Global Bio?Resorbable Implants Market

Global Bio Resorbable Implants Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Material Type (Polymers, Metals, Natural Biomaterials, and Composites), By End User (Hospitals, Specialty Clinics, and Ambulatory Surgical Centers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Bio?Resorbable Implants Market Size Summary, Size & Emerging Trends

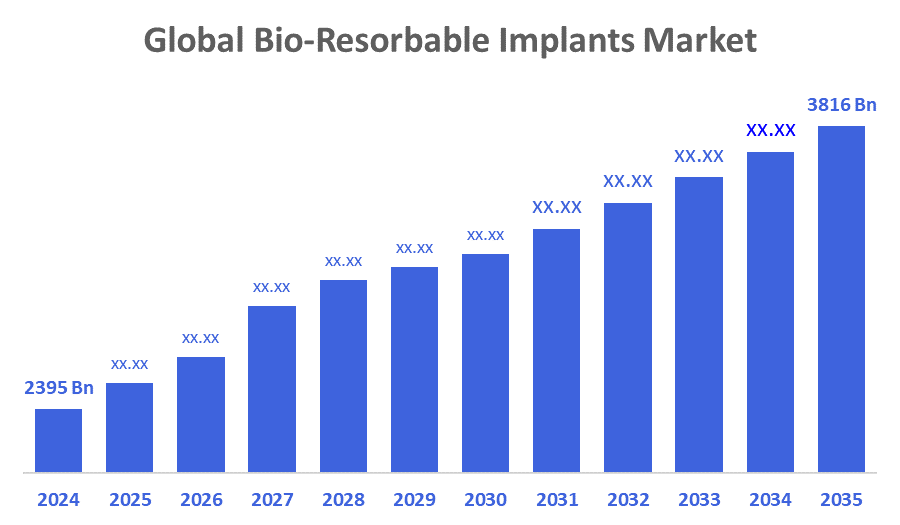

According to Decisions Advisors, The Global Bio Resorbable Implants Market Size is expected to Grow from USD 2395 Billion in 2024 to USD 3816 Billion by 2035, at a CAGR of 4.33% during the forecast period 2025-2035. Advances in biodegradable materials such as polylactic acid (PLA), polyglycolic acid (PGA), magnesium?based metals, and hybrid composites are driving innovation.

Key Market Insights

- Polymer-based bio resorbable implants maintain the largest share, attributed to their regulatory acceptance and favorable safety profiles.

- Hospitals constitute the major end-user base, although specialty clinics and ambulatory centers are increasingly adopting these technologies.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2,395 Billion

- 2035 Projected Market Size: USD 3,816 Billion

- CAGR (2025-2035): 4.33%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Bio?Resorbable Implants Market

Bio?resorbable implants are medical devices designed to safely degrade inside the human body after serving their function, thus avoiding the need for a second surgery. These implants utilize materials such as biodegradable polymers, metals (e.g., magnesium alloys), natural biomaterials, and composites. Their applications span orthopedics, cardiovascular stents, dental implants, neurosurgery, and tissue engineering. The ability to reduce complications, lower long?term foreign body reaction, and improve patient comfort is enhancing their appeal. Technological improvements around degradation rate, strength, and form factor are bolstering acceptance.

Bio?Resorbable Implants Market Trends

- Magnesium and composite materials are gaining traction due to their superior strength and controlled degradation properties.

- 3D printing technologies are enabling personalized, patient-specific bio-resorbable implants.

- Smart bio-resorbable implants with sensors are emerging for real-time healing and drug monitoring.

- Pediatric and geriatric applications are driving adoption due to the benefits of eliminating implant removal surgeries.

Bio?Resorbable Implants Market Dynamics

Driving Factors:

Rising incidence of orthopedic trauma, cardiovascular disease, and tissue damage

The growing number of bone fractures, sports injuries, cardiovascular procedures, and dental surgeries is driving demand for implants that naturally dissolve in the body. Bio?resorbable implants eliminate the need for secondary removal surgeries, making them especially appealing to both surgeons and patients. As global populations age and healthcare systems expand, especially in developed and emerging nations, the demand for minimally invasive, post-operative-friendly solutions continues to rise. These implants are particularly valuable in pediatrics and geriatrics, where surgical complications can be more severe, further strengthening their role in modern healthcare settings.

Restrain Factors:

Cost, regulatory complexity, and long?term performance concerns

Bio?resorbable implants face several adoption barriers. High production costs, due to the use of advanced biodegradable polymers or magnesium alloys, increase overall product pricing. Regulatory agencies demand thorough testing for biocompatibility, degradation behavior, and mechanical integrity, leading to prolonged approval timelines and increased R&D costs. Furthermore, inconsistent clinical performance—such as unpredictable degradation or insufficient structural support—can diminish surgeon confidence. Manufacturers also face challenges in scaling production while maintaining tight tolerances. These issues, combined with limited insurance reimbursement in some regions, restrict accessibility and slow the adoption rate, particularly in cost-sensitive healthcare environments.

Opportunity:

Technological innovation & expansion in emerging regions

Advancements in material science, including drug-eluting and hybrid composites, are enhancing implant functionality and healing outcomes. Technologies like 3D printing are allowing for custom, patient-specific implants with improved integration and faster recovery. At the same time, emerging economies in Asia Pacific, Latin America, and the Middle East are increasing healthcare budgets, upgrading surgical infrastructure, and seeking affordable, high-quality medical devices. These trends open new markets for bio?resorbable implants, especially lower-cost, portable variants suited for high-volume procedures. Strategic collaborations, local manufacturing, and government support in these regions present untapped potential for significant growth.

Challenges: Biocompatibility, degradation control, and post?market surveillance

A critical challenge lies in ensuring that bio?resorbable implants maintain structural integrity during healing, then degrade safely without causing adverse reactions. Factors like body temperature, immune response, and patient condition influence degradation rates, which can vary widely. Maintaining predictable behavior across diverse patient populations is difficult. Post?market surveillance is essential but underdeveloped in many regions, making it harder to track real-world performance. In addition, surgical technique, sterilization, storage conditions, and handling practices directly affect implant behavior. Meeting regulatory demands for long-term safety data and continuous product monitoring is necessary but resource-intensive for manufacturers.

Global Bio?Resorbable Implants Market Ecosystem Analysis

The bio-resorbable implants market ecosystem includes material suppliers (polymers, metals, natural biomaterials), device manufacturers, R&D institutions, regulatory bodies determining safety and standards, hospitals and surgical centers performing implant procedures, and end?users (surgeons and patients). Collaboration among scientists, medical professionals, and regulators helps improve safety, efficacy, and adoption.

Global Bio?Resorbable Implants Market, By Material Type

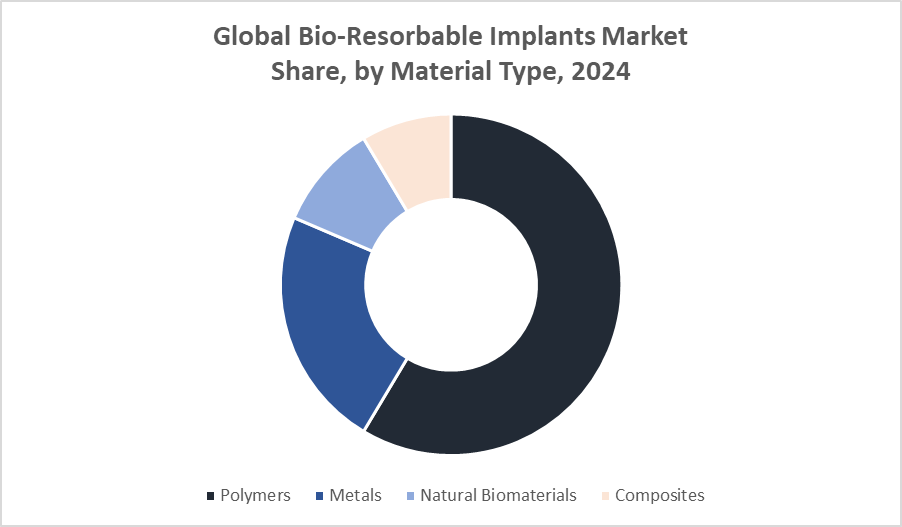

Polymers are the dominant material type in the bio-resorbable implants market, capturing around 45% of the revenue share. Their dominance stems from their excellent biocompatibility, versatility, and ability to degrade predictably within the body over time. Common polymers used include polylactic acid (PLA), polyglycolic acid (PGA), and their copolymers, which are widely applied in orthopedic fixation devices, cardiovascular stents, and surgical sutures. Polymers allow for customization of degradation rates and mechanical properties, making them suitable for various implant applications.

Metals represent a significant segment with approximately 30% bio-resorbable implants market share. Magnesium-based alloys are the most prominent among bioresorbable metals due to their favorable mechanical strength and biodegradation characteristics, which are essential for load-bearing implants such as bone screws and plates. These metals provide superior structural support compared to polymers but require careful control over degradation rates to avoid adverse tissue reactions.

Global Bio Resorbable Implants Market, By End User

Hospitals dominate the end-user segment, holding approximately 60% of the bio-resorbable implants market share. This is because hospitals handle a wide range of complex surgeries, including orthopedic, cardiovascular, and dental procedures that require bio-resorbable implants. Hospitals have the necessary infrastructure, skilled surgeons, and resources to support the use of advanced implant technologies. Their large patient volumes and ability to perform both inpatient and outpatient procedures contribute to their dominant position.

Specialty clinics account for a significant share of around 30%. These clinics focus on specific areas such as orthopedics, dentistry, or cardiovascular care. They are increasingly adopting bio-resorbable implants due to their focus on minimally invasive and patient-friendly treatments. The rise in outpatient specialty clinics is driving demand as they offer convenient, specialized care for targeted patient groups.

North America is a key revenue generator in the bio-resorbable implants market,

Largely due to its well-developed healthcare infrastructure and presence of major medical device manufacturers. The region benefits from a strong regulatory framework that ensures high-quality and safe medical devices, which encourages innovation and adoption of new technologies. High healthcare spending and a large patient base needing orthopedic, cardiovascular, and dental procedures further strengthen demand. The U.S. in particular leads with extensive clinical research and fast integration of advanced implant materials, keeping North America dominant in this market.

The Asia-Pacific region is the fastest-growing bio-resorbable implants market,

Due to rising healthcare expenditures, increasing government initiatives to improve healthcare infrastructure, and a growing aging population. Countries such as China, India, Japan, and South Korea are expanding their surgical facilities and increasing access to advanced medical technologies. Additionally, the rising prevalence of trauma cases, cardiovascular diseases, and lifestyle-related health issues drives the demand for bio-resorbable implants. The region also benefits from cost-effective manufacturing and growing awareness among healthcare providers and patients, fueling rapid adoption.

WORLDWIDE TOP KEY PLAYERS IN THE BIO?RESORBABLE IMPLANTS MARKET INCLUDE

- DePuy Synthes

- Medtronic plc

- Stryker Corporation

- Smith & Nephew plc

- Boston Scientific Corporation

- Bioretec Ltd

- Zimmer Biomet Holdings, Inc.

- BIOTRONIK SE & Co. KG

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the bio?resorbable implants market based on the below-mentioned segments:

Global Bio Resorbable Implants Market, By Material Type

- Polymers

- Metals

- Natural Biomaterials

- Composites

Global Bio Resorbable Implants Market, By End?User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

Global Bio Resorbable Implants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 228 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |