Global Baby Powder Market

Global Baby Powder Market Size, Share, and COVID-19 Impact Analysis, By Product (Talc-based, Talc-free), By Distribution Channel (Online, Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Baby Powder Market Summary

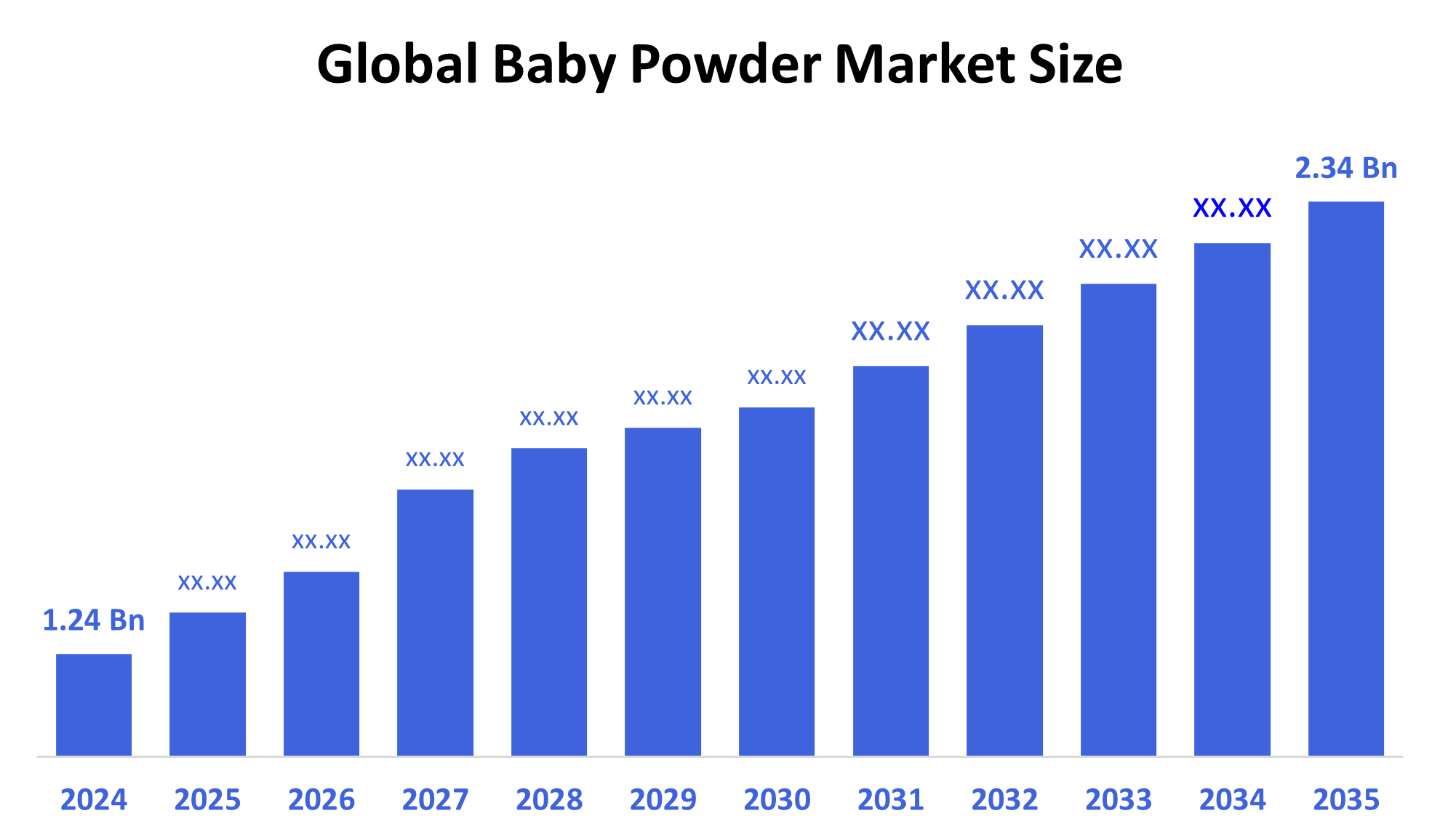

The Global Baby Powder Market Size Was Estimated at USD 1.24 Billion in 2024 and is Projected to Reach USD 2.34 Billion by 2035, Growing at a CAGR of 5.94% from 2025 to 2035. Growing demand for safe, gentle, and effective skincare products, growing disposable incomes, and growing awareness of infant hygiene are all factors driving the baby powder market's expansion.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific baby powder market held the largest revenue share of 34.6% and dominated the global market.

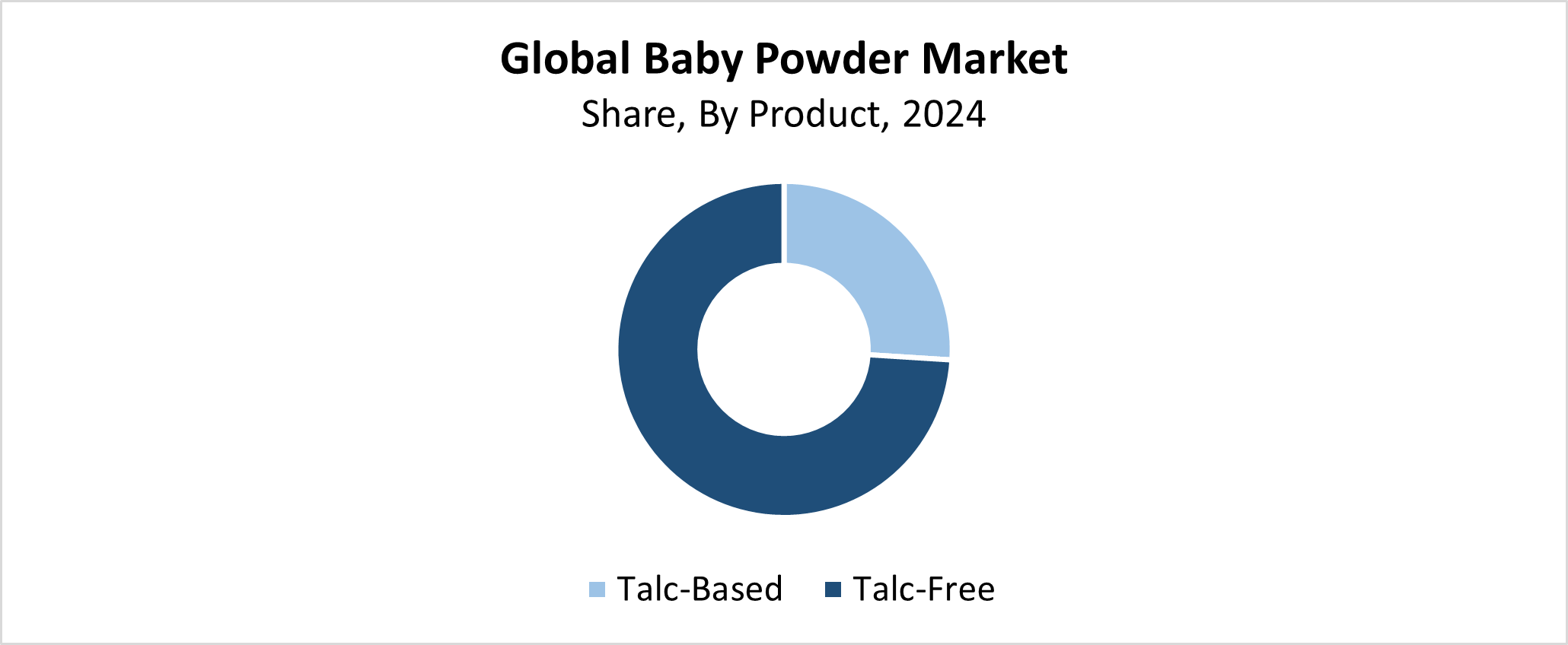

- In 2024, the talc-free segment held the highest revenue share of 74.2% and dominated the global market by product.

- With the biggest revenue share of 82.5% in 2024, the offline segment led the worldwide baby powder market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.24 Billion

- 2035 Projected Market Size: USD 2.34 Billion

- CAGR (2025-2035): 5.94%

- Asia Pacific: Largest market in 2024

The baby powder market functions as an industry that creates and sells baby skincare powders for moisture absorption, alongside friction reduction and rash prevention. The main drivers of this industry include expanding awareness about infant care, together with rising household earnings and population growth worldwide. The demand for gentle and chemical-free products has risen because parents now understand the significance of proper baby skin care. Market expansion is fueled by growing working parent populations who purchase more products, as well as wide distribution channels and digital marketing approaches.

The baby powder industry has experienced notable expansion because of technological progress. The adoption of hypoallergenic formulations together with natural ingredients such as cornstarch and talc-free powders has attracted customers who are concerned about their health. The market has expanded because of new product alternatives, which include fragrance-free and dermatologist-tested options. Consumer trust has risen because government initiatives that focus on product safety have introduced stricter quality control measures and labeling requirements. Market dynamics receive influenced by educational programs that focus on environmentally friendly packaging together with proper baby care methods.

Product Insights

The talc-free segment held the largest revenue share of 74.2% during 2024 and led the worldwide baby powder market. The expansion of this market segment results from growing customer apprehension about talc-based powders since they might cause respiratory problems and contamination risks. The rise in popularity of talc-free baby powders exists because parents seek safe and gentle skincare products containing natural ingredients like cornstarch. The market experiences increased demand from consumers seeking organic and hypoallergenic products alongside their growing understanding of product safety. Manufacturers focus on developing new talc-free product lines to meet changing consumer demands, which leads this market segment to become the baby powder industry's leading revenue source.

The talc-based segment of the baby powder market will experience significant growth during the forecast period despite increasing consumer interest in talc-free options. The long-term customer belief in talc's effectiveness continues to drive growth because of its superior moisture absorption and friction reduction capabilities. Talc-based products maintain strong market demand because people trust their proven reliability and quality in regions where they have been used historically. The safety of talc-based powders receives attention from manufacturers who focus on creating high-purity formulations combined with advanced quality management systems. The talc-based segment will remain present in the market if regulatory bodies continue to enhance safety standards, particularly for markets that have limited knowledge about alternative options.

Distribution Channel Insights

The offline segment led the global baby powder market with the largest revenue share of 82.5% in 2024. Baby powder products maintain their strong presence in traditional retail stores such as supermarkets, pharmacies, and convenience stores because a large number of customers choose these outlets for their shopping needs, which drives their market dominance. Parents who buy baby care products prefer offline channels because they get instant purchases along with personalized assistance and the ability to examine products firsthand. The long-term offline sales performance depends on strong distribution systems and well-known brands that exist in physical retail locations. The offline retail segment maintains a substantial market share despite e-commerce expansion because it serves customers who need baby care products, in-store shopping, and those living in areas with limited internet access.

The online segment of the baby powder market will experience a significant CAGR during the forecast period because more people choose internet shopping. Parents select online shopping platforms to purchase products since they can buy from home with access to various baby powder brands and product types. Online stores, including Amazon and Walmart, together with specialty baby care websites, attract rising numbers of customers through their competitive pricing and delivery services, and user feedback. Mobile shopping growth, combined with targeted web marketing, has made baby powder products more accessible for consumers to purchase. Rising digital adoption rates across emerging markets worldwide create opportunities for fast online segment growth, which works alongside existing offline retail channels.

Regional Insights

In 2024, the Asia Pacific region dominated the global baby powder market by generating the largest revenue share of 34.6%. The expanding population base, together with rising consumer earnings and increasing baby hygiene understanding, drives this market expansion. The baby powder market in the Asia Pacific receives strong contributions from China and India together with Japan because working parents need simple baby care solutions. The demand for baby powders remains high because people continue to use them traditionally while maintaining strong cultural connections to these items. Physical and online retailers in the area benefit from the rising retail infrastructure alongside local and international brand availability, thus driving market growth. The region experiences growth because people show increasing preference for premium baby powders, which contain no chemicals and maintain safety standards.

North America Baby Powder Market Trends

The North American baby powder market is growing significantly because of high demand for products that are safe and effective, and dermatologist-tested. Regional growth stems from customers becoming more aware of proper baby skin care practices. Organic and talc-free powder alternatives experience increased market demand despite health issues, which have reduced talc-based powder usage. The market growth benefits from the presence of top baby care brands, together with the convenience of shopping both online and at physical retail locations. The advanced healthcare system in North America, together with strict regulations, ensures products meet high safety standards, which builds consumer trust. Natural products and environmentally friendly alternatives continue to shape the direction of the market.

Europe Baby Powder Market Trends

The European baby powder market is expected to grow at a significant rate because consumers want products that are safe for babies and environmentally friendly, and hypoallergenic. Parents now show increased health awareness, which drives them to select talc-free and natural substitutes for their purchases. Consumers feel more confident about purchasing products because of Europe's strict regulations, which mandate testing for all items sold. The market continues to grow because more parents join the workforce, while they need baby care products that are simple to use. E-commerce growth plays a key role in market expansion since it allows parents to discover multiple baby powder brands. The European market's demand for chemical-free and eco-friendly baby products aligns with the ongoing sustainability movement that emphasizes organic ingredients and biodegradable packaging.

Key Baby Powder Companies:

The following are the leading companies in the baby powder market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- Church & Dwight

- KimberlyClark

- Pigeon Corp.

- Baby Forest

- Beiersdorf

- California Baby

- Prestige Consumer Healthcare

- Aquaphor

- Himalaya Wellness

- Others

Recent Developments

- In November 2024, in the UK, Fresh & Dry Baby Powder was introduced as a talc substitute in response to worries about the possible asbestos contamination and cancer hazards associated with talc. It is made from natural maize powder, which is free of hazardous substances, more absorbent, and non-allergenic. A safer choice for families, the product is certified as vegan, cruelty-free, and ethically made.

- In October 2024, to administer the Mothercare brand in Bangladesh, Bhutan, Sri Lanka, Nepal, and India, Mothercare partnered with Reliance Brands Holding UK. 51% of the company is owned by Reliance Brands, and 49% is owned by Mothercare. This collaboration promotes financial expansion and lower leverage while bolstering Mothercare's footprint in South Asia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the baby powder market based on the below-mentioned segments:

Global Baby Powder Market, By Product

- Talc-Based

- Talc-Free

Global Baby Powder Market, By Distribution Channel

- Online

- Offline

Global Baby Powder Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |