Global Biologic Therapy Market

Global Biologic Therapy Market Size, Share, and COVID-19 Impact Analysis, By Therapy Type (Monoclonal Antibodies, Vaccines, Cell Therapy, and Gene Therapy), By Route of Administration (Intravenous, Subcutaneous, Intramuscular, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

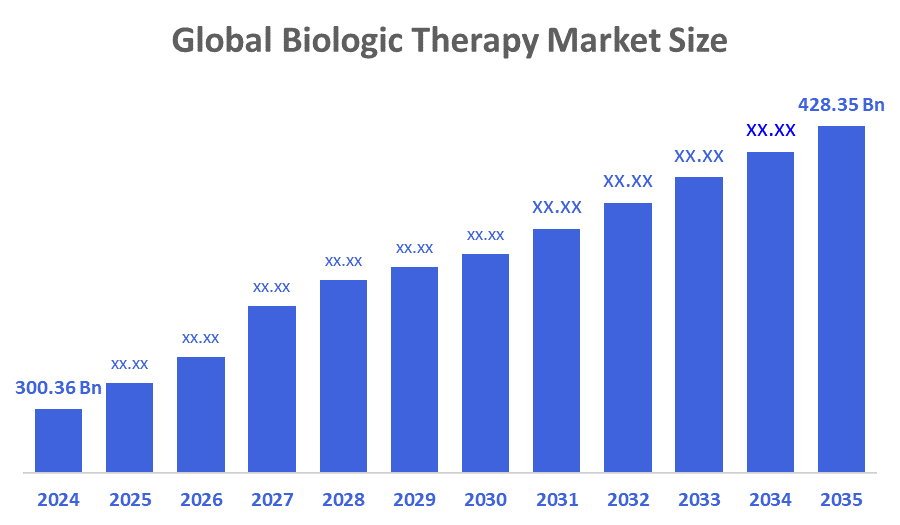

Global Biologic Therapy Market Size Insights Forecasts to 2035

- The Global Biologic Therapy Market Size Was Estimated at USD 300.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.28% from 2025 to 2035

- The Worldwide Biologic Therapy Market Size is Expected to Reach USD 428.35 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Biologic Therapy Market Size was worth around USD 300.36 Billion in 2024 and is predicted to Grow to around USD 428.35 Billion by 2035 with a compound annual growth rate (CAGR) of 3.28% from 2025 to 2035. The increasing incidence of cancer, genetic disorders, and autoimmune diseases, along with the introduction of various disease-modifying therapies for these conditions, are the main factors for market growth. The increasing focus on personalised medicine and companion diagnostics is also helping the market grow. These technological developments facilitate more targeted and efficacious treatments, leading to an increase in demand.

Market Overview

The biologic therapy market is an industry on a global scale that deals with the production of medicines which are biologically sourced from living organisms, these include monoclonal antibodies, vaccines, recombinant proteins, cell and gene therapies, and other newer biologics. The market not only covers the process of discovering the therapies but also their manufacturing, getting regulatory clearance, and marketing of these biologics that are used in treating diseases such as cancer, autoimmune disorders, neurology, and rare diseases. Investment in research and development within the biologic therapy market is escalating. Both public and private sectors are pooling their investments to develop innovative biologics, which is a direct result of the requirement for new treatments to satisfy the currently unmet medical needs. Partnerships between the industry and the academic world are expected to be the main contributors to breakthrough innovations.

Sanofi’s $625 million commitment to its corporate venture arm, Sanofi Ventures, is a major move in the biotechnology and digital health investment landscape. It strengthens Sanofi’s ability to back early-stage companies in areas like immunology, neurology, rare diseases, and vaccines, directly impacting the broader biologic therapy and healthcare innovation markets.

Regeneron’s planned investments of more than $7 billion in New York and North Carolina they expand manufacturing capacity for biologic medicines. It expands U.S. production capacity for biologic medicines while also boosting regional biotech employment.

Report Coverage

This research report categorises the biologic therapy market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biologic therapy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the biologic therapy market.

Driving Factors

The biologic therapy market is a sector in flux as innovations in biotechnology and deeper knowledge of the nature of diseases fuel its growth. Biologic therapies essentially refer to a broad category of medicinal products obtained or manufactured from living organisms, which are applied for the treatment of various conditions such as autoimmune diseases, cancer, and infectious diseases. The increase in the number of patients with chronic diseases and the preference for personalised medicine are the main factors pushing the creation of novel biologics. At the same time, the regulatory environment is changing to allow faster approval of new drugs, which may help in opening the market for more players and thus intensifying the competition among manufacturers. Moreover, the biologic therapy market is witnessing a trend of raising funds from both public and private sources, thus signalling a strong commitment to research and development in this area. There is also a trend of forming partnerships between pharmaceutical companies and educational enterprises, which might result in new treatment alternatives. The growth of biosimilars is an additional factor that should not be overlooked since these drugs provide less expensive alternatives to original biologics, thus increasing the availability of treatments to patients.

Restraining Factors

The biologic therapy market continues to face problems due to high costs, stringent regulations, and safety issues, which could limit access. Biosimilars can help ease the situation; however, their utilisation is still slow, thus making affordability, streamlined approvals, and education indispensable to the growth.

Market Segmentation

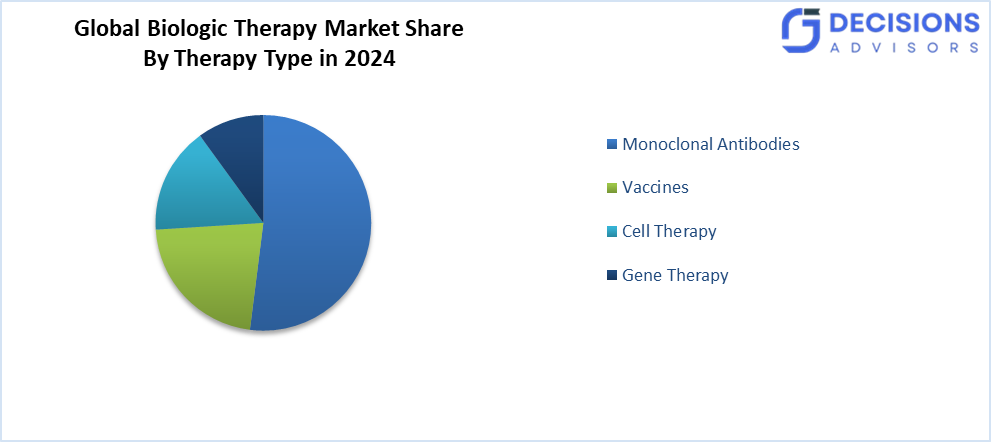

The biologic therapy market share is classified into therapy type, and route of administration.

- The monoclonal antibodies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the therapy type, the biologic therapy market is divided into monoclonal antibodies, vaccines, cell therapy, and gene therapy. Among these, the monoclonal antibodies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. They have a very strong presence as a result of their proven efficacy and wide applications in the treatment of various diseases, especially cancers and autoimmune disorders. Their effectiveness and versatility in treating various conditions have been recognised. The extensive use of these medicines has resulted in major breakthroughs in therapy and better patient outcomes.

- The intravenous segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the route of administration, the biologic therapy market is divided into intravenous, subcutaneous, intramuscular, and others. Among these, the intravenous segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its quick action and effectiveness in treating complicated diseases. The confirmed capability of the mode to deliver high, high-concentration biologics right into the blood. It is usually the preferred method for acute treatments and drugs that need fast therapeutic effects.

Regional Segment Analysis of the Biologic Therapy Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the biologic therapy market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the biologic therapy market over the predicted timeframe. These factors are backed by healthcare spending, widening of the healthcare facilities, and raised awareness of health in the patients, especially in the countries of China, Japan, and India, which find a major representation in the region. On one side, one cannot deny that due to the epidemics of chronic and infectious diseases, demand for vaccines and monoclonal antibodies (mAbs) has seen a sudden and sharp increase. On the other hand, at the same time, different government definitions favouring biotechnology and personalised medicine keep their role in making the market more vibrant through these therapies. The region is turning out to be a biologics production centre, which ultimately brings down the cost of these products and makes them more accessible. Furthermore, the rising trend of urban living and the emergence of a middle class, thus, inevitably become the driving force for the expansion of this market.

The 27th PM-STIAC meeting, held on 21 January 2025 at Vigyan Bhawan and focused on advancing Cell and Gene Therapy (CGT) in India, with emphasis on rare diseases and cancer treatment. Key government officials, industry leaders, and researchers discussed strategies to strengthen India’s CGT ecosystem, highlighting successes like CAR-T therapy and the Genome India Project.

North America is expected to grow at a rapid CAGR in the biologic therapy market during the forecast period. The U.S. market is primarily propelled by the triad of advanced healthcare infrastructure, the elevated uptake of innovative biologics, and a robust R&D ecosystem. There's an escalating preference among patients and healthcare practitioners for targeted therapies like monoclonal antibodies, CAR, T cell therapies, and vaccines for chronic, autoimmune, and cancer diseases. The co, co-occurrence of top-notch biotechnology and pharmaceutical firms along with attractive reimbursement policies is instrumental in the quick market growth. Besides, a large number of clinical trials and the early introduction of next-generation biologics are the factors that lead to the increase in the market size. The patient demand for individualised therapy options and the rise in the incidence of chronic diseases continue to drive the U.S. market.

Amgen pledged $650 million to Puerto Rico for biologic production expansion. Samsung Biologics agreed on a 1.3 billion, dollar U.S. pharma contract through 2029, thus boosting global supply chains. In Canada, more than 2.5 billion dollars of government funding is provided for biomanufacturing and life sciences innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biologic therapy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen Inc.

- Novartis AG

- Sanofi

- Johnson & Johnson and its affiliates

- Bristol-Myers Squibb Company

- Lilly USA, LLC

- F. Hoffmann-La Roche Ltd

- Biogen Inc.

- Regeneron Pharmaceuticals, Inc.

- Moderna, Inc.

- Takeda Pharmaceutical Company Limited

- Gilead Sciences, Inc.

- Vertex Pharmaceuticals Incorporated

- BioMarin Pharmaceutical Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Biocon Biologics announced that it will introduce three new oncology biosimilars, Trastuzumab/Hyaluronidase (Herceptin SC/Hylecta), Nivolumab (Opdivo), and Pembrolizumab (Keytruda), to expand affordable access to cancer treatment and strengthen its global oncology portfolio. Biocon Biologics’ move positions it as a key global player in oncology biosimilars, with the potential to significantly lower cancer treatment costs in India and worldwide.

- In November 2025, Sandoz officially launched Tyruko (natalizumab-sztn) in the U.S., developed by Polpharma Biologics, making it the first and only FDA-approved biosimilar of natalizumab. This is a major milestone in the biologic therapy market, expanding access to advanced treatments for multiple sclerosis (MS) and Crohn’s disease at a lower cost.

- In June 2023, Alkem Laboratories launched Cetuxa, the world’s first biosimilar of Cetuximab, in India for the treatment of head and neck cancers. Developed and manufactured indigenously by Enzene Biosciences (Alkem’s biological arm), Cetuxa was approved by the Drug Controller General of India (DCGI) in May 2023 and is priced at ?9,990—about 50% cheaper than existing brands.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the biologic therapy market based on the below-mentioned segments:

Global Biologic Therapy Market, By Therapy Type

- Monoclonal Antibodies

- Vaccines

- Cell Therapy

- Gene Therapy

Global Biologic Therapy Market, By Route of Administration

- Intravenous

- Subcutaneous

- Intramuscular

- Others

Global Biologic Therapy Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global biologic therapy market?

The market was valued at USD 300.36 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 428.35 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 3.28% from 2025 to 2035.

- Which therapy type holds the largest market share?

Monoclonal antibodies accounted for the largest share in 2024 and are expected to grow significantly.

- Which route of administration leads in revenue?

Intravenous held the highest revenue in 2024 due to its effectiveness for complex diseases.

- Which region is expected to grow the fastest?

North America is anticipated to grow at the fastest CAGR, driven by advanced infrastructure and R&D.

- What are the main drivers of market growth?

Rising cases of cancer, autoimmune diseases, and genetic disorders, plus advances in personalised medicine.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 298 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |