Global Benzenoid Market

Global Benzenoid Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Benzaldehyde, Benzoic Acid, Toluene, Xylene, Styrene, Others), By Source (Natural, Synthetic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Benzenoid Market Summary

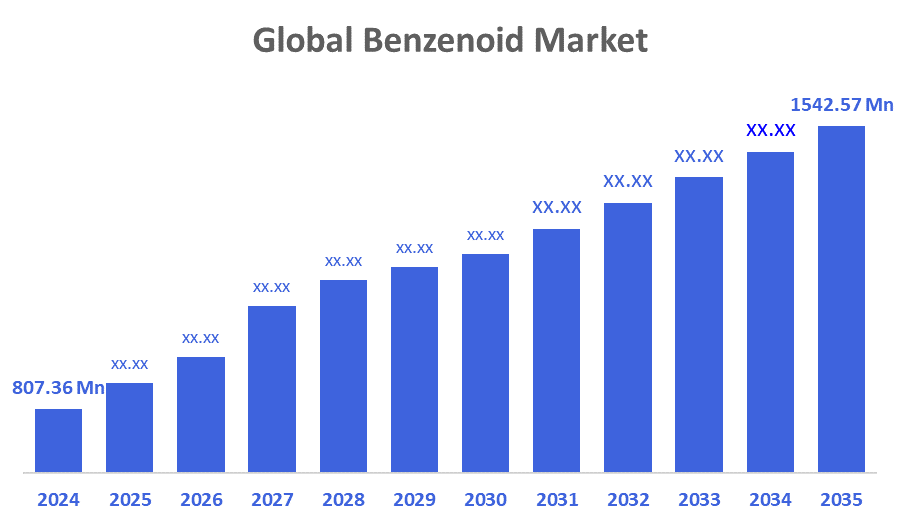

The Global Benzenoid Market Size Was Estimated at USD 807.36 Million in 2024 and is Projected to Reach USD 1542.57 Million by 2035, Growing at a CAGR of 6.06% from 2025 to 2035. The market for benzenoid is expanding because of the growing demand in the taste and fragrance sectors, the growing use of benzenoid in personal care and cosmetics, the growing use of benzenoid in pharmaceuticals, and the growing popularity of natural-scented products and aromatherapy in global consumer markets.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 43.57% and dominated the market globally.

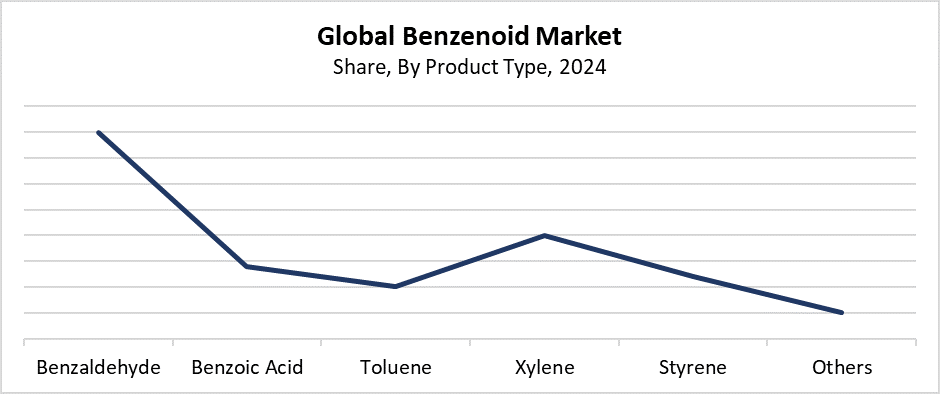

- In 2024, the benzaldehyde segment had the highest market share and led the market by product type, accounting for 40.73%.

- In 2024, the natural segment had the biggest market share and led the market by source, accounting for 54.63%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 807.36 Million

- 2035 Projected Market Size: USD 1542.57 Million

- CAGR (2025-2035): 6.06%

- Asia Pacific: Largest market in 2024

The benzenoid market contains aromatic chemicals with benzene ring structures that find extensive use in taste and perfumery products and medical and cosmetic applications. Household and personal care products depend on these substances to create the distinct scents and aromas found in numerous consumer goods. Market growth is driven by rising consumer interest in natural and synthetic fragrances, along with expansion in the food and beverage industry and broader medical applications. Market growth occurs because of rising world population numbers and urban development, which have driven demand for beauty and personal care products. The market expansion of benzenoid compounds is fueled by increasing consumer interest in aromatherapy products as well as wellness goods.

Technological progress has improved both the synthesis and extraction processes for benzenoid compounds which resulting in higher purity and reduced manufacturing expenses. The rising popularity of green chemistry and bio-based synthesis methods drives industrial sustainability through their adoption. The government implements rules that encourage manufacturers to use environmentally friendly production techniques that avoid hazardous substances. Market expansion occurs because research and development programs in the pharmaceutical and fragrance industries drive innovative solutions. The combination of these factors creates a supportive environment that enables the worldwide development of the benzenoid market.

Product Type Insights

What Factors Enabled the Benzaldehyde Segment to Lead the Benzenoid Market with a 40.73% Revenue Share in 2024?

The benzaldehyde segment led the benzenoid market with the largest revenue share of 40.73% in 2024. The flavor and fragrance industries value benzaldehyde as an essential component that emits a distinct almond scent. The compound experiences strong market demand because it functions as a primary ingredient for producing food flavorings, cosmetics, and perfumes. Benzaldehyde maintains a strong market position because it serves as an essential building block for making agrochemical products and pharmaceutical drugs. The commercial appeal of this compound grows through its multiple applications and ongoing developments in its extraction and synthesis processes. The benzenoid market maintains its dominance of benzaldehyde because consumers increasingly prefer both natural and synthetic fragrances in their personal care products.

The xylene segment of the benzenoid market is expected to grow at the fastest CAGR during the forecast period. The solvent xylene plays a fundamental role in the paint, coatings, and printing industries, which experience rapid expansion because of urban growth and industrial development. Xylene demand increases because it functions as an essential base substance for manufacturing phthalic anhydride and terephthalic acid, which lead to polyester fiber and plastic production. The segment continues to expand because of its increasing usage in adhesive and pharmaceutical products. The refinement and purification processes have advanced through technology, which enhances both the quality and accessibility of xylene. Additionally, the segment growth stems from rising industrial activities in developing countries and increased synthetic fiber and packaging material requirements.

Source Insights

How Did the Natural Segment Achieve Market Dominance in the Benzenoid Market in 2024?

The natural segment held the largest revenue share of 54.63% and dominated the benzenoid market in 2024. The market dominance stems from rising consumer interest in natural and organic products, which mainly affects the personal care and flavor and fragrance sectors. Natural benzenoid chemicals derive their main components from essential oils and other plant sources because they offer pure and environmentally friendly qualities. The awareness about synthetic chemicals' environmental and health impacts has led to a rising demand for natural benzenoids. The market growth of natural ingredients in food and cosmetic items has been supported by strict laws and certification programs. The natural source segment maintains its strong position because of the expanding aromatherapy market and increasing demand for clean-label products.

The synthetic segment within the benzenoid market is anticipated to grow at the fastest CAGR throughout the forecast period. The market growth results from rising demand for benzenoid compounds that maintain stable quality at affordable prices for industrial and medicinal as well as flavor and fragrance applications. The large-scale production of synthetic benzenoids offers manufacturers a continuous year-round supply combined with scalability and controlled purity levels. The combination of chemical synthesis and bioengineering technologies has enhanced production efficiency while reducing environmental effects, which makes synthetic benzenoids more attractive to manufacturers. The market expands because of rising industrial development in emerging markets, along with increasing consumption of synthetic benzenoids for food flavouring, personal care, and cosmetics products.

Regional Insight

The benzenoid market in North America demonstrates consistent growth because of rising interest from the pharmaceutical and flavor and taste industries. The market grows because more people seek personal care and cosmetic products that contain aromatic compounds. The increasing utilization of benzenoid chemicals in the food and beverage industry, flavoring both natural and synthetic, supports market growth. The region's clean-label focus and environmental product demand have driven technological improvements in extraction and synthesis methods to achieve superior product quality and sustainability. Government regulations that promote chemical safety, along with non-toxic substances, push both innovation and market acceptance. Large producers, together with ongoing research & development work, drive North America's strong position in the international benzenoid market.

Asia Pacific Benzenoid Market Trends

The Asia Pacific region held the largest revenue share of 43.57% and dominated the global benzenoid market in 2024. The leadership position of this market segment stems from fast-growing sectors such as tastes, fragrances, personal care, and medicines in China, India, Japan, and South Korea. The demand for benzenoids stems from increasing urbanization and growing disposable incomes, as well as shifting customer preferences toward natural and aromatic products. The growing food and beverage sector, together with the expanding cosmetics industry, drives increased use of benzenoids. The area enjoys benefits from abundant natural resources combined with government policies that facilitate industrial development. The Asia Pacific region will continue to dominate the benzenoid market through its ongoing R&D investments and advancements in extraction and synthesis technologies.

Europe Benzenoid Market Trends

The benzenoid market in Europe experiences substantial growth because of strong demand from the fragrance and flavor and pharmaceutical industries. Benzenoid usage gets a boost because customers prefer innovative, high-end cosmetics along with their personal care products. The expanding food and beverage sector, especially natural and clean-label products, drives substantial market growth. High-purity, environmentally friendly benzenoid chemicals find market success because of strict environmental sustainability and product safety regulations. New extraction methods and eco-friendly synthesis technology improves product quality at the same time it minimizes environmental impact. Government initiatives focusing on sustainable production, combined with rising consumer understanding of organic components, lead to market expansion.

Key Benzenoid Companies:

The following are the leading companies in the benzenoid market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Haarmann & Reimer

- Firmenich

- Sigma-Aldrich Co. LLC.

- Quest International

- Takasago

- International Flavors & Fragrances

- Givaudan

- The Good Scents Company

- Sensient Technologies

- Others

Recent Developments

- In June 2025, Innovate UK granted a Smart Grant to UK chemical wholesaler Bowden Chemicals to develop bio-based unsaturated polyester resins (UPR) with over 50% renewable content over three years.

- In January 2024, Covestro, a world leader in high-performance polymers, and Encina, a U.S.-based manufacturer of ISCC PLUS-certified circular chemicals, have signed a long-term supply deal for chemically recycled circular feedstock made from post-consumer end-of-life plastic. In order to complete its global production plant, Encina will provide Covestro with benzene and toluene. The production of TDI (toluene diisocyanate) and MDI (methylene diphenyl diisocyanate) uses benzene and toluene as basic ingredients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the benzenoid market based on the below-mentioned segments:

Global Benzenoid Market, By Product Type

- Benzaldehyde

- Benzoic Acid

- Toluene

- Xylene

- Styrene

- Others

Global Benzenoid Market, By Source

- Natural

- Synthetic

Global Benzenoid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 175 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |