Global Biopharmaceutical Excipients Market

Global Biopharmaceutical Excipients Market Size, Share, and COVID-19 Impact Analysis, By Excipient (Bulking Agents, Solubilizers and Surfactants, Buffering and Tonicity Agents, and Others), By Biologics (Monoclonal Antibodies, Vaccines, and Others), By End Use (Commercial, and Research), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Biopharmaceutical Excipients Market Size Insights Forecasts to 2035

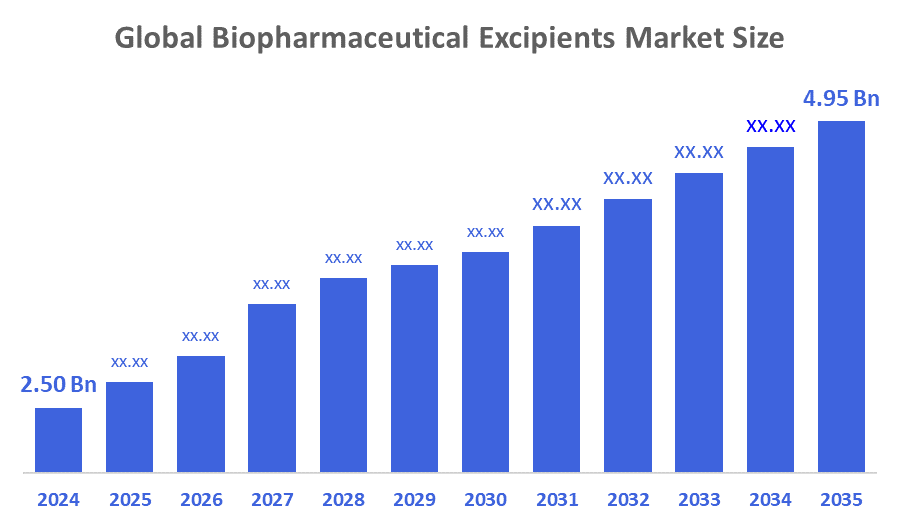

- The Global Biopharmaceutical Excipients Market Size Was Estimated at USD 2.50 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.41% from 2025 to 2035

- The Worldwide Biopharmaceutical Excipients Market Size is Expected to Reach USD 4.95 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Biopharmaceutical Excipients Market Size was worth around USD 2.50 Billion in 2024 and is predicted to Grow to around USD 4.95 Billion by 2035 with a compound annual growth rate (CAGR) of 6.41% from 2025 to 2035. The market for biopharmaceutical excipients has opportunities due to the growing need for smaller electronics, improvements in packaging technologies, the expansion of LED applications, and the growing uptake of energy-efficient lighting in various consumer sectors worldwide.

Market Overview

The biopharmaceutical excipients market is the worldwide sector that deals with excipients, i.e. any components besides the active drug, which are especially designed and implemented in the formulation, stabilisation, and delivery of biopharmaceutical products such as monoclonal antibodies, vaccines, recombinant proteins, and cell & gene therapies. Such excipients play a pivotal role in making sure that biologic drugs are safe, effective, and can be stored for a long time. This demand has been greatly stimulated by the improvements made in biotechnology and the continuous increase in the number of patients suffering from chronic diseases, which are challenges that really need to be addressed by new and innovative drug therapies. However, along with the development of the biopharmaceutical industry, the function and significance of the excipients used in the biopharmaceutical industry are elevated to a new level. From being mere inactive ingredients, these excipients are now viewed as essential components that not only contribute to the drug's delivery and stability but also act as essential ingredients. The biopharmaceutical excipients market is made up of a wide spectrum of excipients, which are stabilisers, preservatives, solubilisers, etc., that are essentially created and used for the purpose of making biopharmaceutical formulations more effective.

Strong venture capital investments in drug discovery platforms are reported by general biotech trackers, such as Excelsior Sciences' $95 million for automated small-molecule synthesis (possibly utilising cutting-edge excipients).

Strand Therapeutics' $153 million for mRNA therapies requiring specific lipid excipients. However, rather than particularly focusing on excipient manufacture, these funds target medicines.

Report Coverage

This research report categorises the biopharmaceutical excipients market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biopharmaceutical excipients market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the biopharmaceutical excipients market.

Driving Factors

The biopharmaceutical excipients market is the market segment of the biopharmaceutical industry that provides the products needed for biopharmaceutical product manufacturing. It is currently undergoing a rapid change due to the increasing demand for various kinds of biopharmaceutical products. Besides that, the biopharmaceutical excipients market is observing a trend towards the use of more sustainable and natural excipients, which is in line with the general trend in the pharmaceutical industry to use environmentally friendly solutions and approaches. Furthermore, regulatory bodies are making more demands on and placing greater emphasis on the quality and safety of excipients, which also influence the dynamics of the market. As manufacturers are aiming at fulfilling these ever-changing requirements, the emphasis on research and development becomes stronger, which, in turn, might bring about novel excipients that could change the method of formulation intentions.

Restraining Factors

One of the key issues that concerns regulatory authorities is the quality and safety of pharmaceutical medicinal products. Besides the imposition of more stringent regulations in recent years, the regulatory agencies have strengthened their position on the prevention of adulteration of pharmaceuticals in excipients and APIs, thus restraining the market growth.

Market Segmentation

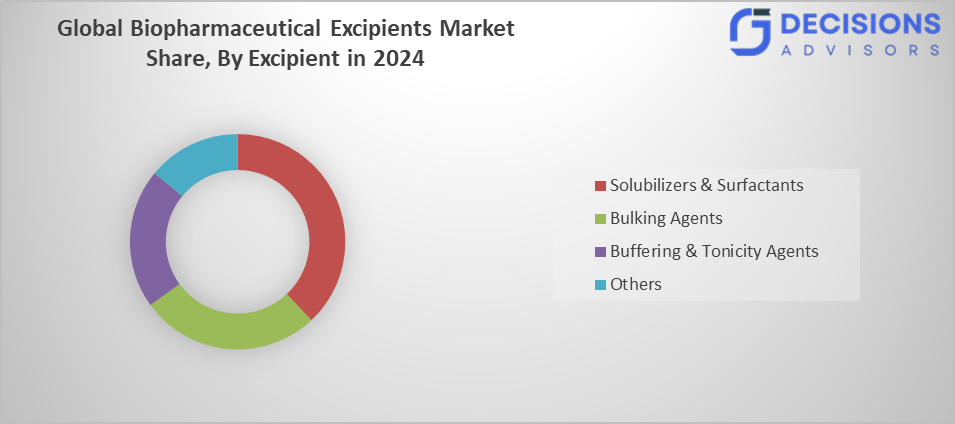

The biopharmaceutical excipients market share is classified into excipient, biologics, and end use.

- The solubilizers and surfactants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the excipient, the biopharmaceutical excipients market is differentiated into bulking agents, solubilizers and surfactants, buffering and tonicity agents, and others. Among these, the solubilizers and surfactants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to their vital function in ensuring the stability and efficacy of intricate biopharmaceutical formulations; the focus has shifted towards these molecules. For instance, non-ionic surfactants are the main stabilising agents for biologics such as monoclonal antibodies, air, liquid and solid, liquid interfaces manufacturing, storage, and delivery, where they adsorb.

- The monoclonal antibodies segment accounted for the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the biologics, the biopharmaceutical excipients market is segmented into monoclonal antibodies, vaccines, and others. Among these, the monoclonal antibodies segment accounted for the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Monoclonal antibody formulations depend on six different categories of excipients: buffers, salts, surfactants, sugars/polysaccharides, amino acids, and antioxidants. Typically, buffers such as histidine or phosphate, surfactants like polysorbate 80/20 and poloxamer 188, and stabilizers such as sucrose or mannitol are used. Additionally, amino acids (glycine, arginine) and antioxidants (ascorbic acid, methionine, EDTA) are combined to improve stability and inhibit degradation.

- The commercial segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the biopharmaceutical excipients market is divided into commercial, and research. Among these, the commercial segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to the need for an enormous rise in infectious diseases and the emergence of pandemics and epidemics. As biologics are used more widely, there is an increasing need to produce them in huge quantities. The quick development of large-scale production is a crucial step that necessitates massive amounts of ingredients due to the huge patient population in the commercial phase.

Regional Segment Analysis of the Biopharmaceutical Excipients Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the biopharmaceutical excipients market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the biopharmaceutical excipients market over the predicted timeframe. Asia-Pacific is projected to outpace other regions and lead the development and manufacturing of vaccines. China, Japan, South Korea, India, and Australia dominate the revenue generation in this area. Emerging markets like China are major contributors because of cheap labour and the trend of outsourcing both inorganic and organic chemical production. This is mainly the result of the growing role of contract manufacturers in the vaccine development process, thus accelerating the pace of the vaccine-related industry.

In November 2025, CBC India officially launched its excipient business under a new identity called Ingredients & Packaging Solutions, marking a strategic expansion into pharmaceutical and nutraceutical support services. With a global perspective at our heart, CBC Group keeps expanding internationally, now having more than 40 bases across the globe.

Europe is expected to grow at a rapid CAGR in the biopharmaceutical excipients market during the forecast period. The market for excipients in biopharmaceuticals in Europe is growing at a steady pace. The main factors driving this growth are the production of biologics and biosimilars. The most commonly used delivery forms are injectable and freeze-dried. Growth is additionally supported by innovation in coprocessed excipients and borderless manufacturing integration.

In the UK, high biologics research and speciality formulations keep the demand for stabilisers, surfactants, and novel excipient systems very high, while contract manufacturing acts as a further, reinforcing factor. The entirety of Germany's pharmaceutical sector and export activities, in turn, account for the increase in the consumption of buffers and cryoprotectants that are used in precision biologics. In France, the increase in vaccines and protein production leads to a greater dependence on surfactants, sugars, and functional excipients. This is, however, supported by localised sourcing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biopharmaceutical excipients market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Associated British Foods plc

- BASF SE

- Clariant

- Colorcon

- DFE Pharma

- Evonik Industries AG

- IMCD

- J. RETTENMAIER & SÖHNE GmbH + Co. KG

- Merck KGaA

- Roquette Frères

- Sigachi Industries Limited

- Signet Excipients Pvt. Ltd (IMCD)

- Spectrum Chemical Manufacturing Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Asahi Kasei launched its Sonanos next-generation excipients, introducing two new speciality grades designed to improve injectable drug formulations. Paid samples are already available, with GMP-compliant products expected for commercial release in 2027.

- In June 2025, BASF reinforced its commitment to the biopharma and pharmaceutical ingredients industries by opening a new Good Manufacturing Practice (GMP) Solution Centre in Wyandotte, Michigan, USA. This strategic investment expands its excipient and bioprocessing capabilities in North America.

- In November 2024, Clariant introduced eight new high-performing excipients at CPHI India 2024, expanding its pharmaceutical ingredients portfolio to support safe and effective medicines. The launch emphasised “Made in India” production and tailored solutions for biologics, generics, and sensitive APIs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the biopharmaceutical excipients market based on the below-mentioned segments:

Global Biopharmaceutical Excipients Market, By Excipient

- Bulking Agents

- Solubilizers and Surfactants

- Buffering and Tonicity Agents

- Others

Global Biopharmaceutical Excipients Market, By Biologics

- Monoclonal Antibodies

- Vaccines

- Others

Global Biopharmaceutical Excipients Market, By End Use

- Consumer Electronics

- Industrial

- Automobile

- Others

Global Biopharmaceutical Excipients Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global biopharmaceutical excipients market?

The market was valued at USD 2.50 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 4.95 billion by 2035.

- What is the CAGR of the market from 2025 to 2035?

The market is forecasted to grow at a CAGR of 6.41% during this period.

- Which excipient segment holds the largest share?

Solubilizers and surfactants accounted for the largest share in 2024 and are expected to grow significantly.

- Which biologics segment dominates the market?

Monoclonal antibodies held the largest share in 2024 and are projected to grow at a substantial CAGR.

- Which region is expected to grow the fastest?

Europe is anticipated to grow at the fastest CAGR, while Asia-Pacific holds the largest overall share.

- What drives growth in the commercial end-use segment?

Rising infectious diseases, pandemics, and the need for large-scale biologics production fuel its leading revenue share.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 287 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |