Global Biologics Manufacturing Market

Global Biologics Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Modality (Monoclonal Antibodies (mAbs), Biosimilar & Recombinant Proteins, Vaccines (recombinant/mRNA/Viral), Cell & Gene Therapies, RNA-based Therapeutics, Others), By Disease Indication (Oncology, Autoimmune Disorders, Infectious Diseases, Neurological Disorders, Cardiovascular Disorders, Other Disease Indications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Biologics Manufacturing Market Summary

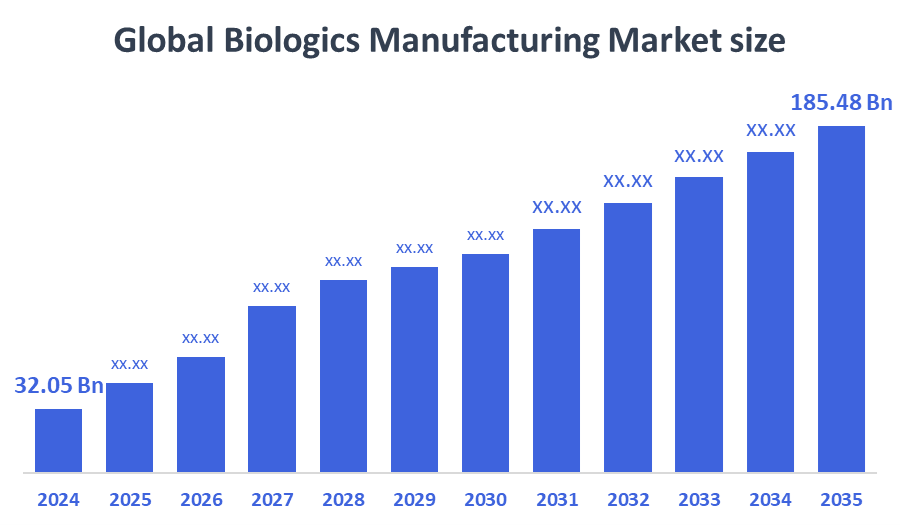

The Global Biologics Manufacturing Market Size Was Estimated at USD 32.05 Billion in 2024 and is Projected to Reach USD 185.48 Billion by 2035, Growing at a CAGR of 17.3% from 2025 to 2035. Increased prevalence of chronic diseases, growing biopharmaceutical R&D, the need for effective, scalable production of complex biologics like monoclonal antibodies, vaccines, and cell therapies, as well as growing demand for biologic therapies and bioprocessing technologies, are all driving growth in the biologics manufacturing market.

Key Regional and Segment-Wise Insights

- In 2024, the biologics manufacturing market in North America accounted for 40.52% and led the global market.

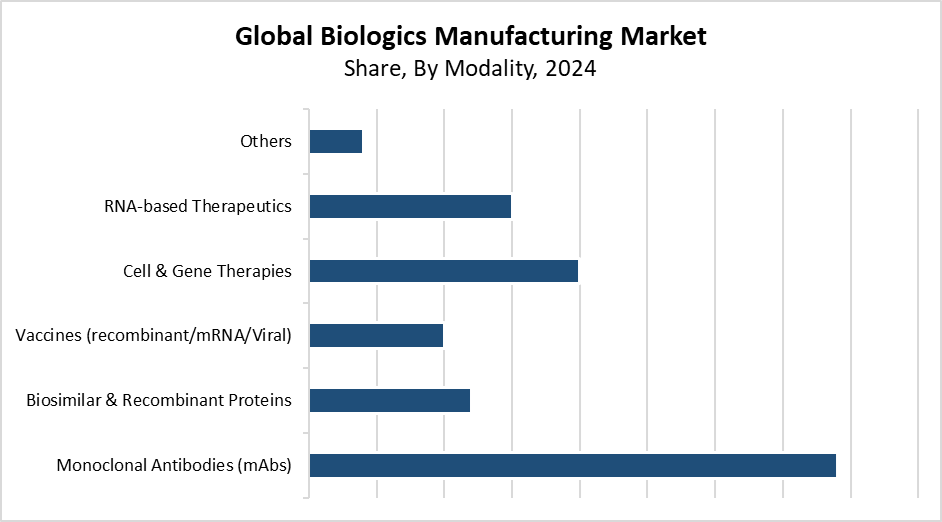

- In 2024, the monoclonal antibodies (mAbs) segment had the largest market share, accounting for 39.57% and dominated the market by modality.

- In 2024, the oncology segment dominated the market and had the largest market share by disease indication, accounting for 37.52%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 32.05 Billion

- 2035 Projected Market Size: USD 185.48 Billion

- CAGR (2025-2035): 17.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The biologics manufacturing market focuses on producing biologically derived medications through the manufacturing of monoclonal antibodies, vaccines, recombinant proteins, gene treatments, and cell therapies. The production of biologics requires specialized facilities together with unique processes because these drugs are developed from live cells, whereas conventional drugs follow different manufacturing protocols. The expanding market results from the increasing worldwide occurrence of chronic diseases, including diabetes, autoimmune disorders, and cancer, which drives the need for targeted biologic treatments. The market experiences faster growth because the biopharmaceutical pipeline continues to expand while biologics receive more approvals and personalized treatment approaches become standard. The business experiences accelerated growth because biosimilars have emerged, and contract manufacturing organizations (CMOs) have gained popularity for outsourcing production.

The manufacturing of biologics experiences a transformative shift because of new technological advancements. The combination of automation with continuous manufacturing and single-use bioreactors enables manufacturers to reduce production costs while increasing scalability and operational efficiency. The implementation of artificial intelligence together with data analytics enables process control and quality assurance to reach their optimal performance levels. Public-private partnerships, together with accelerated regulatory processes and biologics research funding, form part of government programs that support innovative and infrastructure development initiatives. North American, European, and Asia-Pacific nations invest heavily in biomanufacturing facilities because this strategic investment will drive future market growth and decrease dependency on imported goods.

Modality Insights

The monoclonal antibodies (mAbs) segment led the biologics manufacturing market with the largest revenue share of 39.57% in 2024. The widespread application of mAbs for treating complex and chronic conditions like cancer, together with autoimmune disorders and infectious diseases, makes them the dominant market player. The medical field turns to them as their primary therapeutic option because they deliver superior specificity together with effective results and minimal adverse reactions. The clinical pipeline growth, together with rising FDA and EMA approvals of monoclonal antibody-based medications, drives the increased demand for manufacturing. The market leadership of mAbs grows stronger because manufacturers now use better bioreactor technologies and improved upstream and downstream processing methods, along with enhanced cell line development for efficient scalability.

The biologics manufacturing market's cell and gene therapies segment is expected to grow at the fastest CAGR during the forecast period. The rapid growth of this industry results from the increasing number of approved innovative therapies targeting complex disorders and rare diseases, such as cancer, neurological diseases, and genetic disorders. The demand for personalized medicine alongside curative treatments has driven increased funding and research activities in this field. The generation process becomes more scalable and efficient through technological advancements in viral vector production methods combined with cell engineering techniques and manufacturing systems. The development of industrial capacities and infrastructure receives support from strong regulatory frameworks and rising research investments in cell and gene therapies from both public and private sectors across North America and Europe.

Disease Indication Insights

In 2024, the oncology segment dominated the biologics manufacturing market by holding 37.52% revenue share. The worldwide rise in cancer cases, along with increasing biologics use as primary treatment options, has driven this market dominance. The cancer treatment field has undergone a revolution through therapies like CAR-T cells, alongside antibody-drug conjugates and monoclonal antibodies, which offer personalized and effective therapeutic options. The market receives support from the expanding number of regulatory approvals and the strong pipeline of biologic medicines that target oncology. The manufacturing process receives acceleration from substantial funding dedicated to cancer investigations, together with advanced production systems. The worldwide development of biologics manufacturing receives its main push from oncology because medical science requires better targeted treatments with fewer side effects.

The neurological disorders segment of the biologics manufacturing market will experience significant growth throughout the forecast period. The main driver of this market expansion is the growing occurrence of neurological diseases, including multiple sclerosis, Parkinson's disease, Alzheimer's disease, and other genetic nervous system disorders. The limited effectiveness of conventional treatments has propelled the popularity of advanced biologic medications, which deliver targeted disease-modifying approaches. Research and clinical trials for neurobiologic treatments, including gene therapies and monoclonal antibodies, contribute to the expanding therapeutic field. Pharmaceutical companies are increasing their investments in the segment, and pharmaceutical delivery system improvements and enhanced neurological healthcare awareness are driving its rapid growth.

Regional Insights

The biologics manufacturing market is dominated by the North America region, with the largest revenue share of 40.52% in 2024. The region maintains its market leadership because of its advanced biomanufacturing systems and numerous biotechnology and pharmaceutical companies, and substantial research funding. The United States stands at the forefront of worldwide biologic drug development through its leadership in clinical trials and approval processes for new treatments and adoption of gene, cell, and monoclonal antibody therapies. The market growth receives additional support through government funding for biologic research, public-private partnerships, and regulatory support from the FDA and other organizations. The global biologics market maintains its leadership position due to North America's increasing chronic disease rates and growing requirements for personalized medical treatments.

Europe Biologics Manufacturing Market Trends

The steady expansion of Europe's biologics manufacturing market results from rising demand for advanced biologic drugs combined with pharmaceutical research innovation. The biologics research and manufacturing industry in Europe finds its main operational hubs in Germany, Switzerland, and the United Kingdom due to their advanced infrastructure and highly skilled workforce. The European Medicines Agency (EMA) provides active support for biologics approvals and research, which establishes favorable regulatory conditions throughout the European region. The business receives additional support through rising rare disease cases and chronic disease prevalence, together with growing biotech startup funding and pharmaceutical-academic partnership strategies. The European biologics manufacturing industry experiences continuous growth because of biosimilar advancements alongside rising interest in personalized medical treatments.

Asia Pacific Biologics Manufacturing Market Trends

The Asia Pacific biologics manufacturing market is anticipated to grow at the fastest CAGR during the projection period because of increasing biotechnology investments, expanding healthcare infrastructure, and rising demand for biologics medicines. Nations such as China, India, South Korea, and Japan have become major biomanufacturing hubs due to their affordable production costs, alongside government support and an expanding skilled workforce. The regional development accelerates through government programs, which boost domestic biologics manufacturing, together with regulatory changes that support foreign business investments. The increasing occurrence of chronic diseases, together with the rising popularity of new biologic medicines and biosimilar products, drives the market demand. The region maintains its position as a leading global biologics player by prioritizing capacity expansion initiatives.

Key Biologics Manufacturing Companies:

The following are the leading companies in the biologics manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- Boehringer Ingelheim International GmbH

- AbbVie Inc.

- Pfizer Inc

- Wuxi Biologics

- Novo Nordisk A/S

- F. Hoffmann La-Roche Ltd.

- Lonza

- Amgen Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Samsung Biologics

Recent Developments

- In May 2025, Samsung Biologics extended its CDMO dealmaking record through 2031 when it signed a USD 518 million biologics manufacturing contract with an unnamed U.S. pharmaceutical business.

- In May 2025, Pfizer spent USD 1.25 billion up front and up to USD 4.8 billion in milestones to clinch an exclusive worldwide licensing deal with China's 3SBio for the bispecific antibody SSGJ-707, with plans to manufacture in North Carolina and Kansas.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the biologics manufacturing market based on the below-mentioned segments:

Global Biologics Manufacturing Market, By Modality

- Monoclonal Antibodies (mAbs)

- Biosimilar & Recombinant Proteins

- Vaccines (recombinant/mRNA/Viral)

- Cell & Gene Therapies

- RNA-based Therapeutics

- Others

Global Biologics Manufacturing Market, By Disease Indication

- Oncology

- Autoimmune Disorders

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Disorders

- Other Disease Indications

Global Biologics Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 216 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |