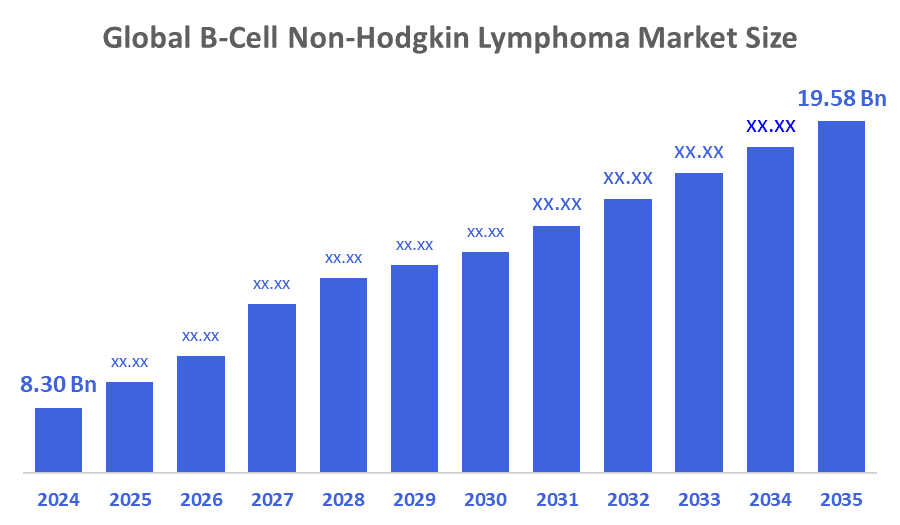

Global B-Cell Non-Hodgkin Lymphoma Market Size Insights Forecasts to 2035

- The Global B-Cell Non-Hodgkin Lymphoma Market Size Was Estimated at USD 8.30 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.11 % from 2025 to 2035

- The Worldwide B-Cell Non-Hodgkin Lymphoma Market Size is Expected to Reach USD 19.58 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global B-Cell Non-Hodgkin Lymphoma Market Size was worth around USD 8.30 Billion in 2024 and is predicted to Grow to around USD 19.58 Billion by 2035 with a compound annual growth rate (CAGR) of 8.11 % from 2025 to 2035. The growing incidence rates of B-cell non-Hodgkin's lymphoma (NHL), which have been steadily increasing over the past few decades, are the primary driver of the B-cell NHL therapy industry. The industry growth is fueled by an ageing global population, as older individuals are more likely to contract the illness. Innovative medicines like monoclonal antibodies, immunotherapies, and CAR-T cell treatments have been made possible by advances in research and development. These treatments have shown significant efficacy and improved patient survival outcomes.

Market Overview

The global industry related to the identification, treatment, and management of B-cell subtypes of non-Hodgkin lymphoma, including licensed medications, future medicines, epidemiological data, and local development trends, is referred to as the B-Cell non-Hodgkin lymphoma (B-NHL) market. B-cell non-Hodgkin lymphoma (NHL) is a kind of cancer that starts in B cells, a subset of white blood cells that help the immune system fight off pathogens. Depending on the particular subtype, stage of the illness, and organs or tissues impacted, the symptoms may differ. Common symptoms include night sweats, fever, itching, chronic exhaustion, unexplained weight loss, and painless enlargement of lymph nodes in the neck, groin, or armpits. Abdominal discomfort or swelling, chest pain, breathing difficulties, bone pain, etc., are some other potential symptoms. Moreover, there is an emphasis on treatments including chemotherapy, targeted therapy, immunotherapy, and new biologics, which include patients, research organisations, pharmaceutical corporations, and healthcare professionals.

In June 2024, A new $20 million research funding program was launched to accelerate the development of cures for follicular lymphoma, the most common slow-growing non-Hodgkin’s lymphoma. The initiative is a joint effort between the Leukaemia & Lymphoma Society (LLS) and the Institute for Follicular Lymphoma Innovation (IFLI).

Report Coverage

This research report categorises the B-cell non-Hodgkin lymphoma market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the B-cell non-Hodgkin lymphoma market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the B-cell non-Hodgkin lymphoma market.

Driving Factors

The market for B-cell non-Hodgkin lymphoma is driven by the rising incidence of translocations, deletions, and mutations in particular genes that can interfere with the normal functioning of B cells. A favourable prognosis for the industry is also being created by the increasing prevalence of several related risk factors, such as exposure to ionising radiation, viral infections, rheumatoid arthritis, Sjögren's disease, and other autoimmune illnesses. Additionally, the market is expanding due to the growing use of targeted medicines, such as ibrutinib and idelalisib, which disrupt cellular processes or signalling pathways necessary for cancer cell survival, resulting in tumour regression. In addition, the growing use of CAR-T (chimeric antigen receptor T-cell) treatment,

In June 2025, Roche’s pivotal Phase III SUNMO trial showed that the combination of Lunsumio (mosunetuzumab) and Polivy (polatuzumab vedotin) significantly prolongs remission in patients with relapsed or refractory large B-cell lymphoma, tripling median progression-free survival compared to standard chemotherapy.

Restraining Factors

The high cost of B-cell non-Hodgkin lymphoma treatments, insufficient financial aid, and rigid payment alternatives, patients are frequently unable to obtain cutting-edge therapies, which impedes market expansion and accessibility. Furthermore, a lack of qualified medical personnel with training in cancer treatment methods restricts the use of cutting-edge technologies, lowers the quality of care, and hinders accurate diagnosis.

Market Segmentation

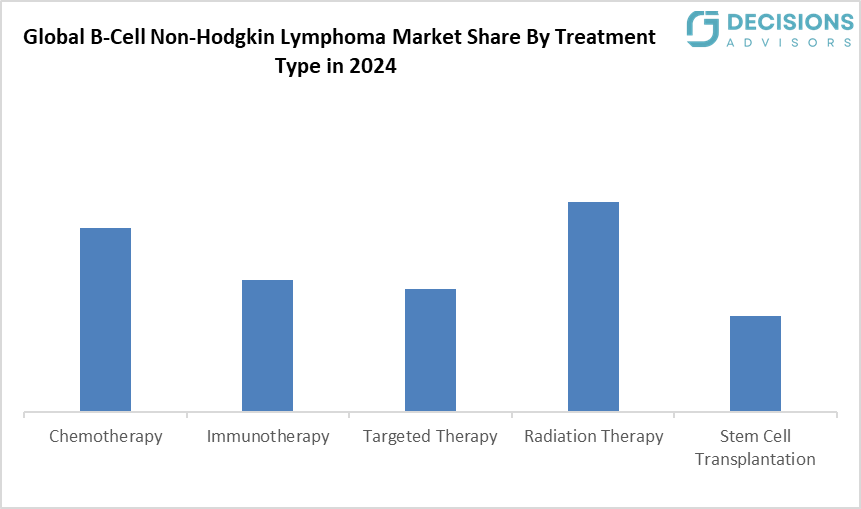

The B-cell non-Hodgkin lymphoma market share is classified into treatment type, drug class, and administration route.

- The radiation therapy segment accounted for the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the treatment type, the B-cell non-Hodgkin lymphoma market is divided into chemotherapy, immunotherapy, targeted therapy, radiation therapy, and stem cell transplantation. Among these, the radiation therapy segment accounted for the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Radiation therapy is a crucial therapeutic strategy for B-cell non-Hodgkin lymphoma because of its success in treating localised illness and its ability to be integrated with other modalities. Further, its widely available equipment and well-established role in treatments.

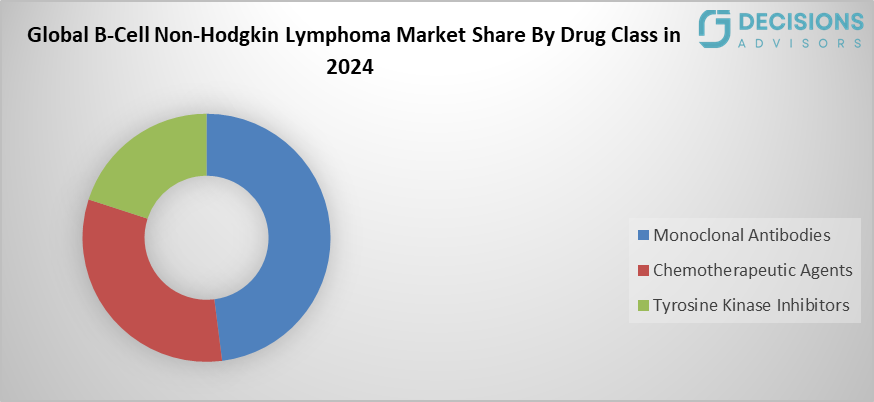

- The monoclonal antibodies segment dominated the market in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the drug class, the B-cell non-Hodgkin lymphoma market is differentiated into monoclonal antibodies, chemotherapeutic agents, and tyrosine kinase inhibitors. Among these, the monoclonal antibodies segment dominated the market in 2024 and is projected to grow at a substantial CAGR over the forecast period. This is Due to the extensive usage of drugs that target CD20 on B-cells, such as rituximab and obinutuzumab, monoclonal antibodies currently account for the greatest portion of the B-cell non-Hodgkin lymphoma medication market. Moreover, their effectiveness and comparatively acceptable safety profiles when compared to more recent tyrosine kinase inhibitors and conventional chemotherapeutic drugs, these medicines fundamental to treatment procedures.

- The intravenous (IV) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the administration route, the B-cell non-Hodgkin lymphoma market is segmented into intravenous (IV), subcutaneous, and oral. Among these, the intravenous (IV) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The widespread use of intravenous (IV) delivery for monoclonal antibodies and other targeted medicines, which necessitate direct bloodstream infusion. Further, its maximum efficacy and dispersion throughout the body are the reasons for this dominance.

Regional Segment Analysis of the B-Cell Non-Hodgkin Lymphoma Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the B-cell non-Hodgkin lymphoma market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the B-cell non-Hodgkin lymphoma market over the predicted timeframe. NHL incidence is rising as a result of changes in lifestyle and demographics. Increased healthcare spending and better infrastructure for oncology. With improvements in regulations and quicker approvals for novel treatments, such as bispecific antibodies and CAR-T. Measures by the government to support lymphoma treatment reimbursement and early diagnosis. The main nations influencing the APAC B-cell non-Hodgkin lymphoma market are China, Japan, India, South Korea, and Australia; China leads the market in terms of both size and growth. Moreover, the growing health consciousness is responsible for the expansion of the B-cell non-Hodgkin lymphoma market in Japan. The demand for wellness goods and services is rising as the nation's population becomes more health-conscious.

North America is expected to grow at a rapid CAGR in the B-cell non-Hodgkin lymphoma market during the forecast period. The U.S. leads the world in both market size and therapeutic innovation, and it has the largest patient pool for B-cell NHL. The rising disease incidence, greater awareness, and advantageous reimbursement policies are driving market expansion. The creation of focused treatments, an increase in available treatments, and significant funding for cancer research are some of the main motivators. Besides, the market growth is anticipated as a result of continuous improvements in diagnostic and therapeutic approaches.

The U.S. FDA has approved Pfizer’s ADCETRIS® (brentuximab vedotin) combination regimen for adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL), based on strong Phase III trial results.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the B-cell non-Hodgkin lymphoma market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbvie

- Astrazeneca

- Bayer AG

- Bristol Myers Squibb Company

- Genentech Inc.

- Janssen Pharma

- Kite Pharma

- Kyowa Kirin Co.,

- Merck & co.

- Novartis

- Sanofi

- Spectrum Pharma

- Takeda Pharma

- Teva Pharma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, the European Commission officially approved Incyte’s Minjuvi® (tafasitamab), in combination with lenalidomide and rituximab, for adult patients with relapsed or refractory follicular lymphoma (FL, Grade 1–3a) after at least one prior systemic therapy. This marks a major milestone, introducing a first-of-its-kind, chemotherapy-free option in Europe.

- In June 2025, Johnson & Johnson released the first clinical data for JNJ-90014496 (JNJ-4496), an investigational dual-targeting anti-CD19/CD20 bispecific autologous chimeric antigen receptor (CAR) T-cell therapy. The study is being conducted in patients with relapsed or refractory large B-cell lymphoma (R/R LBCL) who have never received CAR T-cell therapy.

- In February 2025, Breyanzi (lisocabtagene maraleucel), a CD19-directed CAR?T therapy developed by Bristol Myers Squibb, has shown improved responses in relapsed/refractory (R/R) indolent B?cell NHL, including marginal zone lymphoma and follicular lymphoma. Results from the TRANSCEND FL trial demonstrated durable efficacy and manageable safety, which led to the FDA approval of Breyanzi.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors and Consulting has segmented the B-cell non-Hodgkin lymphoma market based on the below-mentioned segments:

Global B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type

- Chemotherapy

- Immunotherapy

- Targeted Therapy

- Radiation Therapy

- Stem Cell Transplantation

Global B-Cell Non-Hodgkin Lymphoma Market, By Drug Class

- Monoclonal Antibodies

- Chemotherapeutic Agents

- Tyrosine Kinase Inhibitors

Global B-Cell Non-Hodgkin Lymphoma Market, By Administration Route

- Intravenous (IV)

- Subcutaneous

- Oral

Global B-Cell Non-Hodgkin Lymphoma Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected market size and growth rate for the Global B-Cell Non-Hodgkin Lymphoma Market?

The market was valued at USD 8.30 billion in 2024 and is expected to reach USD 19.58 billion by 2035, growing at a CAGR of 8.11% from 2025 to 2035.

- What are the main drivers of market growth?

Rising incidence of B-cell NHL due to genetic mutations, an ageing population, and risk factors like radiation exposure and autoimmune diseases fuel growth. Advances in targeted therapies (e.g., ibrutinib, idelalisib), immunotherapies, and CAR-T treatments also boost the market.

- Which regions dominate or grow fastest in this market?

Asia-Pacific holds the largest share, driven by rising NHL incidence, improved oncology infrastructure, and government support in countries like China, Japan, and India. North America grows at the fastest CAGR, led by the U.S., with high patient pools, innovation, and reimbursement policies.

- Who are the major companies in the B-Cell Non-Hodgkin Lymphoma Market?

Key players include AbbVie, AstraZeneca, Bayer AG, Bristol Myers Squibb, Genentech, Janssen Pharma, Kite Pharma, Kyowa Kirin, Merck & Co., Novartis, Sanofi, Spectrum Pharma, Takeda, Teva Pharma, and others.

- What challenges restrain market expansion?

High treatment costs, limited financial aid, rigid reimbursement, and shortages of trained oncology personnel hinder access to advanced therapies and quality care.

- What is B-Cell Non-Hodgkin Lymphoma?

It's a cancer starting in B-cells (white blood cells key to immunity), with symptoms like swollen lymph nodes, fever, night sweats, weight loss, fatigue, and organ-specific pain. Treatments focus on chemotherapy, targeted therapy, immunotherapy, and biologics.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Treatment Type

- Market Attractiveness Analysis By Drug Class

- Market Attractiveness Analysis By Administration Route

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rising rates of B-cell non-Hodgkin's lymphoma (NHL), treatment, and management

- Restraints

- High cost and a lack of financial aid

- Opportunities

- Growing global population of seniors, and cutting-edge medicines

- Challenges

- Strict payment options and regulatory hurdles

- Global B-Cell Non-Hodgkin Lymphoma Market Analysis and Projection, By Treatment Type

- Segment Overview

- Chemotherapy

- Immunotherapy

- Targeted Therapy

- Radiation Therapy

- Stem Cell Transplantation

- Global B-Cell Non-Hodgkin Lymphoma Market Analysis and Projection, By Drug Class

- Segment Overview

- Monoclonal Antibodies

- Chemotherapeutic Agents

- Tyrosine Kinase Inhibitors

- Global B-Cell Non-Hodgkin Lymphoma Market Analysis and Projection, By Administration Route

- Segment Overview

- Intravenous (IV)

- Subcutaneous

- Oral

- Global B-Cell Non-Hodgkin Lymphoma Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global B-Cell Non-Hodgkin Lymphoma Market-Competitive Landscape

- Overview

- Market Share of Key Players in the B-Cell Non-Hodgkin Lymphoma Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- AbbVie

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- AstraZeneca

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bayer AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bristol Myers Squibb Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Genentech Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Janssen Pharma

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Kite Pharma

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Kyowa Kirin Co

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Merck & Co.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Novartis

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sanofi

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Spectrum Pharma

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Takeda Pharma

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Teva Pharma

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- AbbVie

List of Table

- Global B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Global Chemotherapy, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global Immunotherapy, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global Targeted Therapy, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global Radiation Therapy, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global Stem Cell Transplantation, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Global Monoclonal Antibodies, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global Chemotherapeutic Agents, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global Tyrosine Kinase Inhibitors, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Global Intravenous (IV), B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global Subcutaneous, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- Global Oral, B-Cell Non-Hodgkin Lymphoma Market, By Region, 2024-2035(USD Billion)

- North America B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- North America B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- North America B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- U.S. B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- U.S. B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- U.S. B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Canada B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Canada B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Canada B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Mexico B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Mexico B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Mexico B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Europe B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Europe B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Europe B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Germany B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Germany B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Germany B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- France B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- France B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- France B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- U.K. B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- U.K. B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- U.K. B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Italy B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Italy B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Italy B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Spain B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Spain B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Spain B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Asia Pacific B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Asia Pacific B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Asia Pacific B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Japan B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Japan B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Japan B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- China B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- China B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- China B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- India B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- India B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- India B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- South America B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- South America B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- South America B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- Brazil B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- Brazil B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- Brazil B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- The Middle East and Africa B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- The Middle East and Africa B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- The Middle East and Africa B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- UAE B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- UAE B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- UAE B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

- South Africa B-Cell Non-Hodgkin Lymphoma Market, By Treatment Type, 2024-2035(USD Billion)

- South Africa B-Cell Non-Hodgkin Lymphoma Market, By Drug Class, 2024-2035(USD Billion)

- South Africa B-Cell Non-Hodgkin Lymphoma Market, By Administration Route, 2024-2035(USD Billion)

List of Figures

- Global B-Cell Non-Hodgkin Lymphoma Market Segmentation

- B-Cell Non-Hodgkin Lymphoma Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the B-Cell Non-Hodgkin Lymphoma Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: B-Cell Non-Hodgkin Lymphoma Market

- B-Cell Non-Hodgkin Lymphoma Market Segmentation, By Treatment Type

- B-Cell Non-Hodgkin Lymphoma Market For Chemotherapy, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market For Immunotherapy, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market For Targeted Therapy, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market For Radiation Therapy, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market For Stem Cell Transplantation, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market Segmentation, By Drug Class

- B-Cell Non-Hodgkin Lymphoma Market For Monoclonal Antibodies, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market For Chemotherapeutic Agents, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market For Tyrosine Kinase Inhibitors, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market Segmentation, By Administration Route

- B-Cell Non-Hodgkin Lymphoma Market For Intravenous (IV), By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market For Subcutaneous, By Region, 2024-2035 ($ Billion)

- B-Cell Non-Hodgkin Lymphoma Market For Oral, By Region, 2024-2035 ($ Billion)

- AbbVie: Net Sales, 2024-2035 ($ Billion)

- AbbVie: Revenue Share, By Segment, 2024 (%)

- AbbVie: Revenue Share, By Region, 2024 (%)

- AstraZeneca: Net Sales, 2024-2035 ($ Billion)

- AstraZeneca: Revenue Share, By Segment, 2024 (%)

- AstraZeneca: Revenue Share, By Region, 2024 (%)

- Bayer AG: Net Sales, 2024-2035 ($ Billion)

- Bayer AG: Revenue Share, By Segment, 2024 (%)

- Bayer AG: Revenue Share, By Region, 2024 (%)

- Bristol Myers Squibb Company: Net Sales, 2024-2035 ($ Billion)

- Bristol Myers Squibb Company: Revenue Share, By Segment, 2024 (%)

- Bristol Myers Squibb Company: Revenue Share, By Region, 2024 (%)

- Genentech Inc: Net Sales, 2024-2035 ($ Billion)

- Genentech Inc: Revenue Share, By Segment, 2024 (%)

- Genentech Inc: Revenue Share, By Region, 2024 (%)

- Janssen Pharma: Net Sales, 2024-2035 ($ Billion)

- Janssen Pharma: Revenue Share, By Segment, 2024 (%)

- Janssen Pharma: Revenue Share, By Region, 2024 (%)

- Kite Pharma: Net Sales, 2024-2035 ($ Billion)

- Kite Pharma: Revenue Share, By Segment, 2024 (%)

- Kite Pharma: Revenue Share, By Region, 2024 (%)

- Kyowa Kirin Co: Net Sales, 2024-2035 ($ Billion)

- Kyowa Kirin Co: Revenue Share, By Segment, 2024 (%)

- Kyowa Kirin Co: Revenue Share, By Region, 2024 (%)

- Merck & Co..: Net Sales, 2024-2035 ($ Billion)

- Merck & Co..: Revenue Share, By Segment, 2024 (%)

- Merck & Co..: Revenue Share, By Region, 2024 (%)

- Novartis: Net Sales, 2024-2035 ($ Billion)

- Novartis: Revenue Share, By Segment, 2024 (%)

- Novartis: Revenue Share, By Region, 2024 (%)

- Sanofi: Net Sales, 2024-2035 ($ Billion)

- Sanofi: Revenue Share, By Segment, 2024 (%)

- Sanofi: Revenue Share, By Region, 2024 (%)

- Spectrum Pharma: Net Sales, 2024-2035 ($ Billion)

- Spectrum Pharma: Revenue Share, By Segment, 2024 (%)

- Spectrum Pharma: Revenue Share, By Region, 2024 (%)

- Takeda Pharma: Net Sales, 2024-2035 ($ Billion)

- Takeda Pharma: Revenue Share, By Segment, 2024 (%)

- Takeda Pharma: Revenue Share, By Region, 2024 (%)

- Teva Pharma: Net Sales, 2024-2035 ($ Billion)

- Teva Pharma: Revenue Share, By Segment, 2024 (%)

- Teva Pharma: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 269 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |