Global Baby Toiletries Market

Global Baby Toiletries Market Size, Share, and COVID-19 Impact Analysis, By Product (Skin Care Products, Diapers, Hair Care Products, Wipes, Bathing Products, Others), By Distribution Channel (Hypermarkets, Chemist And Pharmacy Stores, E-commerce, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Baby Toiletries Market Summary

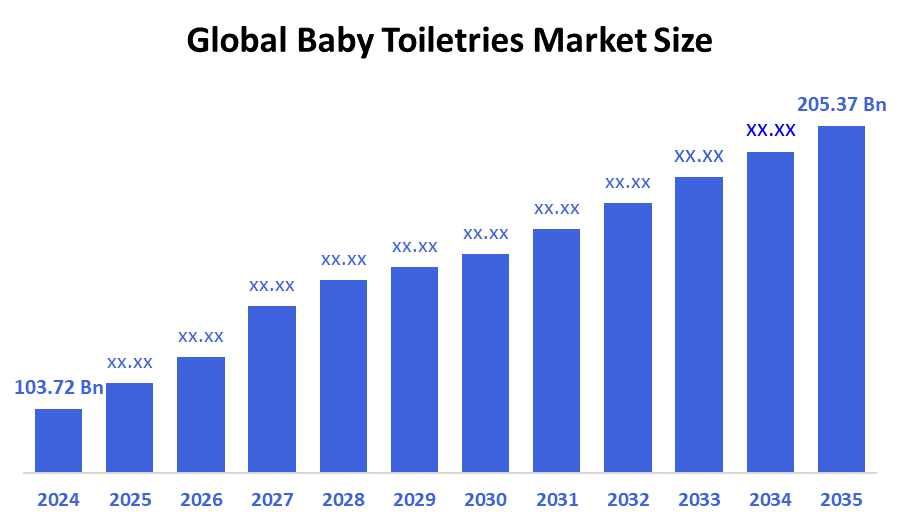

The Global Baby Toiletries Market Size Was Estimated at USD 103.72 Billion in 2024 and is Projected to Reach USD 205.37 Billion by 2035, Growing at a CAGR of 6.41% from 2025 to 2035. The market for baby toiletries is expanding as a result of factors such as rising birth rates, better living standards, more parental hygiene awareness, urbanization, the growing demand for organic products, aggressive brand marketing, growing e-commerce, and increased expenditure on necessities for baby care.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 33.7% and dominated the market globally.

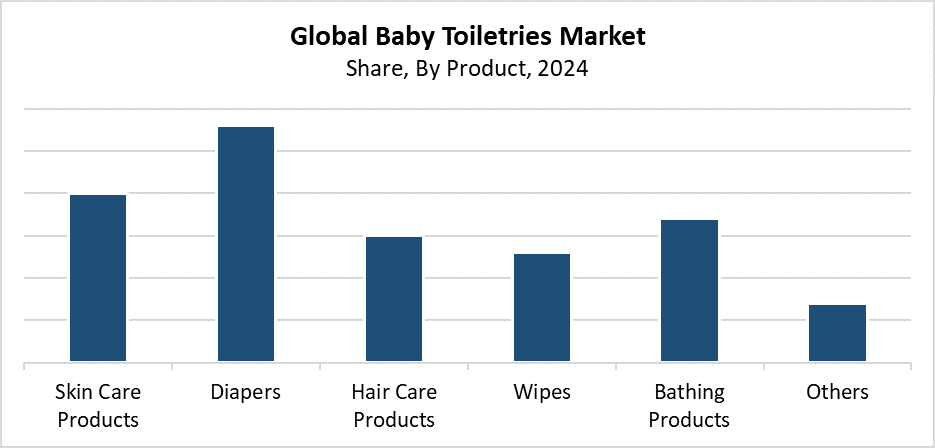

- In 2024, the diapers segment had the highest market share and dominated the market by product, accounting for 28.4%.

- In 2024, the hypermarkets segment had the biggest market share and dominated the market by distribution channel, accounting for 38.5%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 103.72 Billion

- 2035 Projected Market Size: USD 205.37 Billion

- CAGR (2025-2035): 6.41%

- North America: Largest market in 2024

The market for baby toiletries consists of various products that are designed specifically for babies and toddlers, including diapers, wipes, lotions, powders, soaps, and shampoos. These products are hypoallergenic, mild, and appropriate for sensitive infant skin. The primary drivers of market growth include rising birth numbers in developing countries, along with better baby care knowledge and increasing disposable income among parents. Modern parenting preferences for top-quality organic baby products have pushed up the demand for chemical-free and natural products. The combination of urban growth, social media platforms, and parenting blogs has made consumers better informed, which has driven market expansion.

The market for baby toiletries has experienced substantial changes because of new technological advancements in product formulas and packaging systems. People who care about the environment show interest in new products such as tear-free formulas along with eco-friendly diapers and wipes made from biodegradable materials. The use of advanced packaging systems, which enhance safety features, now attracts more attention from consumers. Government programs focused on mother and child health promotion, especially in developing areas, push people to choose high-grade infant care products. The market growth results from healthcare infrastructure development combined with hygiene education campaigns and subsidies for essential baby products, which together make these items more affordable and accessible.

Product Insights

The diapers segment dominated the baby toiletry market in 2024, holding the largest share of 28.4%. The growing number of births worldwide, combined with increased awareness about baby hygiene and a rising need for user-friendly disposable diaper solutions, drives this market expansion. The demand for premium skin-friendly, highly absorbent diapers continues to increase as parents seek products that offer both comfort and rash-prevention. People who prioritize environmental sustainability have become interested in purchasing diapers made from biodegradable materials. Major brands invest in developing organic materials and smart diapers to expand their category growth potential. Urban centers maintain particularly strong demand because of their expanding retail presence and easy access to e-commerce platforms.

The skin care products segment is expected to grow at a significant rate throughout the forecast period because parents are becoming more aware of proper skin care for their newborns. The increasing demand for products containing infant lotions, creams, oils, and powders is driven by the need for gentle chemical-free formulations that address skin sensitivity concerns. Consumers select products based on their preference for hypoallergenic and dermatologist-tested items, which also stems from their increasing interest in natural and organic ingredients. The combination of rising internet retail platforms and effective marketing strategies employed by established brands helps improve product visibility and availability. This segment experiences substantial expansion because emerging nations, specifically in the Asia-Pacific and Latin America, benefit from rising disposable income and increased healthcare education.

Distribution Channel Insights

The hypermarkets segment held the largest revenue share of 38.5% and led the baby toiletries market in 2024. The major hypermarket stores maintain their market leadership because they offer a wide variety of brands at reasonable prices with convenient shopping options that let customers pick from multiple brands at a single location. These retail formats attract customers to purchase in bulk because they regularly offer appealing discounts and promotional deals on essential products such as diapers and wipes. Customers can inspect product quality directly when items are physically present in stores, which becomes essential for baby care products. The strong urban and semi-urban market presence of hypermarkets, along with their expanding reach in developing countries, drives both category growth and customer loyalty and trust.

The e-commerce segment of the baby toiletry market is expected to experience significant growth because of increased internet accessibility and smartphone use, along with shifting consumer habits toward online shopping during the forecast period. Digital platforms have attracted parents, especially millennials, to choose them for browsing extensive baby care product selections as well as reading reviews and obtaining doorstep delivery services. E-commerce platforms enable customers to get better value through their packaged deals, as well as subscription models and frequent discounts. The online presence of international organic and niche brands has driven increased customer demand. Urban and tech-savvy customers now prefer e-commerce because better logistics combined with secure payment gateways create an enhanced shopping experience.

Regional Insights

The worldwide baby toiletry market is dominated by the North America region with the largest revenue share of 33.7% in 2024. The dominant market position of this region stems from high purchasing power alongside the broad availability of premium baby care products and strong consumer knowledge about infant hygiene. The rising demand for organic items, together with hypoallergenic and dermatologist-tested products among parents in the region, drives increased sales of wipes, lotions, and diapers. The market growth occurs because of famous international brands, as well as advanced medical facilities and frequent product launches. The area's existing retail and e-commerce systems provide easy access to a broad range of infant toiletry products. The North American market continues to expand due to strategic marketing along with brand loyalty, and increasing parental spending.

Europe Baby Toiletries Market Trends

The European market held a 28.2% revenue share of the worldwide baby toiletries market during 2024. The market growth depends mainly on increasing consumer purchasing power and rising interest in natural and organic baby products, as well as growing knowledge about infant health and sanitation. The demand for eco-friendly, chemical-free, and dermatologist-tested toiletries exceeds expectations because European parents deeply care about product safety and ingredient quality. The European Union ensures high-quality standards through its rigorous regulatory framework, which applies to all member states. The presence of established brands and developments in sustainable product formulas and packaging systems makes the market grow. The region's expanding e-commerce sector and developed retail network make products more accessible, which drives additional market growth.

Asia Pacific Baby Toiletries Market Trends

The Asia Pacific baby toiletries market will experience a significant CAGR during the forecast period because developing nations, including China, Indonesia, and India, experience rising birth rates alongside improved living standards and increased awareness about newborn cleanliness. The expansion of disposable income and growing urban populations drives parents to select premium baby care products, which include organic and dermatologist-tested toiletries. The market experiences growth because of government initiatives for mother-child health support and healthcare system development. E-commerce platforms have expanded their reach to rural and semi-urban areas, which has led to greater availability of infant toiletries. Businesses from both domestic and international markets actively invest in the region to create higher consumer demand along with enhanced product accessibility.

Key Baby Toiletries Companies:

The following are the leading companies in the baby toiletries market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Avon Healthcare

- Hengan International Group Company Ltd.

- KCWW

- Dabur

- Himalaya Wellness Company

- Beiersdorf

- Unilever

- Procter & Gamble

- Others

Recent Developments

- In January 2025, to improve skin health and immunity, CITTA, a high-end baby bath and skincare company with headquarters in Pune, introduced a cutting-edge baby care line that includes humus extract. Their "Protection Range" consists of Protecting Sunscreen and Protecting Body Lotion, which are intended to promote the microbiota of sensitive skin and nourish it. These products combine scientific research and cultural knowledge to offer safe and efficient skincare treatments for babies.

- In September 2024, Dove launched its Baby Dove Eczema Care line, created especially to meet the sensitive requirements of infants with eczema. The Baby Dove Eczema Care Soothing Bath Treatment and Eczema Care Cream, which are both designed to protect and nurture delicate skin, are part of this new line. The National Eczema Association-approved solutions are packed with 100% natural nutrients and free of phthalates, dyes, parabens, steroids, and scents. This ensures that eczema symptoms are effectively relieved while preserving the skin's natural moisture barrier.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the baby toiletries market based on the below-mentioned segments:

Global Baby Toiletries Market, By Product

- Skin Care Products

- Diapers

- Hair Care Products

- Wipes

- Bathing Products

- Others

Global Baby Toiletries Market, By Distribution Channel

- Hypermarkets

- Chemist and Pharmacy Stores

- E-commerce

- Others

Global Baby Toiletries Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |