Global Bioengineered Protein Drugs Market

Global Bioengineered Protein Drugs Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Monoclonal Antibodies, Recombinant Hormones, and Fusion Proteins), By Application (Oncology, Autoimmune Diseases, Endocrinology), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Bioengineered Protein Drugs Market Summary, Size & Emerging Trends

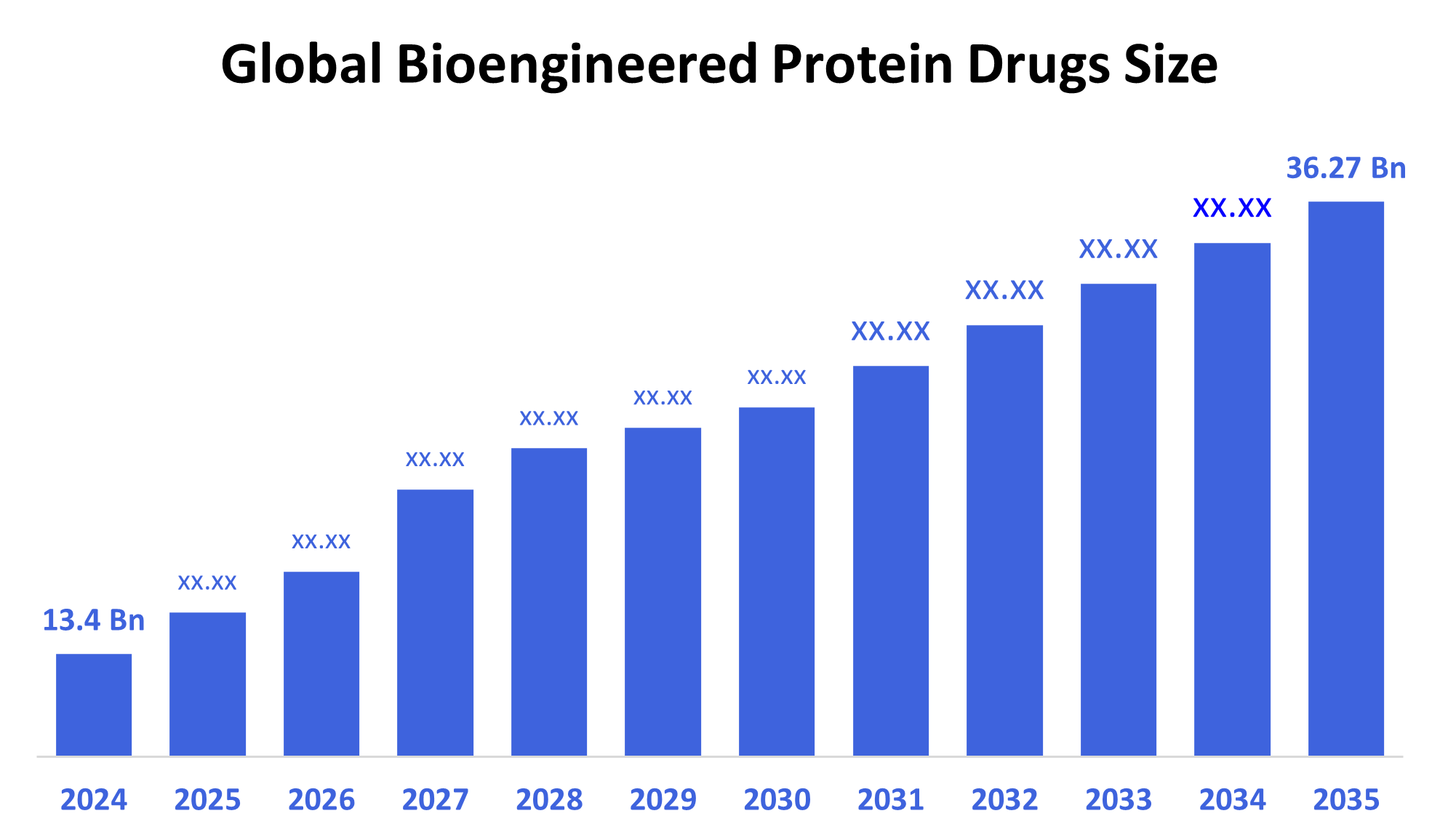

According to Decision Advisor, The Global Bioengineered Protein Drugs Market Size is Expected To Grow From USD 13.4 Billion in 2024 to USD 36.27 Billion by 2035, at a CAGR of 9.47% during the Forecast Period 2025-2035. Increasing prevalence of chronic diseases and rising adoption of biologics are primary growth drivers in this market.

Key Market Insights

- North America holds the largest market share in bioengineered protein drugs due to advanced healthcare infrastructure and strong R&D activities.

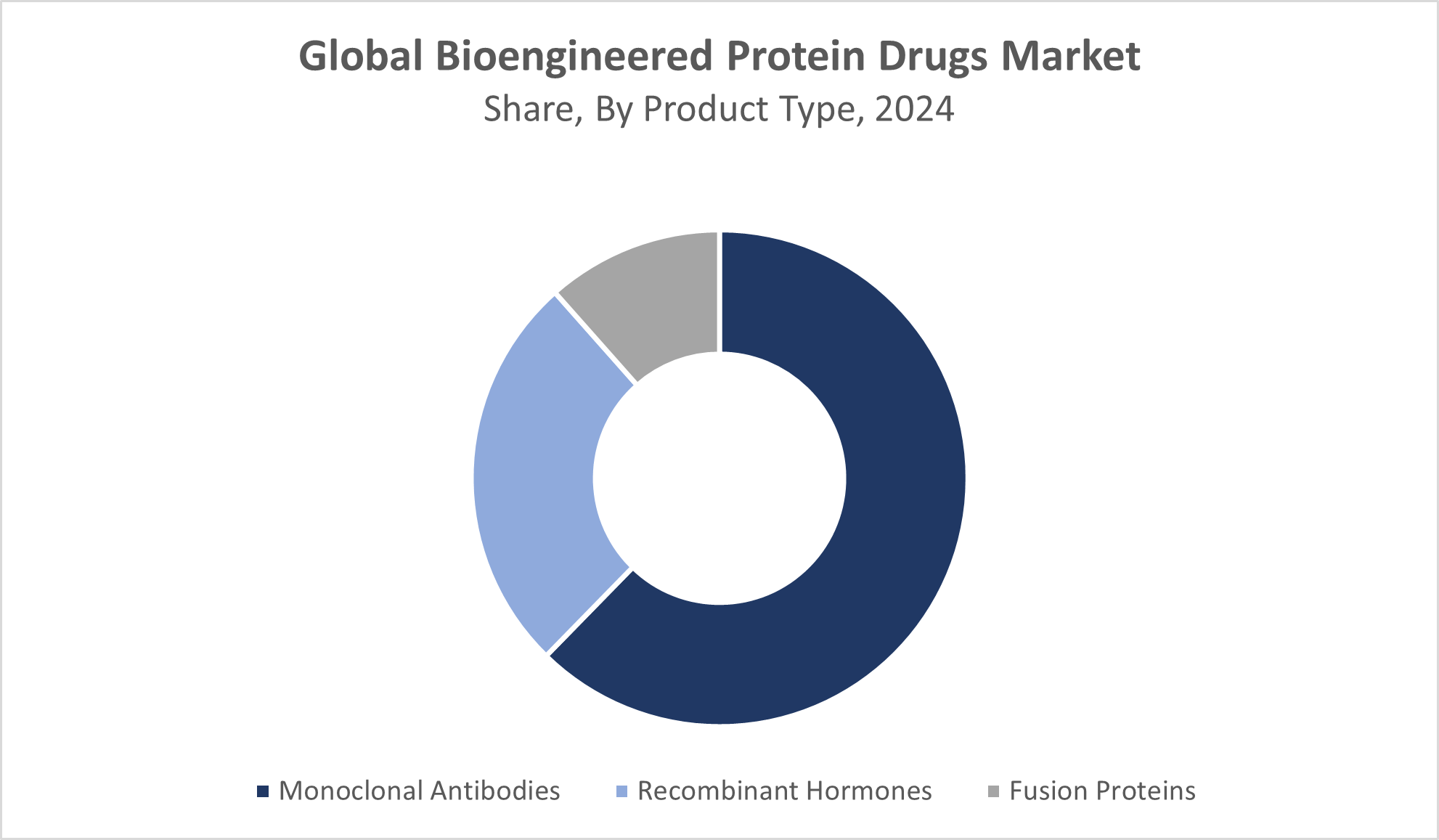

- Monoclonal antibodies dominate the product type segment by revenue during the forecast period.

- Oncology applications account for the largest revenue share among therapeutic uses globally.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 13.4 Billion

- 2035 Projected Market Size: USD 36.27 Billion

- CAGR (2025-2035): 9.47%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Bioengineered Protein Drugs Market

Bioengineered protein drugs are therapeutic proteins created using recombinant DNA technology, including monoclonal antibodies, fusion proteins, and recombinant hormones. These drugs play a vital role in treating various conditions such as cancer, autoimmune diseases, diabetes, and rare disorders by precisely targeting specific molecular pathways. This targeted approach improves treatment efficacy while minimizing side effects compared to traditional therapies. The market is propelled by the growing emphasis on personalized medicine, expansion of biologics pipelines, and supportive government policies encouraging biotechnology innovation. However, the industry faces challenges like high development and manufacturing costs, complex regulatory approval processes, and patent-related issues. Despite these obstacles, continuous advancements in protein engineering and increasing demand for effective biologic treatments are driving steady growth in the bioengineered protein drugs market globally.

Bioengineered Protein Drugs Market Trends

- Growing investment in biosimilar development to reduce treatment costs and improve access.

- Advances in protein engineering enabling improved drug efficacy and reduced immunogenicity.

- Strategic collaborations between biotech firms and pharmaceutical companies to accelerate drug commercialization.

Bioengineered Protein Drugs Market Dynamics

Driving Factors: Rising Chronic Disease Burden and Biologics Adoption

The increasing prevalence of chronic diseases such as cancer, autoimmune disorders, and metabolic conditions is a major driver for bioengineered protein drugs. These drugs offer targeted treatment options that improve patient outcomes with fewer side effects compared to traditional therapies. Additionally, better diagnostic technologies and growing healthcare investments worldwide enhance early disease detection and personalized treatment, expanding the adoption of biologics.

Restrain Factors: High Manufacturing Costs and Regulatory Complexity

Producing bioengineered protein drugs is costly and technically challenging due to intricate manufacturing processes and the need for specialized facilities. Moreover, the regulatory landscape is highly complex, requiring rigorous clinical trials and approvals that extend time-to-market and increase costs. The expiration of patents has also led to biosimilar competition, pressuring pricing and profit margins. In many emerging markets, limited healthcare infrastructure and reimbursement hurdles further restrict market growth.

Opportunity: Expansion of Biosimilars and Emerging Market Growth

The biosimilar segment offers promising opportunities by providing lower-cost alternatives to expensive biologics, which can significantly improve access in developing countries. Advances in protein engineering and innovative drug delivery technologies pave the way for next-generation therapies with improved efficacy and patient compliance. Growing biotechnology capabilities and investments in regions like Asia Pacific and Latin America are fostering greater market penetration and adoption.

Challenges: Navigating Regulatory Standards and Patent Litigation

Bioengineered protein drug manufacturers face the challenge of complying with diverse and stringent regulatory frameworks across different countries, which complicates global commercialization strategies. Patent disputes and intellectual property litigation are common, requiring substantial resources to protect innovations. Ensuring that biosimilars meet strict quality and efficacy standards necessitates continuous innovation and adherence to evolving regulatory requirements, adding to operational complexity.

Global Bioengineered Protein Drugs Market Ecosystem Analysis

The ecosystem involves key stakeholders including biotech and pharmaceutical companies, raw material suppliers, contract manufacturing organizations, healthcare providers, and regulatory agencies. Collaboration among these players fosters innovation, regulatory compliance, and efficient market delivery. Regulatory bodies enforce stringent quality and safety standards influencing product development timelines and costs.

Global Bioengineered Protein Drugs Market, By Product Type

Why was the monoclonal antibodies segment preferred over other therapeutic modalities?

The monoclonal antibodies segment leads the market in revenue share, capturing over 50%, primarily due to their targeted therapeutic capabilities, high efficacy, and growing adoption across a wide range of chronic and acute diseases, including cancer, autoimmune disorders, and infectious diseases. Advances in biotechnology, increasing approval of monoclonal antibody drugs, and their role in personalized medicine have significantly contributed to the segment’s dominance in the market.

Why did the recombinant hormones segment dominate the global bioengineered protein drugs market in 2024?

The recombinant hormones segment held a significant market share of bioengineered protein drugs in 2024 due to its proven efficacy in treating various chronic and hormonal disorders, along with advancements in biotechnological processes that improved yield and purity. The segment benefited from a strong pipeline of innovative therapies, established regulatory approvals, and widespread clinical acceptance, which together enhanced patient outcomes and adoption rates. Furthermore, recombinant hormones offered targeted treatment options with fewer side effects compared to traditional therapies, solidifying their preference among healthcare providers and patients.

Global Bioengineered Protein Drugs Market, By Application

How did the oncology segment gain a competitive edge in the bioengineered protein drugs market to capture 55% of revenue in 2024?

The oncology segment accounted for the largest revenue share, capturing approximately 55% of the bioengineered protein drugs market in 2024, due to the increasing global burden of cancer and the growing demand for more effective and targeted therapies. Significant advancements in bioengineered protein drugs, including monoclonal antibodies and checkpoint inhibitors, have revolutionized cancer treatment by offering improved efficacy and reduced side effects. Additionally, strong research and development investments, regulatory approvals, and expanding clinical applications contributed to the oncology segment’s dominance.

What made the autoimmune diseases segment a leading contributor, holding about 30% of the bioengineered protein drugs market in 2024?

The autoimmune diseases segment held around 30% of the bioengineered protein drugs market share in 2024 due to the rising prevalence of autoimmune disorders worldwide and the critical need for targeted, effective therapies. Advances in bioengineering have enabled the development of protein drugs that specifically modulate immune responses, offering improved treatment outcomes and fewer side effects compared to conventional therapies. The segment benefited from a robust pipeline of innovative treatments, increasing regulatory approvals, and growing patient awareness, all of which drove adoption rates.

North America dominates the bioengineered protein drugs market, accounting for approximately 40% of the global revenue.

This leadership position is supported by advanced healthcare infrastructure, substantial investment in research and development, and a strong presence of major pharmaceutical and biotechnology companies. Early adoption of innovative therapies and well-established regulatory frameworks also contribute to the region’s market strength. Additionally, the high prevalence of chronic diseases such as cancer and autoimmune disorders drives consistent demand for bioengineered protein drugs across the United States and Canada.

Asia Pacific is the fastest-growing region in the market, with a projected compound annual growth rate (CAGR) exceeding 8% over the forecast period.

This rapid expansion is driven by several key factors including expanding biotechnology capabilities, increasing prevalence of chronic diseases, and ongoing improvements in healthcare infrastructure. Countries like China and India are major contributors to this growth, fueled by rising healthcare spending, government initiatives supporting biotech innovation, and growing awareness about advanced therapeutics. The region’s large population base also provides a vast patient pool, further accelerating demand.

Europe maintains a steady growth trajectory in the bioengineered protein drugs market,

supported by significant contributions from countries such as Germany, the UK, and France. The region benefits from a mature healthcare system, strong regulatory standards, and active participation in biotechnology research. Government support and reimbursement policies in key European countries encourage the adoption of biologics for treating chronic and complex diseases. While growth rates are more moderate compared to Asia Pacific, Europe’s market remains robust due to ongoing innovation and high demand for personalized medicine.

WORLDWIDE TOP KEY PLAYERS IN THE BIOENGINEERED PROTEIN DRUGS MARKET INCLUDE

-

- Amgen Inc.

- Roche Holding AG

- Pfizer Inc.

- Novartis AG

- Johnson & Johnson

- Eli Lilly and Company

- Bristol-Myers Squibb

- Samsung Biologics

- Biogen Inc.

- Others

Product Launches in Bioengineered Protein Drugs Market

- In January 2024, Amgen Inc. introduced a next-generation monoclonal antibody designed to target multiple types of cancer. This new drug features enhanced binding affinity, allowing it to more effectively recognize and attach to cancer cells, thereby improving therapeutic efficacy. Additionally, the antibody is engineered to reduce immunogenicity, minimizing the risk of adverse immune reactions in patients. This innovation aims to provide better patient outcomes through increased treatment precision and safety. The launch reflects ongoing advancements in bioengineered protein therapies, reinforcing Amgen’s position as a leader in oncology and personalized medicine.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the bioengineered protein drugs market based on the below-mentioned segments:

Global Bioengineered Protein Drugs Market, By Product Type

-

- Monoclonal Antibodies

- Recombinant Hormones

- Fusion Proteins

Global Bioengineered Protein Drugs Market, By Application

-

- Oncology

- Autoimmune Diseases

- Endocrinology

Global Bioengineered Protein Drugs Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. Which product type dominates the bioengineered protein drugs market?

The monoclonal antibodies segment dominates the market, accounting for over 50% of revenue, due to their targeted therapeutic capabilities and wide adoption in treating oncology and autoimmune diseases.

Q. What applications lead the bioengineered protein drugs market?

Oncology applications hold the largest revenue share, approximately 55%, driven by advancements in targeted therapies and the increasing global cancer burden.

Q. What are the key drivers of market growth?

Key drivers include rising chronic disease prevalence, increased adoption of biologics, advances in protein engineering, and supportive government policies.

Q. What are the main challenges faced by the market?

Challenges include high manufacturing costs, complex regulatory approval processes, patent litigations, and maintaining stringent quality standards for biosimilars.

Q. Which region holds the largest market share?

North America leads the market with about 40% of global revenue, supported by advanced healthcare infrastructure and significant R&D investment.

Q. Which region is expected to grow the fastest?

Asia Pacific is the fastest-growing region with a projected CAGR exceeding 8%, driven by expanding biotechnology capabilities and increasing healthcare access.

Q. How do biosimilars influence the market?

Biosimilars offer lower-cost alternatives to biologics, enhancing accessibility in emerging markets and driving competitive pricing.

Q. What are some recent product launches in this market?

In January 2024, Amgen launched a next-generation monoclonal antibody targeting multiple cancer types, featuring improved binding affinity and reduced immunogenicity.

Q. Who are the key players in the bioengineered protein drugs market?

Major players include Amgen Inc., Roche Holding AG, Pfizer Inc., Novartis AG, Johnson & Johnson, Eli Lilly and Company, Bristol-Myers Squibb, Samsung Biologics, and Biogen Inc.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |