Global Beauty Gummies Market

Global Beauty Gummies Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Skin Health, Hair & Nail Health, and Multi-Functional), By Formulation (Gelatin-Based and Plant-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Beauty Gummies Market Summary, Size & Emerging Trends

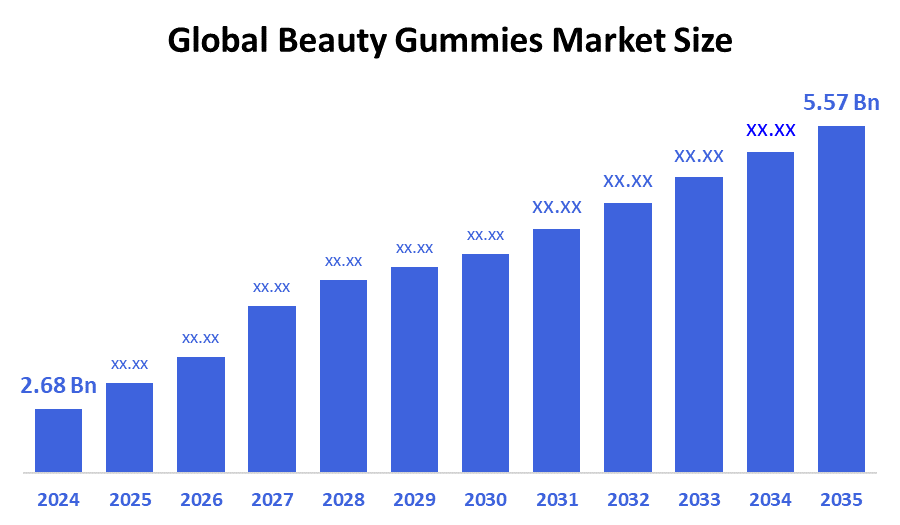

According to Spherical Insights, the Global Beauty Gummies Market Size is Expected to Grow from USD 2.68 Billion in 2024 to USD 5.57 Billion by 2035, at a CAGR of 7.1% during the forecast period 2025-2035. The beauty gummies market is propelled by increasing demand for ingestible beauty solutions, rising health awareness, and the growing popularity of influencer-driven marketing across younger demographics.

Key Market Insights

- North America is expected to account for the largest share in the beauty gummies market during the forecast period.

- In terms of product type, the hair & nail health segment accounted for the largest revenue share of the global beauty gummies market during the forecast period.

- In terms of formulation, the plant-based segment accounted for the highest market share of the global beauty gummies market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.68 Billion

- 2035 Projected Market Size: USD 5.57 Billion

- CAGR (2025-2035): 7.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Beauty Gummies Market

The beauty gummies market refers to chewable dietary supplements designed to improve appearance-related health outcomes such as skin hydration, hair growth, and nail strength. These gummies combine nutritional ingredients like collagen, biotin, vitamin C, hyaluronic acid, and herbal extracts in a consumer-friendly and flavorful format. The market’s growth is driven by convenience, consumer preference for alternatives to pills, and increased spending on personal care. Additionally, the trend toward beauty-from-within is supported by rising awareness around nutrition-based beauty and holistic health practices. Manufacturers are also focusing on clean-label formulations, plant-based gelling agents, and sustainability to meet the preferences of health-conscious consumers.

Beauty Gummies Market Trends

- Growing popularity of beauty-from-within supplements among Gen Z and millennial consumers.

- Rising demand for vegan and plant-based gummies using pectin instead of gelatin.

- Increasing product launches with multifunctional benefits, combining skin, hair, and immune support in a single gummy.

- Expansion of e-commerce and subscription models for personalized beauty nutrition.

- Strategic celebrity and influencer endorsements are shaping consumer preferences and driving brand awareness.

Beauty Gummies Market Dynamics

Driving Factors: The global beauty gummies market is driven by increasing consumer awareness of "beauty from within"

The global beauty gummies market is driven by increasing consumer awareness of "beauty from within" and the rising popularity of convenient, tasty supplement formats. The surge in demand for natural, clean-label, and plant-based beauty products further fuels market expansion. Social media influence, celebrity endorsements, and the success of DTC (direct-to-consumer) wellness brands enhance visibility and trust. Additionally, the growing prevalence of hair and skin concerns due to stress, pollution, and aging populations contributes to product adoption. Innovation in formulations, including collagen, biotin, and vitamins, continues to attract a broader demographic, especially younger consumers prioritizing preventive skincare and wellness.

Restrain Factors: Regulatory inconsistency across countries hampers global expansion

Despite rapid growth, the beauty gummies market faces several restraints. Regulatory inconsistency across countries hampers global expansion, as supplement classifications and approval processes vary. Concerns over sugar content, artificial flavors, and additives deter health-conscious consumers. High product prices, especially for premium or clinically-backed formulas, limit affordability in emerging markets. Limited scientific evidence supporting some product claims can undermine consumer trust. Supply chain disruptions and ingredient shortages, especially of marine collagen, biotin, or natural extracts, also affect production. Furthermore, increasing competition leads to brand saturation, making differentiation challenging for new entrants without unique selling propositions or strong marketing budgets.

Opportunity: Companies can capitalize on clean-label and vegan formulations

The beauty gummies market presents vast opportunities in emerging markets like India, China, and Southeast Asia, where rising disposable incomes and growing beauty consciousness are driving demand. Companies can capitalize on clean-label and vegan formulations, targeting environmentally conscious millennials and Gen Z. Expanding into men’s grooming and senior wellness opens new demographics. E-commerce growth, subscription models, and influencer partnerships offer cost-effective marketing and global reach. Personalized nutrition, powered by AI and DNA-based health analysis, allows brands to develop customized beauty gummies tailored to individual needs. Clinical trials and transparent labeling can enhance credibility. Strategic collaborations with dermatologists and beauty clinics also create opportunities to position beauty gummies as part of holistic skincare regimens.

Challenges: Overpromising beauty benefits without sufficient scientific backing

Key challenges include navigating varying global regulations and ensuring consistent product quality and safety. Overpromising beauty benefits without sufficient scientific backing can damage brand credibility and lead to legal scrutiny. The saturated market landscape demands significant marketing investment to stand out. Additionally, formulating sugar-free, vegan gummies without compromising taste and shelf stability remains difficult. Consumer skepticism around efficacy and long-term results also persists, requiring brands to invest in education, clinical validation, and transparent communication to gain lasting trust and loyalty.

Global Beauty Gummies Market Ecosystem Analysis

The beauty gummies market ecosystem includes major brands like Unilever and startups leveraging influencer marketing. Key ingredients are collagen, biotin, and botanicals, with a growing focus on vegan and sugar-free formulations. Manufacturing faces supply chain challenges and regulatory variations across regions. Distribution is dominated by e-commerce and direct-to-consumer models, supplemented by traditional retail. Heavy investment in R&D and clinical trials builds consumer trust. Social media drives demand, while regulatory complexity and quality control remain ongoing challenges.

Global Beauty Gummies Market, By Product Type

Hair & nail health gummies held the largest revenue share in the global beauty gummies market, accounting for approximately 45% of the market. This segment’s dominance was driven by the increasing consumer focus on biotin and collagen-based supplements to combat common hair and nail issues such as hair fall and brittle nails. Targeted primarily toward women aged 18–40, these gummies addressed a widespread beauty concern, making them a staple product in the beauty supplement industry. The convenience and perceived effectiveness of these gummies contributed to their strong and sustained demand globally.

Multi-functional gummies accounted for the fastest growing segment in the global beauty gummies market, expanding at a CAGR of approximately 8.5% during the forecast period. This rapid growth was driven by their multifunctional formulations that addressed several beauty concerns simultaneously such as skin health, hair growth, and immunity support. The convenience and value-for-money positioning of these gummies made them increasingly popular among consumers seeking comprehensive and efficient beauty solutions.

Global Beauty Gummies Market, By Formulation

Gelatin-based gummies held a significant portion of the global beauty gummies market, accounting for approximately 40% of the market share. This segment's prominence was due to the traditional use of gelatin in gummy formulations, valued for its texture and gelling properties. However, concerns over animal-derived ingredients led to a slower growth rate compared to plant-based alternatives, especially among vegan and clean-label consumers.

Plant-based gummies (pectin & others) were expected to grow at the fastest CAGR of approximately 10% during the forecast period in the global beauty gummies market. This segment’s rapid growth was driven by increasing consumer preference for vegan and vegetarian products, along with a strong demand for clean-label and ethically sourced ingredients. Plant-based formulations gained popularity especially in developed markets, aligning with broader trends toward sustainable and health-conscious consumption.

North America held the largest market share in the global beauty gummies market, accounting for approximately 35% of the total market. This region’s leadership was driven largely by strong consumer demand in the U.S., where the nutraceutical and dietary supplements industry is highly mature. High consumer health awareness, combined with rising interest in beauty-from-within products, fueled market expansion. The presence of celebrity-endorsed brands and innovative, digital-first marketing strategies helped accelerate adoption, especially among millennials and Gen Z consumers.

Europe accounted for around 30% of the global beauty gummies market, marked by a strong preference for clean-label, organic, and vegan products. Countries such as Germany, the UK, and France played a pivotal role due to their large health-conscious populations and stringent regulatory standards, which ensured high product quality and safety. The European market emphasized natural and sustainable formulations, aligning with consumer trends toward eco-friendly and ethical consumption. Furthermore, the growing popularity of wellness and self-care lifestyles encouraged wider acceptance of beauty gummies.

Asia Pacific was the fastest-growing regional market, expanding at an estimated CAGR of 9% during the forecast period. This rapid growth was driven by increasing disposable incomes, rapid urbanization, and the rise of wellness culture across key markets such as China, India, South Korea, and Japan. In these countries, evolving consumer lifestyles and increasing awareness of health and beauty supplements stimulated demand for beauty gummies. The region saw a surge in local and regional brands that developed culturally tailored formulations incorporating traditional beauty ingredients alongside modern supplements.

WORLDWIDE TOP KEY PLAYERS IN THE BEAUTY GUMMIES MARKET INCLUDE

- HUM Nutrition Inc.

- Olly Public Benefit Corp.

- SugarBearHair

- Nature’s Bounty

- Vitafusion

- NutraBlast

- SmartyPants Vitamins

- Goli Nutrition Inc.

- Hairfinity

- Centrum (Pfizer Inc.)

- Others

Product Launches in Beauty Gummies Market

- In March 2025, HUM Nutrition launched a new line of collagen-boosting gummies infused with hyaluronic acid and vitamin C. These gummies were specifically formulated to target skin firmness and enhance natural glow, catering to consumers seeking effective, beauty-from-within solutions. The launch strengthened HUM Nutrition’s position in the beauty gummies market by offering scientifically backed ingredients that support skin health.

- In June 2024, Olly expanded its clean-label beauty portfolio by introducing its plant-based “Glow Sweet Glow Gummies” into new international markets. This launch emphasized Olly’s commitment to natural, vegan-friendly formulations and responded to the growing global demand for sustainable and ethically sourced beauty supplements. The international expansion helped Olly tap into emerging markets and appeal to a broader consumer base focused on holistic wellness.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the beauty gummies market based on the below-mentioned segments:

Global Beauty Gummies Market, By Product Type

- Hair & Nail Health Gummies

- Skin Health Gummies

- Multi-Functional Gummies

Global Beauty Gummies Market, By Formulation

- Gelatin-Based

- Plant-Based

Global Beauty Gummies Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Beauty Gummies Market in 2024?

A: The Global Beauty Gummies Market size was estimated at USD 2.68 billion in 2024.

Q: What is the forecasted CAGR of the Global Beauty Gummies Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of approximately 7.1% during the forecast period 2025–2035.

Q: Which product segment holds the largest revenue share in the Global Beauty Gummies Market?

A: The Hair & Nail Health gummies segment accounted for the largest revenue share, representing around 45% of the market.

Q: Which formulation type is expected to grow the fastest in the Global Beauty Gummies Market?

A: Plant-based gummies are forecasted to grow at the fastest CAGR of approximately 10% due to increasing consumer demand for vegan and clean-label products.

Q: Which region is the largest market for beauty gummies in 2024?

A: North America is expected to hold the largest market share in 2024, accounting for approximately 35% of the global market.

Q: What are the key drivers of growth in the Global Beauty Gummies Market?

A: Growth is driven by increasing consumer awareness of "beauty from within," rising demand for convenient and tasty supplement formats, and the popularity of natural, clean-label, and plant-based beauty products.

Q: What challenges are limiting the expansion of the Global Beauty Gummies Market?

A: Key challenges include regulatory inconsistencies across countries, concerns over sugar content and additives, high product prices, supply chain disruptions, and consumer skepticism due to limited scientific backing for some product claims.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | May 2025 |

| Access | Download from this page |