Global Bio-based Plastics Market

Global Bio-based Plastics Market Size, Share, and COVID-19 Impact Analysis, By Product (Bio-PE (Polyethylene), Bio-PET (Polyethylene Terephthalate), PLA (Polylactic Acid), PHA (Polyhydroxyalkanoates), Starch Blends, Bio-based Polyamides, Bio-based Polyurethanes, Other Products), By Application (Packaging, Textiles & Fibers, Automotive & Transportation, Consumer Goods & Electronics, Agriculture & Horticulture Films, Medical & Healthcare Products, Construction & Building Materials, Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Bio-based Plastics Market Summary

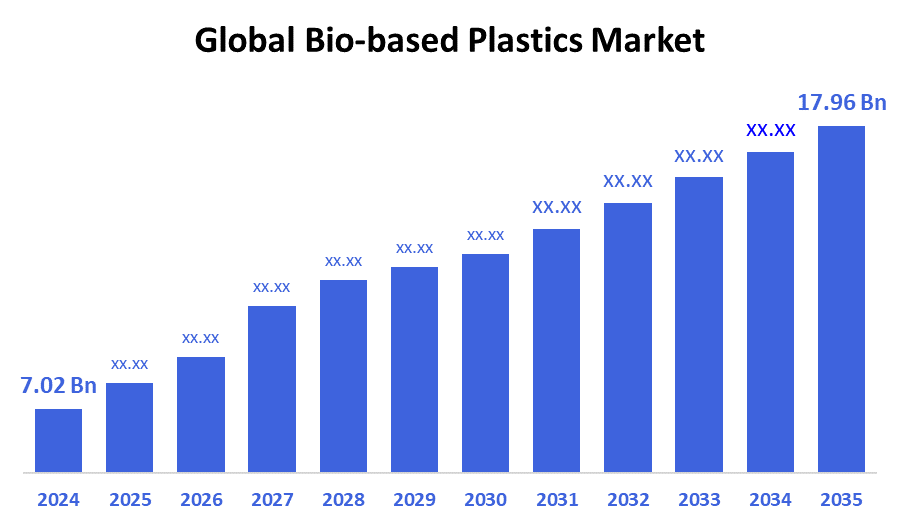

The Global Bio-Based Plastics Market Size Was Estimated at USD 7.02 Billion in 2024 and is Projected to Reach USD 17.96 Billion by 2035, Growing at a CAGR of 8.92% from 2025 to 2035. Growing consumer preference for eco-friendly products across industries like food packaging, agriculture, and automotive, as well as supportive government regulations and the development of biopolymer technology, are all contributing factors to the market expansion for bio-based plastics.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 41.36% and dominated the market globally.

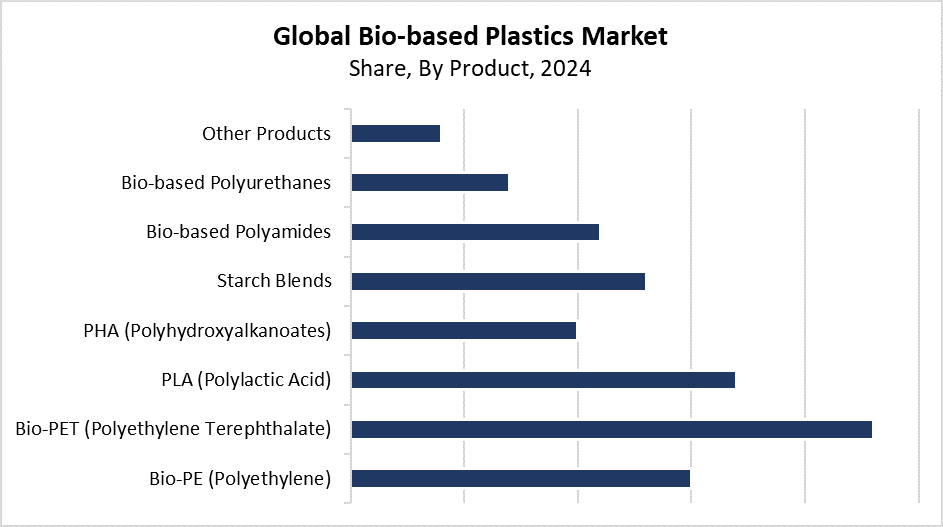

- In 2024, the Bio-PET (polyethylene terephthalate) segment had the highest market share and led the market by product, accounting for 23.75%.

- In 2024, the packaging segment had the biggest market share and led the market by application, accounting for 58.42%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 7.02 Billion

- 2035 Projected Market Size: USD 17.96 Billion

- CAGR (2025-2035): 8.92%

- Asia Pacific: Largest market in 2024

The Bio-based plastics market exists as a segment that uses renewable biological materials like cellulose, sugarcane, and maize starch instead of petroleum-based raw materials. These plastics have been engineered to match traditional plastics in their properties, yet they offer better biodegradability and reduced carbon impact. The market's expansion primarily results from rising environmental consciousness about plastic waste and climate change. Market expansion happens because consumer products, food and beverage industries, together with agricultural businesses, need sustainable packaging alternatives. Bio-based plastics gain greater market adoption because consumers choose environmentally friendly products, and businesses allocate more resources toward sustainability operations.

Technological advancements have significantly improved the performance and economic aspects of bio-based plastics, which now serve as viable replacements for conventional plastics. The development of biopolymer synthesis, together with blending techniques and recycling methods, has enhanced material performance and extended application possibilities. Multiple governments around the world are establishing rigorous regulations and providing incentives to support sustainable materials while reducing plastic waste. The implementation of bio-based plastics benefits from government funding programs, which include green innovation subsidies and single-use plastic restrictions. The expanding global market for bio-based plastics benefits from rising environmental awareness as well as supportive policies.

Product Insights

The Bio-PET (polyethylene terephthalate) segment dominated the bio-based plastics market with the largest market share of 23.75% during 2024. Bio-PET stands out as the preferred choice because it matches traditional PET characteristics, including durability, recyclability, and versatility, which makes it suitable for packaging applications such as bottles, containers, and films. The renewable content from plant-based sugarcane attracts manufacturers who need sustainable alternatives that maintain their product performance. The food and beverage industry has driven Bio-PET adoption because of rising consumer demand and regulatory packaging standards for environmental sustainability. Production technology advancements in scalability and cost efficiency have solidified Bio-PET's leading position within the market for bio-based plastics.

The PLA (polylactic acid) segment is anticipated to grow at a significant CAGR during the forecast period. The biodegradable plastic known as PLA stems from renewable resources such as sugarcane and maize starch, which enables full composting. The combination of excellent mechanical properties and green features makes PLA suitable for applications in textiles and medical devices, as well as packaging and agriculture. The implementation of stricter environmental regulations, along with consumer awareness about plastics, drives PLA adoption as a sustainable alternative. Technological advancements in PLA production methods have lowered costs and improved durability and heat resistance, which enable broader applications. The PLA segment of the bio-based plastics market will experience strong growth because of both carbon footprint reduction efforts from industries and rising public understanding of environmental issues.

Application Insights

The packaging segment held the largest revenue share of 58.42% and dominated the bio-based plastics market in 2024. Consumer goods, along with personal care and food and beverage industries, require sustainable packaging solutions, which drives the market dominance of this segment. Bio-based plastics serve as ideal packaging solutions because they deliver environmental benefits alongside performance characteristics equal to traditional plastics. Manufacturers must adopt bio-based materials because regulations against single-use plastics are becoming stricter, while consumers become more conscious about environmental impact. The development of bio-based plastic production and recycling technologies has led to improved material characteristics and cost-effectiveness, which boosts their packaging applications. The packaging sector will preserve its strong market position because of the shift toward circular economy models.

The textile and fibers segment is anticipated to grow at a significant CAGR throughout the forecasted period. The market expansion happens because the clothing and fashion industries need sustainable materials for their products. The textile industry adopts bio-based plastics, including PLA (polylactic acid), because they offer biodegradable properties and lightweight characteristics and function as replacements for traditional synthetic fibers such as polyester and nylon. Fashion brands now receive encouragement to adopt bio-based fibers due to both rising sustainable trends and increasing environmental impact awareness among consumers. The advancement of fiber manufacturing technology has enhanced bio-based textile products by improving their comfort levels, performance metrics, and durability. The market segment for bio-based plastics expands because government regulations support green manufacturing techniques and work to reduce plastic contamination.

Regional Insights

In 2024, the Asia Pacific region led the bio-based plastics market, accounting for the largest revenue share of 41.36%. The leading position of Asia Pacific in the bio-based plastics market results from industrial development alongside increasing environmental awareness and substantial market needs from the packaging, textile, and agricultural sectors in China, India, and Japan. The production of bio-based plastic relies on two fundamental raw materials, which include corn and sugarcane, and these materials exist in large quantities throughout the region. The industry advances through investments in innovative biopolymer technology alongside expanding government programs that promote sustainability. Asia Pacific leads the global market share for bio-based plastics usage because of its extensive and strict plastic regulations and increasing consumer demand for environmentally friendly products.

North America Bio-based Plastics Market Trends

The market for bio-based plastics in North America is growing significantly because environmental awareness and consumer preference for sustainable plastic alternatives continue to grow. Important industries, including consumer goods, automotive, and packaging, employ bio-based plastics to comply with plastic waste regulations and reduce their carbon emissions. The area receives substantial government support because laws, together with incentives, promote the use of renewable resources and circular economy practices. Technical developments have improved the performance and cost-effectiveness of bio-based plastics, which enhances their attractiveness to manufacturers. The market growth accelerates because more consumers choose environmentally friendly products and become aware of sustainability issues. The North American market leaders dedicate funds toward developing bio-based plastic solutions, which strengthens the region's global market standing.

Europe Bio-based Plastics Market Trends

The European market for bio-based plastics is growing at a significant rate because of environmental regulations, along with increasing customer preferences for sustainable products. The region’s commitment to reducing plastic waste and carbon emissions has led to the widespread adoption of bio-based plastics across industries such as packaging, agriculture, automotive, and textiles. European governments promote manufacturers to adopt renewable resources through strict regulations, as well as financial incentives and green innovation funding programs. Bio-based plastics have gained increased adoption due to advancements that enhance their performance and cost-effectiveness alongside improved biodegradability. The market growth is driven by consumers and businesses learning more about circular economy principles and their environmental consequences. Europe remains a leading worldwide market because industry leaders drive sustainability and innovative practices in bio-based plastics.

Key Bio-based Plastics Companies:

The following are the leading companies in the bio-based plastics market. These companies collectively hold the largest market share and dictate industry trends.

- NatureWorks LLC

- Avantium N.V.

- Mitsubishi Chemical Group Corporation

- Braskem S.A.

- Danimer Scientific, Inc.

- BASF SE

- TotalEnergies Corbion PLA

- Arkema S.A.

- Novamont S.p.A.

- Biome Bioplastics Limited

- Others

Recent Developments

- In April 2025, Praj Industries Ltd. and Uhde Inventa-Fischer, Thyssenkrupp Uhde's polymer experts, collaborated to provide an integrated technical solution for the production of polylactic acid (PLA), a sustainable substitute for traditional plastics.

- In February 2025, Balrampur Chini Mills declared that it would invest roughly USD 342 million (Rs 2,850 crore) to establish India's first large-scale Polylactic Acid (PLA) biopolymer production facility at Kumbhi, Uttar Pradesh. Powered solely by renewable energy, the factory is anticipated to begin operations by October 2026 and generate 80,000 tonnes of PLA per year, which is 100% bio-based and industrially biodegradable.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the bio-based plastics market based on the below-mentioned segments:

Global Bio-based Plastics Market, By Product

- Bio-PE (Polyethylene)

- Bio-PET (Polyethylene Terephthalate)

- PLA (Polylactic Acid)

- PHA (Polyhydroxyalkanoates)

- Starch Blends

- Bio-based Polyamides

- Bio-based Polyurethanes

- Other Products

Global Bio-based Plastics Market, By Application

- Packaging

- Textiles & Fibers

- Automotive & Transportation

- Consumer Goods & Electronics

- Agriculture & Horticulture Films

- Medical & Healthcare Products

- Construction & Building Materials

- Other Applications

Global Bio-based Plastics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |