Global Back To College Market

Global Back To College Market Size, Share, and COVID-19 Impact Analysis, By Product (Clothing & Accessories, Electronics, Dorm/Apartment Furnishings, Stationery Supplies, Others), By Distribution Channel (Offline, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Back To College Market Summary

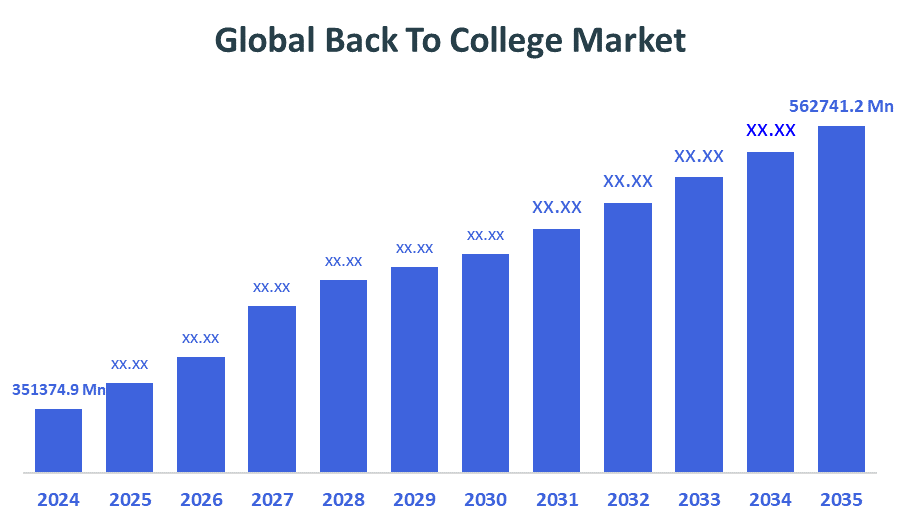

The Global Back-To-College Market Size Was Estimated at USD 351374.9 Million in 2024 and is Projected to Reach USD 562741.2 Million by 2035, Growing at a CAGR of 4.37% from 2025 to 2035. Increased student expenditures, lifestyle changes, digital learning requirements, focused marketing, growing product categories across online and offline channels, and growing college enrollments are all factors driving the back-to-college market's expansion.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 35.4% and dominated the market globally.

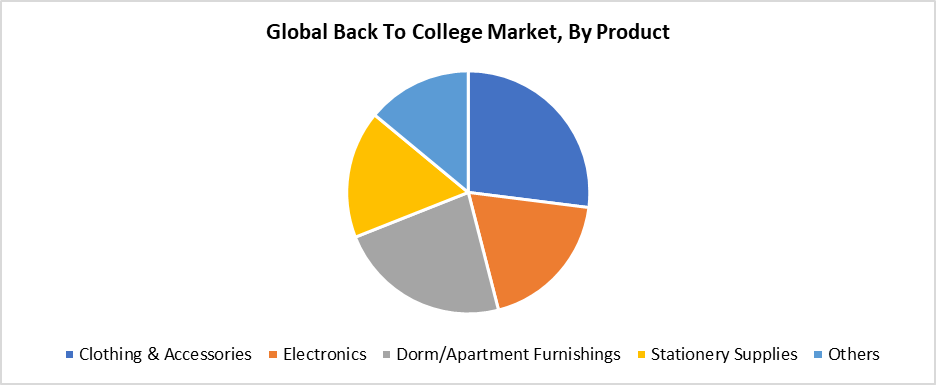

- In 2024, the clothing and accessories segment had the highest market share by product, accounting for 27.53%.

- In 2024, the offline segment had the biggest market share by product, accounting for 52.74%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 351374.9 Million

- 2035 Projected Market Size: USD 562741.2 Million

- CAGR (2025-2035): 4.37%

- Asia Pacific: Largest market in 2024

The back-to-college market refers to the extensive selection of products and services that students purchase each academic year when preparing for their return to school. The market encompasses electronic devices, clothing, personal care items, along with school materials, dormitory decorations, and digital educational resources. The academic calendar mainly drives market trends because students increase their spending during the late summer period. The industry expands because of expanding college enrollment, together with students becoming more independent and changing lifestyle requirements. The purchasing decisions of students are influenced by social media popularity, together with parental support and peer-driven trends. Retailers and companies implement targeted marketing strategies with package discounts and student discounts to seize this highly profitable seasonal market segment.

The back-to-college market experiences major shifts because of technological innovation. Modern students prefer to use smart devices, including laptops and tablets, alongside wireless headphones and cloud-based applications, which support remote learning and digital collaboration. The demand for reliable network connections, together with performance-enhancing devices, has grown because of expanding online learning platforms and virtual classrooms. Retailers now use AI-powered personalization systems and recommendation tools to deliver better services that match student preferences. The market activity grows because of increasing government programs that support student welfare, computer literacy, and higher education access. Public funding for digital inclusion projects, together with educational infrastructure investments, drives additional spending in this sector. These evolving market conditions transform the back-to-college shopping process because students increasingly rely on technology within their academic environment.

Product Insights

Global Back To College Market, By Product

The back-to-college market is led by the clothing and accessories segment with a 27.53% revenue share in 2024 because students focus on preparing for college while developing their personal style and self-expression. College students now allocate more funds toward clothing that expresses their identity because their campus experience marks their transition into independent living. The beginning of the school year brings new outfit demand because students follow their peers' fashion choices and respond to brand trends and seasonal styles. The market has expanded due to the rising popularity of athleisure clothing, branded products, and casual fashion. Retailers capitalize on this trend by offering student discounts and selecting specific collections while running advertising campaigns that focus on college student customers.

The back-to-college market's dorm/apartment furnishings segment will experience significant CAGR during the forecast period. The increasing number of students living away from home, along with their interest in fashionable and practical items for their spaces, leads to this growth. Students need furniture such as desks and chairs as well as bedding, storage, and decorative items to establish comfortable and productive living environments. Small apartments and dormitories are driving the growing need for compact and versatile space-saving furniture solutions. The expanding market receives additional demand from social media trends and do-it-yourself culture and influencer content, which motivates students to spend more money on their home furnishings.

Distribution Channel Insights

The offline segment dominated the back-to-college market in 2024 with a revenue share of 52.74% because customers prefer shopping in person for apparel, furniture, and school supplies. Physical retail establishments, including department stores and specialized shops, together with big-box stores, offered parents and students a chance to inspect products physically before they bought them. The purchase of electronics and dorm room furnishings required this essential approach because these items needed a high level of commitment from buyers. Businesses implemented package deals together with back-to-school activities and exclusive in-store discounts to attract more customers during the entire season. Offline channels secured the majority of 2024 back-to-college spending because they provided immediate product access and fulfilled last-minute shopping requirements.

The back-to-college market's online segment will grow significantly throughout the forecasted period because of students' preference for e-commerce and digital-first buying and their desire for convenience. Users find online platforms highly attractive because they enable cost comparisons along with product reviews and access to various items, including gadgets, school supplies, and dorm décor. Retailers who want to attract student shoppers build their online presence through targeted advertising, personalized recommendations, and mobile applications. The rising trend of online shopping continues to grow because of fast delivery, flexible return policies, and student-specific discounts. Social media, together with influencer marketing, drives purchasing decisions, which makes online channels essential for industry growth in the future.

Regional Insights

The back-to-college industry in North America held 22.81% revenue share during 2024 due to robust college student enrollment figures, along with strong student purchasing power and established retail systems. The US market displayed strong demand for essential products that included school materials along with electronic devices, as well as clothing and dormitory furnishings. The area's dominant market position stemmed from student discounts, together with seasonal marketing campaigns, as well as widespread participation in back-to-school shopping traditions. North American retailers, both physical stores and digital platforms, developed customized product selections and specific discount deals to meet the changing needs of college students. The combination of major universities and a strong campus lifestyle in North America drives substantial worldwide revenue growth, which supports market expansion.

Europe Back To College Market Trends

The European back-to-college market will demonstrate a strong CAGR throughout the forecasted period because of increasing student mobility, changing lifestyle choices, and rising higher education enrollment. The increasing student population moving to educational institutions worldwide creates a rising need for study essentials alongside computing devices, personal care products, and dormitory furniture. The market growth of ergonomic furniture, together with blue-light-blocking devices and organizational products, stems from heightened student productivity awareness and well-being consciousness. The development of e-commerce platforms combined with student-specific discounts and international shipping options has simplified back-to-college shopping experiences. The market's rising direction stems from educational government funding, together with improved internet connectivity infrastructure.

Asia Pacific Back To College Market Trends

The Asia Pacific back-to-college industry led the worldwide market by securing 35.4% revenue share in 2024 because of an expanding student population combined with growing disposable incomes and higher education investment. The need for college-related products, including electronics, stationery, dormitory furniture, and clothing, reached its peak across China, India, Japan, and South Korea. Students across the region spent more money during the back-to-college period because academic success remains vital, and campus life popularity continues to grow. The trend became profitable for both local stores and international retailers who implemented personalized promotional methods together with seasonal advertising and expanded product selections. The rapid development of e-commerce, along with mobile shopping in the Asia Pacific, helped strengthen this region's position as the leading force in the global market.

Key Back To College Companies:

The following are the leading companies in the back to college market. These companies collectively hold the largest market share and dictate industry trends.

- The ODP Corporation

- Newell Brands Inc.

- Mitsubishi Pencil Co. Ltd.

- Amazon.com, Inc.

- Staples Inc.

- Acco Brands Corporation

- HP Inc.

- Faber Castell AG

- ITC Ltd.

- Apple Inc.

- Others

Recent Developments

- In September 2024, Japanese stationery producer Linc Ltd. and Mitsubishi Pencil Company launched a new venture in which Mitsubishi will own a 51 percent share. This collaboration intends to use cutting-edge Japanese technology to create premium, reasonably priced writing instruments especially for the Indian market. In addition to increasing manufacturing efficiency, the partnership is anticipated to expand Linc's product line and satisfy Indian consumers' rising demand for high-end stationery.

- In June 2024, Office Depot LLC expanded its inventory of school supplies and college dorm essentials by partnering with Dormify, an online shop that specializes in dorm décor. Through this partnership, Office Depot can take advantage of Dormify's strong web presence and specialized emphasis, which will increase its appeal to Gen Z students. Together, they provide a full one-stop shop for back-to-school buying, promoting product innovation, expanding market reach, and improving customer engagement.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the back to college market based on the below-mentioned segments:

Global Back To College Market, By Product

- Clothing & Accessories

- Electronics

- Dorm/Apartment Furnishings

- Stationery Supplies

- Others

Global Back To College Market, By Distribution Channel

- Offline

- Online

Global Back To College Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 216 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |